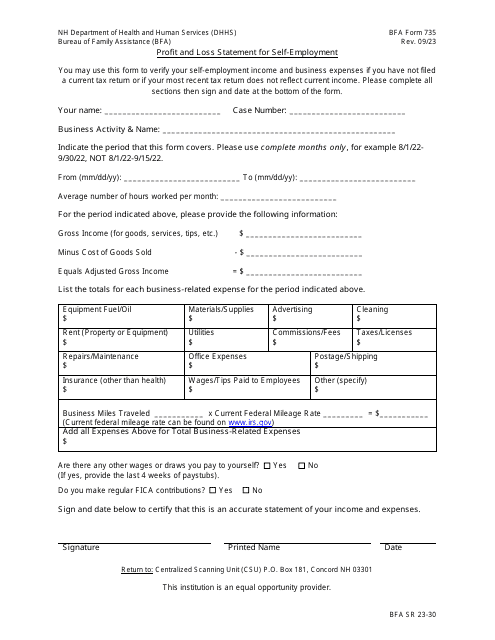

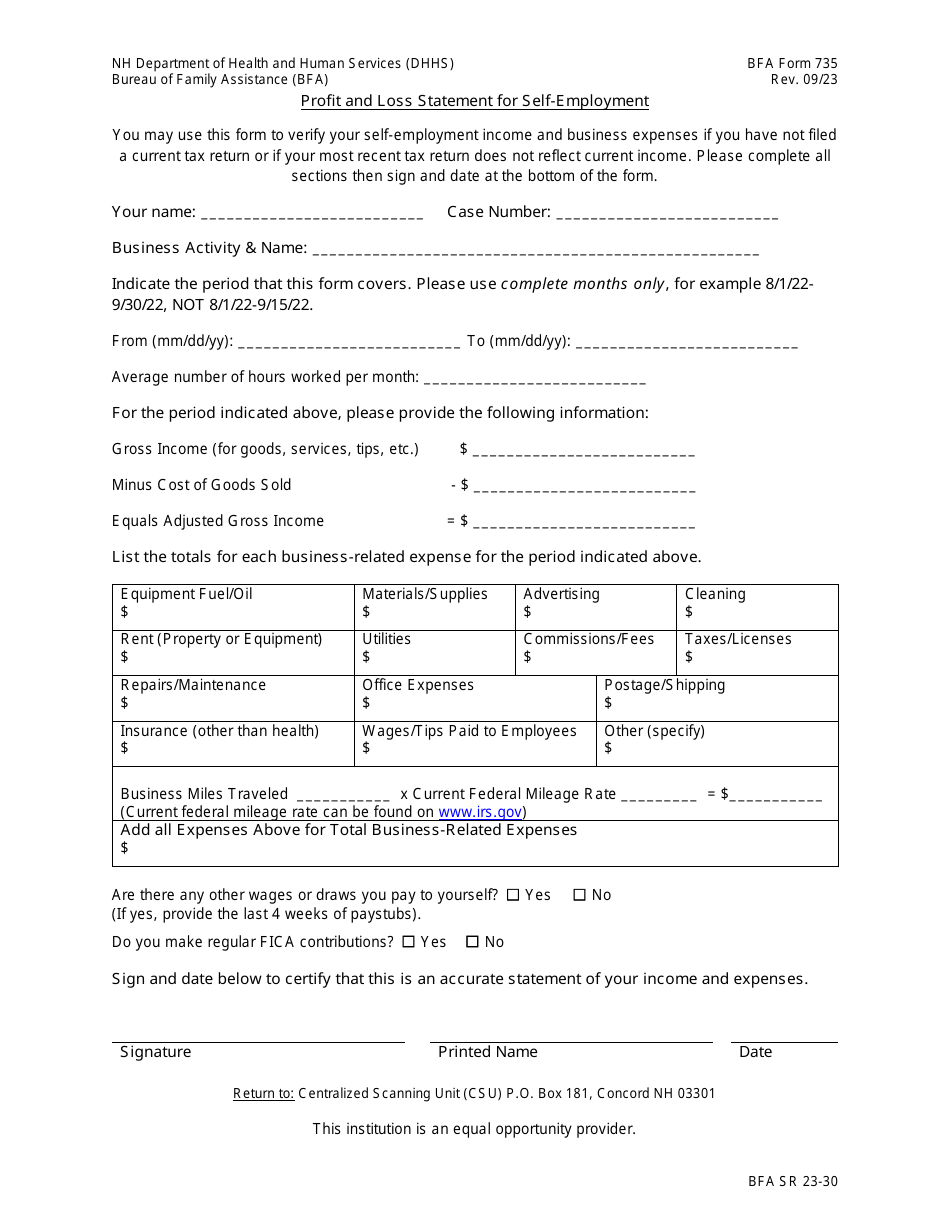

BFA Form 735 Profit and Loss Statement for Self-employment - New Hampshire

- Home

- Legal

- United States Legal Forms

- New Hampshire Legal Forms

- New Hampshire Department of Health and Human Services

- New Hampshire Department of Health and Human Services - Bureau of Family Assistance

- BFA Form 735 Profit and Loss Statement for Self-employment - New Hampshire

BFA Form 735 Profit and Loss Statement for Self-employment - New Hampshire

Fill PDF Online

Fill out online for free

without registration or credit card

ADVERTISEMENT

Download BFA Form 735 Profit and Loss Statement for Self-employment - New Hampshire

4.5

of 5 (12 votes)

ADVERTISEMENT

Related Documents

-

BFA Form 737 Monthly Self-employment Log - New Hampshire

BFA Form 737 Monthly Self-employment Log - New Hampshire

-

Form SSA-7156 Farm Self-employment Questionnaire

Form SSA-7156 Farm Self-employment Questionnaire

-

IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico), 2023

IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico), 2023

-

IRS Form 5471 Schedule E Income, War Profits, and Excess Profits Taxes Paid or Accrued

IRS Form 5471 Schedule E Income, War Profits, and Excess Profits Taxes Paid or Accrued

-

Form PROB48F Request for Self-employment Records

Form PROB48F Request for Self-employment Records

-

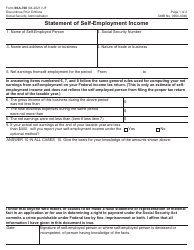

Form SSA-766 Statement of Self-employment Income

Form SSA-766 Statement of Self-employment Income

-

IRS Form 1040 Schedule SE Self-employment Tax, 2023

IRS Form 1040 Schedule SE Self-employment Tax, 2023

-

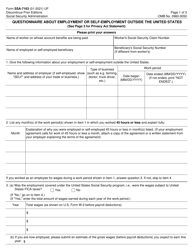

Form SSA-7163 Questionnaire About Employment or Self-employment Outside the United States

Form SSA-7163 Questionnaire About Employment or Self-employment Outside the United States

-

Form SSA-B20-BK Work Activity Report - Self-employment

Form SSA-B20-BK Work Activity Report - Self-employment

-

IRS Form 965 Schedule B Deferred Foreign Income Corporation's Earnings and Profits (E&p)

IRS Form 965 Schedule B Deferred Foreign Income Corporation's Earnings and Profits (E&p)

-

IRS Form 4361 Application for Exemption From Self-employment Tax for Use by Ministers, Members of Religious Orders and Christian Science Practitioners

IRS Form 4361 Application for Exemption From Self-employment Tax for Use by Ministers, Members of Religious Orders and Christian Science Practitioners

-

IRS Form 1120-F Schedule M-1, M-2 Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings Per Books, 2023

IRS Form 1120-F Schedule M-1, M-2 Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings Per Books, 2023

-

IRS Form 965 Schedule C U.S. Shareholder's Aggregate Foreign Earnings and Profits Deficit

IRS Form 965 Schedule C U.S. Shareholder's Aggregate Foreign Earnings and Profits Deficit

-

IRS Form 5471 Schedule H Current Earnings and Profits

IRS Form 5471 Schedule H Current Earnings and Profits

-

IRS Form 5471 Schedule J Accumulated Earnings & Profits (E&p) of Controlled Foreign Corporation

IRS Form 5471 Schedule J Accumulated Earnings & Profits (E&p) of Controlled Foreign Corporation

-

IRS Form 5471 Schedule P Previously Taxed Earnings and Profits of U.S. Shareholder of Certain Foreign Corporations

IRS Form 5471 Schedule P Previously Taxed Earnings and Profits of U.S. Shareholder of Certain Foreign Corporations

convert to pdf

convert from pdf

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2026 ©