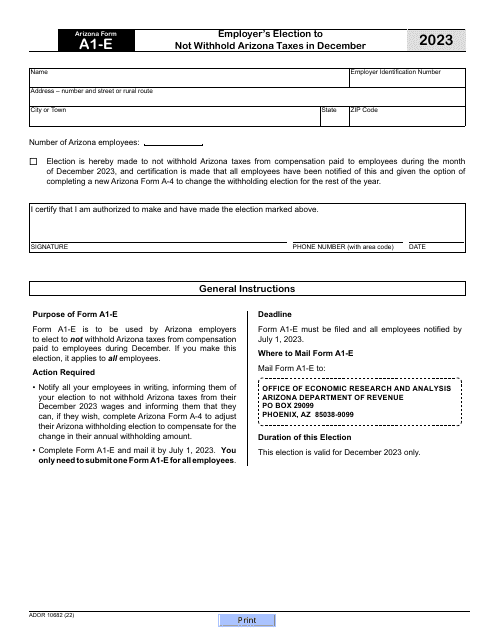

Arizona Form A1-E (ADOR10682) Employer's Election to Not Withhold Arizona Taxes in December - Arizona

- Home

- Legal

- United States Legal Forms

- Arizona Legal Forms

- Arizona Department of Revenue

- Arizona Form A1-E (ADOR10682) Employer's Election to Not Withhold Arizona Taxes in December - Arizona

Arizona Form A1-E (ADOR10682) Employer's Election to Not Withhold Arizona Taxes in December - Arizona

Fill PDF Online

Fill out online for free

without registration or credit card

ADVERTISEMENT

Download Arizona Form A1-E (ADOR10682) Employer's Election to Not Withhold Arizona Taxes in December - Arizona

4.8

of 5 (10 votes)

ADVERTISEMENT

Related Documents

-

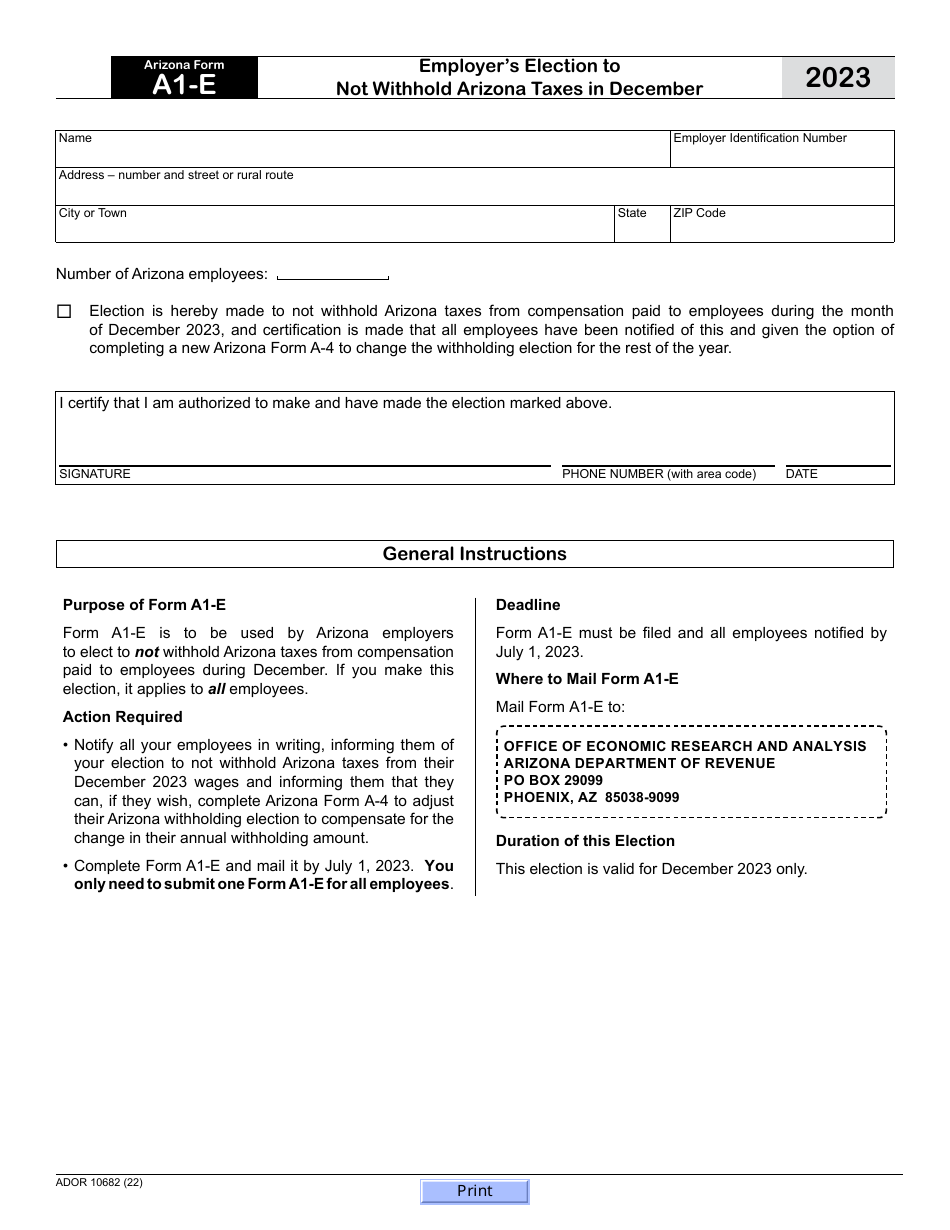

Arizona Form A1-E (ADOR10682) Employer's Election to Not Withhold Arizona Taxes in December - Arizona, 2022

Arizona Form A1-E (ADOR10682) Employer's Election to Not Withhold Arizona Taxes in December - Arizona, 2022

-

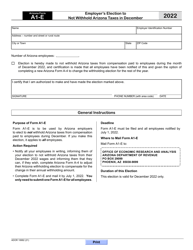

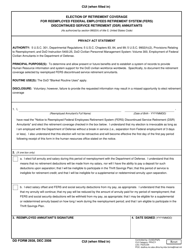

DD Form 2938 Election of Retirement Coverage for Reemployed Federal Employees Retirement System (Fers) Discontinued Service Retirement (Dsr) Annuitants

DD Form 2938 Election of Retirement Coverage for Reemployed Federal Employees Retirement System (Fers) Discontinued Service Retirement (Dsr) Annuitants

-

PBGC Form 719 Election to Withhold Federal Income Tax From Periodic Payments

PBGC Form 719 Election to Withhold Federal Income Tax From Periodic Payments

-

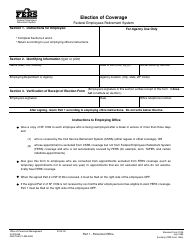

OPM Form SF-3109 Election of Coverage - Federal Employees Retirement System

OPM Form SF-3109 Election of Coverage - Federal Employees Retirement System

-

IRS Form 8288 U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons

IRS Form 8288 U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons

-

IRS Form 1042 Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, 2023

IRS Form 1042 Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, 2023

-

Form UB-433 Voluntary Election for Federal/State Income Tax Withholding - Arizona (English/Spanish)

Form UB-433 Voluntary Election for Federal/State Income Tax Withholding - Arizona (English/Spanish)

-

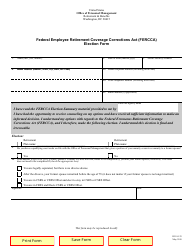

OPM Form RI10-125 Federal Employee Retirement Coverage Corrections Act (Fercca) Election Form

OPM Form RI10-125 Federal Employee Retirement Coverage Corrections Act (Fercca) Election Form

-

IRS Form 8813 Partnership Withholding Tax Payment Voucher (Section 1446)

IRS Form 8813 Partnership Withholding Tax Payment Voucher (Section 1446)

-

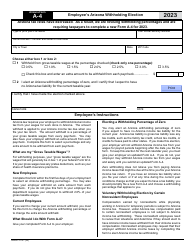

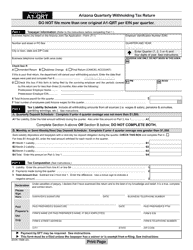

Arizona Form A-4 (ADOR10121) Employee's Arizona Withholding Election - Arizona, 2023

Arizona Form A-4 (ADOR10121) Employee's Arizona Withholding Election - Arizona, 2023

-

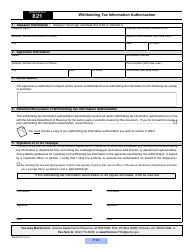

Arizona Form 821 (ADOR10172) Withholding Tax Information Authorization - Arizona

Arizona Form 821 (ADOR10172) Withholding Tax Information Authorization - Arizona

-

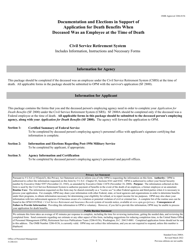

Form SF-2800A Documentation and Elections in Support of Application for Death Benefits When Deceased Was an Employee at the Time of Death - Civil Service Retirement System

Form SF-2800A Documentation and Elections in Support of Application for Death Benefits When Deceased Was an Employee at the Time of Death - Civil Service Retirement System

-

Form F11434 Mandatory State Income Tax Withholding Election for Periodic Withdrawals That Are Not Rollover Eligible - Tiaa

Form F11434 Mandatory State Income Tax Withholding Election for Periodic Withdrawals That Are Not Rollover Eligible - Tiaa

-

IRS Form 8804 Section 1446 Annual Return for Partnership Withholding Tax

IRS Form 8804 Section 1446 Annual Return for Partnership Withholding Tax

-

Arizona Form A1-QRT (ADOR10888) Arizona Quarterly Withholding Tax Return - Arizona

Arizona Form A1-QRT (ADOR10888) Arizona Quarterly Withholding Tax Return - Arizona

-

IRS Form 4670 Request for Relief of Payment of Certain Withholding Taxes

IRS Form 4670 Request for Relief of Payment of Certain Withholding Taxes

-

IRS Form 8805 Foreign Partner's Information Statement of Section 1446 Withholding Tax

IRS Form 8805 Foreign Partner's Information Statement of Section 1446 Withholding Tax

-

IRS Form 4219 Statement of Liability of Lender, Surety, or Other Person for Withholding Taxes

IRS Form 4219 Statement of Liability of Lender, Surety, or Other Person for Withholding Taxes

-

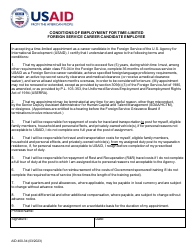

Form AID400-34 Conditions of Employment for Time-Limited Foreign Service Career Candidate Employee

Form AID400-34 Conditions of Employment for Time-Limited Foreign Service Career Candidate Employee

convert to pdf

convert from pdf

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2026 ©