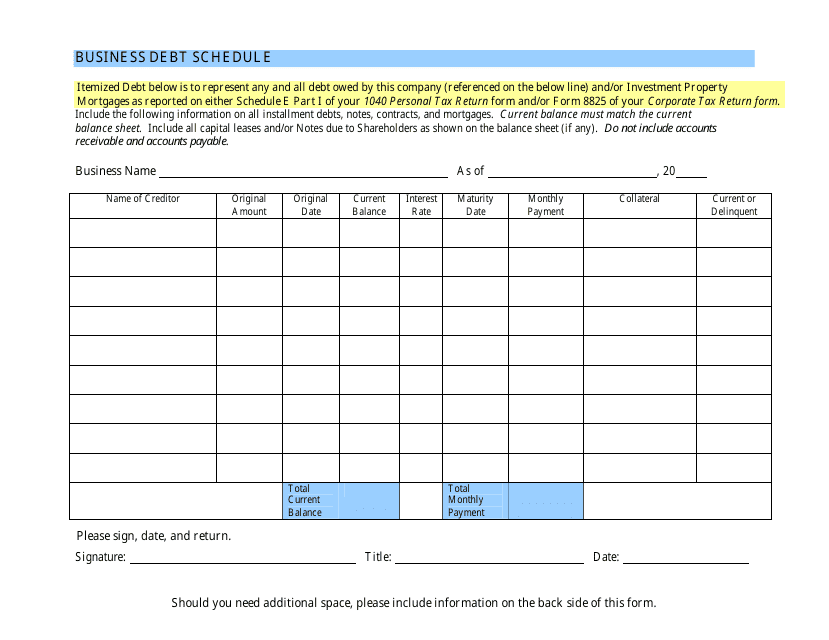

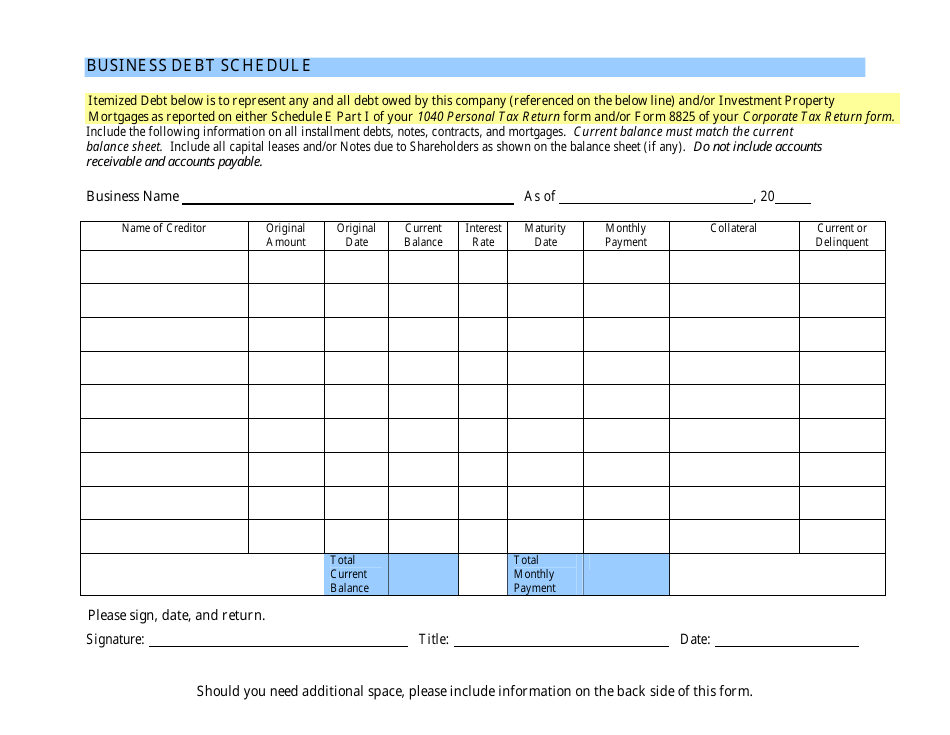

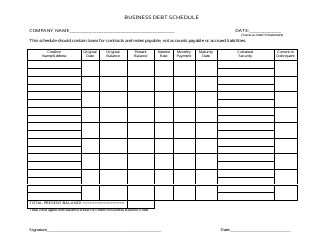

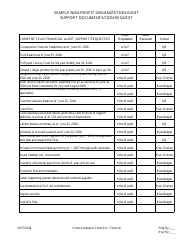

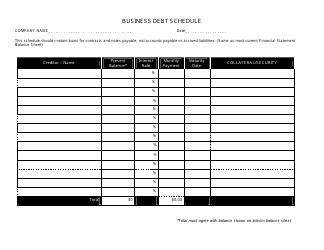

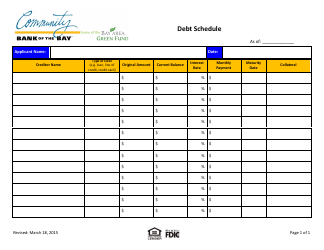

Business Debt Schedule Template - Varicolored

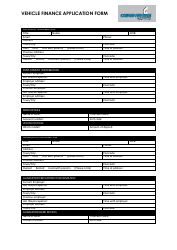

A Business Debt Schedule Template is a tool that helps businesses keep track of their outstanding debts. It organizes and categorizes the various debts a business may have, such as loans, lines of credit, and credit card debt. The varicolored format is likely used to visually differentiate between different types of debts or to highlight important information on the schedule.

FAQ

Q: What is a business debt schedule?

A: A business debt schedule is a document that tracks the outstanding debts of a business.

Q: Why is a business debt schedule important?

A: A business debt schedule is important as it helps in monitoring and managing the financial obligations of the business.

Q: What information is included in a business debt schedule?

A: A business debt schedule typically includes details of the lender, outstanding balance, interest rate, monthly payment, and maturity date of each debt.

Q: How can I create a business debt schedule?

A: You can create a business debt schedule using a template or by manually listing all the outstanding debts and their relevant information.