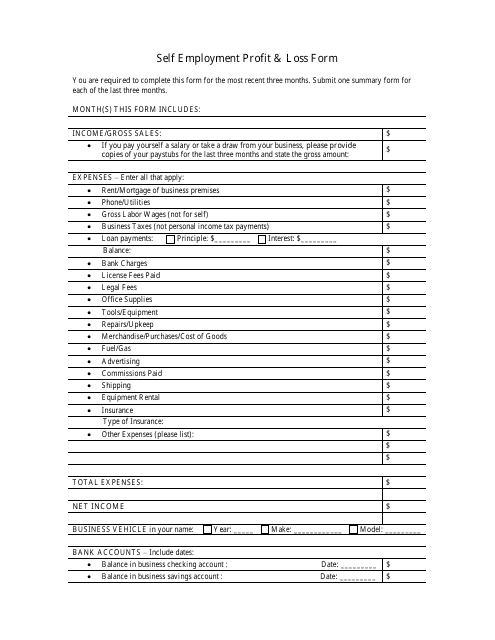

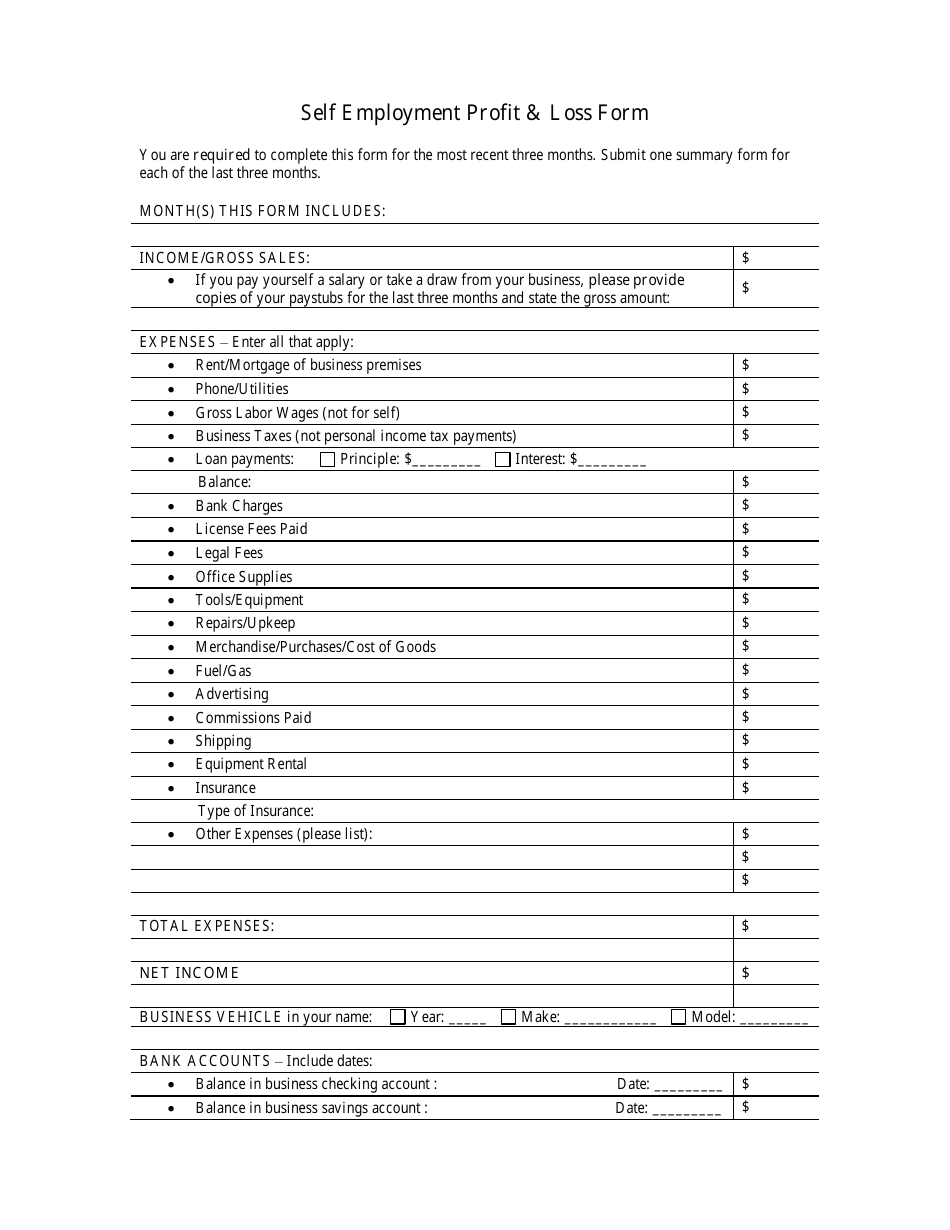

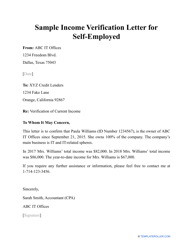

Self Employment Profit and Loss Form

The Self Employment Profit and Loss Form is used to report the income and expenses of individuals who are self-employed. It helps calculate the profit or loss from their self-employment activities for tax purposes.

Self-employed individuals, including freelancers, sole proprietors, and independent contractors, are required to file a Self Employment Profit and Loss form.

FAQ

Q: What is a self-employment profit and loss form?

A: A self-employment profit and loss form is a document used to report the income and expenses of a self-employed individual.

Q: Why is a self-employment profit and loss form important?

A: A self-employment profit and loss form is important because it helps track and report the financial performance of a self-employed business, and it is also used for tax purposes.

Q: What information is included in a self-employment profit and loss form?

A: A self-employment profit and loss form typically includes information such as total income, deductible expenses, net profit or loss, and other relevant financial details.

Q: Do I need to file a self-employment profit and loss form?

A: If you are self-employed and your net earnings from self-employment are $400 or more in a year, you are generally required to file a self-employment profit and loss form.

Q: Can I deduct business expenses on a self-employment profit and loss form?

A: Yes, you can deduct allowable business expenses on a self-employment profit and loss form to reduce your taxable income.

Q: Are there any specific rules or guidelines for completing a self-employment profit and loss form?

A: Yes, there are specific rules and guidelines provided by the IRS for completing a self-employment profit and loss form. It is important to accurately report your income and expenses and keep proper documentation to support your figures.