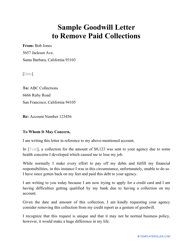

Goodwill Letter Template

What Is a Goodwill Letter?

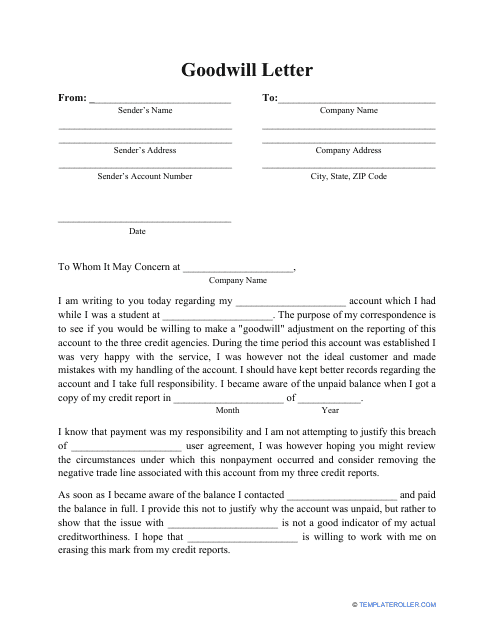

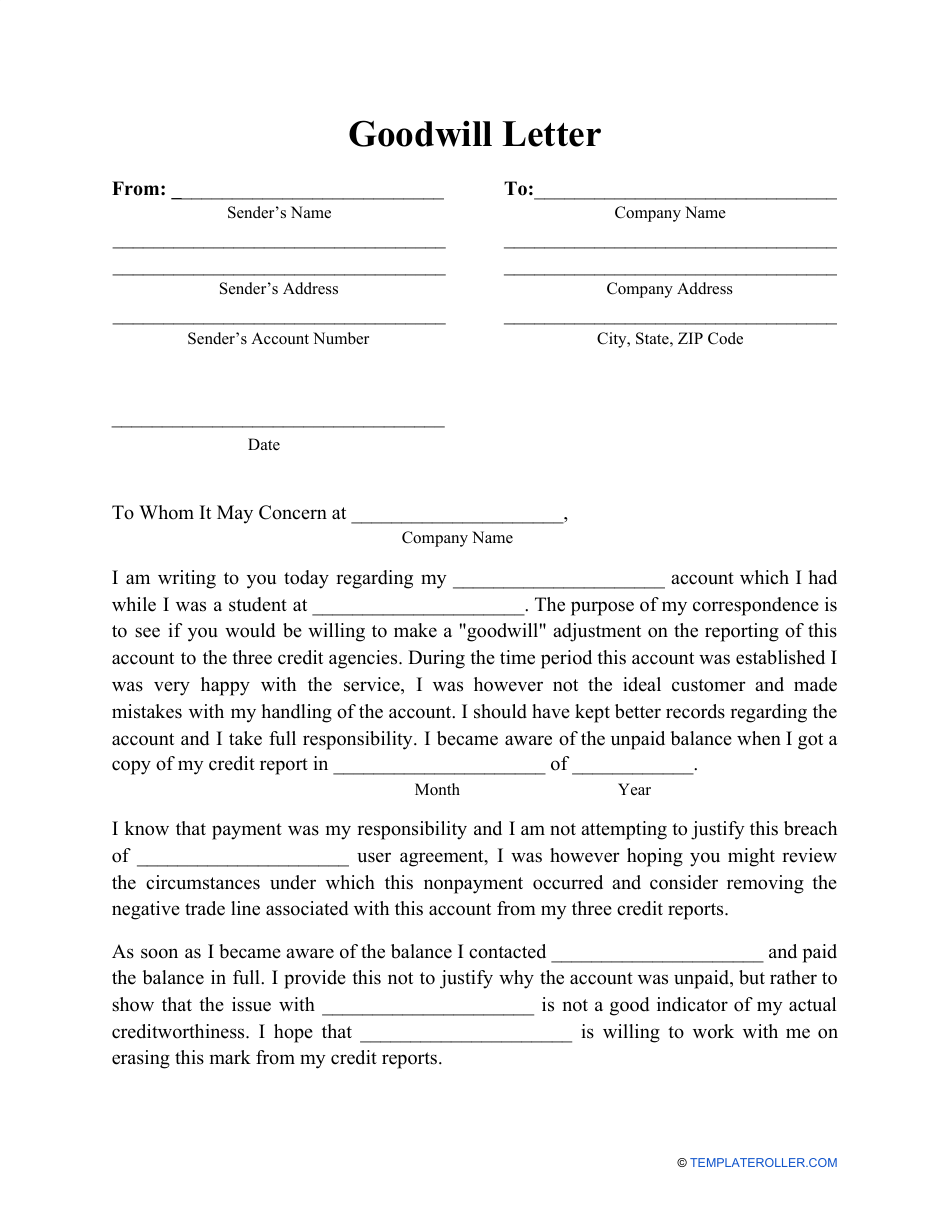

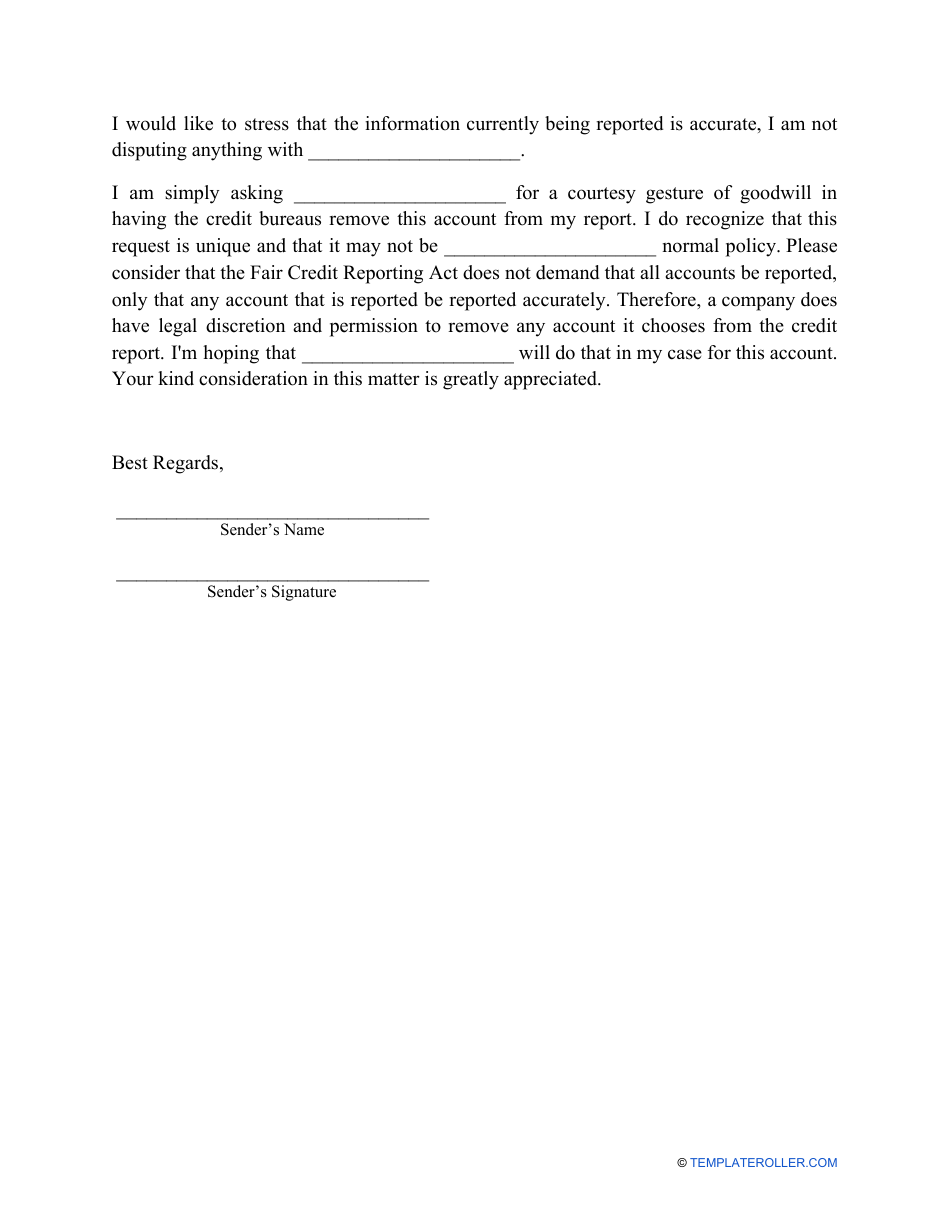

A Goodwill Letter is a written statement composed by a borrower and sent to a creditor if the former needs to remove negative entries from their credit history. Use this document to clean your credit score if you could not make a payment on time and believe this derogatory mark should not remain in your credit report.

Alternate Names:

- Goodwill Adjustment Letter;

- Letter of Goodwill.

Whether you experienced financial hardship or were unemployed in the past, it is recommended to contact the creditor and ask them to delete a mention of the late payment from your records. This will help you qualify for a loan or credit card and will give you better interest rates when you sign a new agreement with a financial institution. A Goodwill Letter to Remove Paid Collections will let you rebuild damaged credit as long as the credit bureau or debt collector sees it was a one-time mistake in your past. You can download a Goodwill Letter template via the link below.

How to Write a Goodwill Letter?

Follow these steps to draft a Goodwill Adjustment Letter:

- Greet the recipient and identify yourself by your name and address.

- Provide a reference to your banking account, the agreement you have signed with the creditor, or loan number to make sure you are correctly recognized.

- Describe the situation you have found yourself in - for example, you are dealing with a lender who cannot approve your loan application because they learned about a payment default in your credit history. Whether you have repaid this amount quickly with or without penalties, you need to show this was an exception rather than a rule and any financial institution should believe your reliability and trustworthiness as a customer.

- State the reason for composing this letter - you are asking the creditor to clean your credit report. The outcome of this request will depend on your relationship with the letter recipient - if you have been a client of the bank for many years and failed to make one payment on time, it is very likely they will agree to help you. On the other hand, if you ignored their attempts to reach out and avoided any communication with them due to difficult financial circumstances, it may be harder to obtain their support. Either way, you need to emphasize your willingness to improve your credit score and work with the creditor in the future to make sure this issue will not arise again.

- Make the letter stronger with documentation that verifies you were unable to handle your financial obligations through no fault of your own . If you were unemployed, took time off to take care of an ill relative, or were evicted, attach documents to convince the creditor to help you fix bad credit.

- Thank the recipient for their time, write down your contact information, date and sign the letter . Get proof of delivery by sending this document via certified mail.

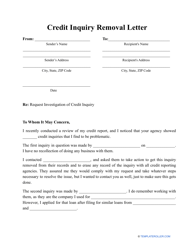

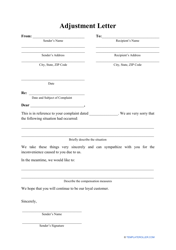

Haven't found the template you're looking for? Take a look at the related templates and samples below: