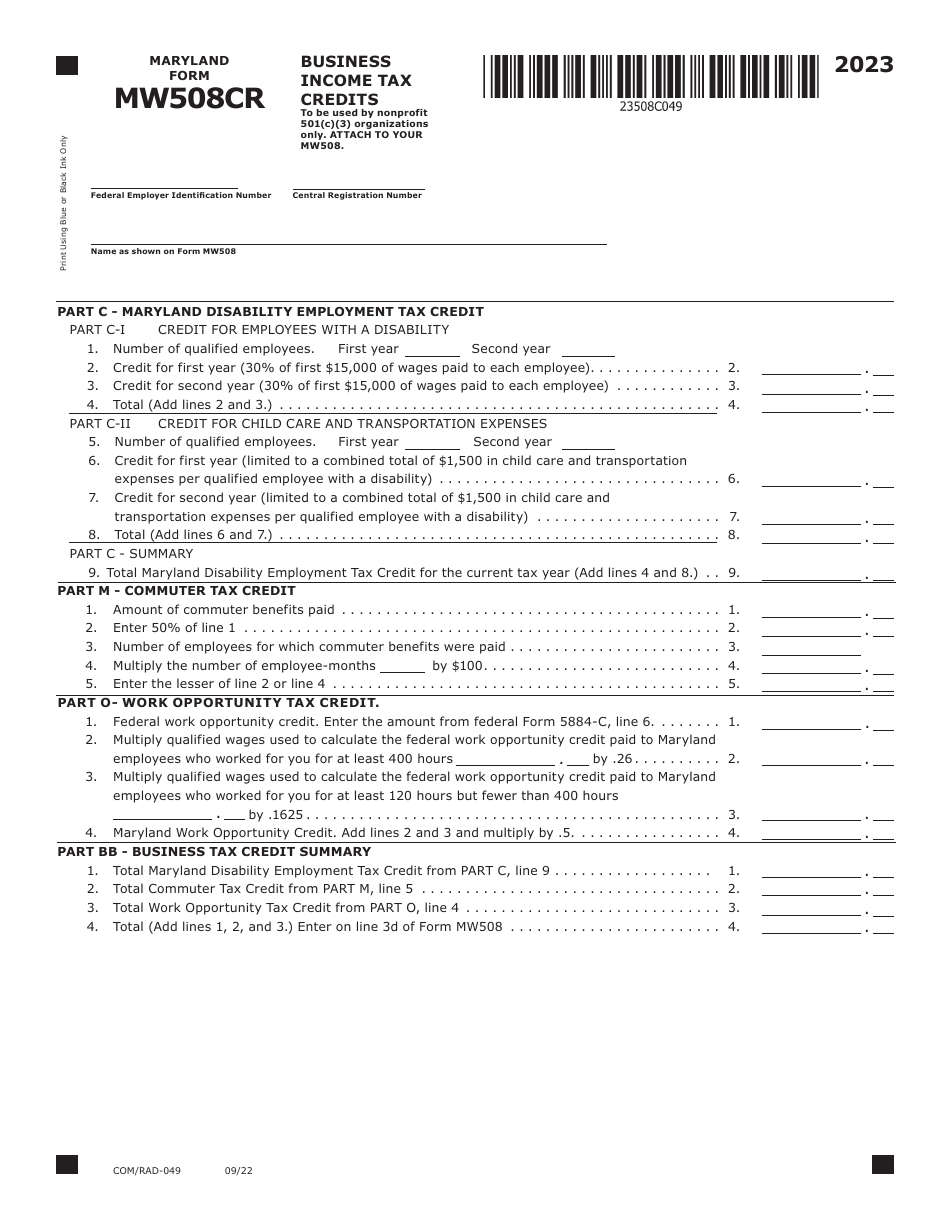

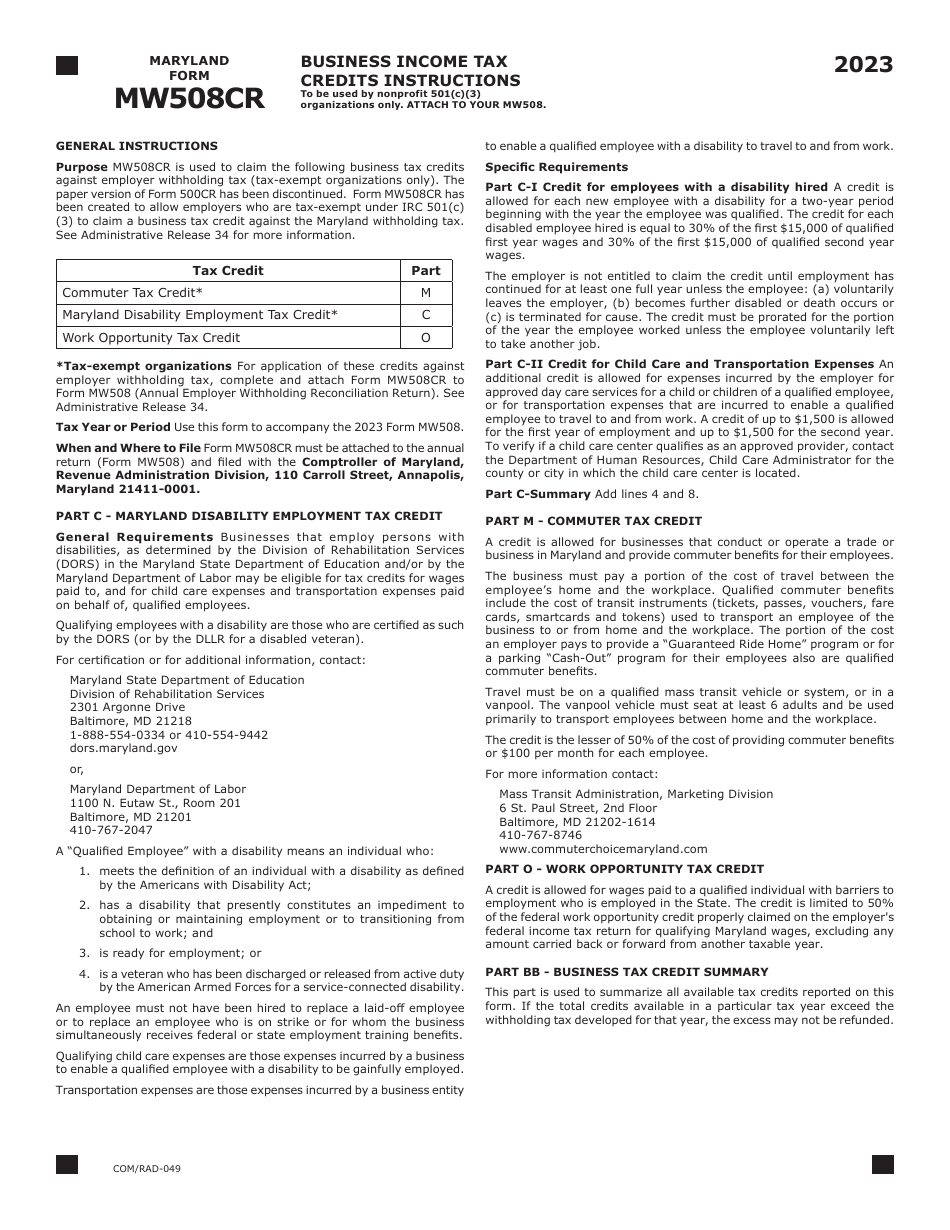

Maryland Form MW508CR (COM / RAD-049) Business Income Tax Credits - Maryland

Fill PDF Online

Fill out online for free

without registration or credit card