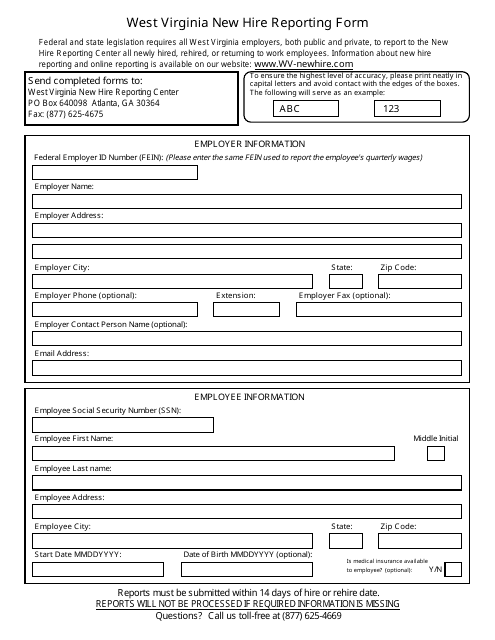

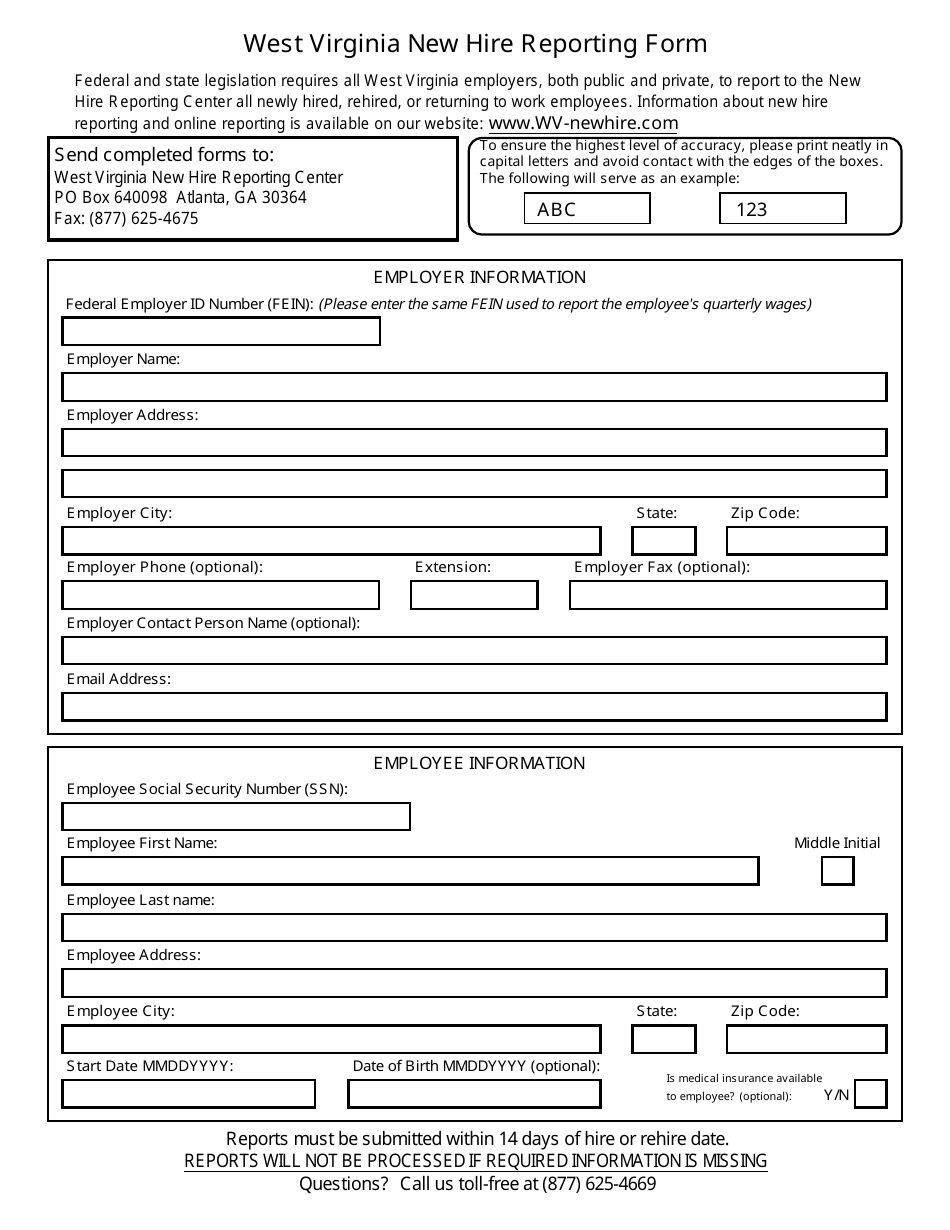

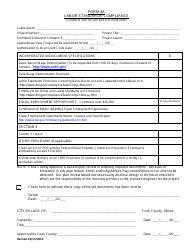

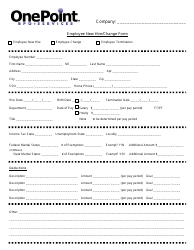

New Hire Reporting Form - West Virginia New Hire Reporting Center - West Virginia

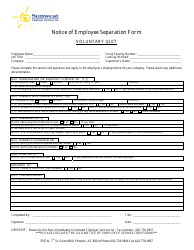

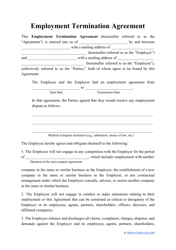

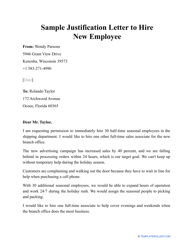

The New Hire Reporting Form in West Virginia is used by the West Virginia New Hire Reporting Center to collect information about newly hired employees. It is a way for employers to comply with the state's requirement of reporting new hires to the authorities. The information collected on this form helps in the administration of various government programs such as child support enforcement and unemployment benefits.

The employer is responsible for filing the New Hire Reporting Form with the West Virginia New Hire Reporting Center.

FAQ

Q: What is the New Hire Reporting Form?

A: The New Hire Reporting Form is a document used to report newly hired employees in West Virginia.

Q: What is the West Virginia New Hire Reporting Center?

A: The West Virginia New Hire Reporting Center is the agency responsible for receiving and processing new hire reports in West Virginia.

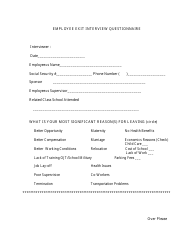

Q: Why is it important to report new hires?

A: Reporting new hires is important to assist in the collection of child support, detect and prevent fraud, and ensure compliance with state and federal laws.

Q: Who is required to submit the New Hire Reporting Form?

A: Employers in West Virginia are required by law to submit the New Hire Reporting Form for all newly hired employees.

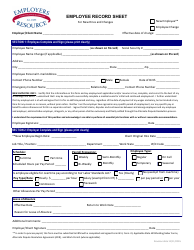

Q: What information is required on the New Hire Reporting Form?

A: The New Hire Reporting Form requires basic information about the employer and the newly hired employee, including their names, addresses, social security numbers, and employment start date.

Q: When should I submit the New Hire Reporting Form?

A: The New Hire Reporting Form should be submitted within 20 calendar days of the employee's hire date.

Q: What are the consequences of not reporting new hires?

A: Failure to report new hires in West Virginia may result in penalties and fines.

Q: Are independent contractors considered new hires?

A: No, independent contractors are not considered new hires and do not need to be reported on the New Hire Reporting Form.