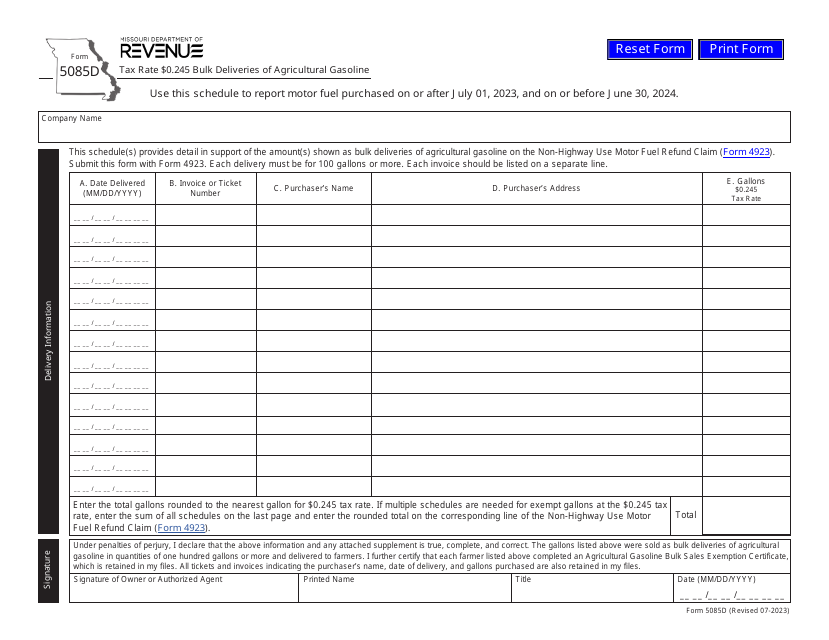

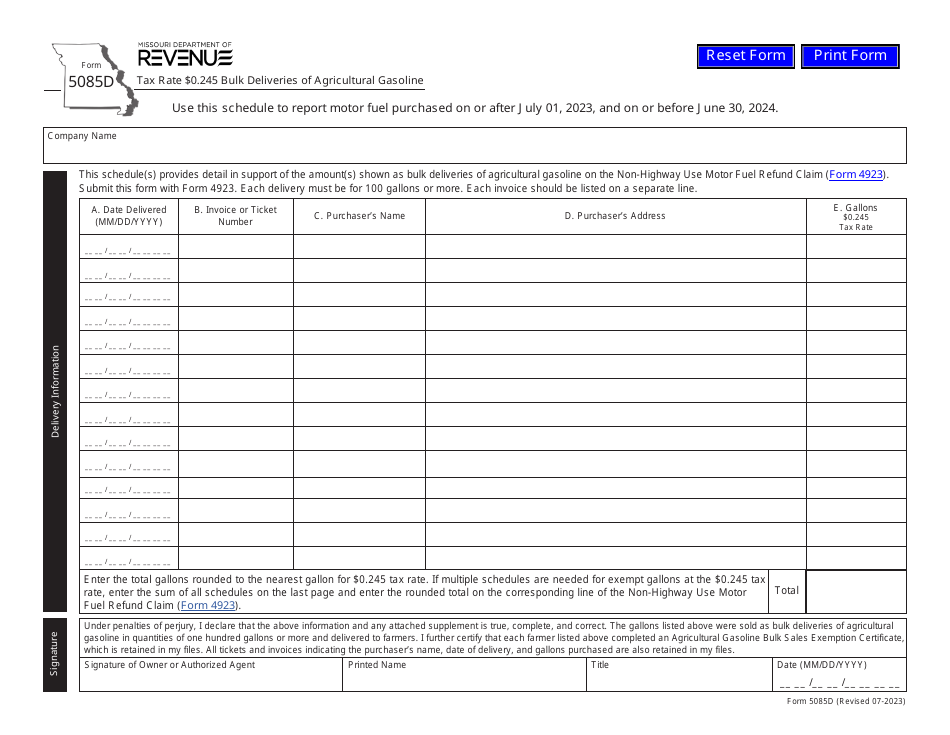

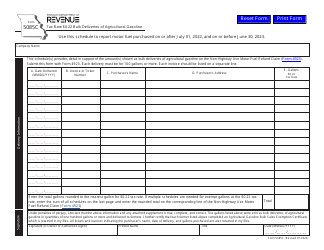

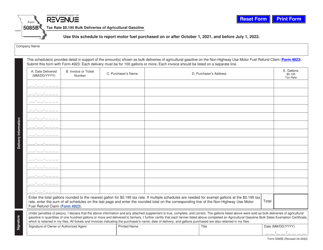

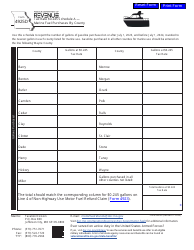

Form 5085D Tax Rate $0.245 Bulk Deliveries of Agricultural Gasoline - Missouri

Fill PDF Online

Fill out online for free

without registration or credit card