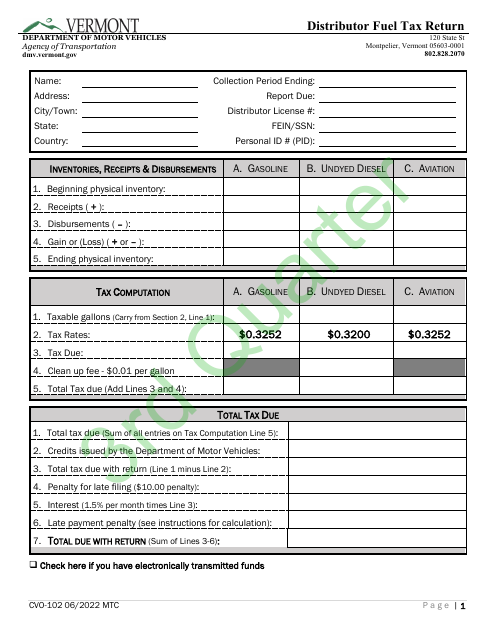

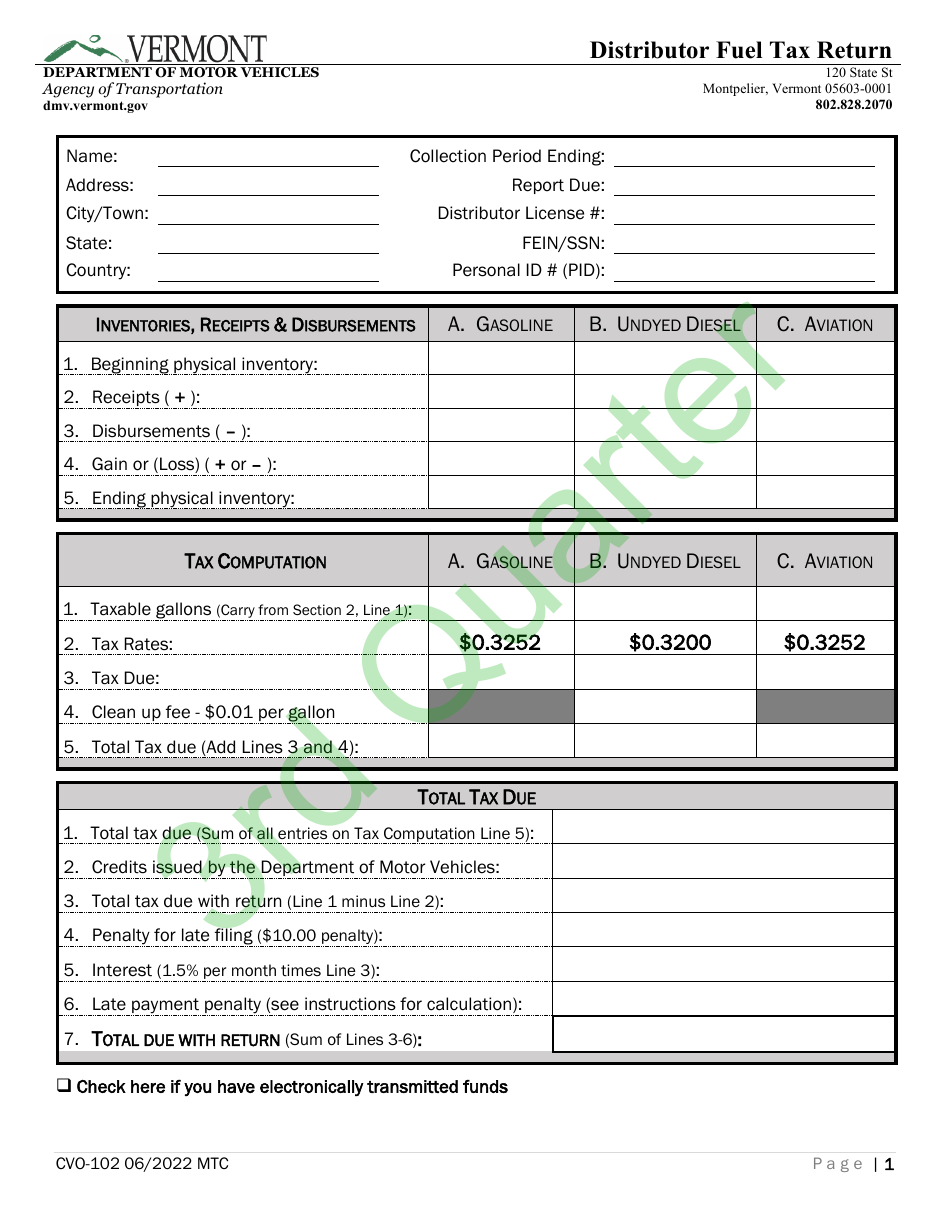

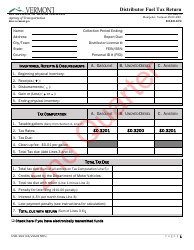

Form CVO-102 Q3 Distributor Fuel Tax Return - 3rd Quarter - Vermont

What Is Form CVO-102 Q3?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

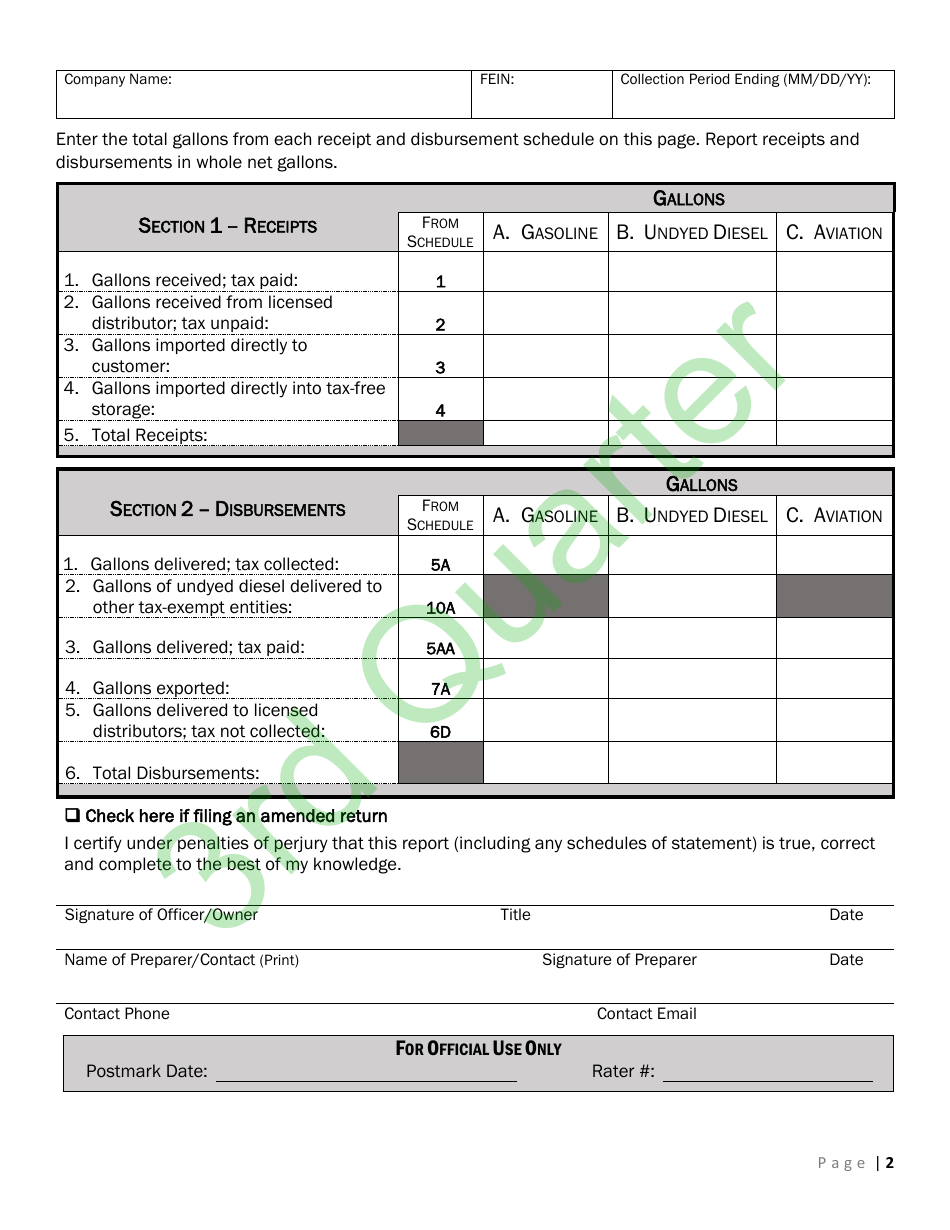

Q: What is Form CVO-102?

A: Form CVO-102 is the Distributor Fuel Tax Return for the 3rd Quarter in Vermont.

Q: What is the purpose of Form CVO-102?

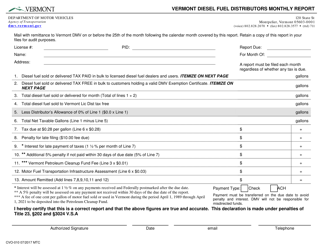

A: Form CVO-102 is used to report and pay the distributor fuel tax for the 3rd quarter in Vermont.

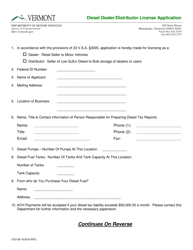

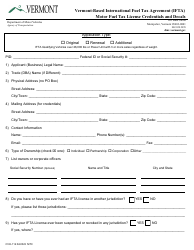

Q: Who needs to file Form CVO-102?

A: Distributors of fuel in Vermont need to file Form CVO-102 for the 3rd quarter.

Q: When is Form CVO-102 due?

A: Form CVO-102 for the 3rd quarter is due by the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing of Form CVO-102?

A: Yes, there may be penalties for late filing of Form CVO-102, including interest charges on the unpaid tax.

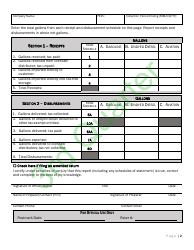

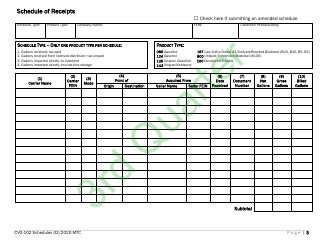

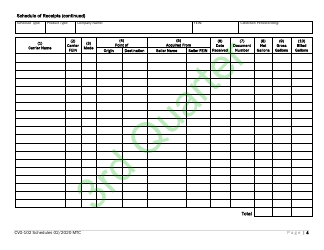

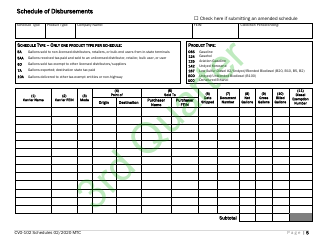

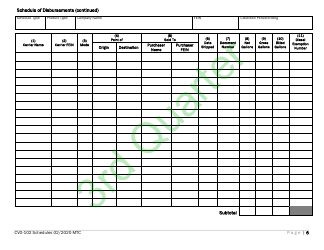

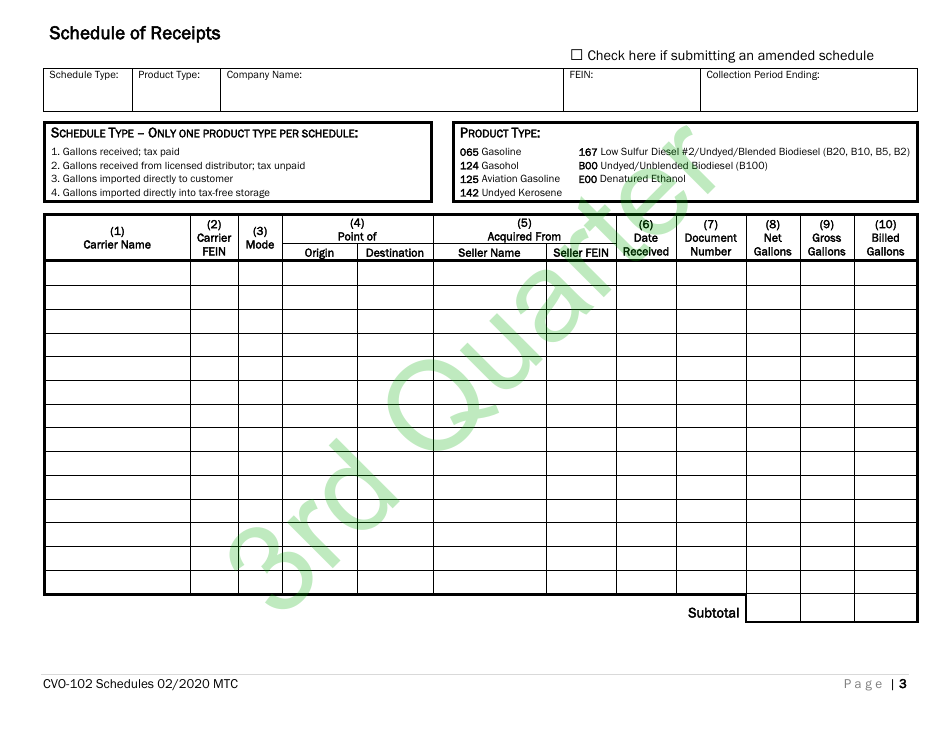

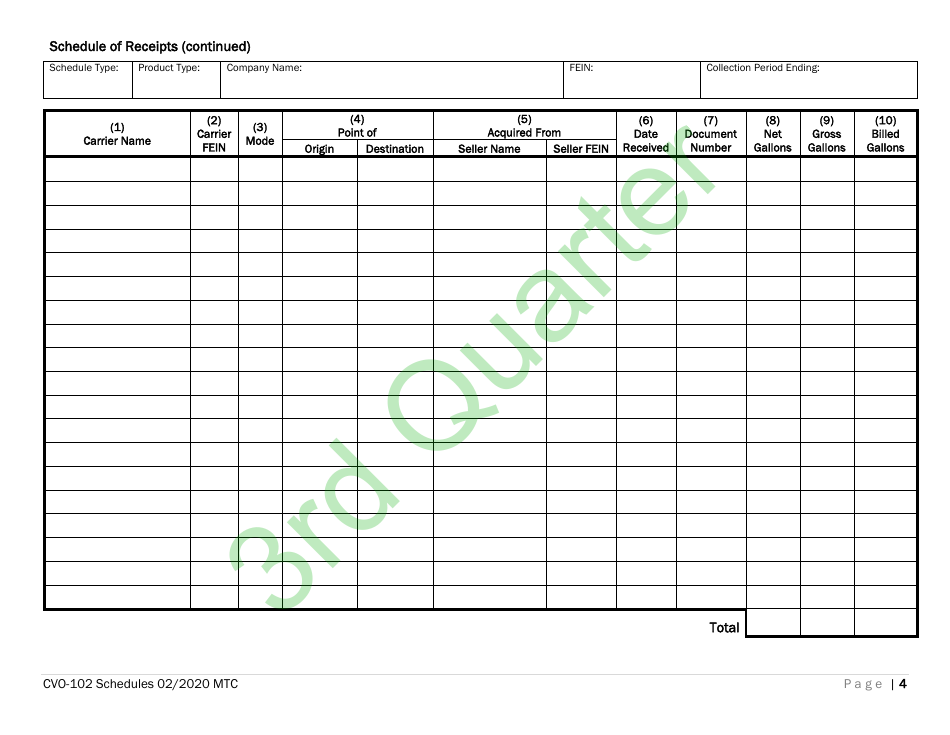

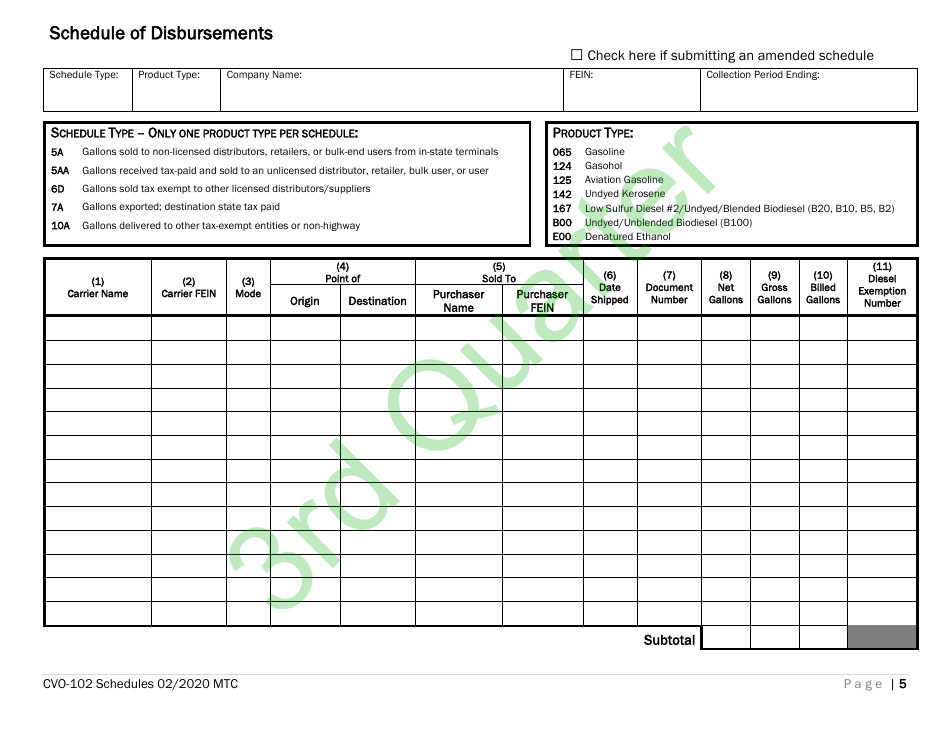

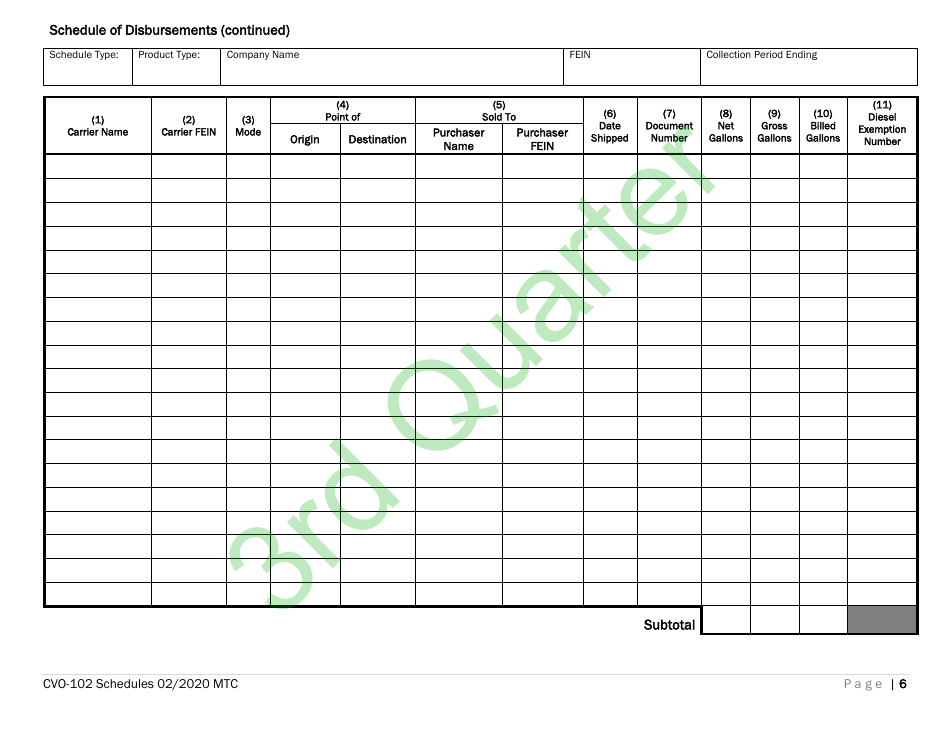

Q: What information is required on Form CVO-102?

A: Form CVO-102 requires information such as fuel sales, gallons sold, and tax due for the 3rd quarter in Vermont.

Q: Is there any additional documentation required with Form CVO-102?

A: No, there is no additional documentation required with Form CVO-102, unless specifically requested by the Vermont Department of Motor Vehicles.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVO-102 Q3 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.