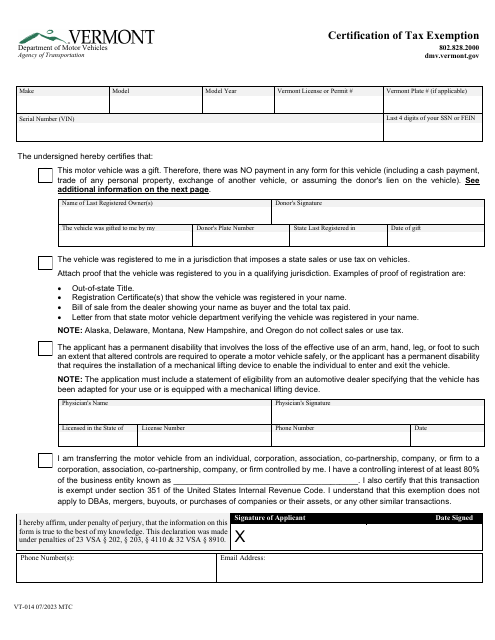

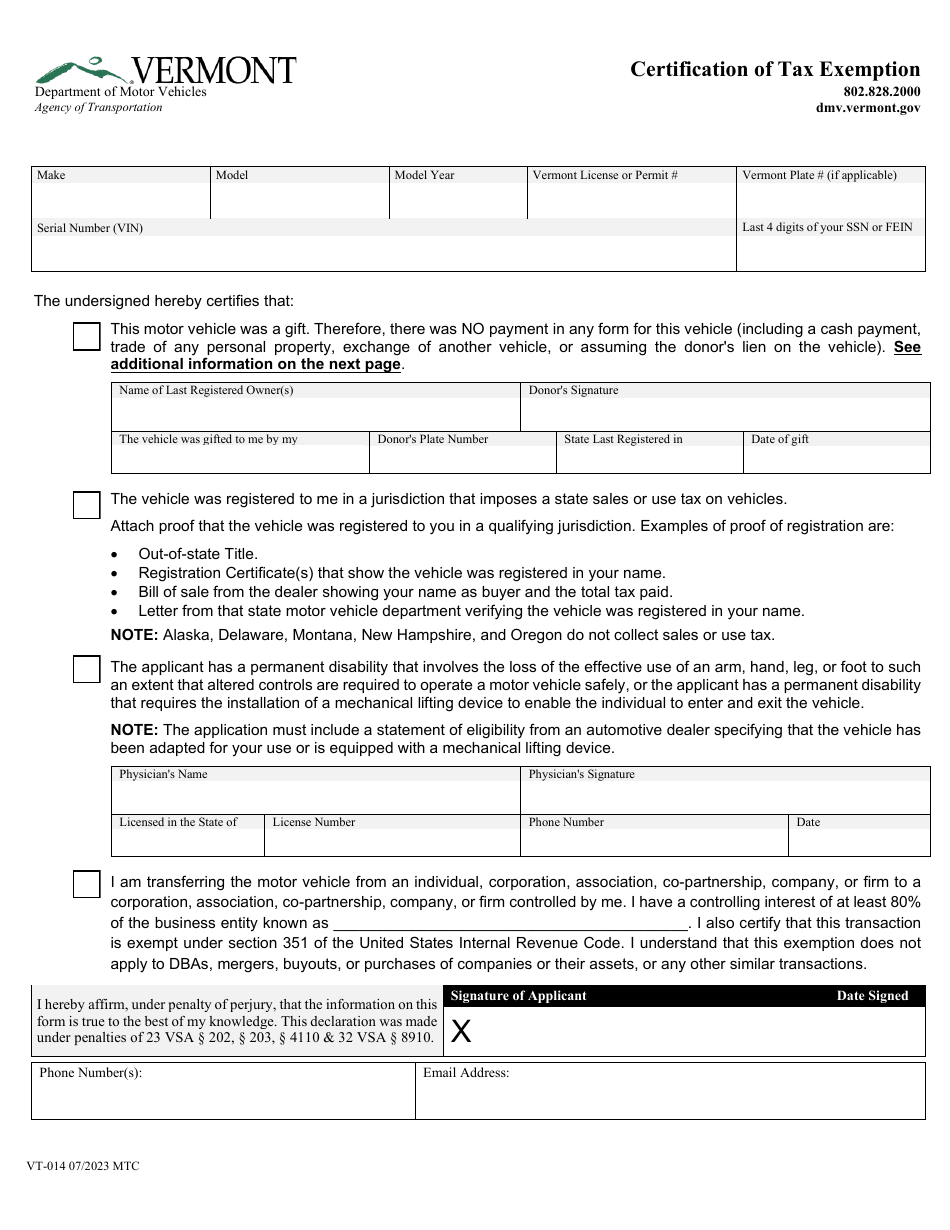

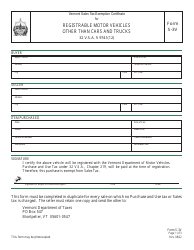

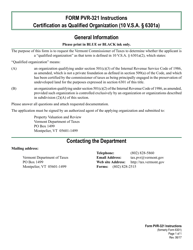

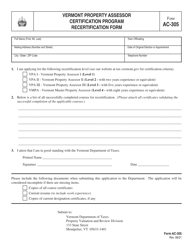

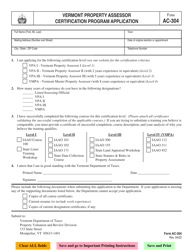

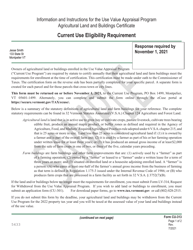

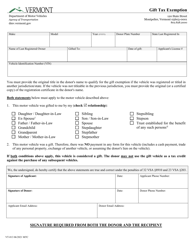

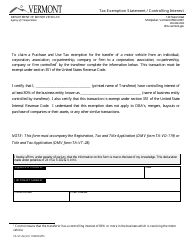

Form VT-014 Certification of Tax Exemption - Vermont

What Is Form VT-014?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VT-014 Certification of Tax Exemption?

A: Form VT-014 Certification of Tax Exemption is a form used in Vermont to certify tax exemption for certain organizations.

Q: Who needs to fill out Form VT-014 Certification of Tax Exemption?

A: Certain organizations in Vermont that are seeking tax exemption need to fill out this form.

Q: What is the purpose of Form VT-014 Certification of Tax Exemption?

A: The purpose of this form is to provide proof of tax exemption status for eligible organizations.

Q: Are there any fees associated with filing Form VT-014 Certification of Tax Exemption?

A: No, there are no fees associated with filing this form.

Q: Is there a deadline for filing Form VT-014 Certification of Tax Exemption?

A: Yes, there is a deadline for filing this form, and it is typically based on the fiscal year of the organization.

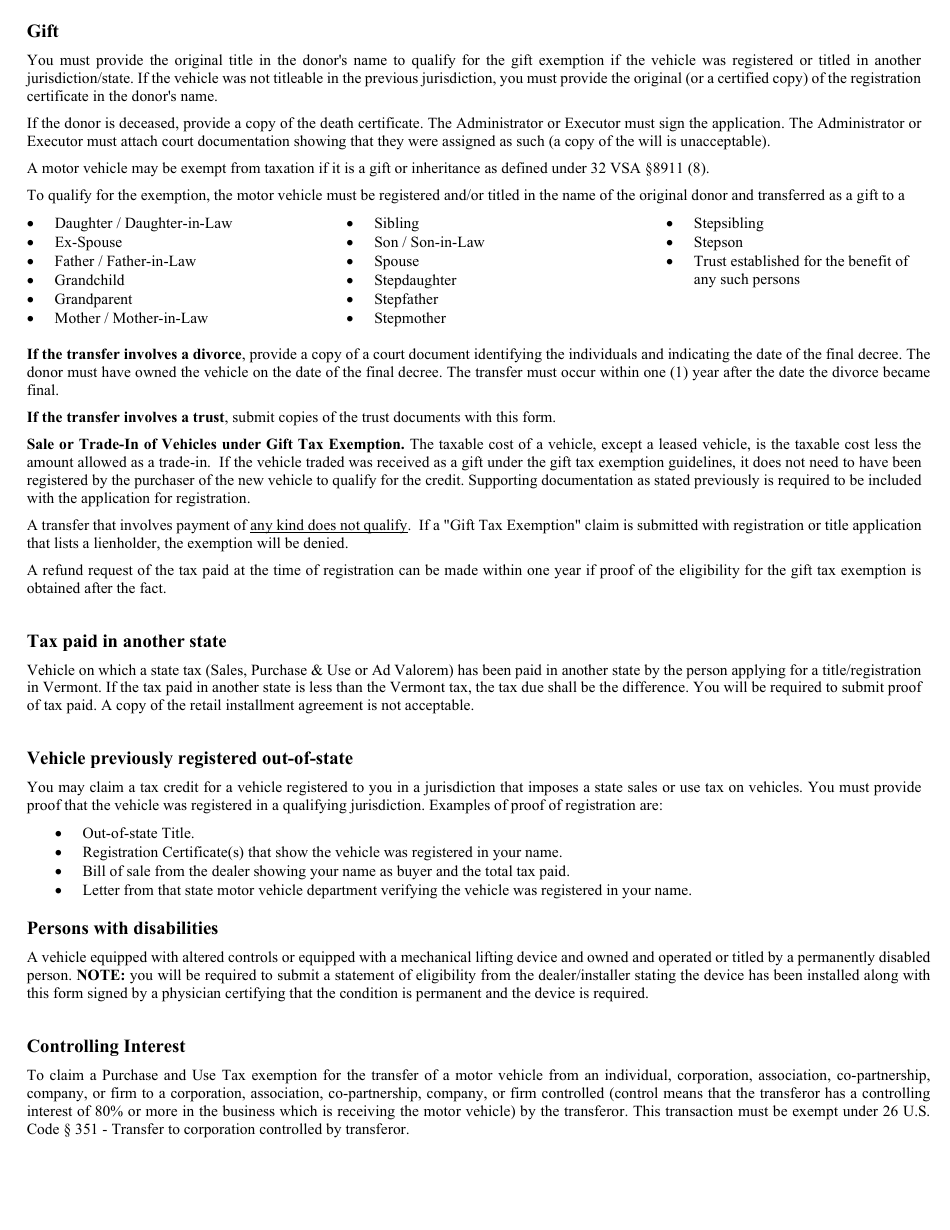

Q: What supporting documents do I need to include with Form VT-014 Certification of Tax Exemption?

A: You may need to include additional documents, such as financial statements or articles of incorporation, depending on the type of organization.

Q: Can I submit Form VT-014 Certification of Tax Exemption electronically?

A: No, this form must be submitted by mail or in person.

Q: What happens after I submit Form VT-014 Certification of Tax Exemption?

A: The Vermont Department of Taxes will review your application and notify you of their decision regarding your tax exemption status.

Form Details:

- Released on July 1, 2023;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VT-014 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.