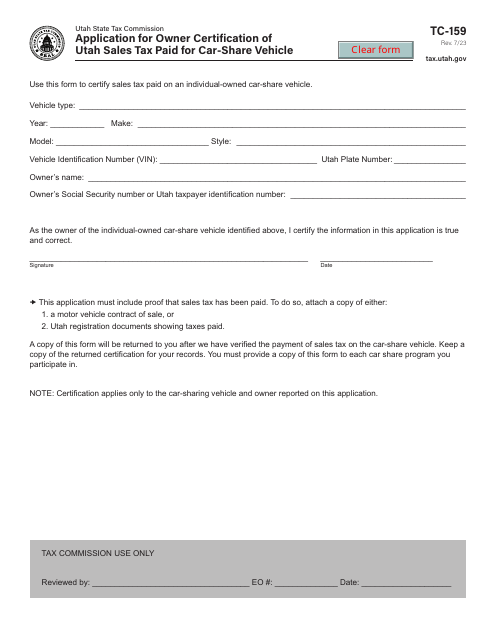

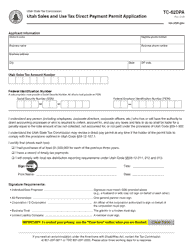

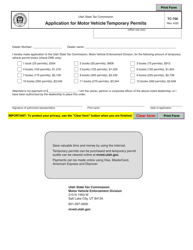

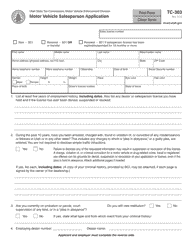

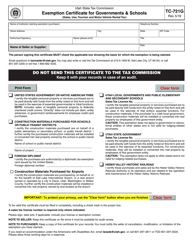

Form TC-159 Application for Owner Certification of Utah Sales Tax Paid for Car-Share Vehicle - Utah

What Is Form TC-159?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-159?

A: Form TC-159 is the Application for Owner Certification of Utah Sales Tax Paid for Car-Share Vehicle in Utah.

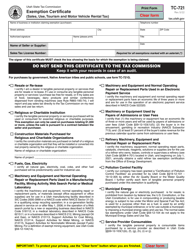

Q: What is the purpose of Form TC-159?

A: The purpose of Form TC-159 is to certify that the sales tax has been paid for a car-share vehicle in Utah.

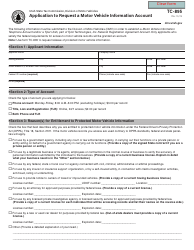

Q: Who needs to fill out Form TC-159?

A: Owners of car-share vehicles in Utah need to fill out Form TC-159.

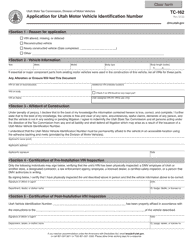

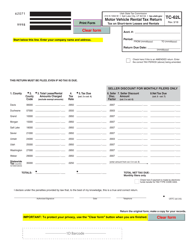

Q: What information is required on Form TC-159?

A: Form TC-159 requires information such as the owner's name, vehicle make and model, vehicle identification number (VIN), and proof of sales tax payment.

Q: Are there any fees associated with Form TC-159?

A: No, there are no fees associated with Form TC-159.

Q: What is the deadline for submitting Form TC-159?

A: Form TC-159 should be submitted within 30 days of the date of purchase or acquisition of the car-share vehicle.

Q: What happens after I submit Form TC-159?

A: After submitting Form TC-159, the Utah State Tax Commission will review the application and issue a certification of sales tax paid for the car-share vehicle.

Form Details:

- Released on July 1, 2023;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-159 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.