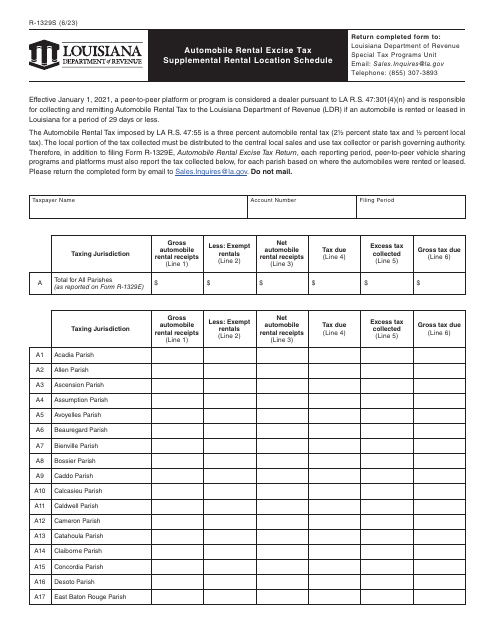

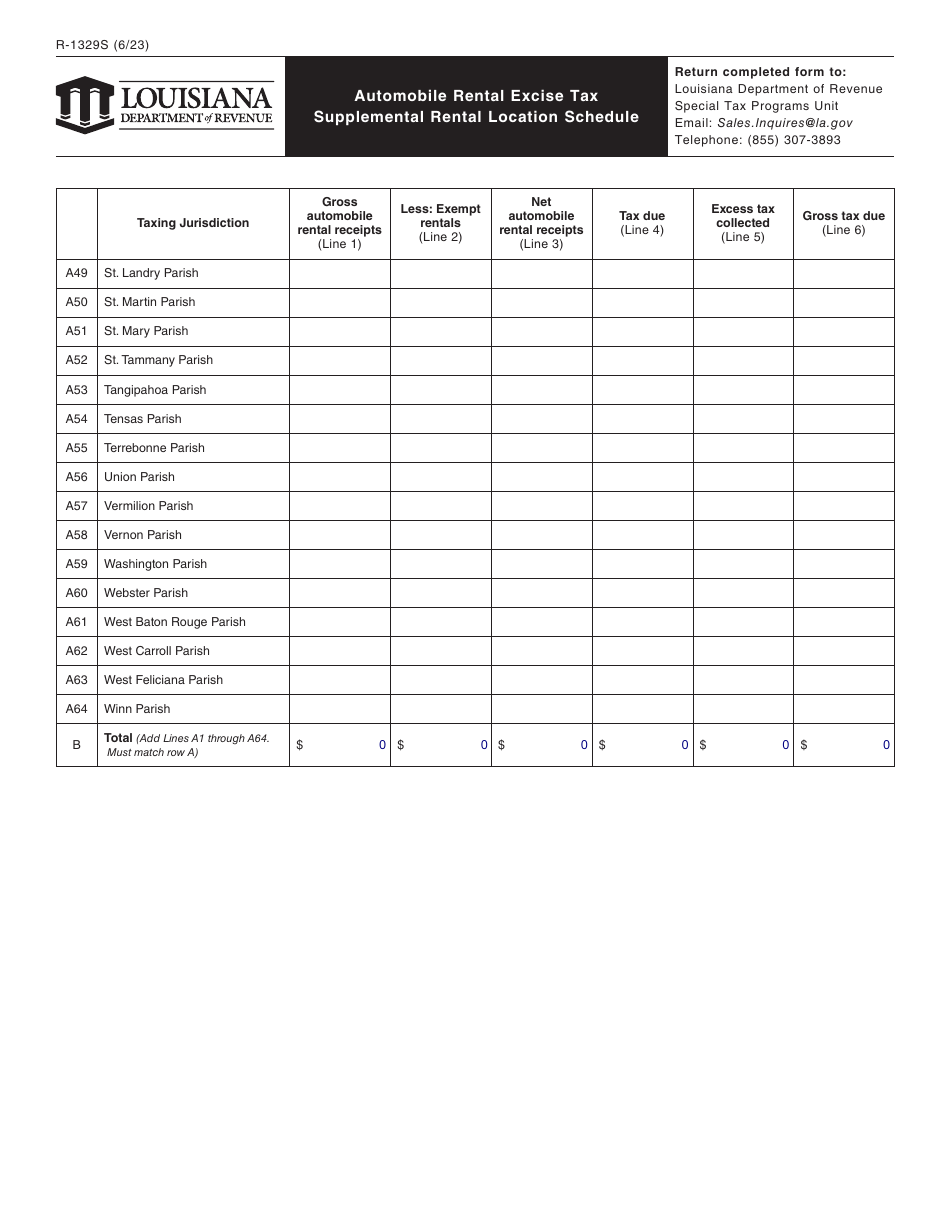

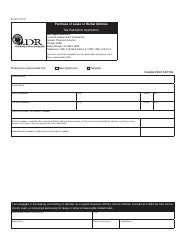

Form R-1329S Automobile Rental Excise Tax Supplemental Rental Location Schedule - Louisiana

What Is Form R-1329S?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

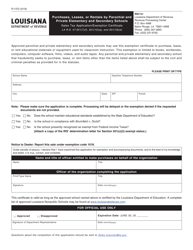

Q: What is Form R-1329S?

A: Form R-1329S is the Automobile Rental Excise Tax Supplemental Rental Location Schedule for the state of Louisiana.

Q: What is the purpose of Form R-1329S?

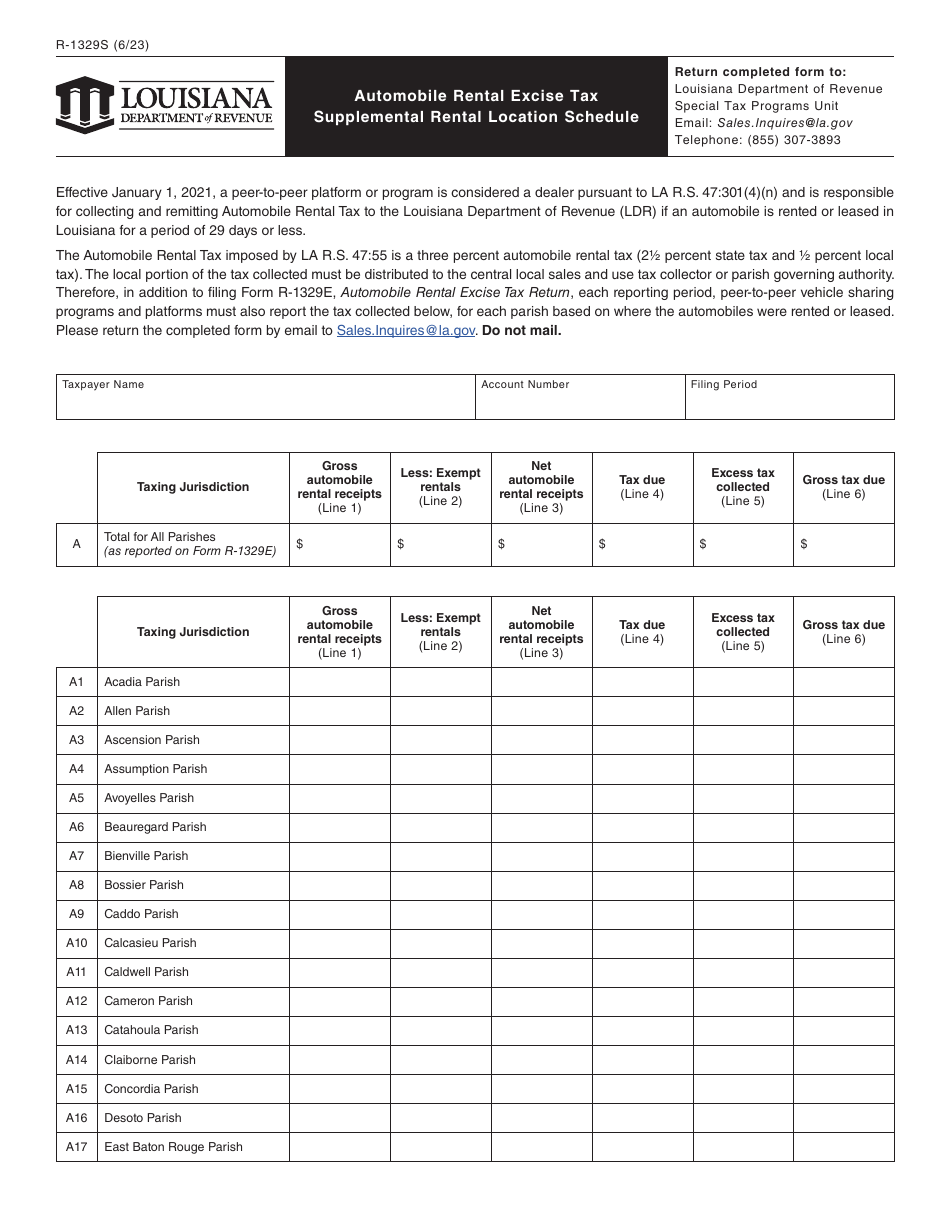

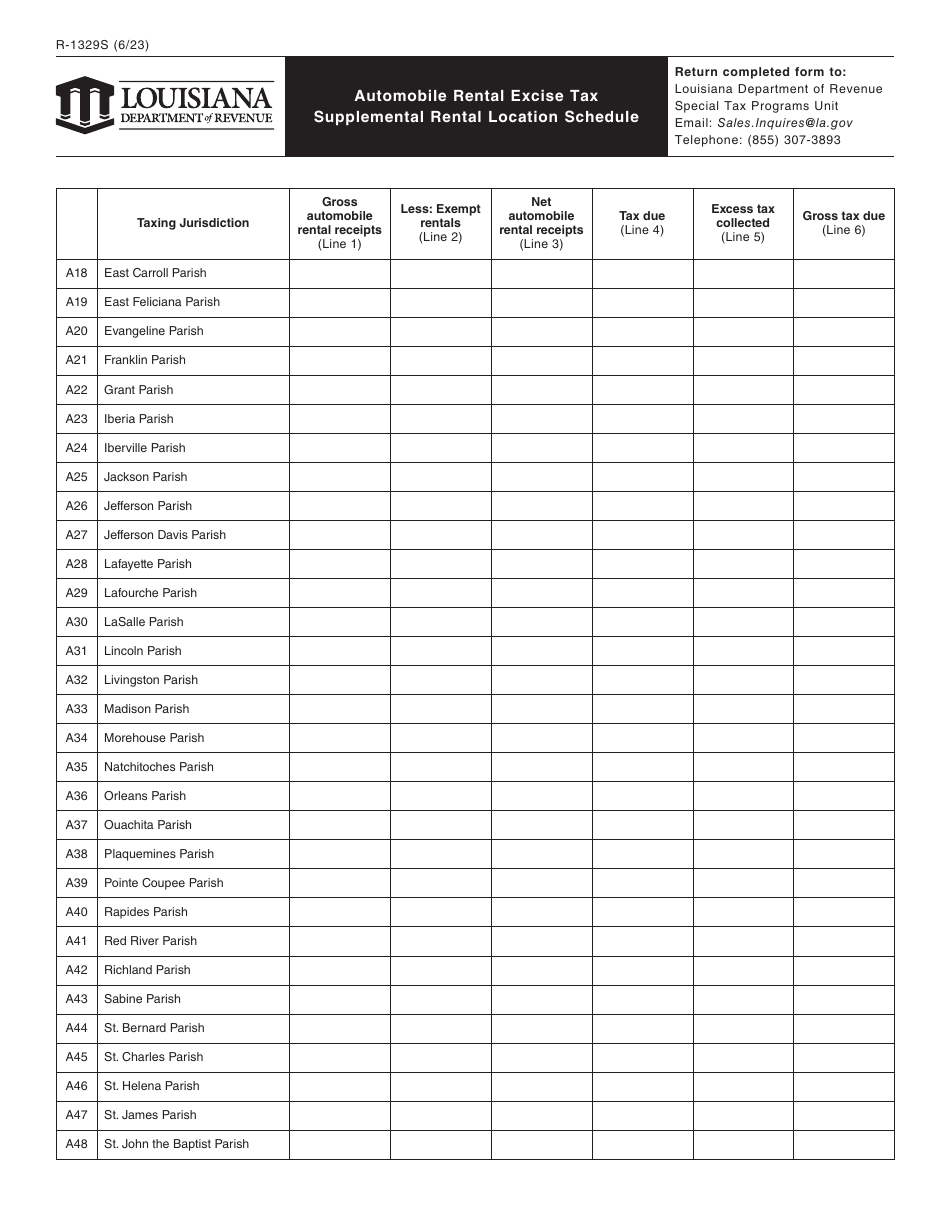

A: The purpose of Form R-1329S is to report automobile rental excise tax for additional rental locations in Louisiana.

Q: Who needs to file Form R-1329S?

A: Automobile rental companies operating in Louisiana with additional rental locations need to file Form R-1329S.

Q: What information is required on Form R-1329S?

A: Form R-1329S requires information such as the rental location address, rental period, total number of rental days, and the amount of excise tax.

Q: When is Form R-1329S due?

A: Form R-1329S is due on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form R-1329S?

A: Yes, there are penalties for late filing of Form R-1329S, including interest charges on unpaid taxes.

Q: Is Form R-1329S subject to audit?

A: Yes, Form R-1329S is subject to audit by the Louisiana Department of Revenue.

Q: Are there any exemptions for Form R-1329S?

A: There are no specific exemptions mentioned for Form R-1329S. However, certain rental transactions may be exempt from the automobile rental excise tax based on other provisions of Louisiana tax law.

Form Details:

- Released on June 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1329S by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.