This version of the form is not currently in use and is provided for reference only. Download this version of

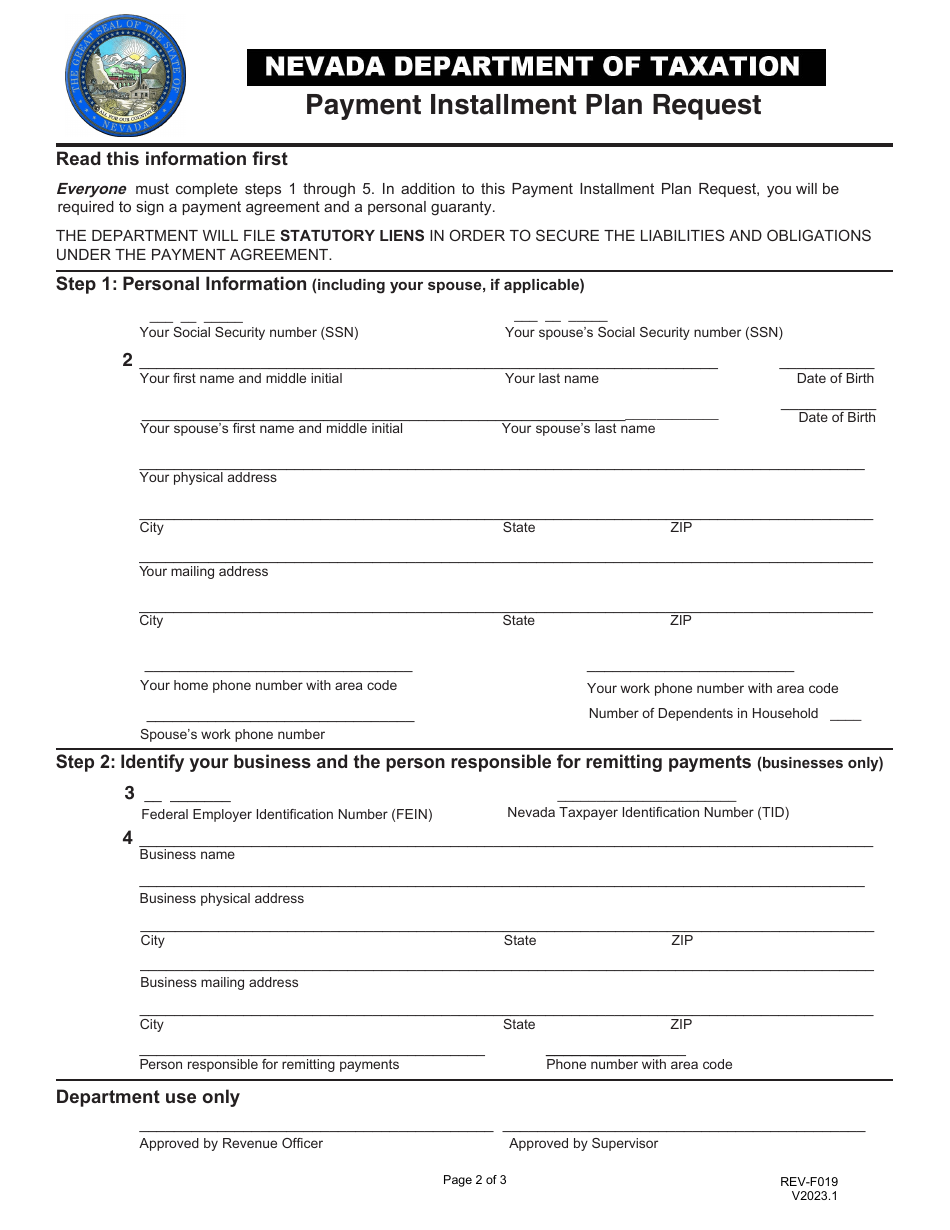

Form REV-F019

for the current year.

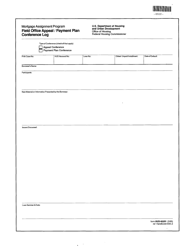

Form REV-F019 Payment Installment Plan Request - Nevada

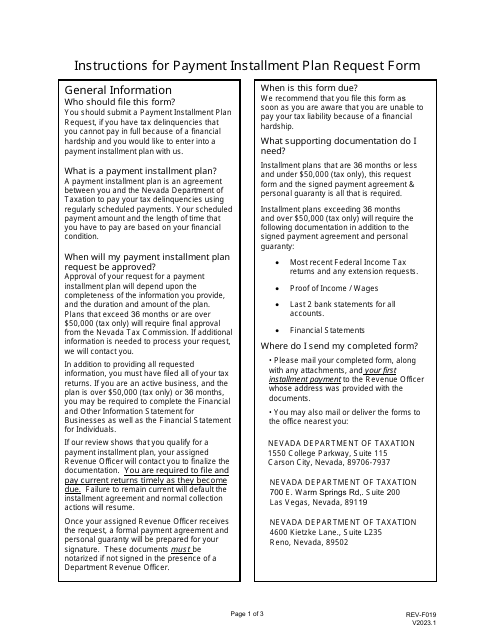

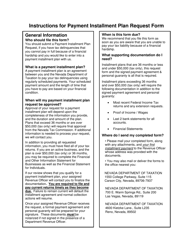

What Is Form REV-F019?

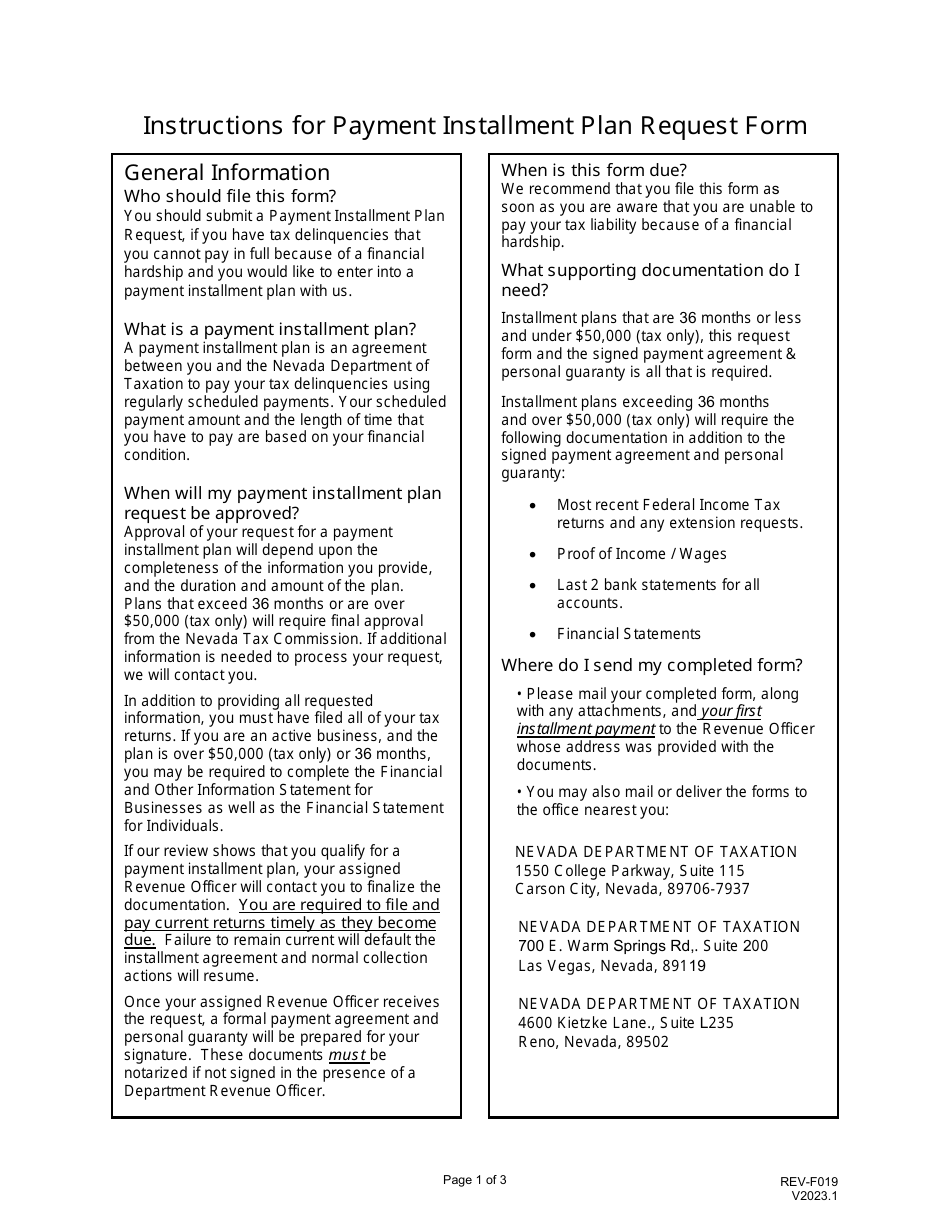

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REV-F019?

A: Form REV-F019 is the Payment Installment Plan Request form in Nevada.

Q: Who can use Form REV-F019?

A: Anyone in Nevada who needs to request a payment installment plan.

Q: What is a payment installment plan?

A: A payment installment plan is an agreement to pay a debt in regular installments instead of a lump sum.

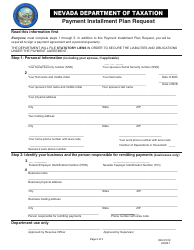

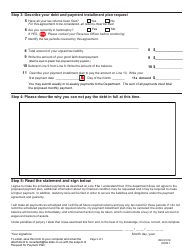

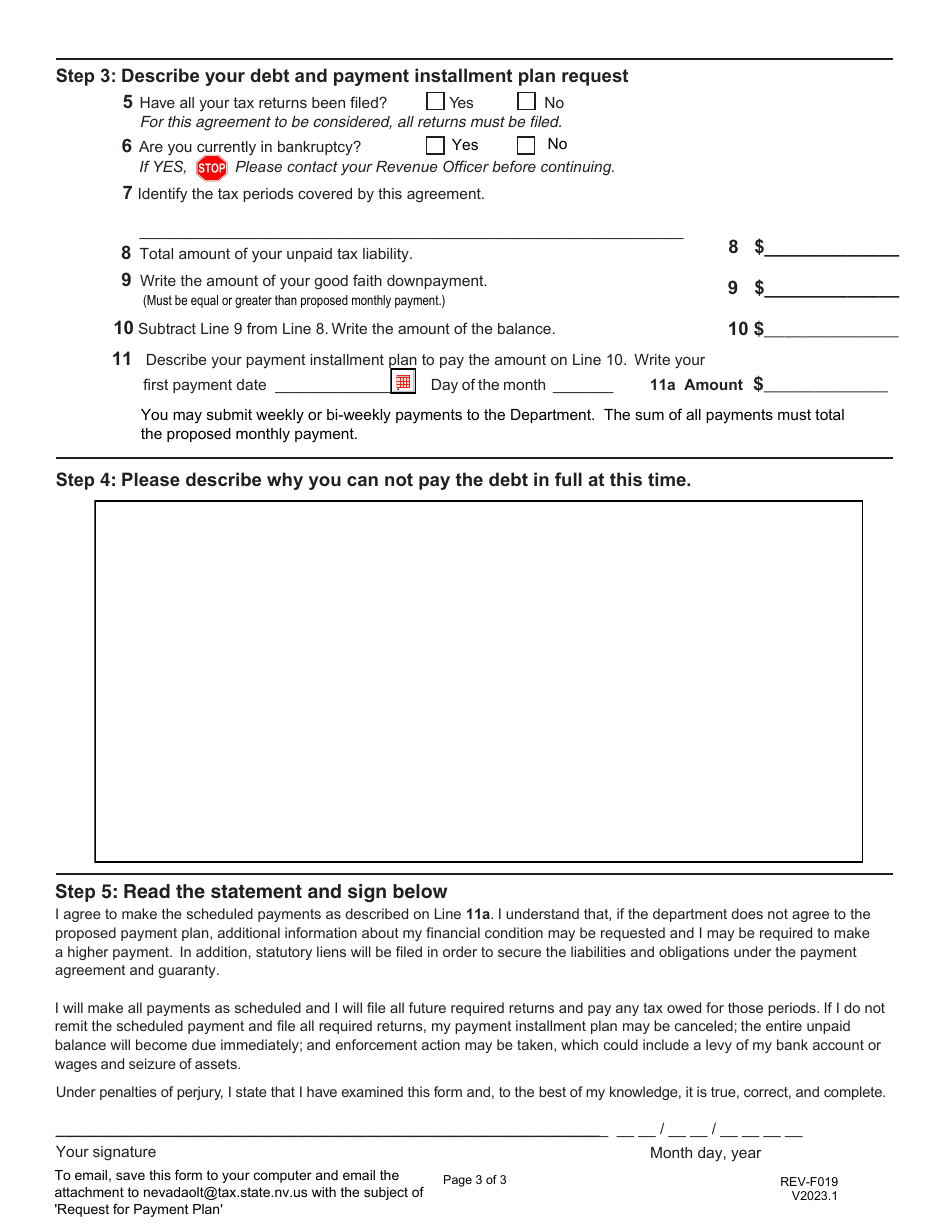

Q: How do I request a payment installment plan using Form REV-F019?

A: Fill out the form with your personal information, details of the debt, and proposed installment plan.

Q: Are there any fees for requesting a payment installment plan?

A: There may be fees associated with setting up a payment installment plan.

Q: Can I request a payment installment plan for any type of debt?

A: Form REV-F019 is specifically for requesting a payment installment plan for tax debts in Nevada.

Q: What happens after I submit Form REV-F019?

A: The Nevada Department of Taxation will review your request and determine if they can approve your payment installment plan.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-F019 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.