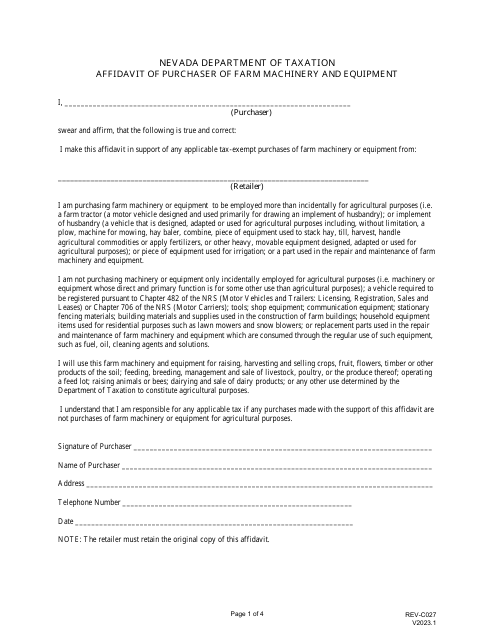

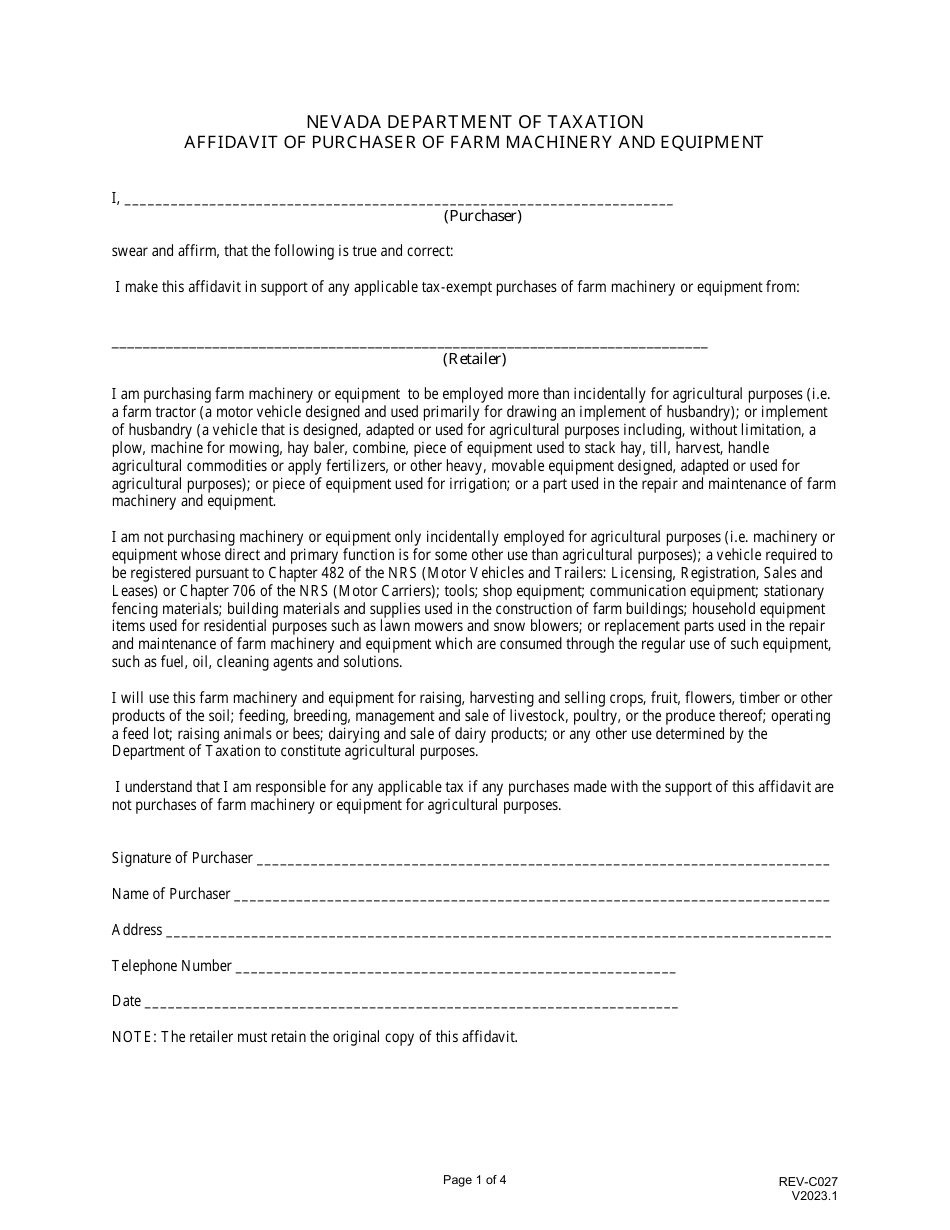

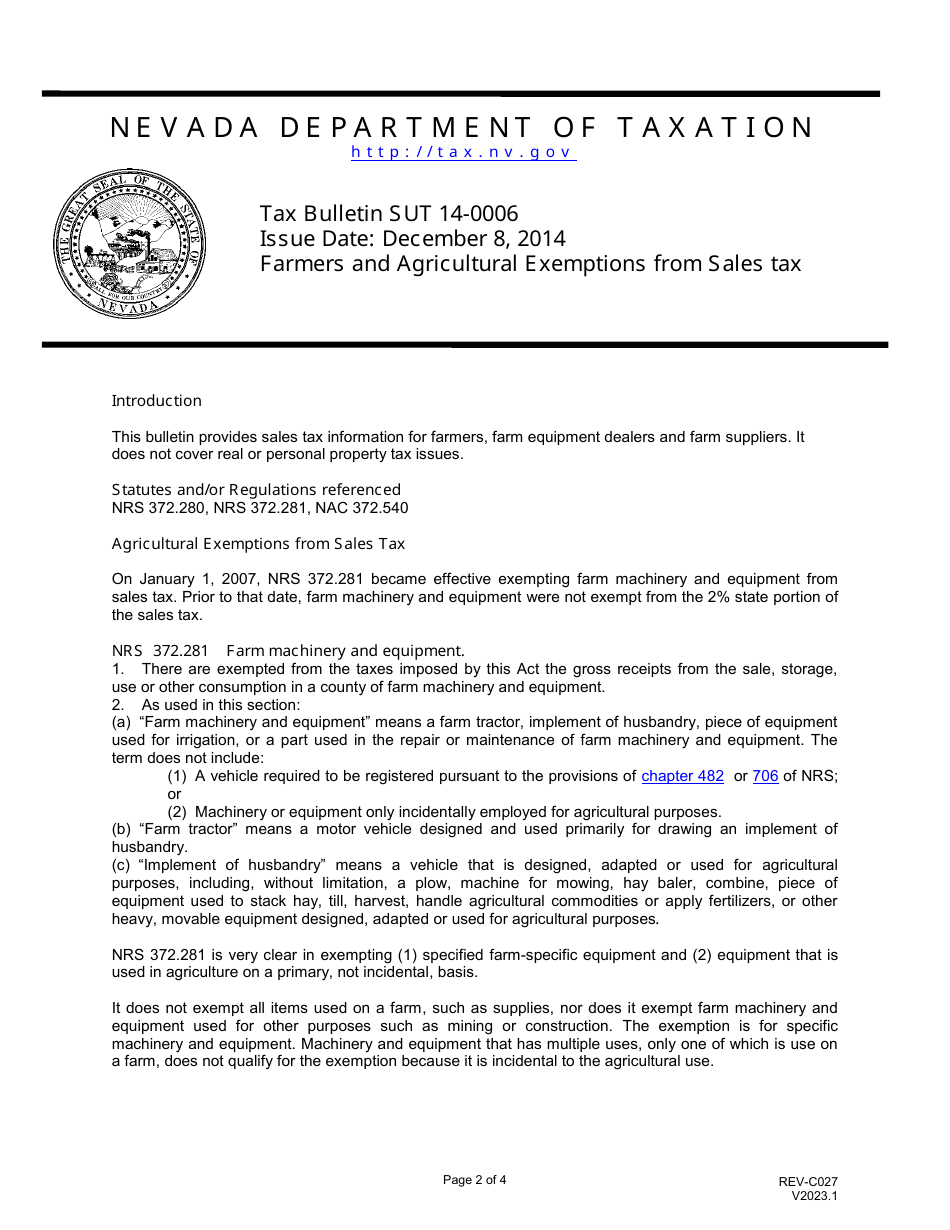

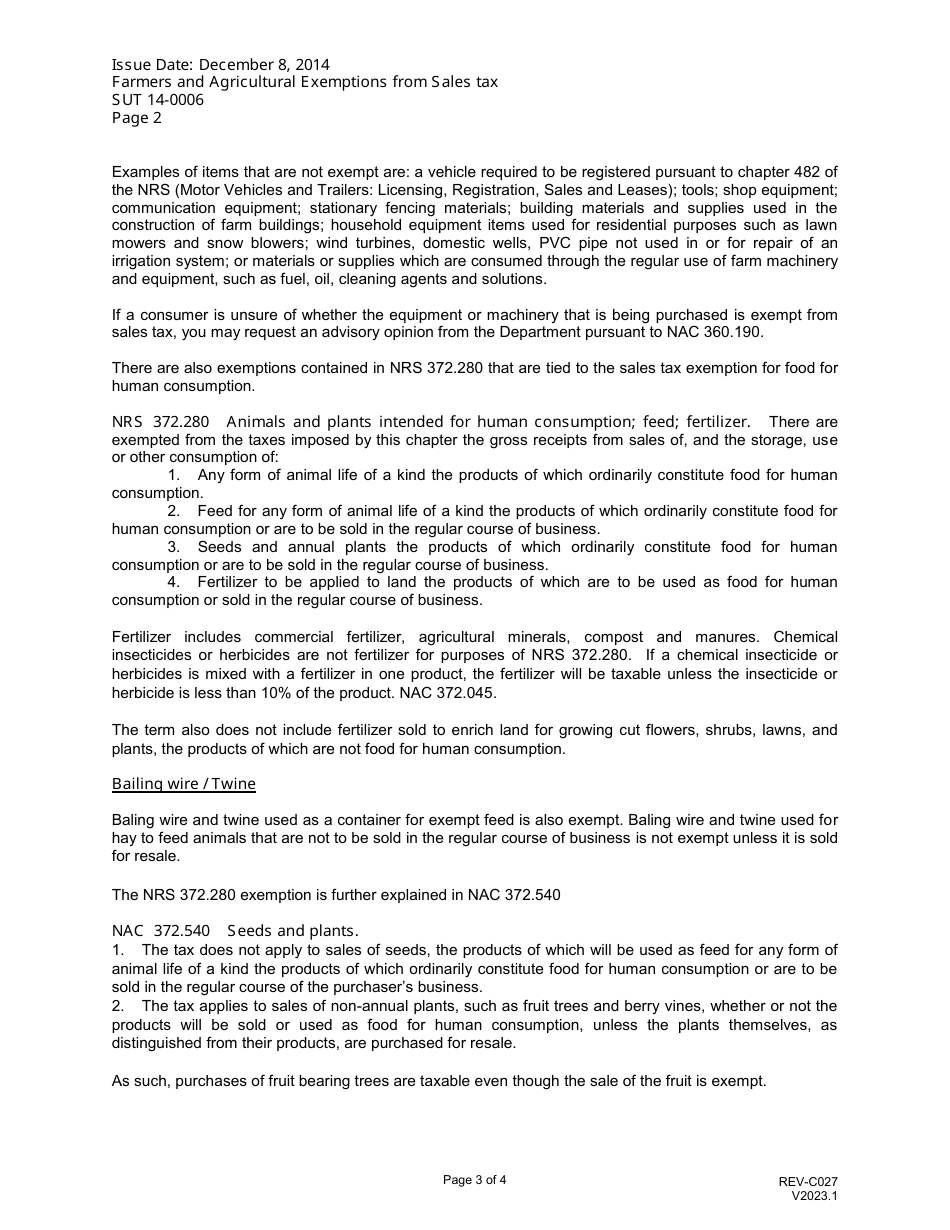

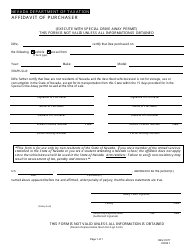

Form REV-C027 Affidavit of Purchaser of Farm Machinery and Equipment - Nevada

What Is Form REV-C027?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-C027?

A: Form REV-C027 is the Affidavit of Purchaser of Farm Machinery and Equipment in Nevada.

Q: What is the purpose of Form REV-C027?

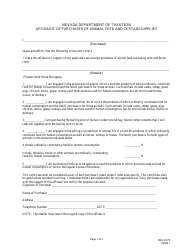

A: The purpose of Form REV-C027 is to certify that an individual is eligible for the sales and use tax exemption for farm machinery and equipment in Nevada.

Q: Who needs to fill out Form REV-C027?

A: Purchasers of farm machinery and equipment in Nevada who want to claim the sales and use tax exemption need to fill out Form REV-C027.

Q: What information is required on Form REV-C027?

A: Form REV-C027 requires information such as the purchaser's name, address, federal employer identification number, description of the equipment being purchased, and the seller's information.

Q: Are there any fees associated with filing Form REV-C027?

A: No, there are no fees associated with filing Form REV-C027.

Q: When should I file Form REV-C027?

A: Form REV-C027 should be filed within 30 days after the date of purchase.

Q: Is Form REV-C027 applicable only for residents of Nevada?

A: Yes, Form REV-C027 is applicable only for residents of Nevada who are purchasing farm machinery and equipment.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-C027 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.