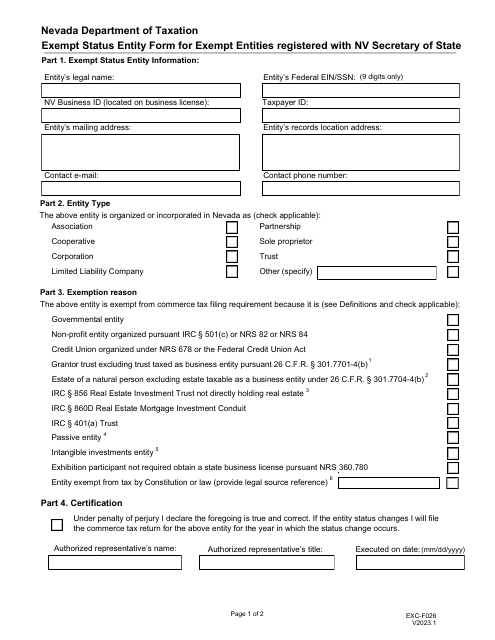

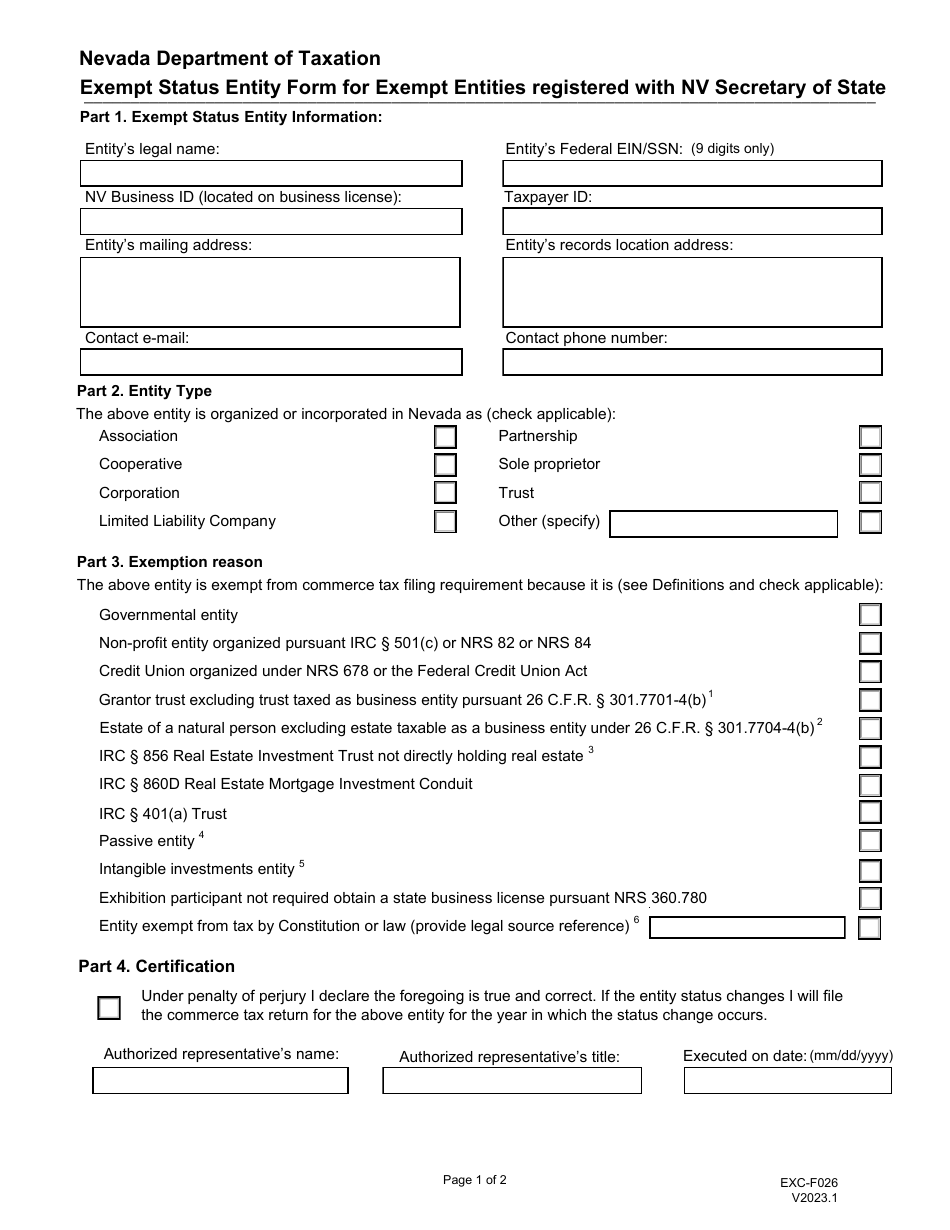

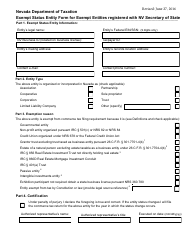

Form EXC-F026 Exempt Status Entity Form for Exempt Entities Registered With Nv Secretary of State - Nevada

What Is Form EXC-F026?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EXC-F026?

A: Form EXC-F026 is a form for exempt entities registered with the Nevada Secretary of State.

Q: Who needs to use Form EXC-F026?

A: Exempt entities registered with the Nevada Secretary of State need to use Form EXC-F026.

Q: What is the purpose of Form EXC-F026?

A: The purpose of Form EXC-F026 is to establish an exempt status for entities registered with the Nevada Secretary of State.

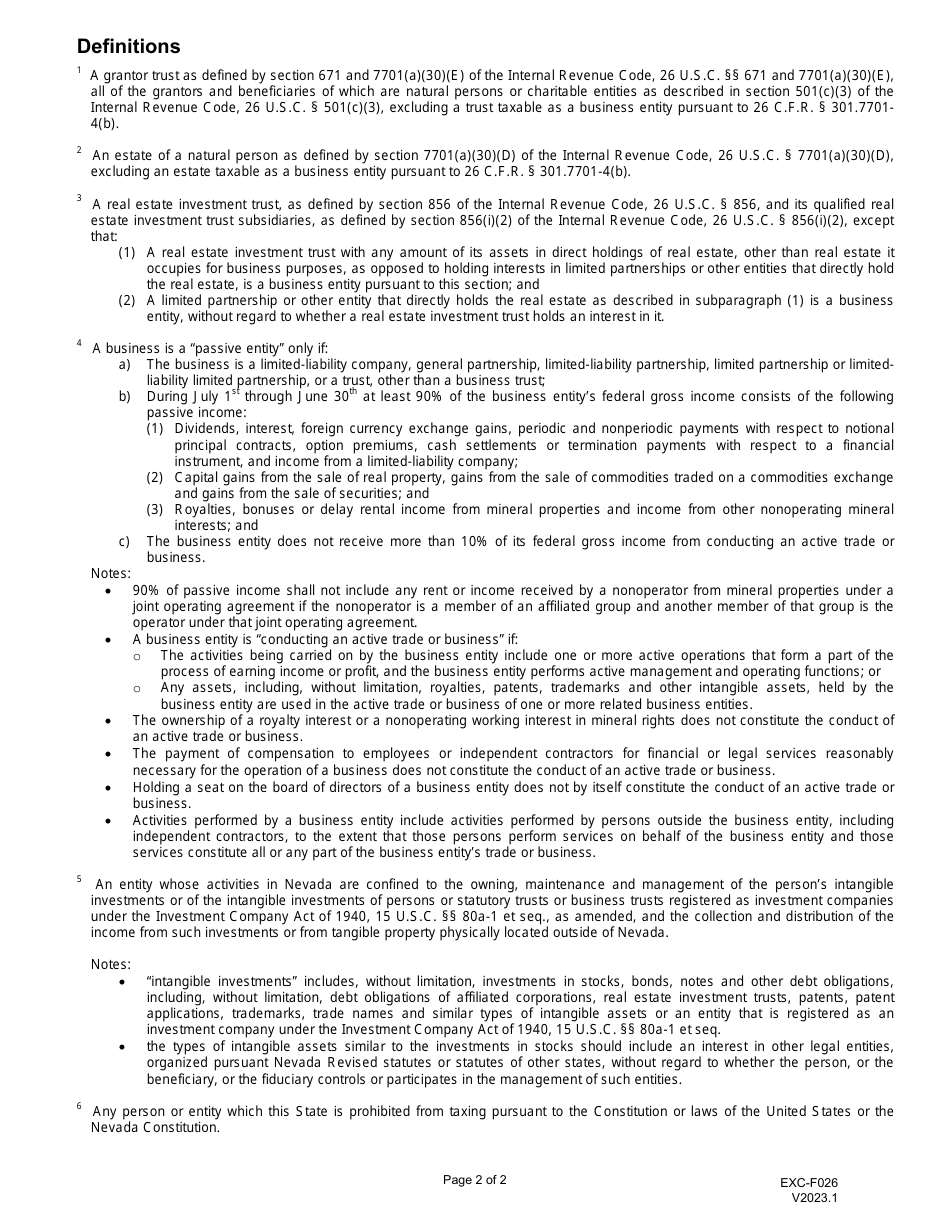

Q: What information do I need to provide on Form EXC-F026?

A: On Form EXC-F026, you will need to provide information about the exempt entity, such as its name, address, and purpose.

Q: How long does it take to process Form EXC-F026?

A: The processing time for Form EXC-F026 varies. Please contact the Nevada Secretary of State's office for more information.

Q: What happens after I submit Form EXC-F026?

A: After you submit Form EXC-F026, the Nevada Secretary of State will review your application and notify you of the status of your exempt status.

Q: Is Form EXC-F026 only for entities in Nevada?

A: Yes, Form EXC-F026 is specifically for entities registered with the Nevada Secretary of State.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EXC-F026 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.