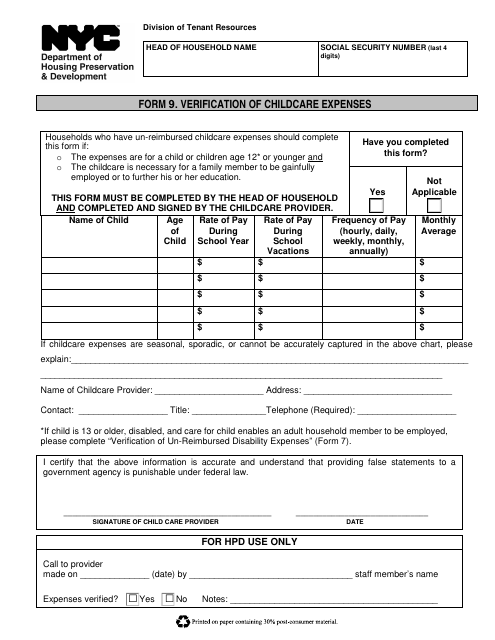

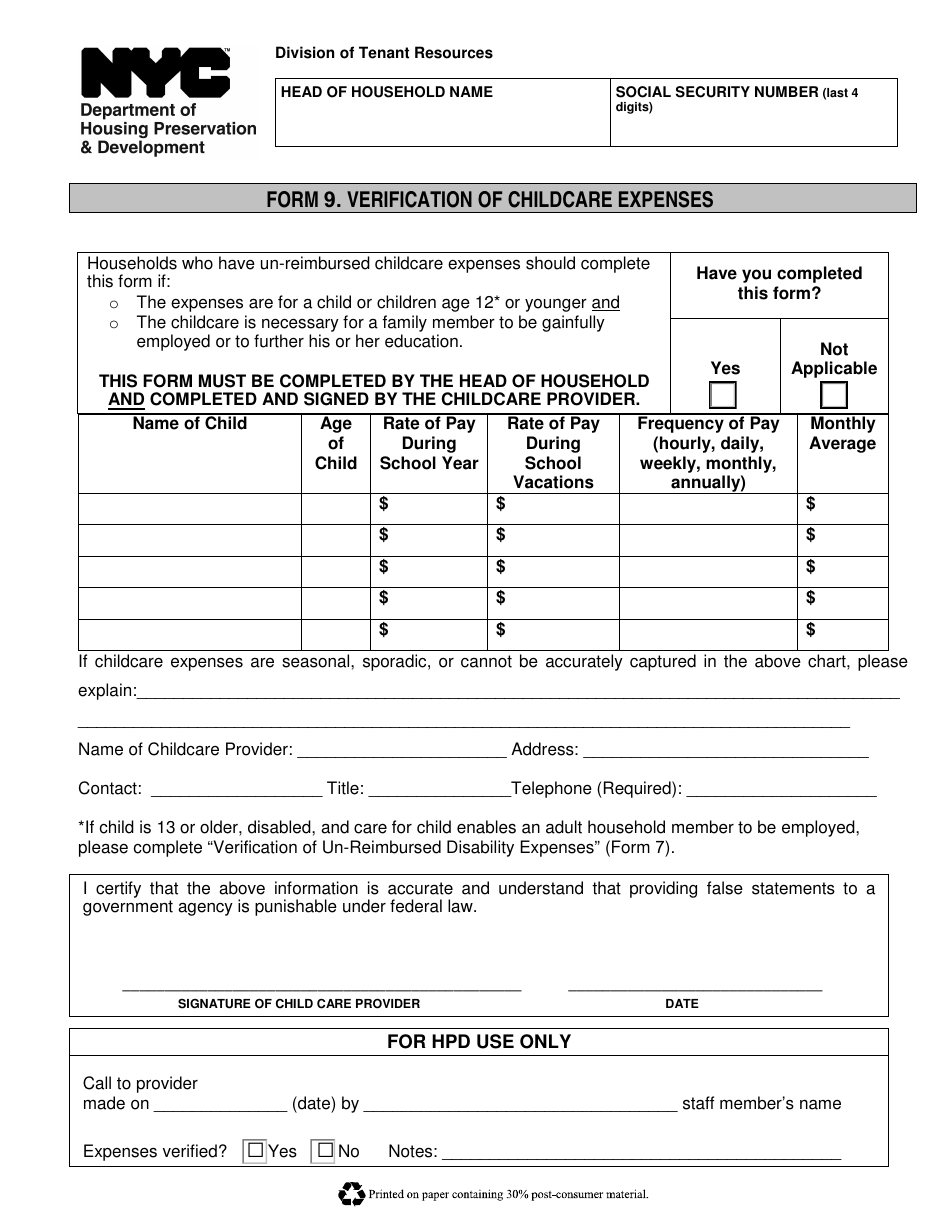

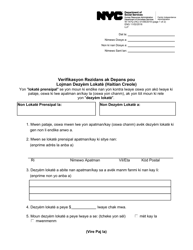

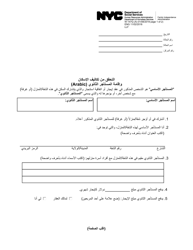

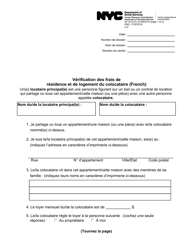

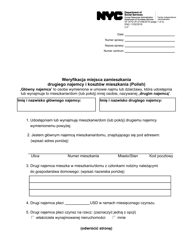

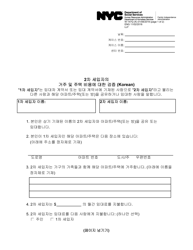

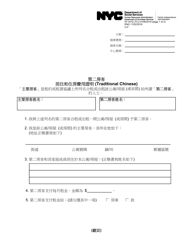

Form 9 Verification of Childcare Expenses - New York City

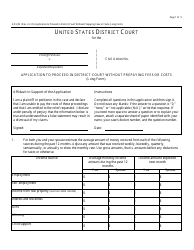

What Is Form 9?

This is a legal form that was released by the New York City Department of Housing Preservation and Development - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 9 Verification of Childcare Expenses?

A: Form 9 Verification of Childcare Expenses is a form used in New York City to verify childcare expenses for tax purposes.

Q: Who needs to fill out Form 9?

A: Parents or guardians who have incurred childcare expenses in New York City and want to claim them as a deduction on their taxes need to fill out Form 9.

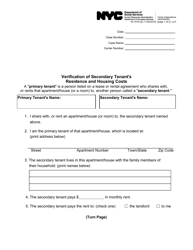

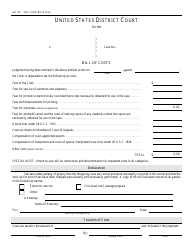

Q: What information is required on Form 9?

A: Form 9 requires the name and address of the childcare provider, the amount of expenses paid, and the Social Security or taxpayer identification number of the childcare provider.

Q: When is the deadline to submit Form 9?

A: The deadline to submit Form 9 is typically the same as the deadline to file your taxes, which is April 15th of each year.

Q: Why is Form 9 important?

A: Form 9 is important because it allows parents or guardians to claim a deduction for childcare expenses, which can help reduce their overall tax liability.

Q: Can I claim childcare expenses if I live outside of New York City?

A: No, Form 9 is specific to childcare expenses incurred in New York City. If you live outside of New York City, you may need to use a different form or follow different procedures.

Q: What should I do if I have questions about filling out Form 9?

A: If you have questions about filling out Form 9, you can contact the New York City Department of Finance for assistance.

Form Details:

- The latest edition provided by the New York City Department of Housing Preservation and Development;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 9 by clicking the link below or browse more documents and templates provided by the New York City Department of Housing Preservation and Development.