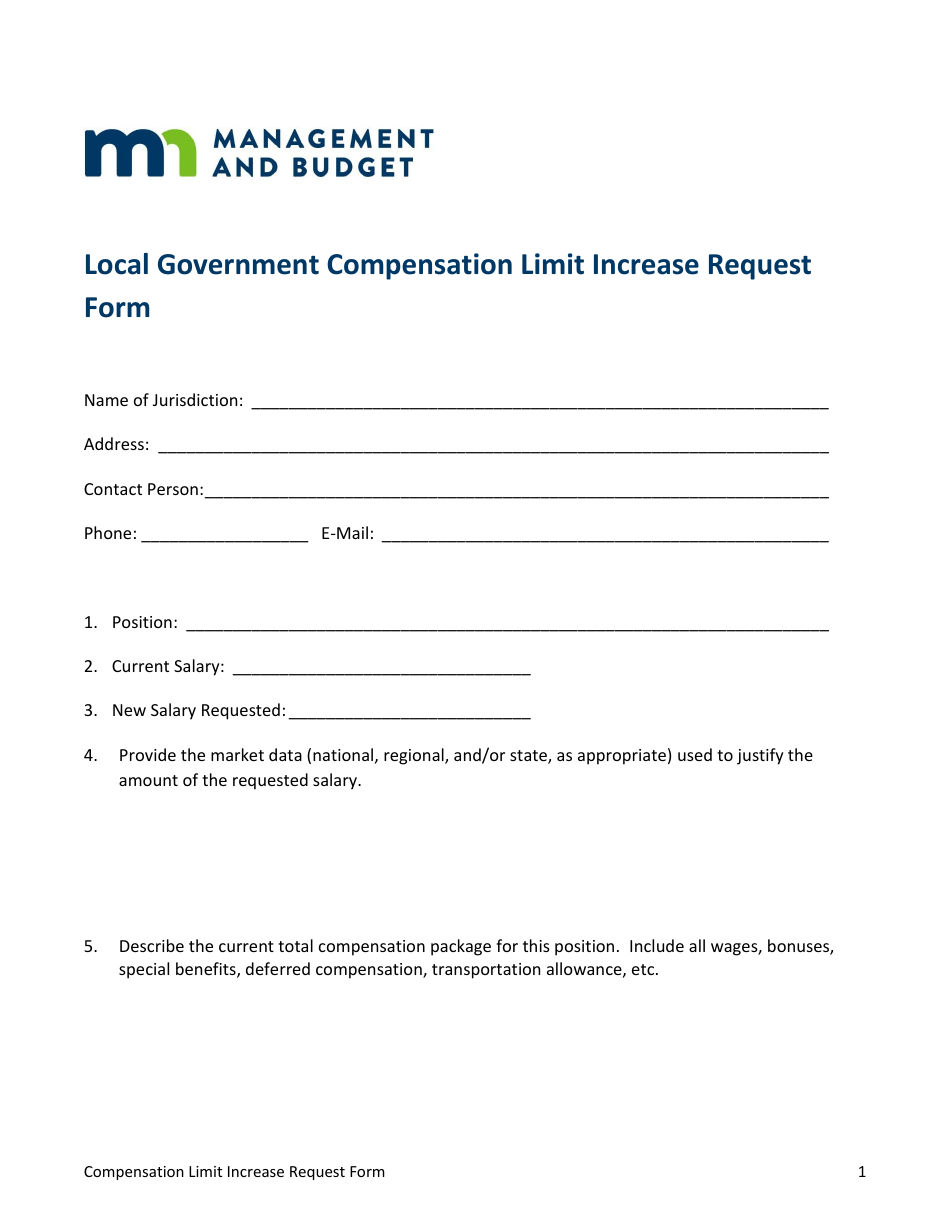

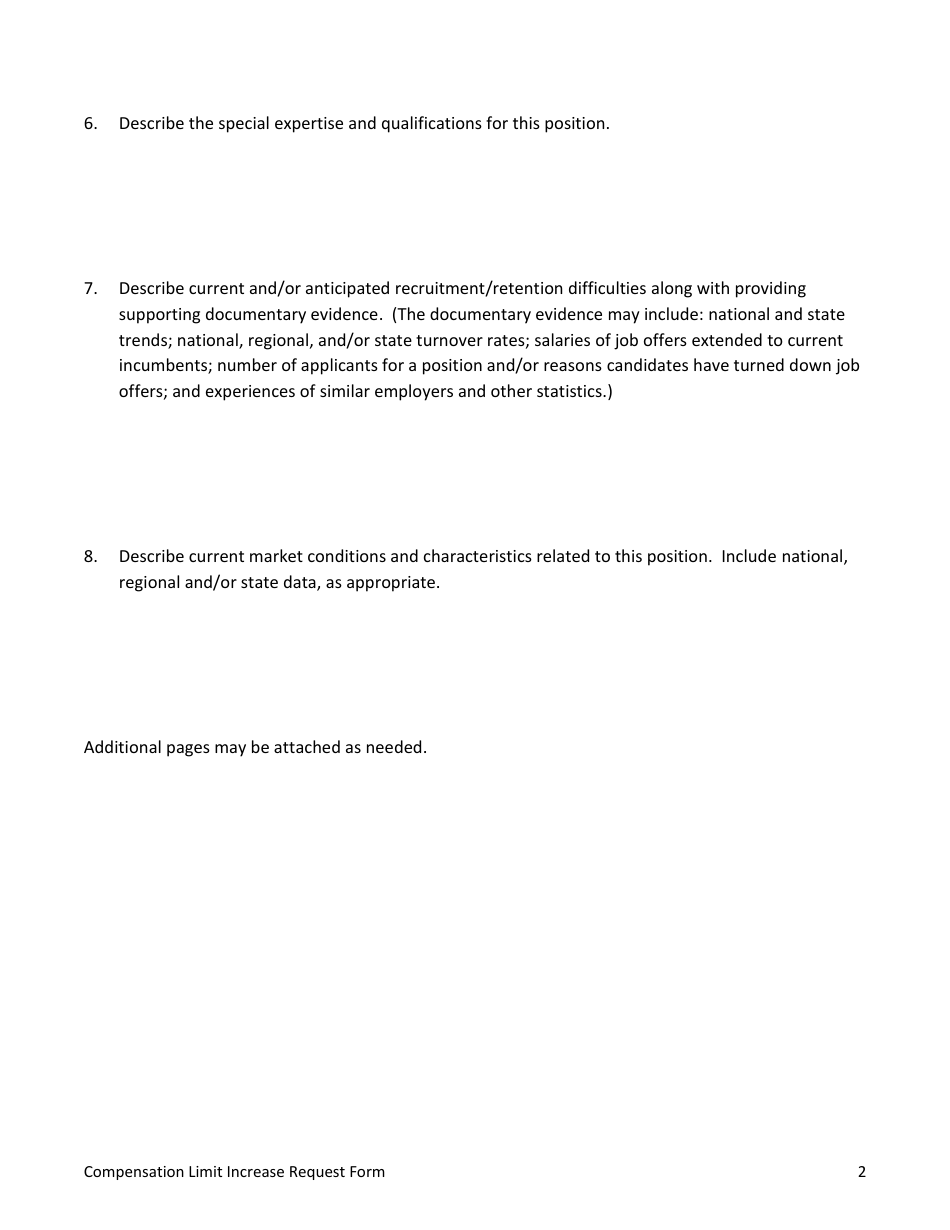

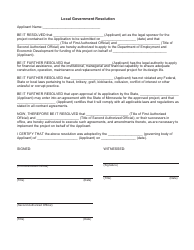

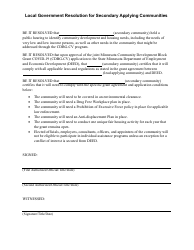

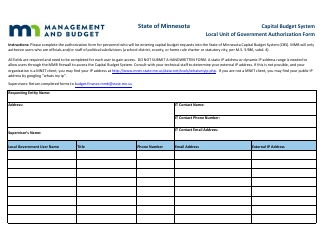

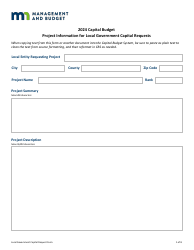

Local Government Compensation Limit Increase Request Form - Minnesota

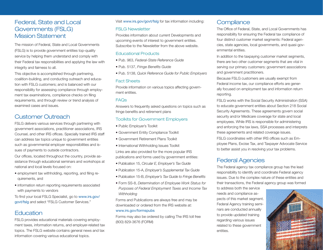

Local Government Compensation Limit Increase Request Form is a legal document that was released by the Minnesota Management and Budget - a government authority operating within Minnesota.

FAQ

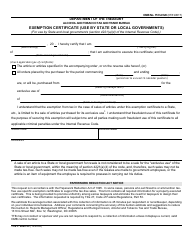

Q: What is the Local Government Compensation Limit Increase Request Form?

A: The Local Government Compensation Limit Increase Request Form is a document used by local government entities in Minnesota to request an increase in the compensation limit for elected officials and appointed officers.

Q: What is the purpose of the form?

A: The purpose of the form is to allow local government entities to request an increase in the compensation limit for elected officials and appointed officers.

Q: Who can use the form?

A: The form can be used by local government entities in Minnesota.

Q: Why would a local government entity need to request an increase in the compensation limit?

A: A local government entity may need to request an increase in the compensation limit if they believe that the current limit is insufficient to attract and retain qualified individuals for elected or appointed positions.

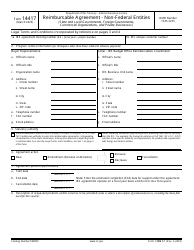

Q: How does the process work?

A: The local government entity fills out the form, providing information about the current compensation limit, the proposed increase, and the reasons for the increase. The form is then submitted to the Minnesota Department of Revenue for review and approval.

Q: Are there any specific requirements or guidelines for requesting an increase?

A: Yes, the Minnesota Department of Revenue provides guidelines and requirements for requesting an increase in the compensation limit.

Q: Is there a deadline for submitting the form?

A: There is no specific deadline mentioned, but it is recommended to submit the form well in advance of the desired effective date of the increase.

Q: What happens after the form is submitted?

A: After the form is submitted, the Minnesota Department of Revenue will review the request and make a decision on whether to approve or deny the increase.

Q: Is there an appeal process if the request is denied?

A: Yes, if the request for an increase is denied, the local government entity may appeal the decision to the Minnesota Tax Court.

Form Details:

- The latest edition currently provided by the Minnesota Management and Budget;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Management and Budget.