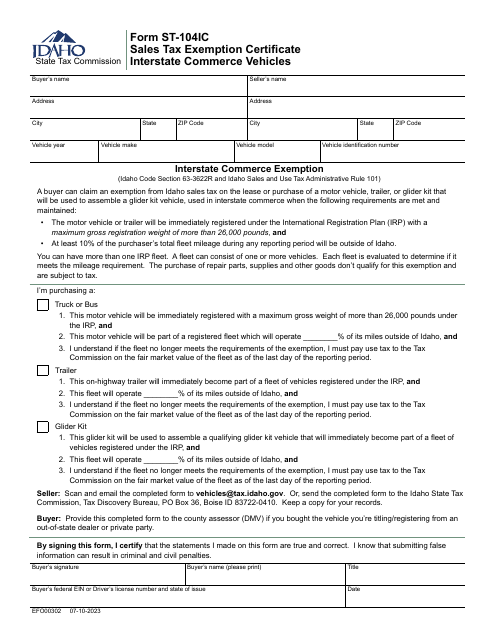

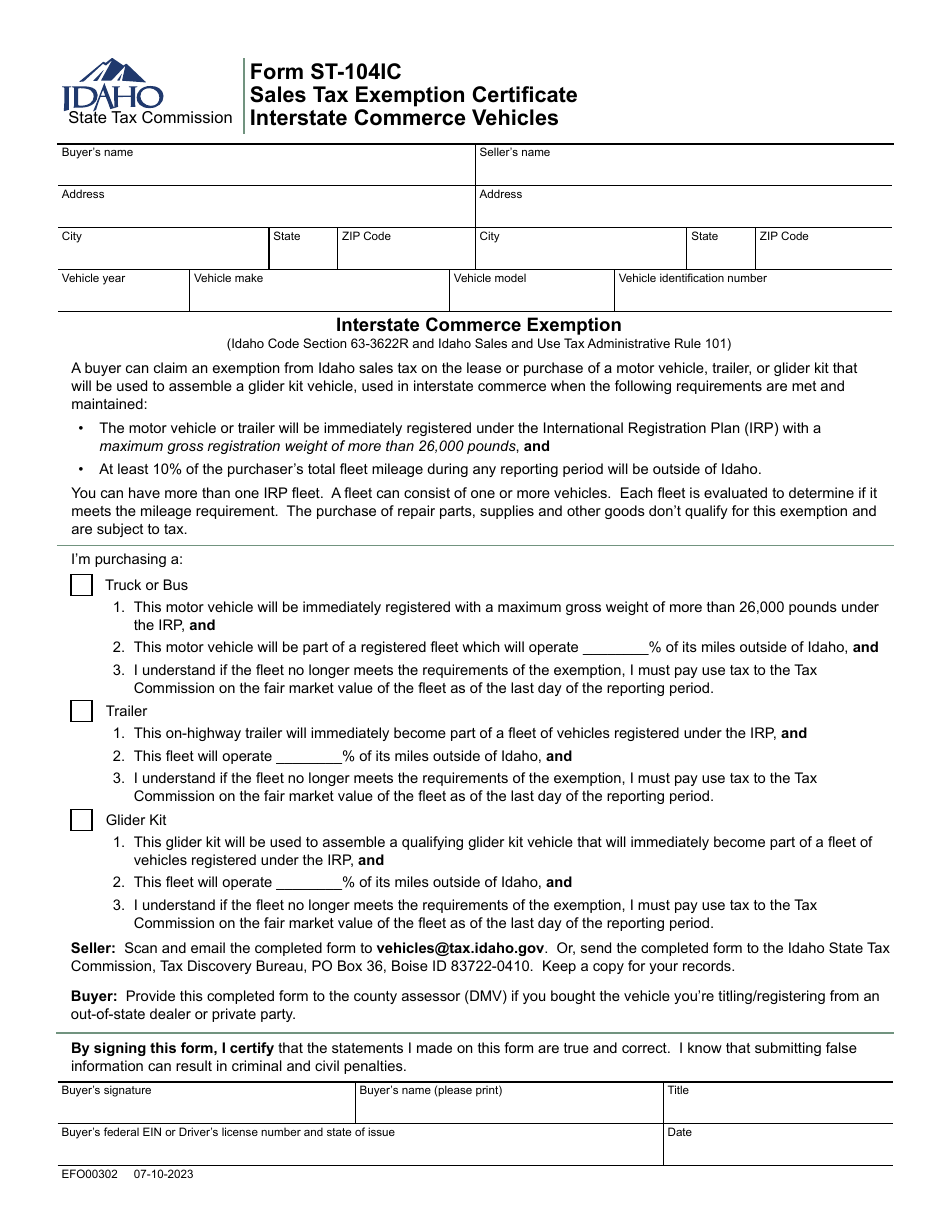

Form ST-104IC (EFO00302) Sales Tax Exemption Certificate Interstate Commerce Vehicles - Idaho

What Is Form ST-104IC (EFO00302)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-104IC?

A: Form ST-104IC is a Sales Tax Exemption Certificate for Interstate Commerce Vehicles in Idaho.

Q: Who needs to use Form ST-104IC?

A: Individuals and businesses engaged in interstate commerce in Idaho need to use Form ST-104IC.

Q: What is the purpose of Form ST-104IC?

A: The purpose of Form ST-104IC is to claim an exemption from sales tax on vehicles used for interstate commerce in Idaho.

Q: What information is required on Form ST-104IC?

A: Form ST-104IC requires information such as the vehicle identification number (VIN), owner's name and address, and the vehicle's intended use.

Q: Are there any fees associated with Form ST-104IC?

A: No, there are no fees associated with filing Form ST-104IC.

Q: When should I submit Form ST-104IC?

A: Form ST-104IC should be submitted to the Idaho State Tax Commission before the vehicle is registered or titled in Idaho.

Q: Can I use Form ST-104IC for vehicles used solely within Idaho?

A: No, Form ST-104IC is specifically for vehicles used in interstate commerce.

Q: What happens if I do not file Form ST-104IC?

A: If you fail to file Form ST-104IC and pay the appropriate sales tax, you may be subject to penalties and interest.

Form Details:

- Released on July 10, 2023;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-104IC (EFO00302) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.