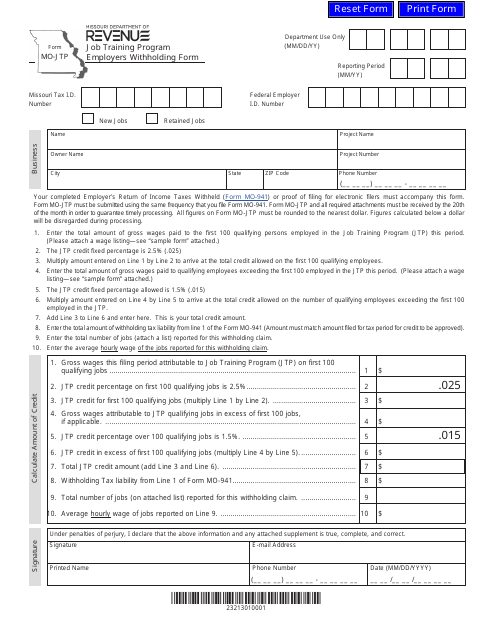

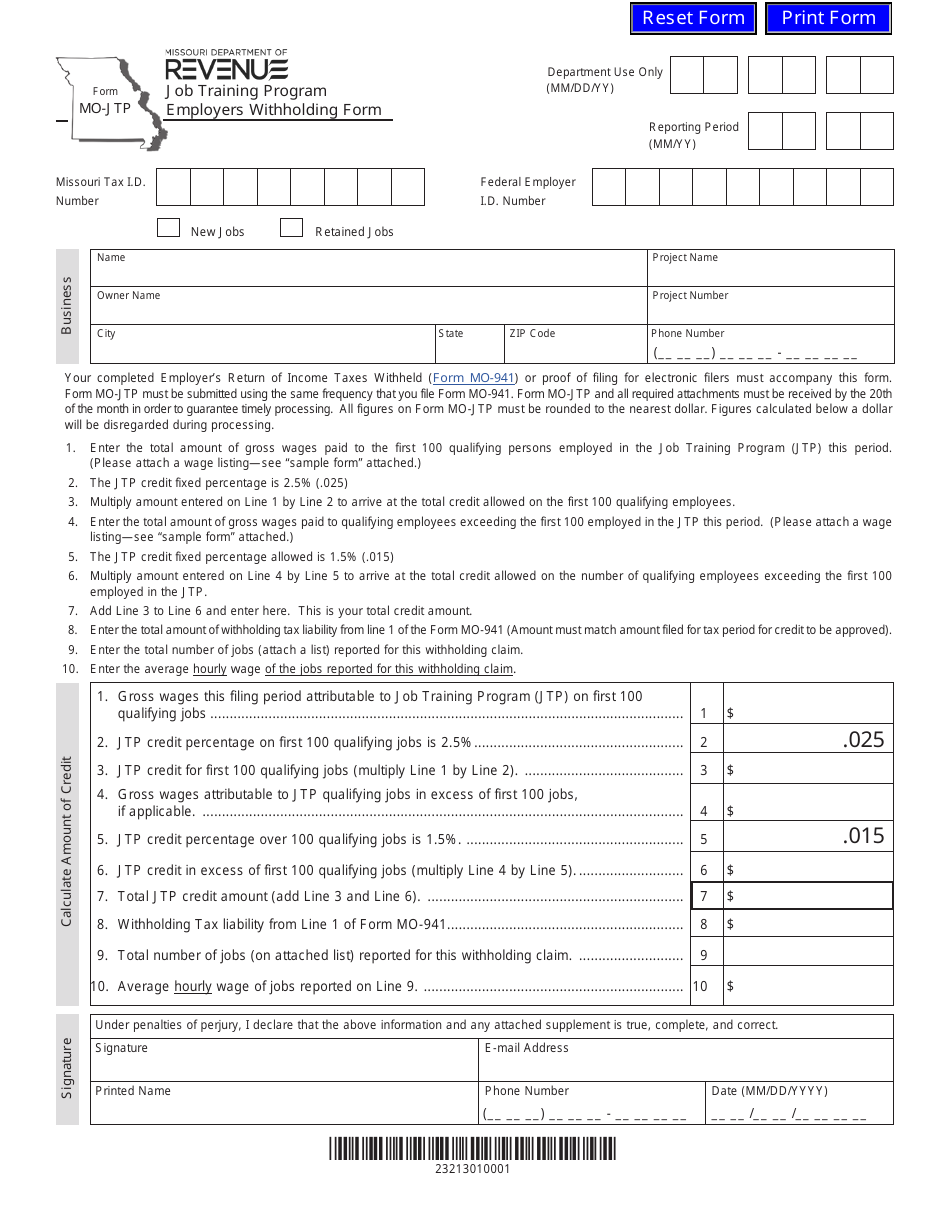

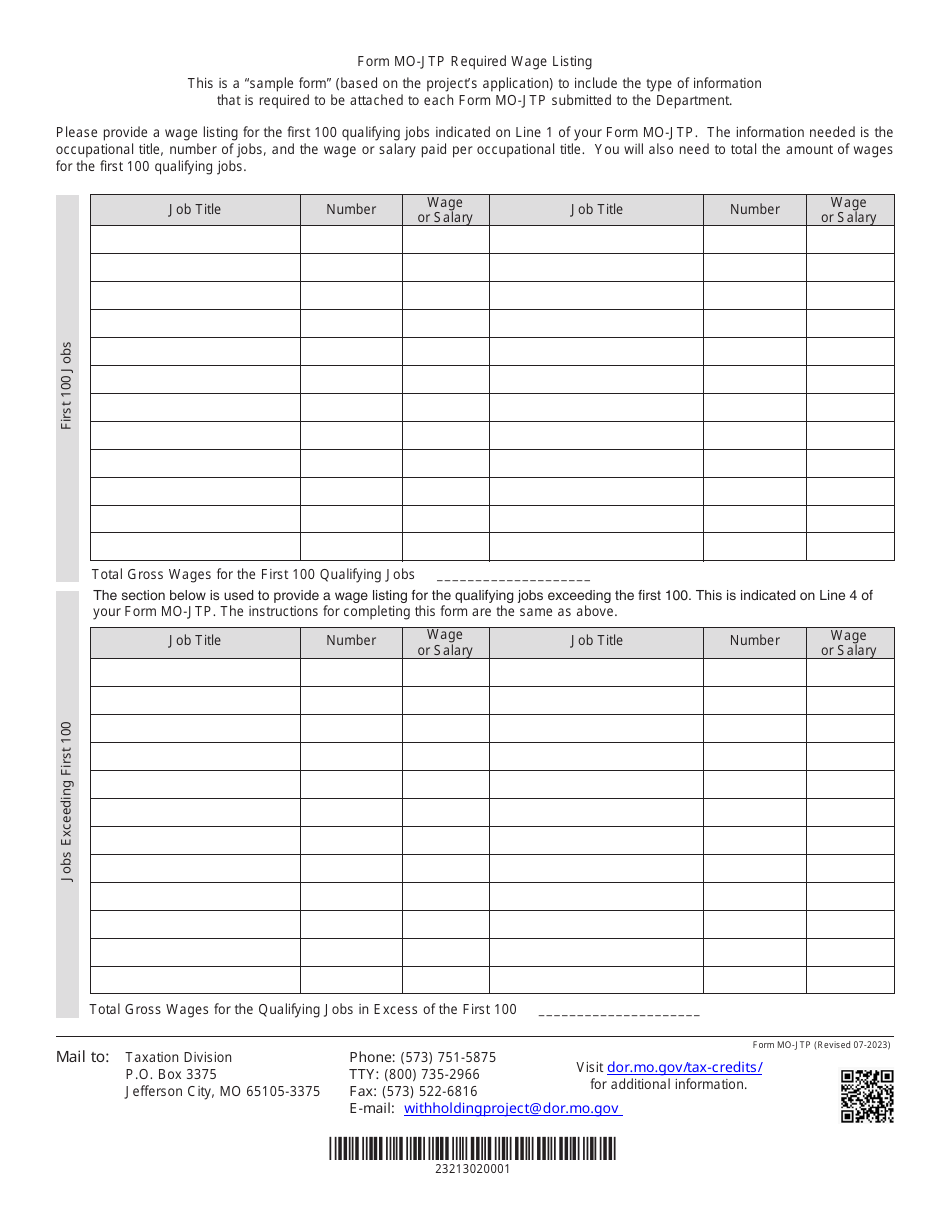

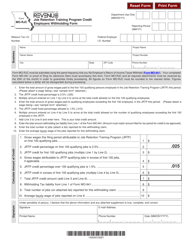

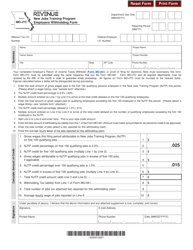

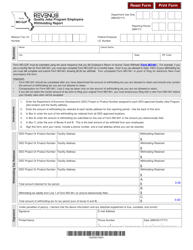

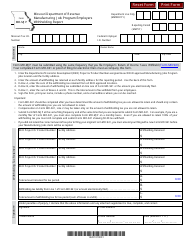

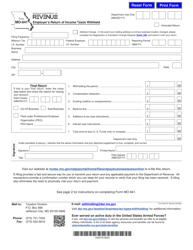

Form MO-JTP Job Training Program Employers Withholding Form - Missouri

What Is Form MO-JTP?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-JTP Job Training Program Employers Withholding Form?

A: The MO-JTP Job Training Program Employers Withholding Form is a form used by employers in Missouri to report payroll taxes for the Job Training Program.

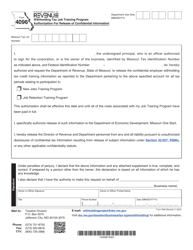

Q: Who is required to file the MO-JTP Job Training Program Employers Withholding Form?

A: Employers in Missouri who participate in the Job Training Program are required to file the MO-JTP Job Training Program Employers Withholding Form.

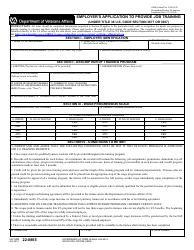

Q: What is the Job Training Program in Missouri?

A: The Job Training Program in Missouri is a program that provides training opportunities to eligible individuals to prepare them for employment.

Q: What taxes are reported on the MO-JTP Job Training Program Employers Withholding Form?

A: The MO-JTP Job Training Program Employers Withholding Form is used to report state income taxes withheld from employee wages for the Job Training Program.

Form Details:

- Released on July 1, 2023;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-JTP by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.