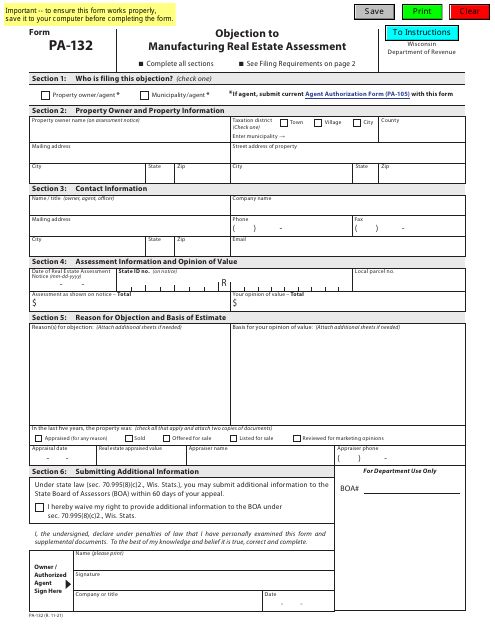

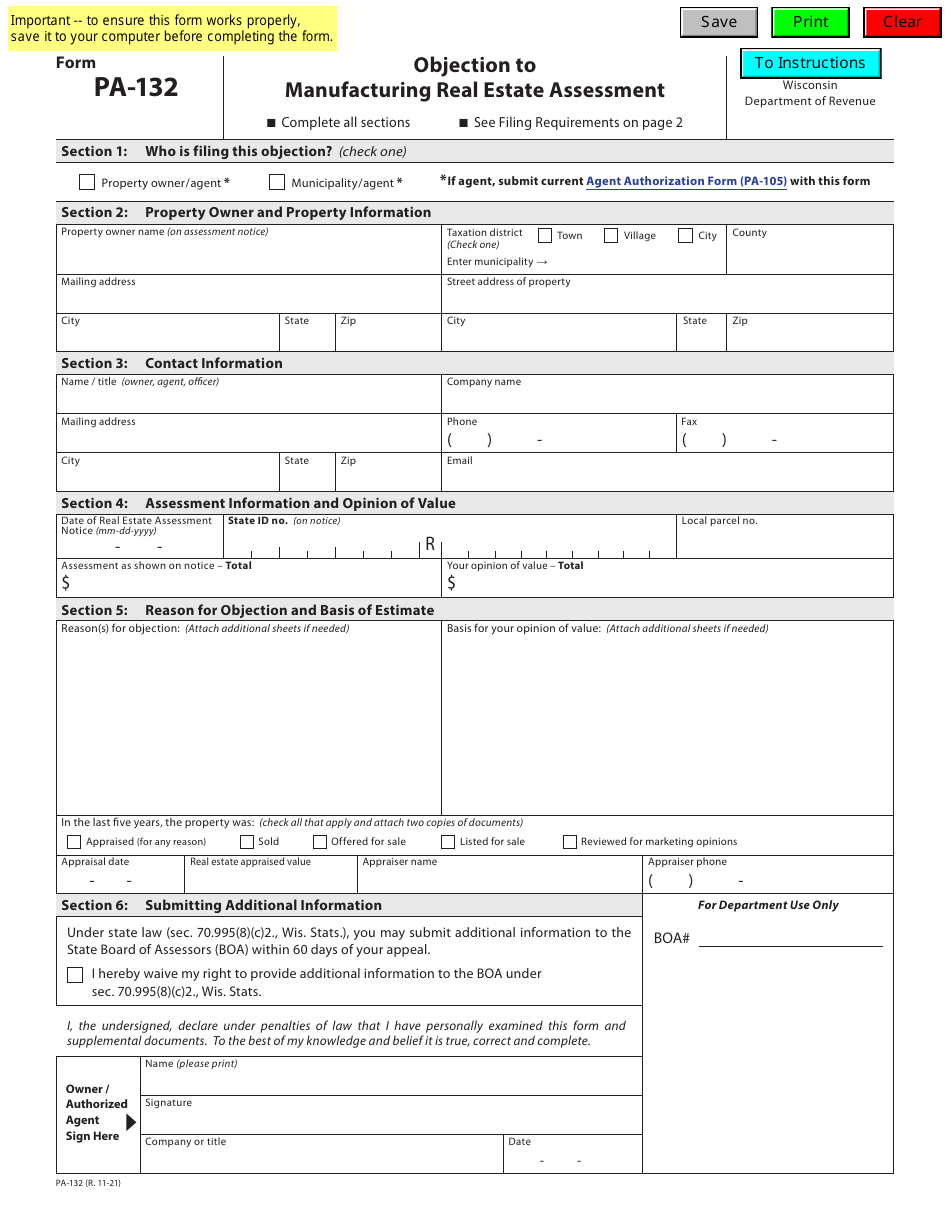

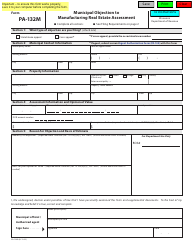

Form PA-132 Objection to Manufacturing Real Estate Assessment - Wisconsin

What Is Form PA-132?

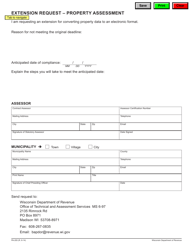

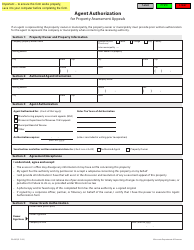

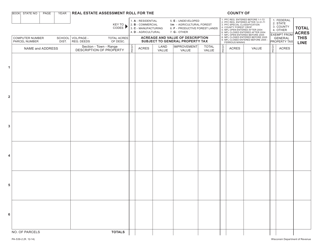

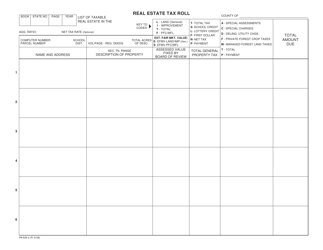

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-132?

A: Form PA-132 is a document used to object to the assessment of manufacturing real estate in Wisconsin.

Q: Who can use Form PA-132?

A: Any property owner of manufacturing real estate in Wisconsin can use Form PA-132 to object to the assessment.

Q: What is the purpose of Form PA-132?

A: The purpose of Form PA-132 is to formally object to the assessment of manufacturing real estate in Wisconsin.

Q: What information is required on Form PA-132?

A: Form PA-132 requires information such as the property owner's name, address, property description, and reasons for objecting to the assessment.

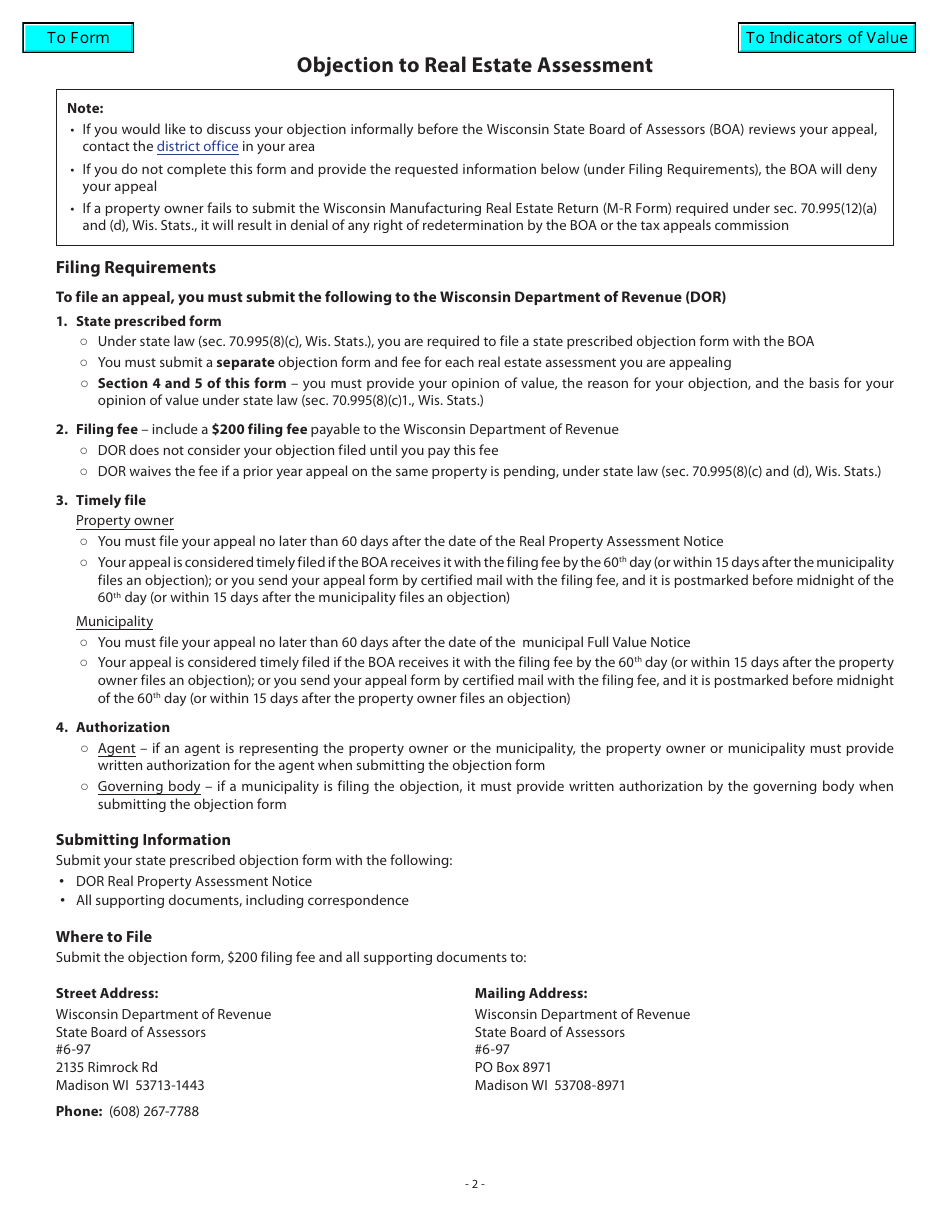

Q: When should I submit Form PA-132?

A: Form PA-132 should be submitted to the local assessor's office within the specified timeframe for filing assessment objections.

Q: What happens after I submit Form PA-132?

A: After submitting Form PA-132, the local assessor's office will review your objection and may schedule a hearing to resolve the assessment dispute.

Q: Can I appeal the decision made on Form PA-132?

A: Yes, if you disagree with the decision made on Form PA-132, you have the option to further appeal the assessment dispute through the Wisconsin Department of Revenue's Board of Review or the courts.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-132 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.