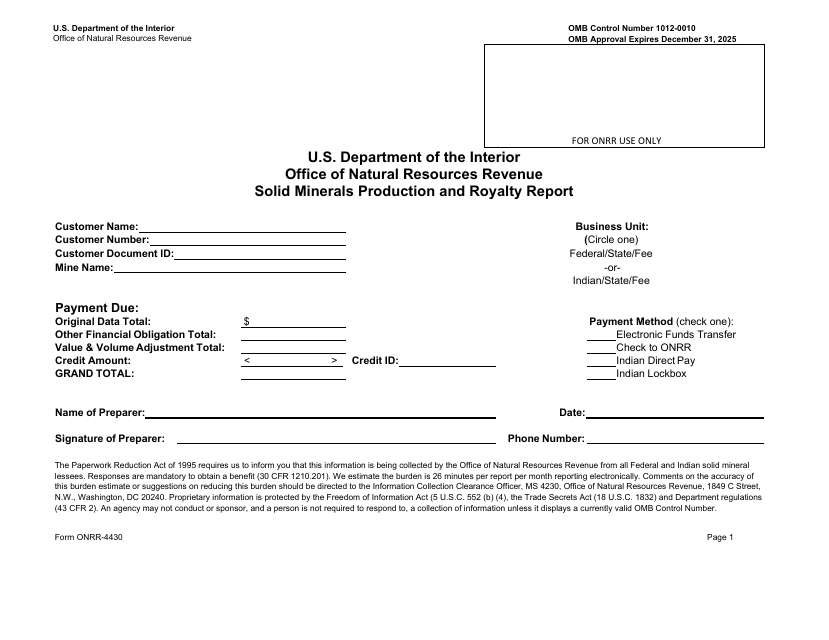

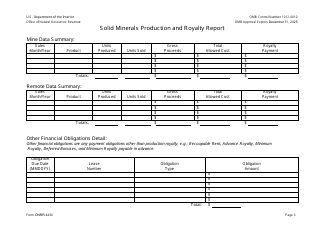

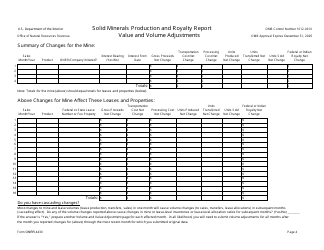

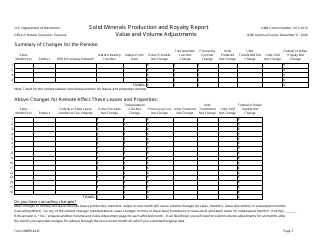

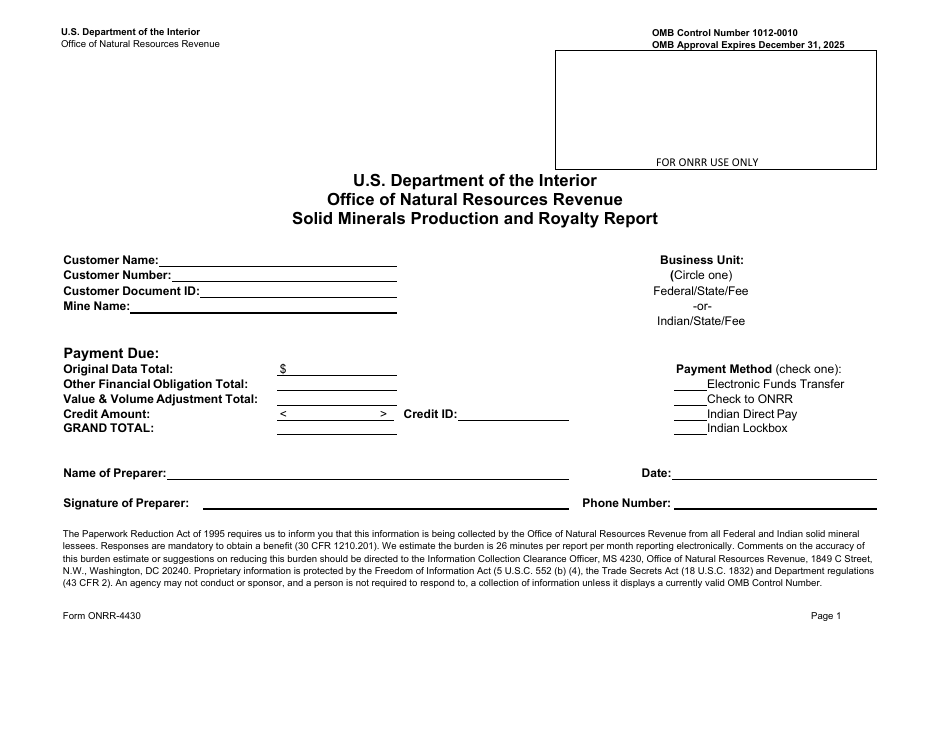

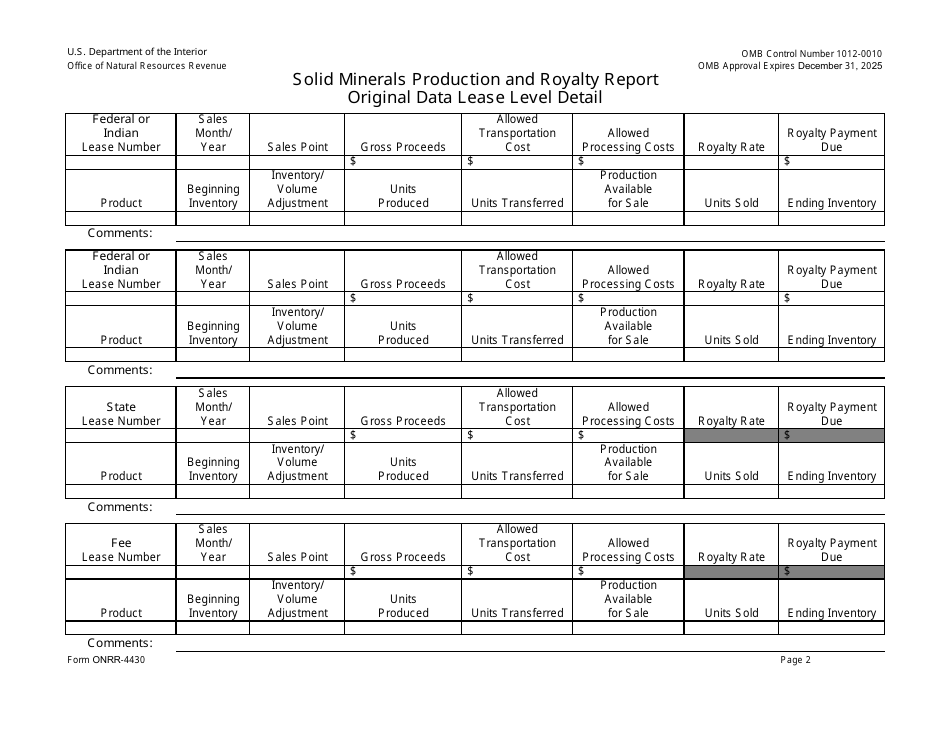

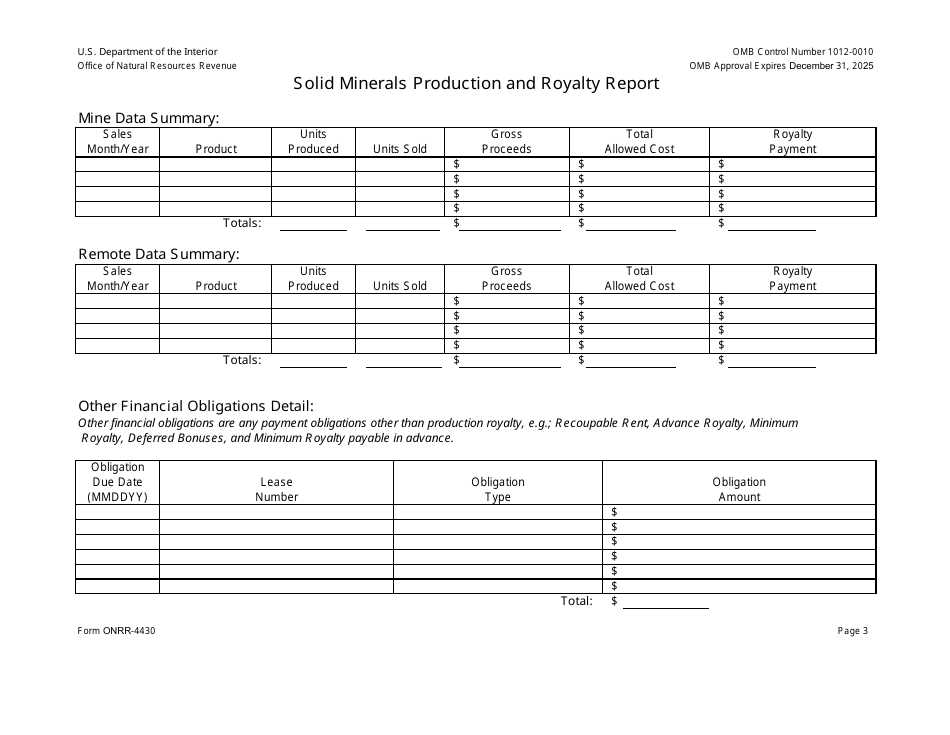

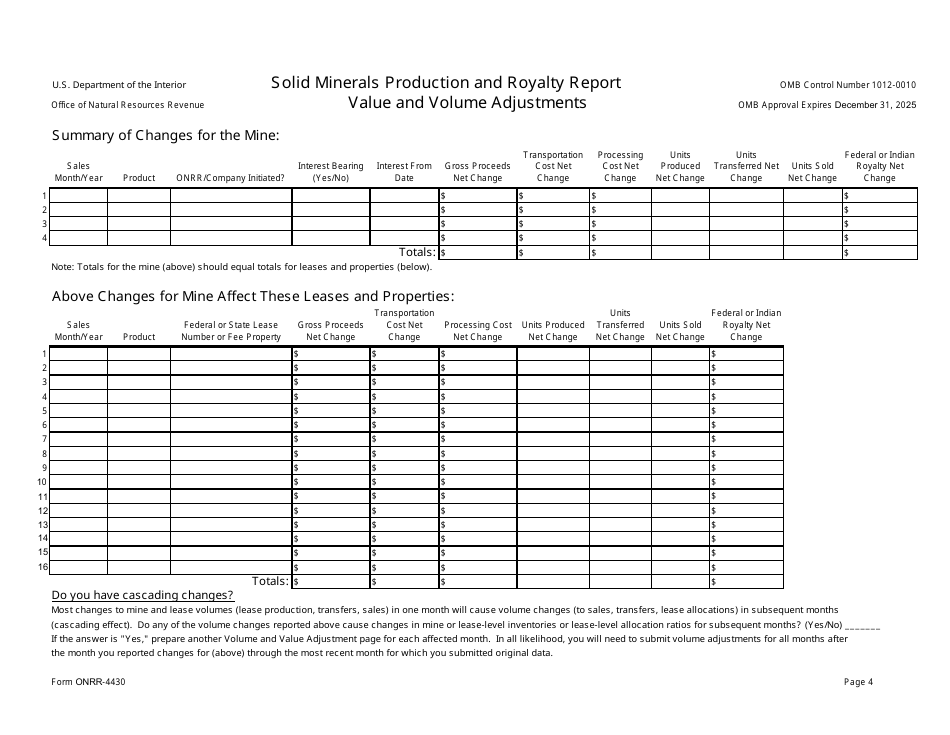

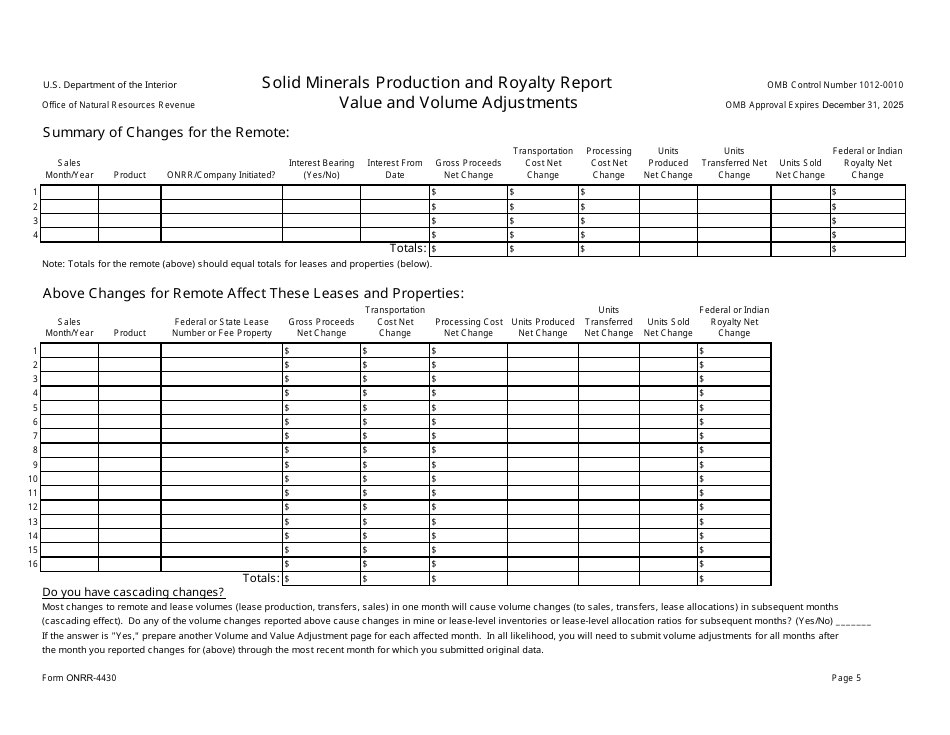

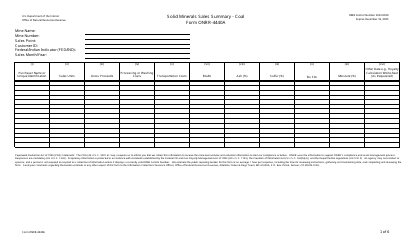

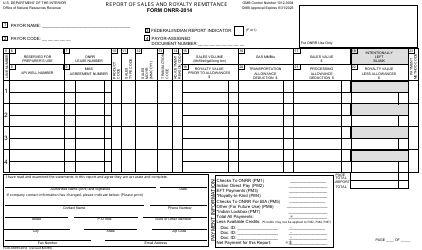

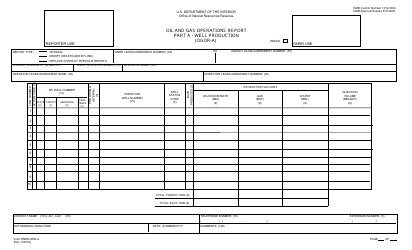

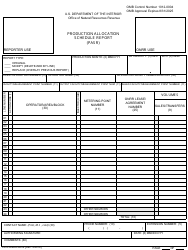

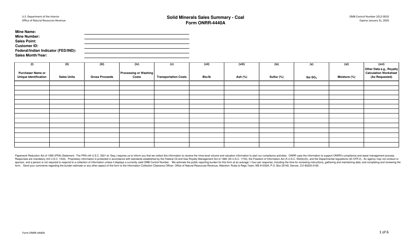

Form ONRR-4430 Solid Minerals Production and Royalty Report

What Is Form ONRR-4430?

This is a legal form that was released by the U.S. Department of the Interior - Office of Natural Resources Revenue and used country-wide. Check the official instructions before completing and submitting the form.

FAQ

Q: What is ONRR-4430?

A: ONRR-4430 is a form used to report solid minerals production and royalty.

Q: Who is required to file ONRR-4430?

A: Operators who produce and extract solid minerals are required to file ONRR-4430.

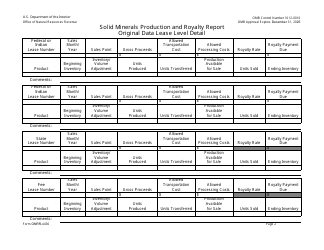

Q: What information is included in ONRR-4430?

A: ONRR-4430 includes information related to solid minerals production and the payment of royalties.

Q: What type of solid minerals are covered by ONRR-4430?

A: ONRR-4430 covers a variety of solid minerals, including coal, oil shale, and metallic and non-metallic minerals.

Q: When is ONRR-4430 due?

A: ONRR-4430 is due on a monthly basis, typically within 45 days after the end of the production month.

Q: Are there any penalties for failing to file ONRR-4430?

A: Yes, there are penalties for failing to file ONRR-4430, including possible fines and interest on unpaid royalties.

Q: Is there any support available for filling out ONRR-4430?

A: Yes, the Office of Natural Resources Revenue (ONRR) provides resources and assistance for filling out ONRR-4430.

Q: Can ONRR-4430 be filed electronically?

A: Yes, ONRR-4430 can be filed electronically through the ONRR Electronic Source Leasing System.

Form Details:

- The latest available edition released by the U.S. Department of the Interior - Office of Natural Resources Revenue;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ONRR-4430 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Interior - Office of Natural Resources Revenue.