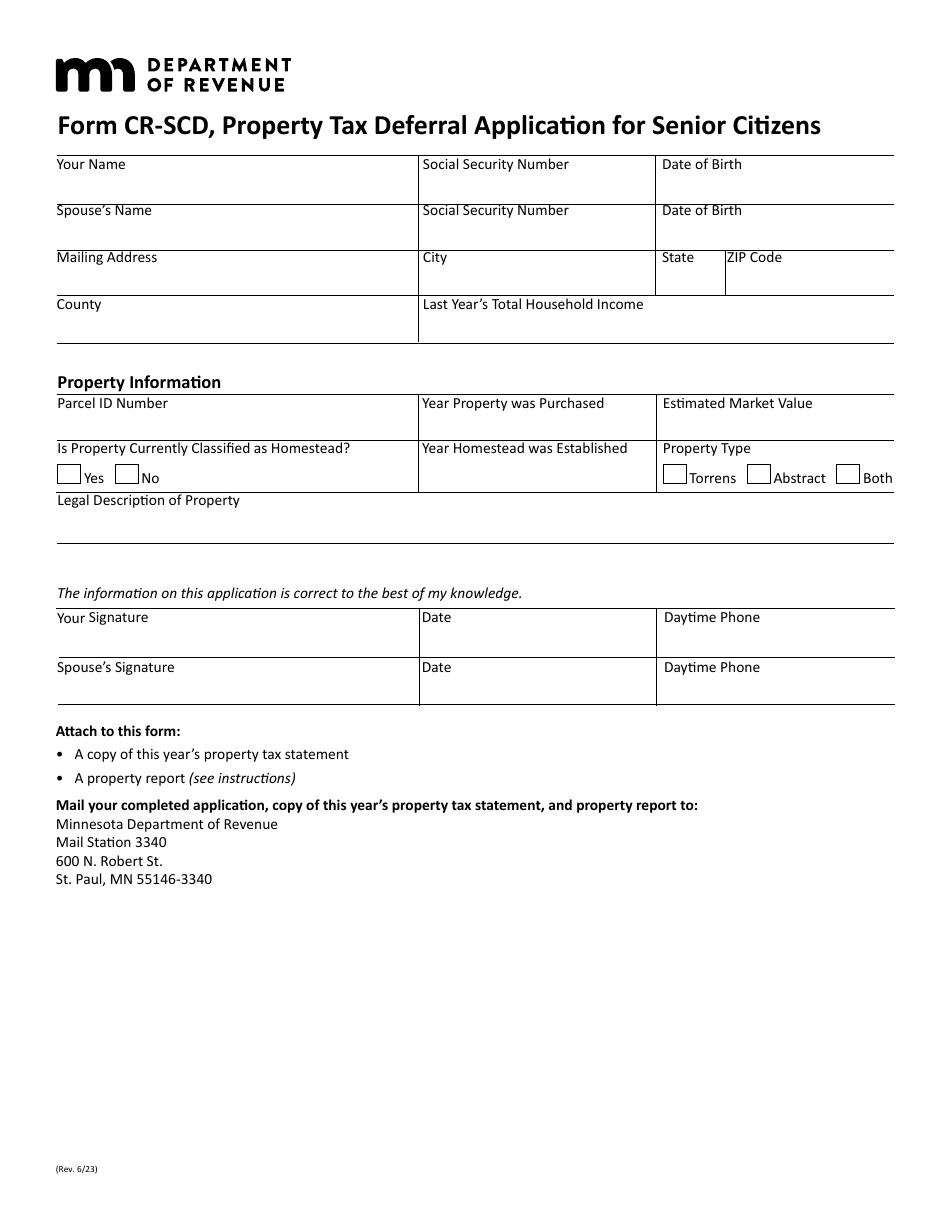

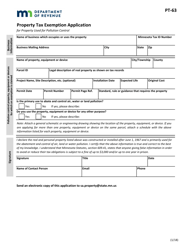

Form CR-SCD Property Tax Deferral Application for Senior Citizens - Minnesota

What Is Form CR-SCD?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CR-SCD Property Tax Deferral Application for Senior Citizens?

A: The CR-SCD Property Tax Deferral Application for Senior Citizens is a form that allows senior citizens in Minnesota to defer their property tax payments.

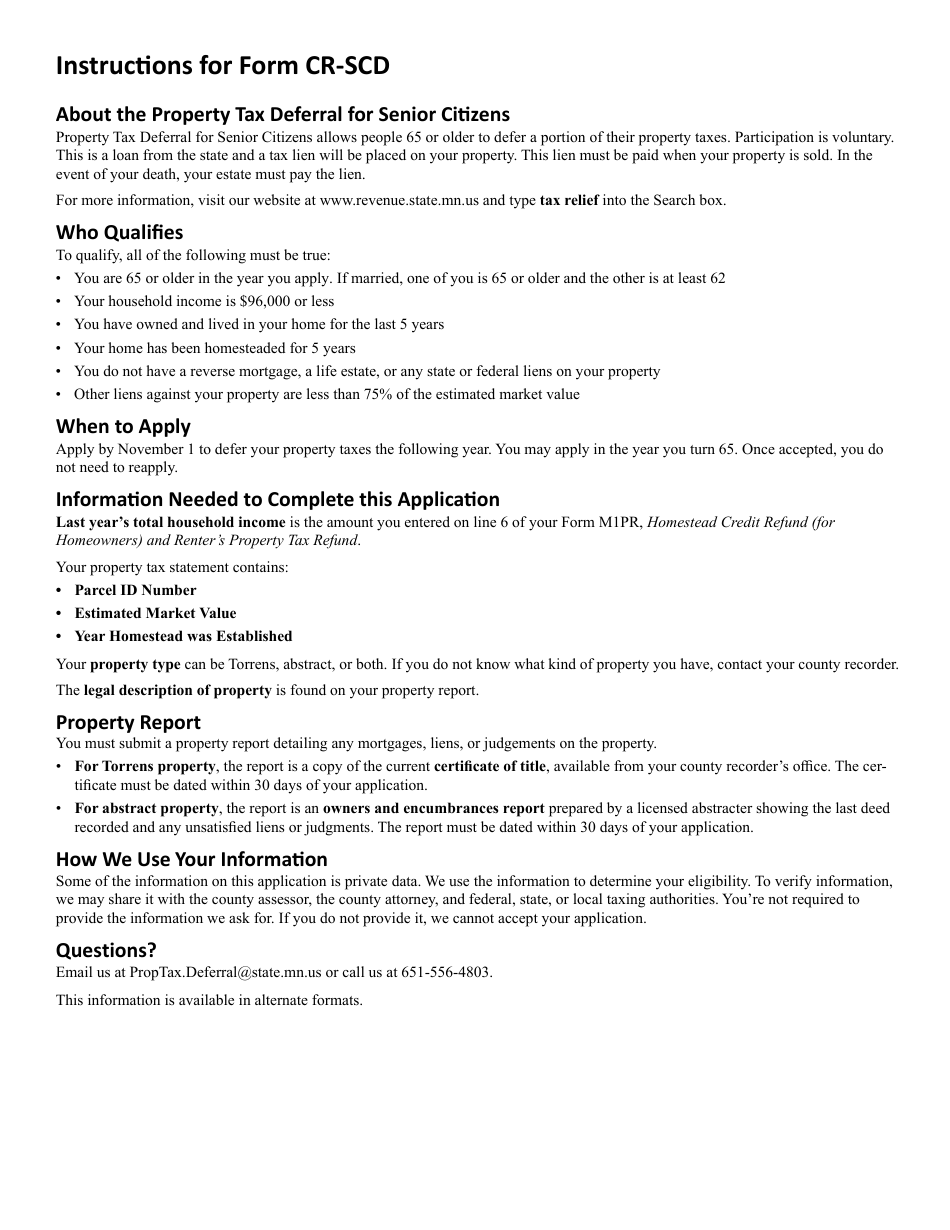

Q: Who is eligible to use the CR-SCD Property Tax Deferral Application?

A: Senior citizens who meet the eligibility requirements set by the state of Minnesota are eligible to use the CR-SCD Property Tax Deferral Application.

Q: What is the purpose of deferring property tax payments?

A: Deferring property tax payments allows eligible senior citizens to delay paying their property taxes until a later date, reducing the burden on their finances.

Q: How does the CR-SCD Property Tax Deferral Application work?

A: Once approved, the CR-SCD Property Tax Deferral Application allows senior citizens to defer their property tax payments until they sell their property or are no longer eligible for the program.

Q: Are there any fees or interest charges for deferring property tax payments?

A: Yes, there is an interest rate charged on the deferred property tax payments. The interest rate is set by the Minnesota Department of Revenue.

Form Details:

- Released on June 1, 2023;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-SCD by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.