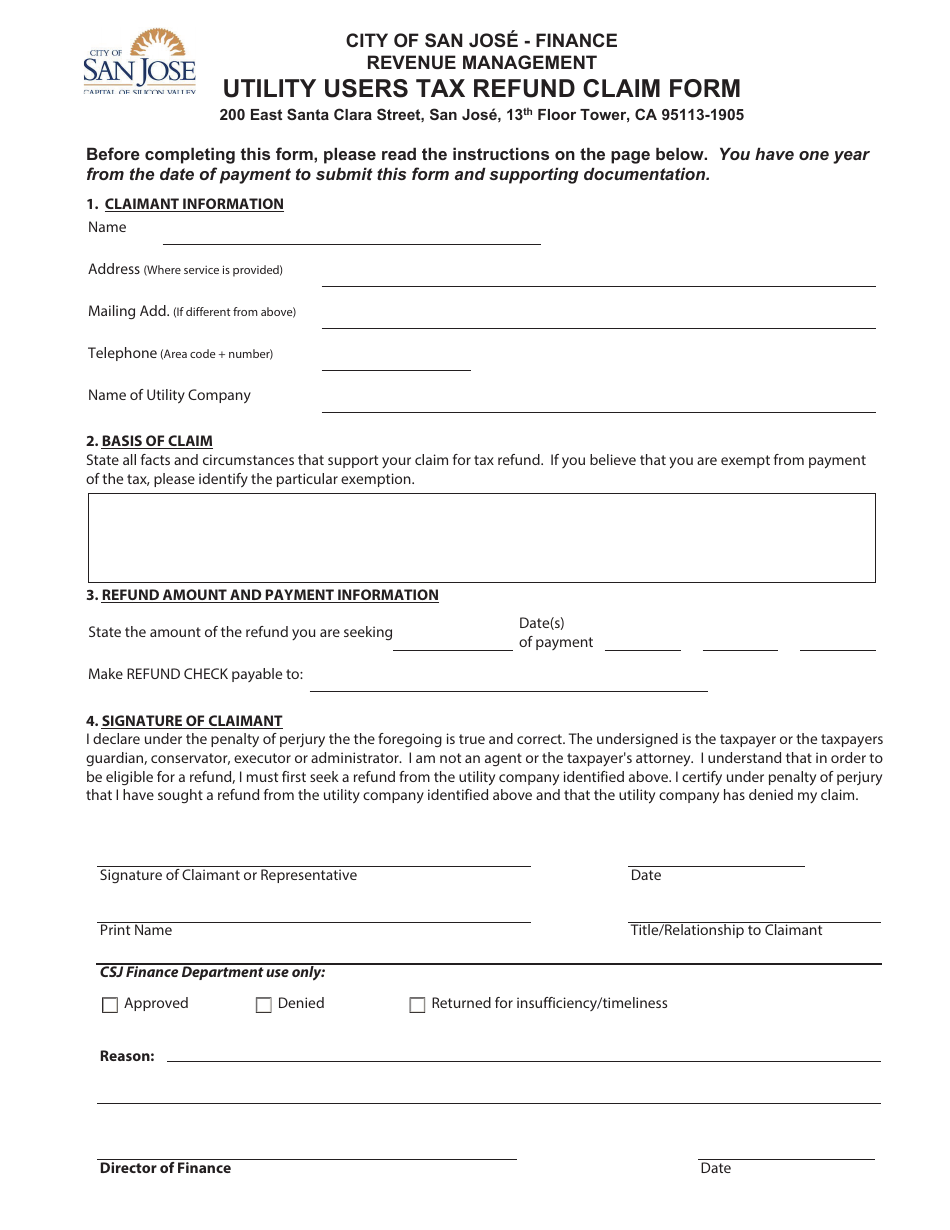

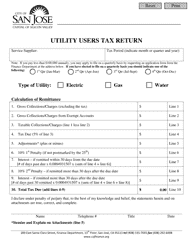

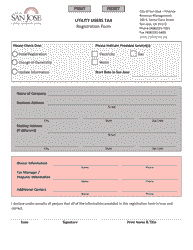

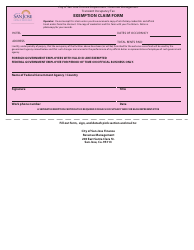

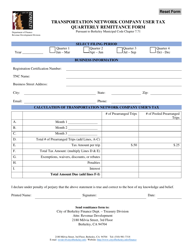

Utility Users Tax Refund Claim Form - City of San Jose, California

Utility Users Tax Refund Claim Form is a legal document that was released by the Finance Department - City of San Jose, California - a government authority operating within California. The form may be used strictly within City of San Jose.

FAQ

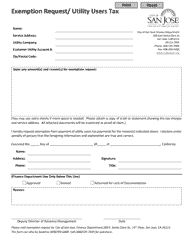

Q: What is the Utility Users Tax Refund Claim Form?

A: The Utility Users Tax Refund Claim Form is a form provided by the City of San Jose, California for residents to claim a refund on utility taxes paid.

Q: Who can use the Utility Users Tax Refund Claim Form?

A: Residents of the City of San Jose, California who have paid utility taxes can use the form to claim a refund.

Q: What is the purpose of filing a Utility Users Tax Refund Claim?

A: The purpose of filing a Utility Users Tax Refund Claim is to request a refund on taxes paid for utilities in the City of San Jose, California.

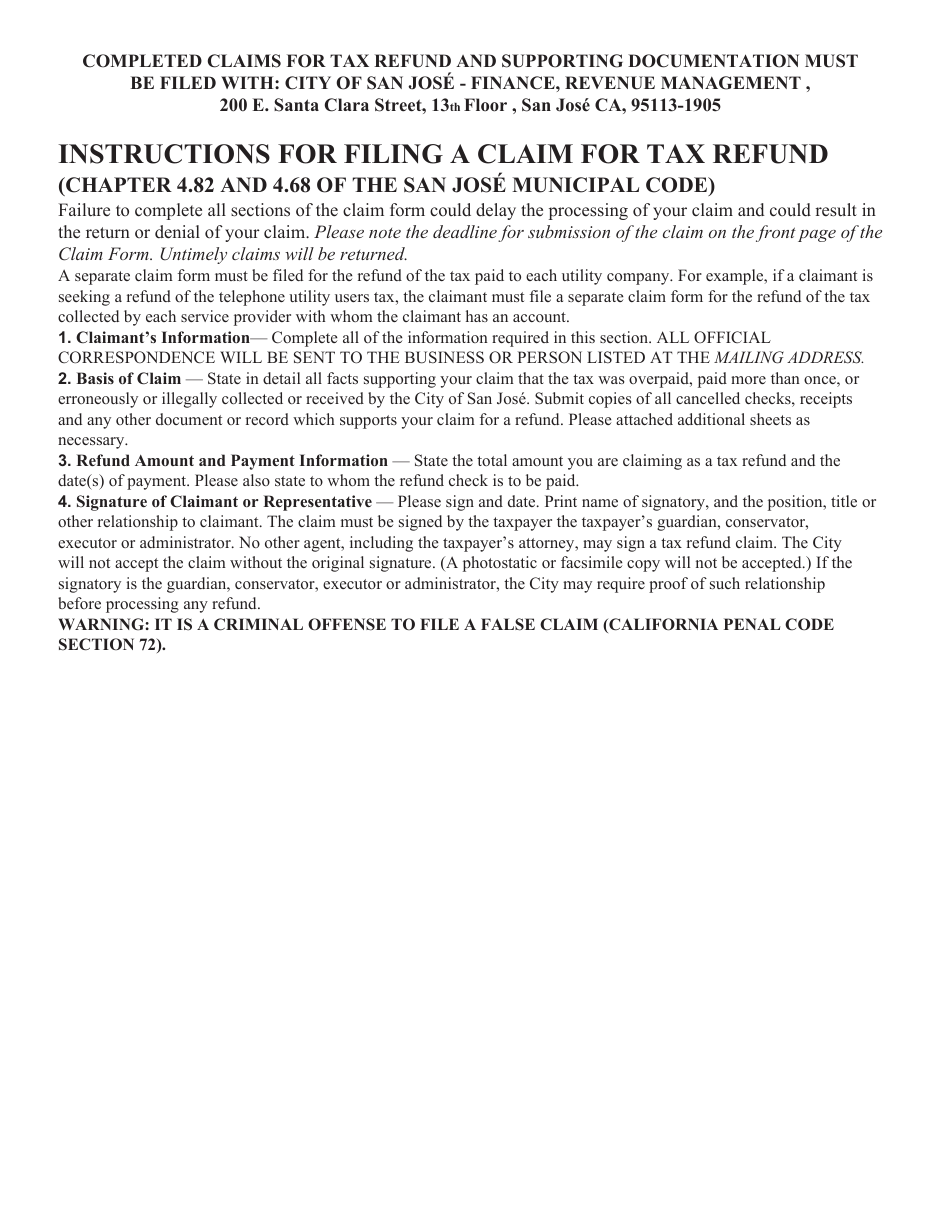

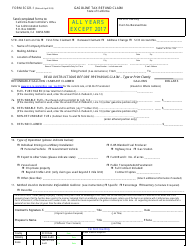

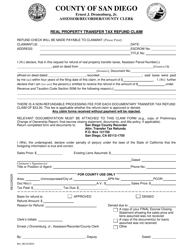

Q: What documents do I need to submit with the Utility Users Tax Refund Claim Form?

A: You may need to submit proof of payment and other supporting documents with the Utility Users Tax Refund Claim Form. Please refer to the instructions on the form for specific requirements.

Q: Is there a deadline for filing the Utility Users Tax Refund Claim?

A: Yes, there is a deadline for filing the Utility Users Tax Refund Claim. The specific deadline and any extensions will be mentioned in the instructions on the form.

Q: How long does it take to process a Utility Users Tax Refund Claim?

A: The processing time for a Utility Users Tax Refund Claim may vary. It is best to check with the City of San Jose, California for an estimated timeframe.

Q: What should I do if I have any questions about the Utility Users Tax Refund Claim Form?

A: If you have any questions about the Utility Users Tax Refund Claim Form, you can contact the City of San Jose, California's customer service for assistance.

Form Details:

- The latest edition currently provided by the Finance Department - City of San Jose, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of San Jose, California.