This version of the form is not currently in use and is provided for reference only. Download this version of

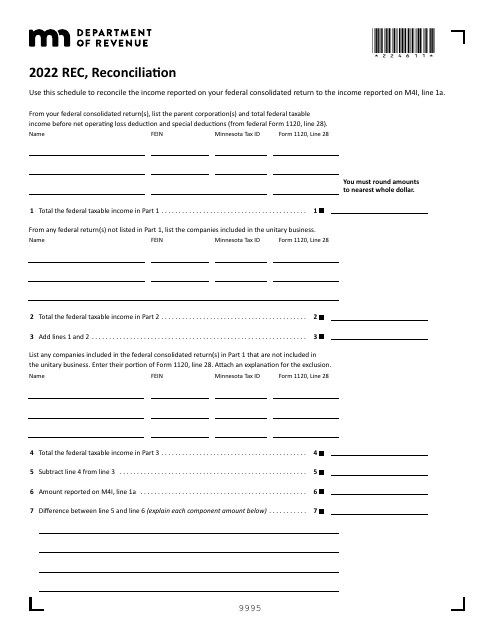

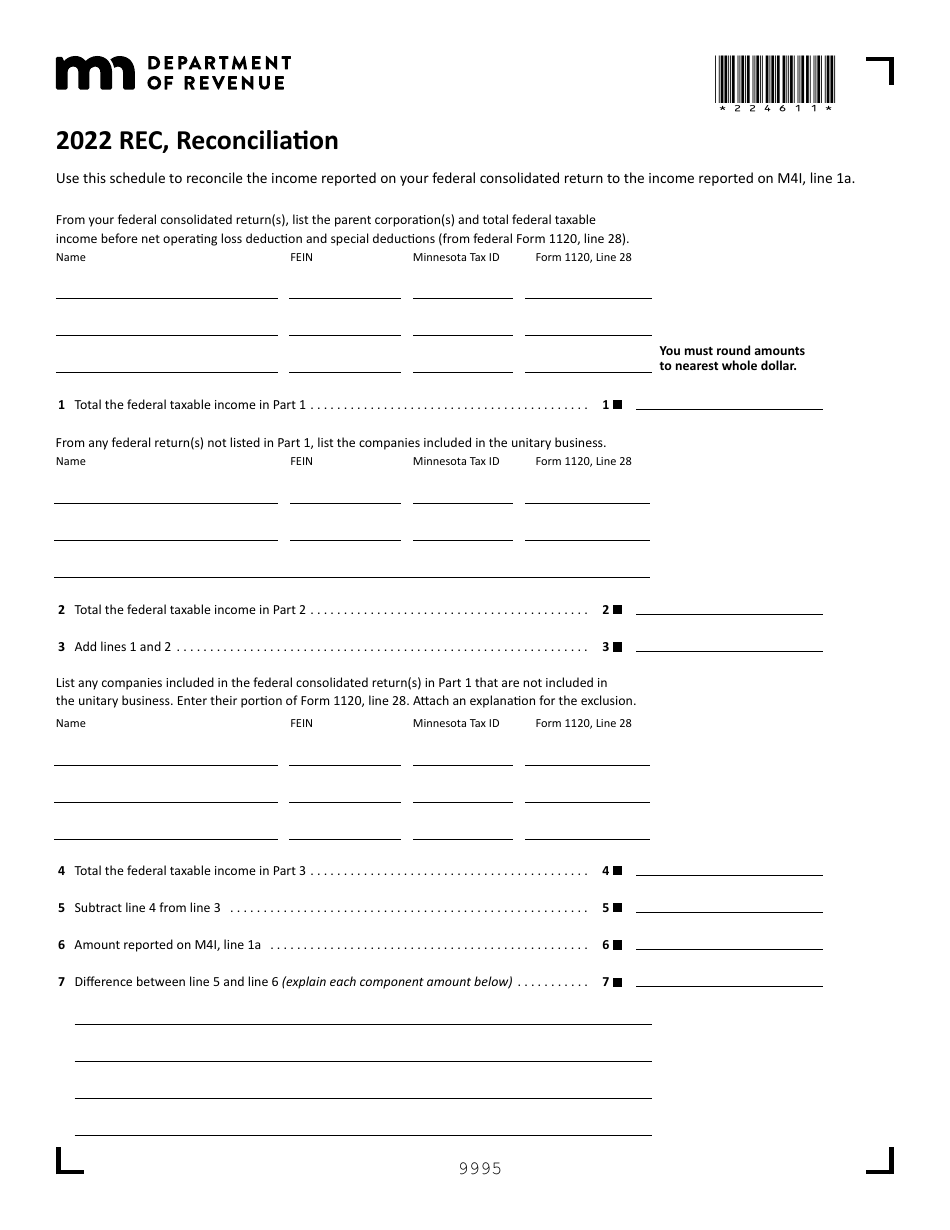

Form REC

for the current year.

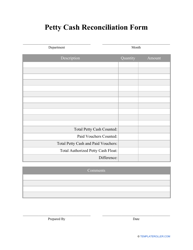

Form REC Reconciliation - Minnesota

What Is Form REC?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REC Reconciliation?

A: Form REC Reconciliation is a form used in Minnesota to report and reconcile withholding tax information.

Q: Who needs to file Form REC Reconciliation?

A: Employers in Minnesota who have withheld income taxes from their employees' wages.

Q: When is Form REC Reconciliation due?

A: The form is due annually by January 31st.

Q: What information do I need to complete Form REC Reconciliation?

A: You will need information about the total wages paid, the total amount of state income tax withheld, and the total number of employees.

Q: Is Form REC Reconciliation only for Minnesota residents?

A: No, Form REC Reconciliation is for employers who have employees in Minnesota, regardless of their residence.

Q: Are there penalties for late or incorrect filing of Form REC Reconciliation?

A: Yes, there may be penalties for late or incorrect filing, so it's important to submit the form on time and accurately.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REC by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.