This version of the form is not currently in use and is provided for reference only. Download this version of

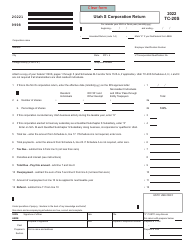

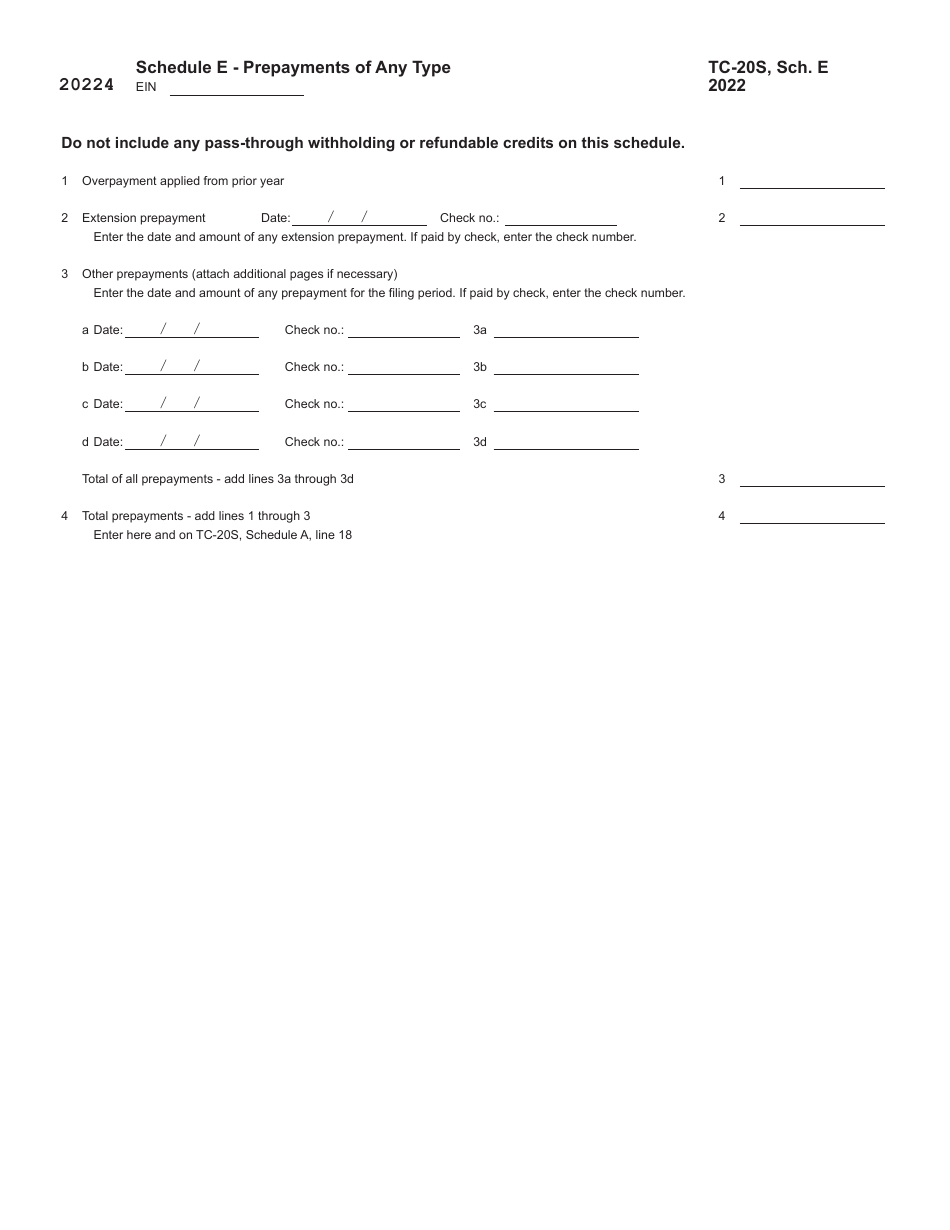

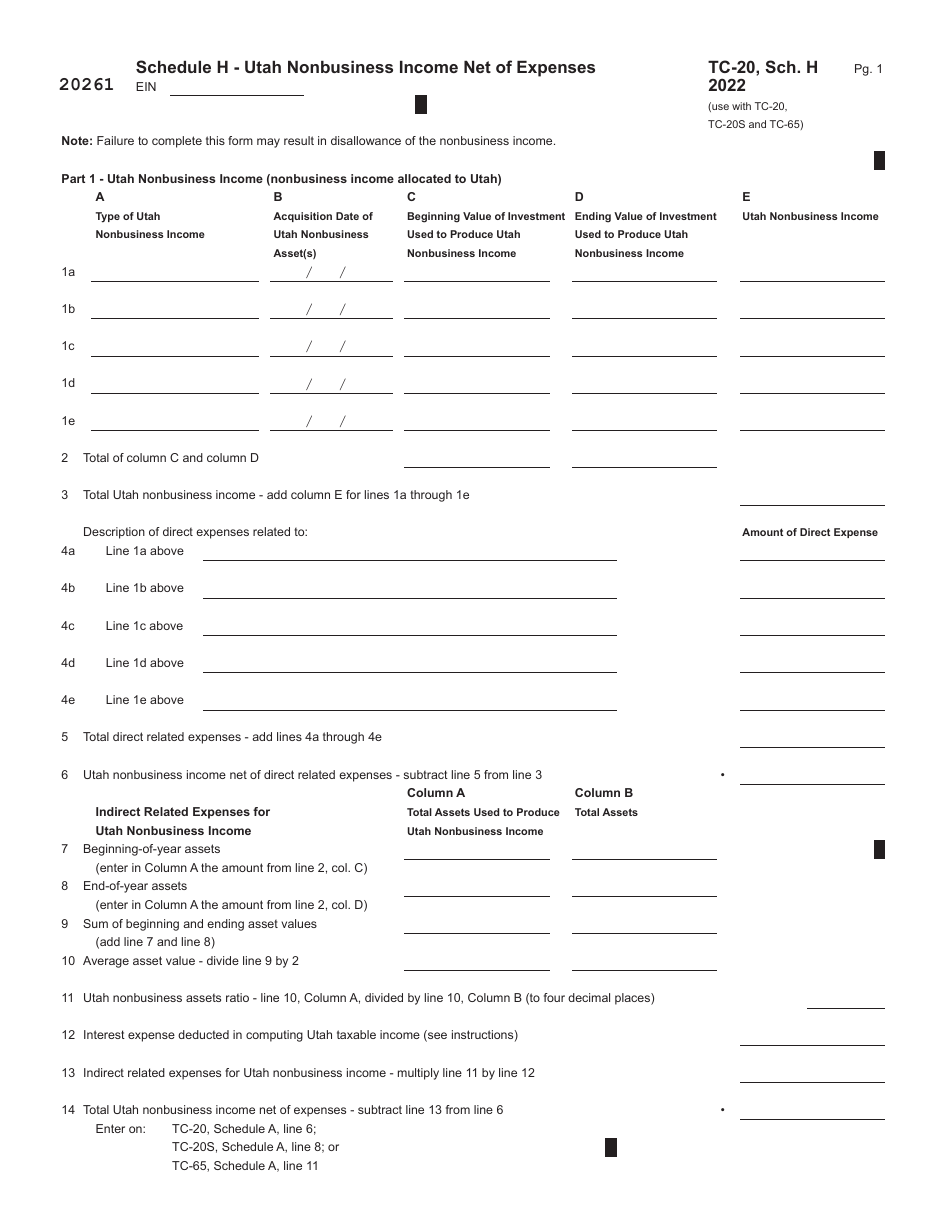

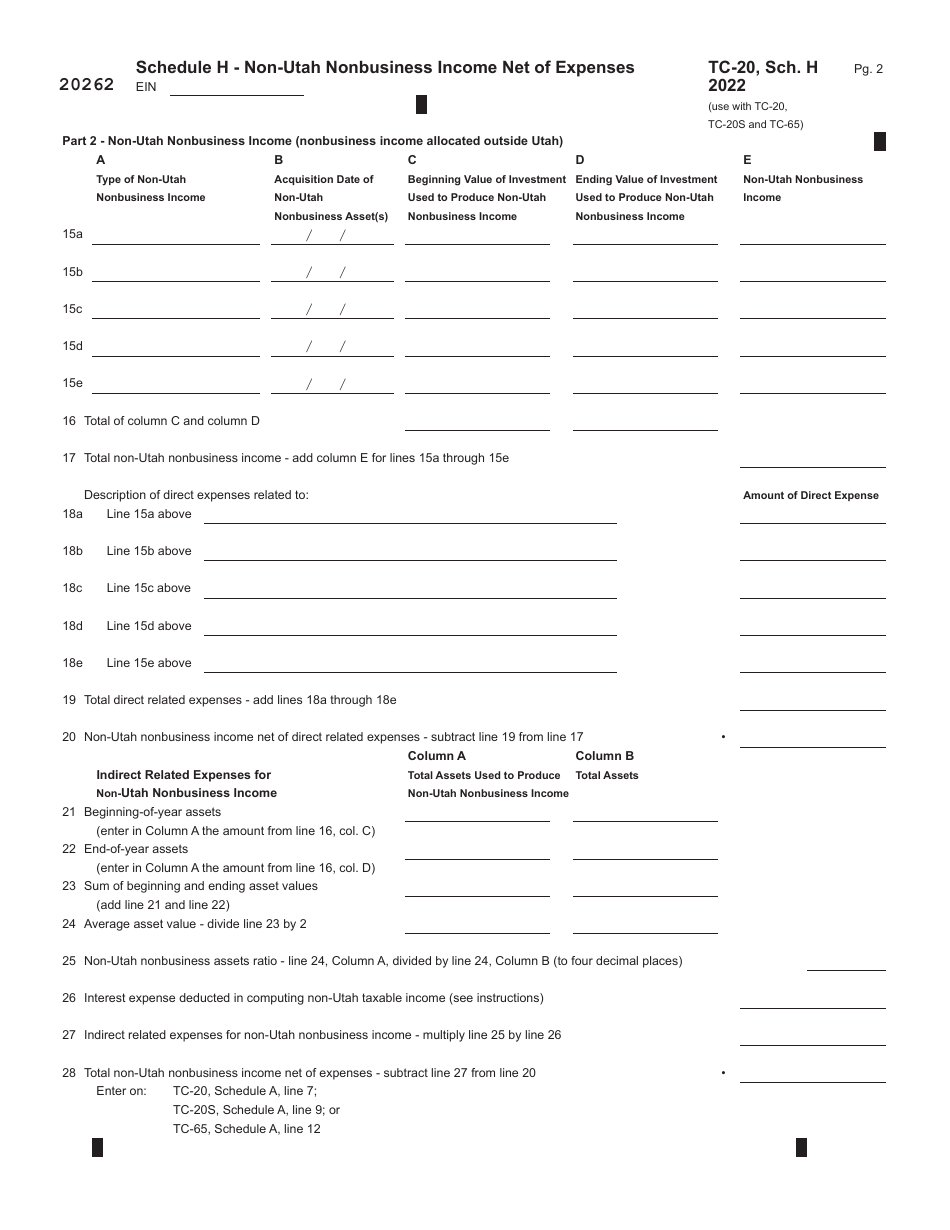

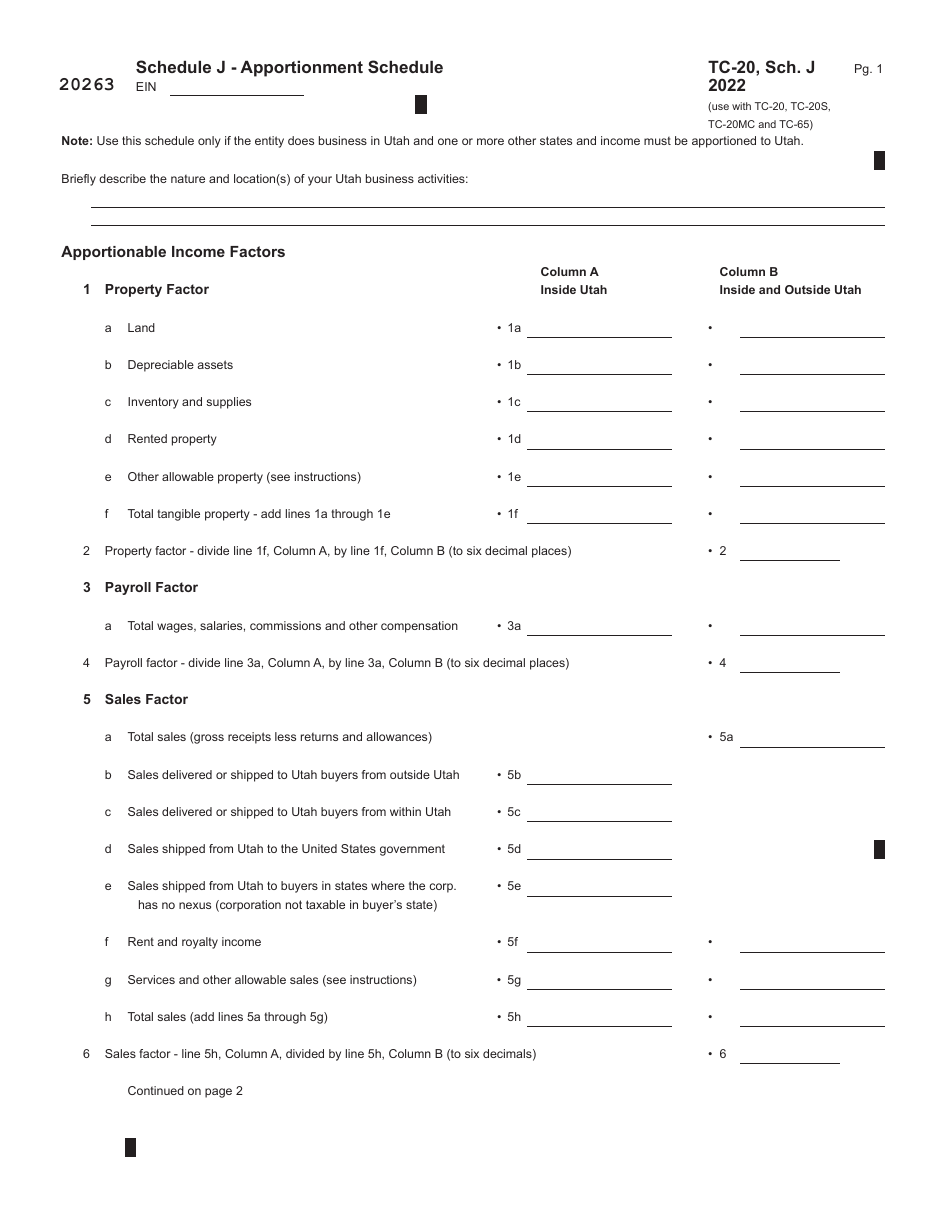

Form TC-20S

for the current year.

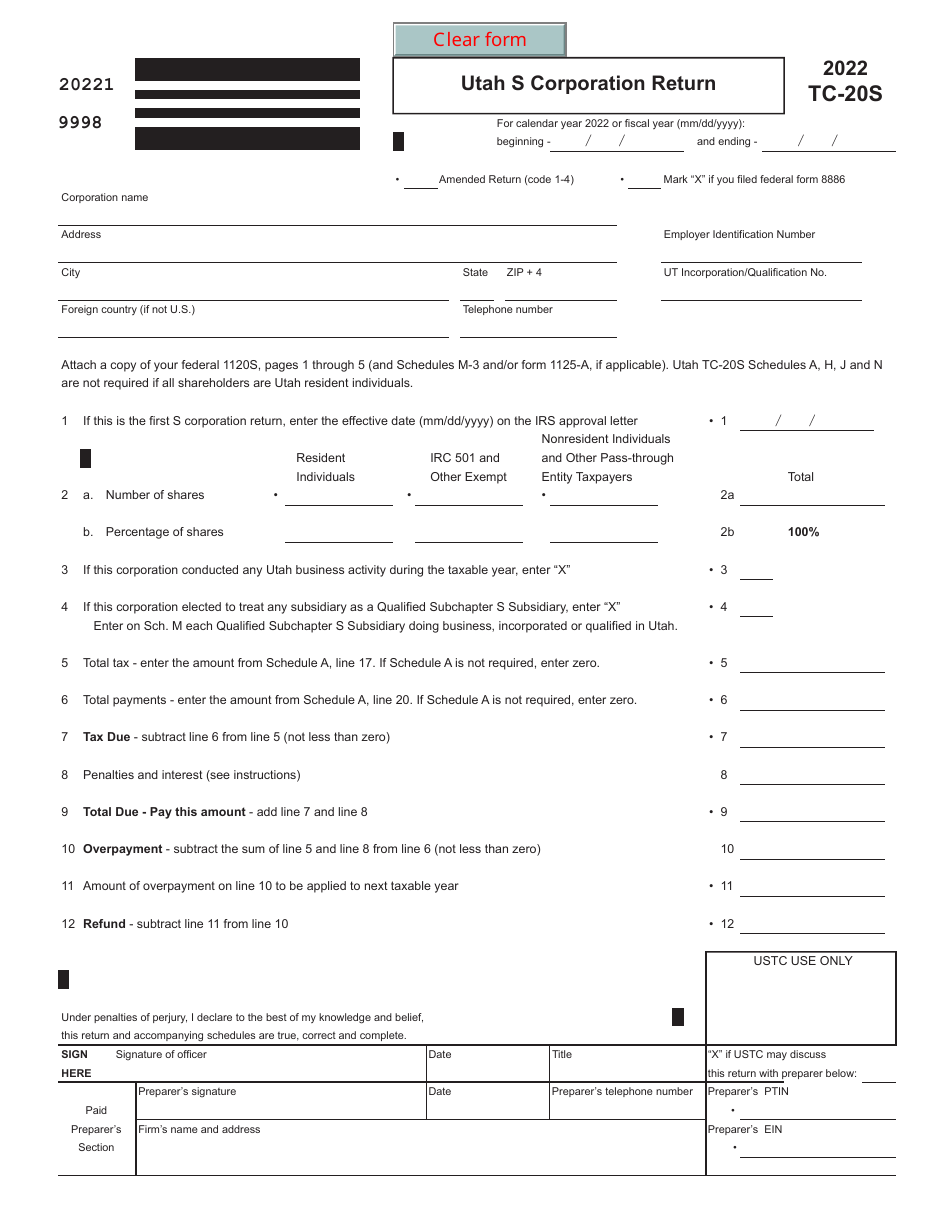

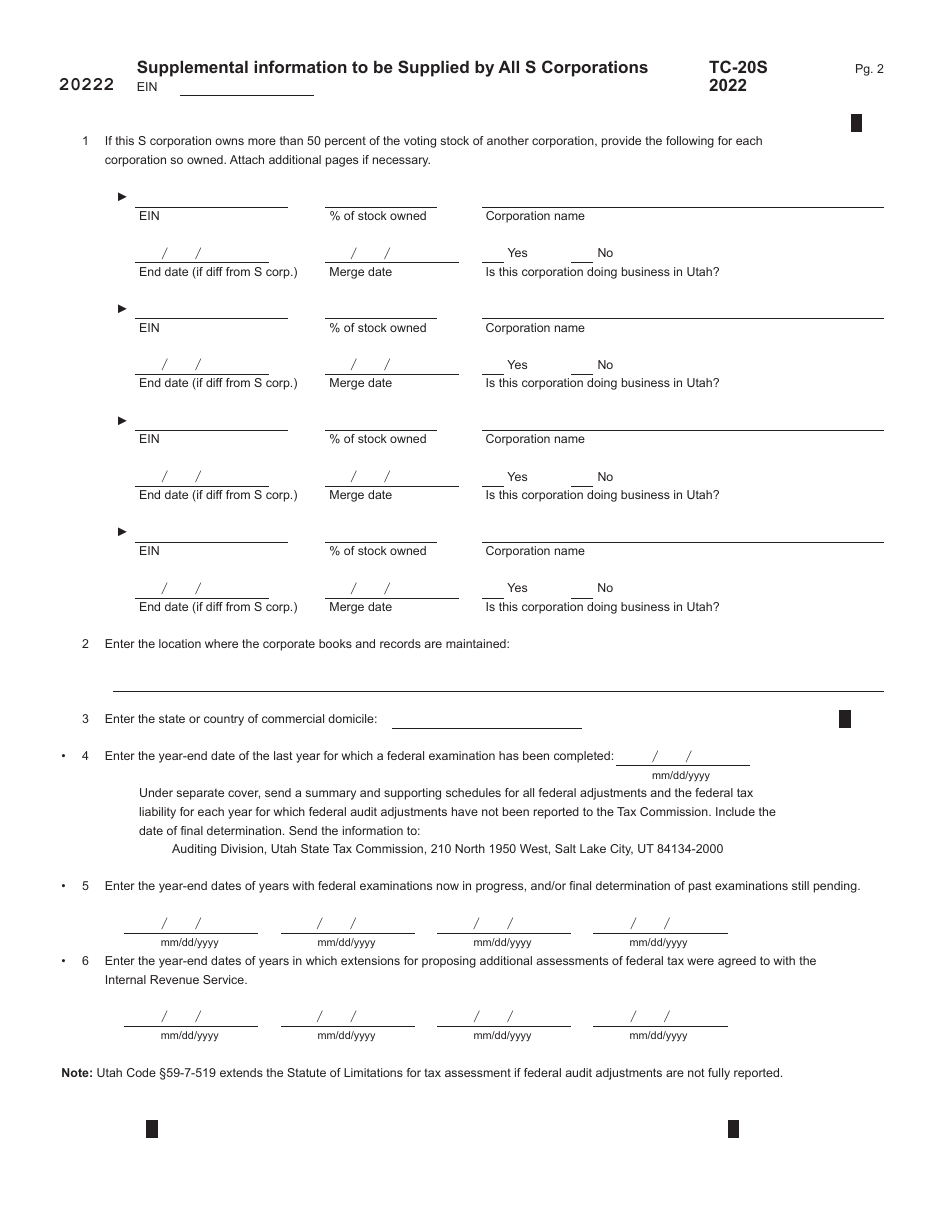

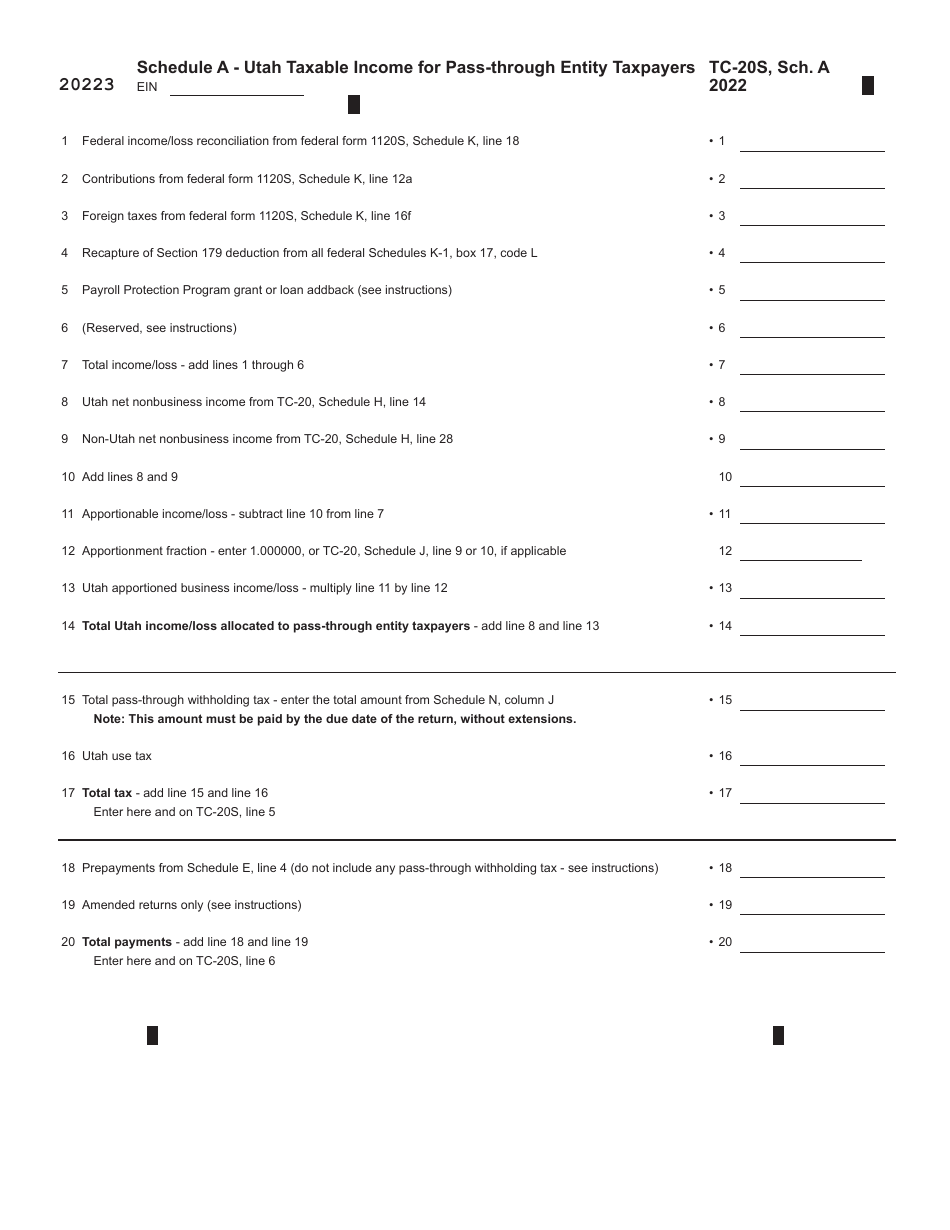

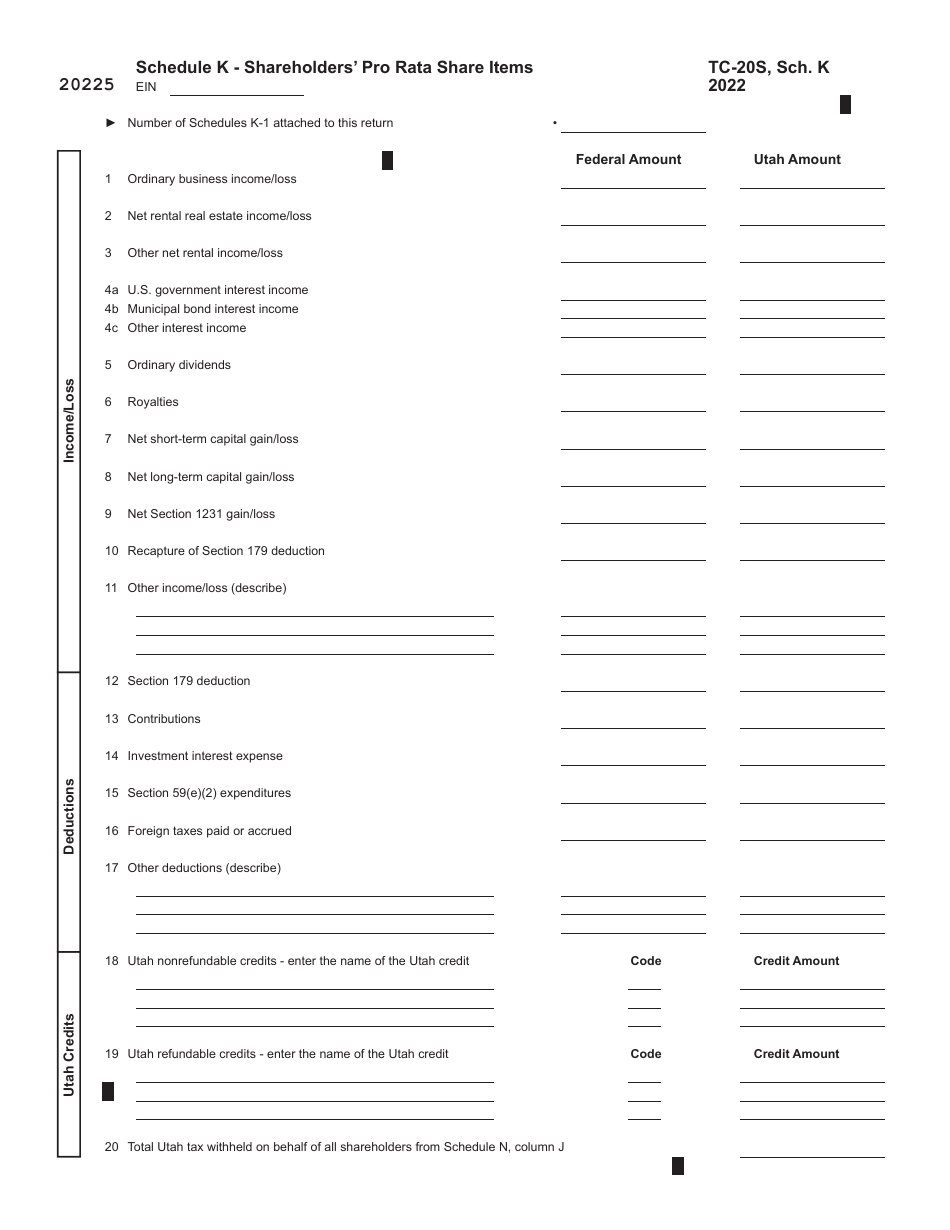

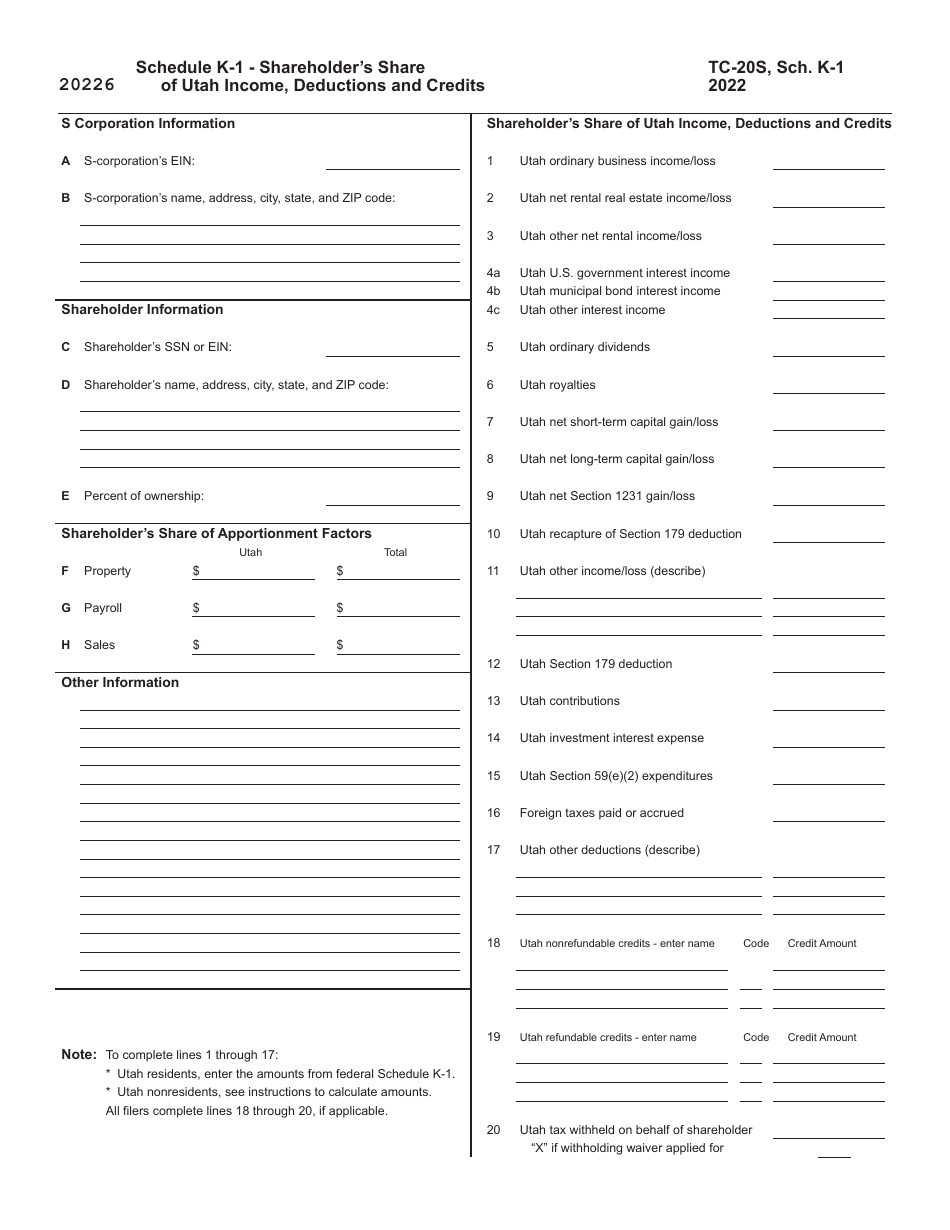

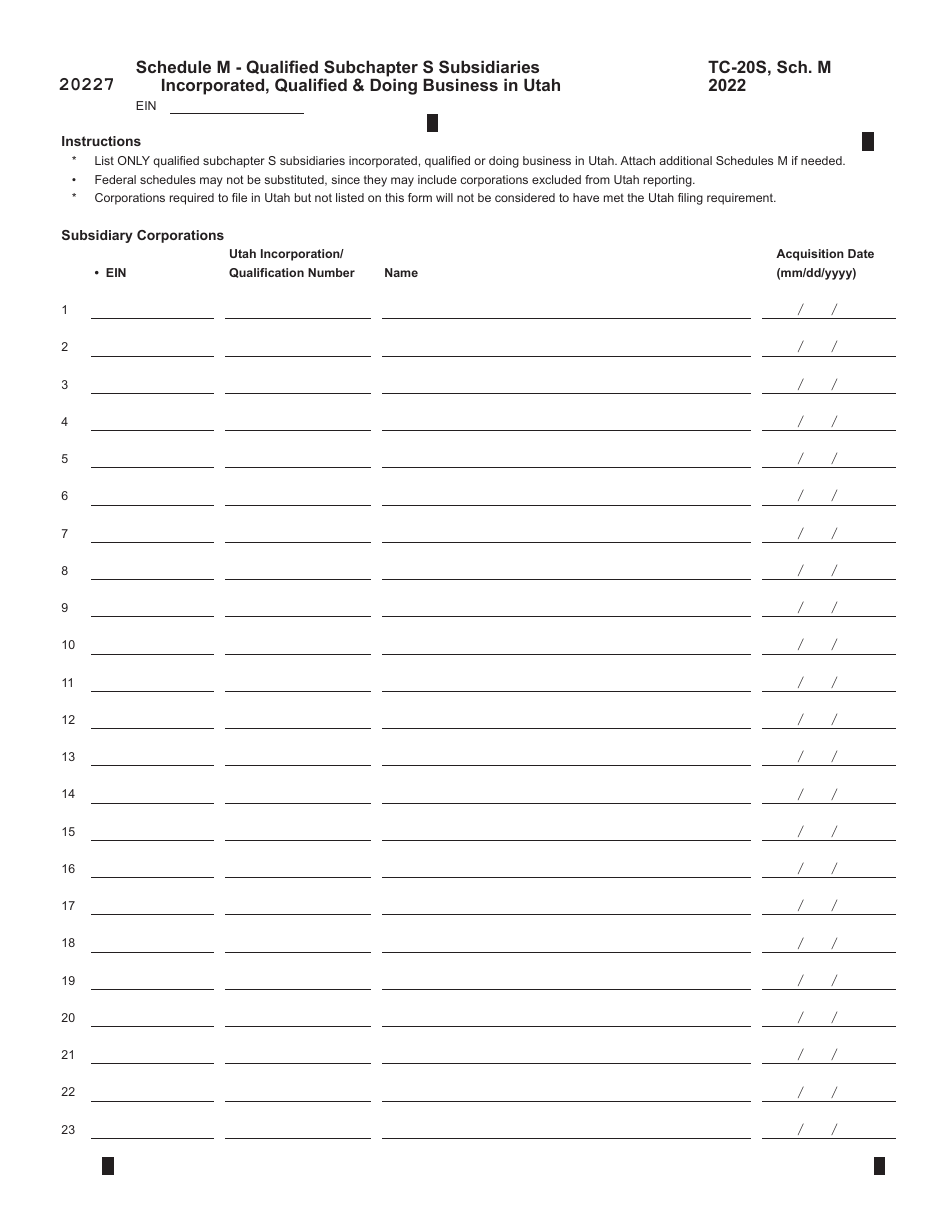

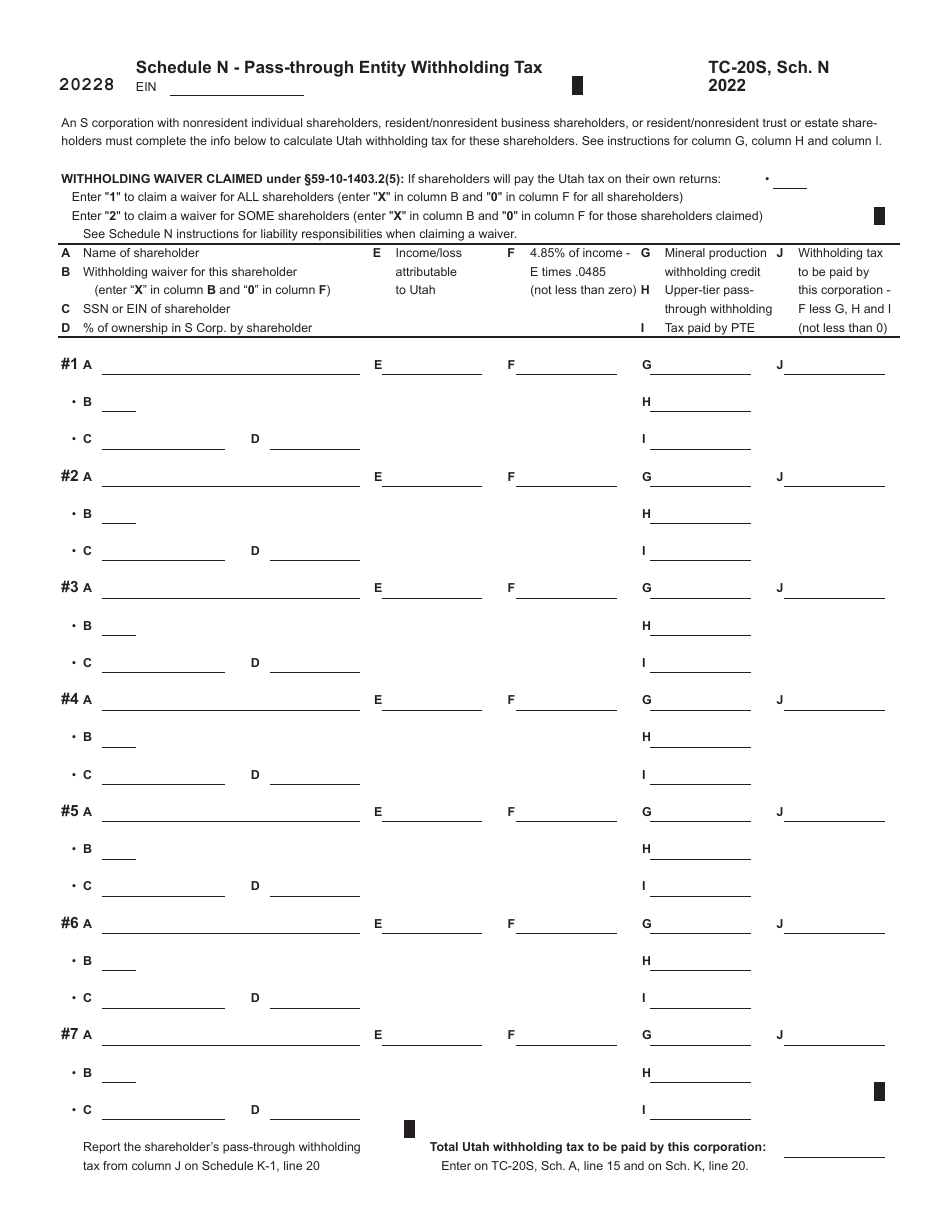

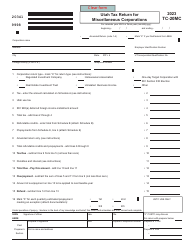

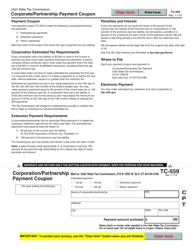

Form TC-20S Utah S Corporation Return - Utah

What Is Form TC-20S?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the TC-20S Utah S Corporation Return?

A: The TC-20S Utah S Corporation Return is a tax form used by S corporations in Utah to report their income, deductions, and tax liability.

Q: Who needs to file Form TC-20S?

A: S corporations that are doing business in Utah, or have income derived from Utah sources, need to file Form TC-20S.

Q: When is Form TC-20S due?

A: Form TC-20S is due on the 15th day of the 3rd month following the close of the corporation's tax year.

Q: What information is required on Form TC-20S?

A: Form TC-20S requires information about the corporation's income, deductions, credits, and tax liability. It also requires information about the corporation's shareholders.

Form Details:

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-20S by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.