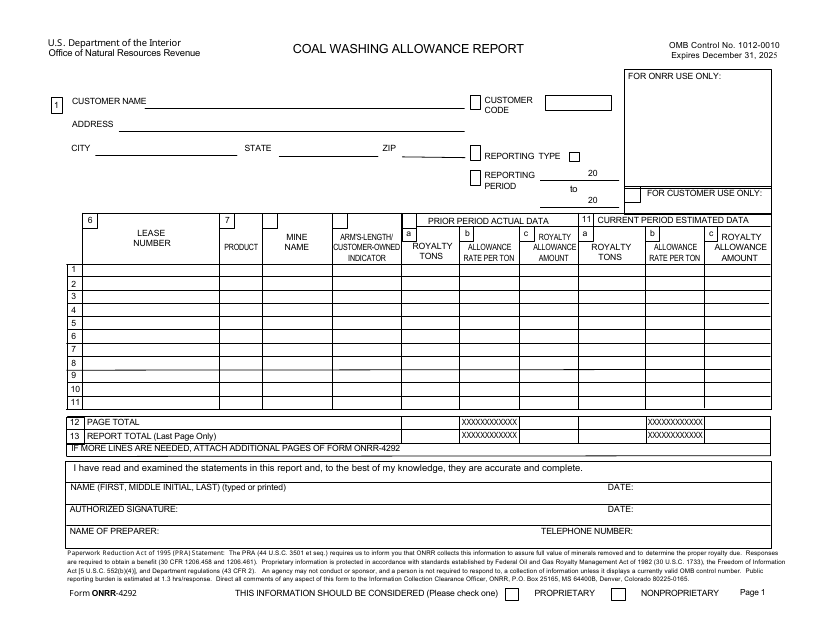

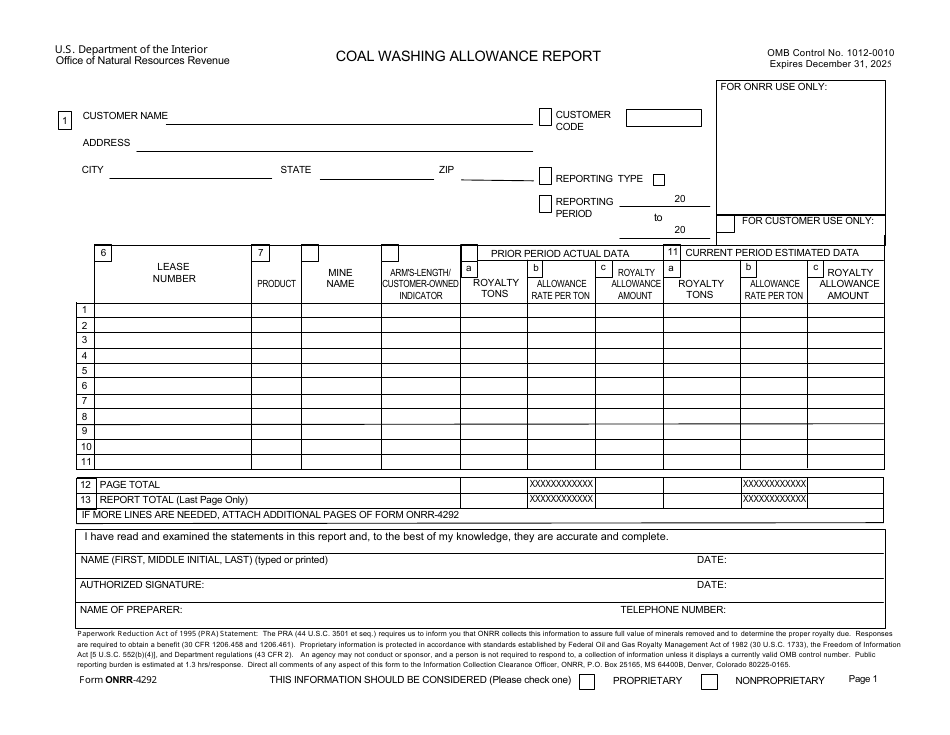

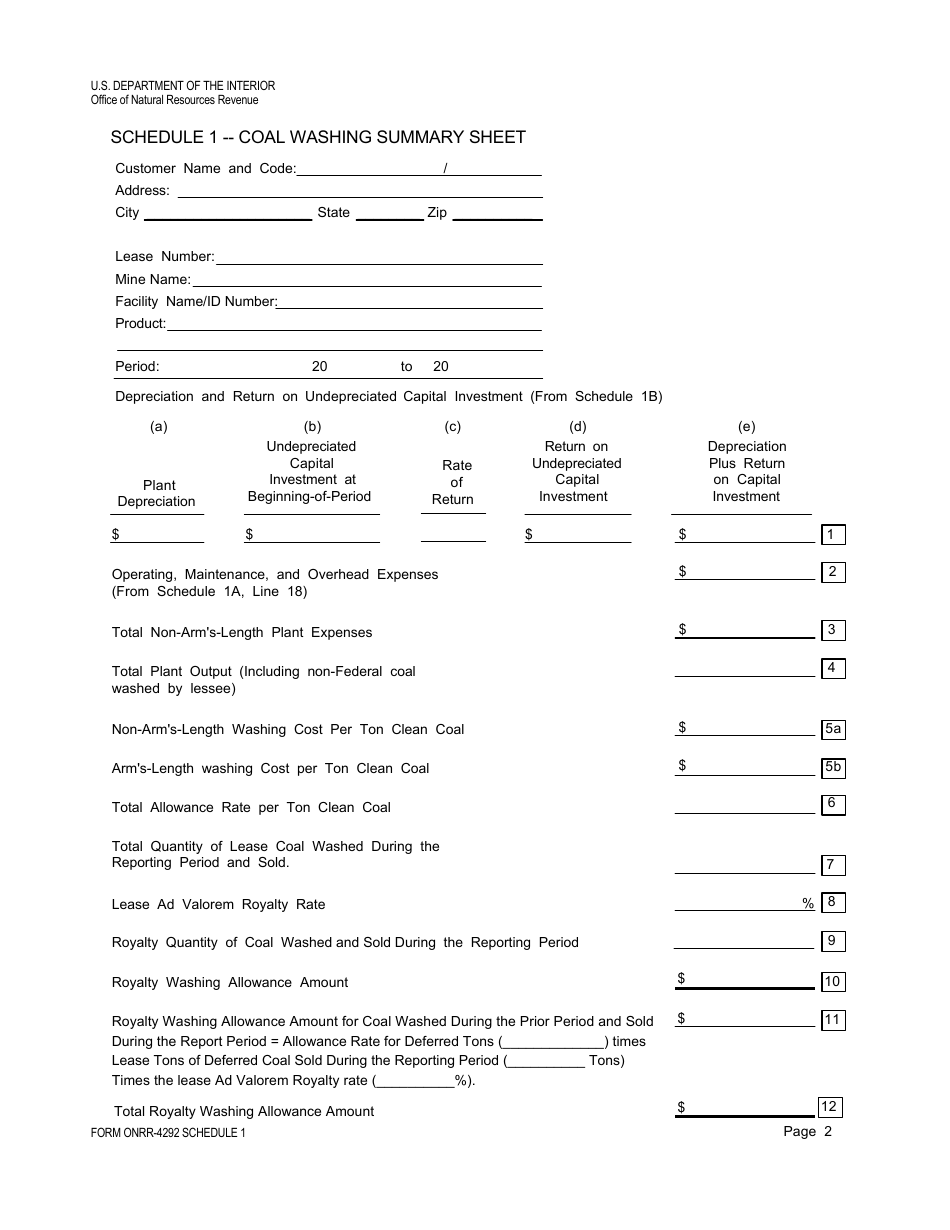

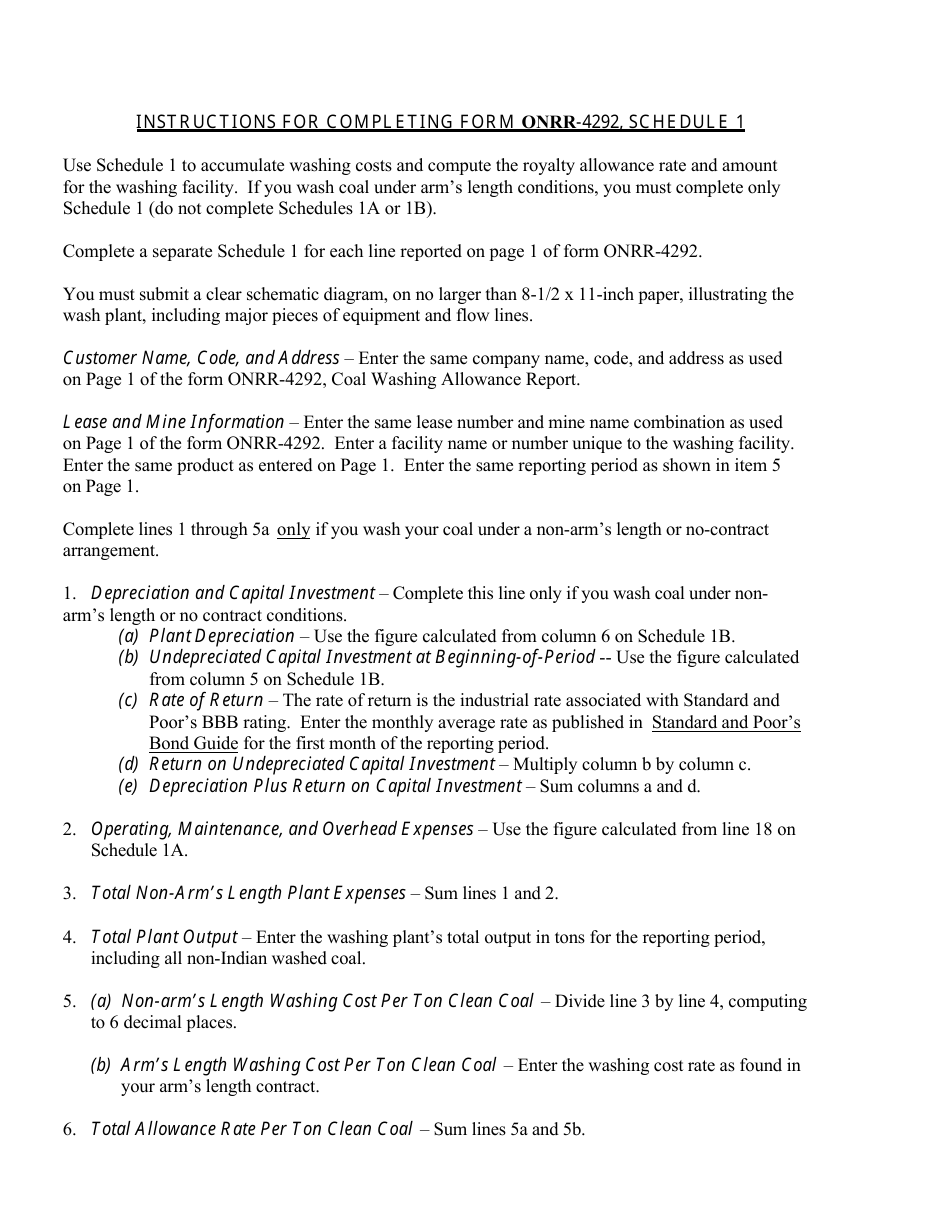

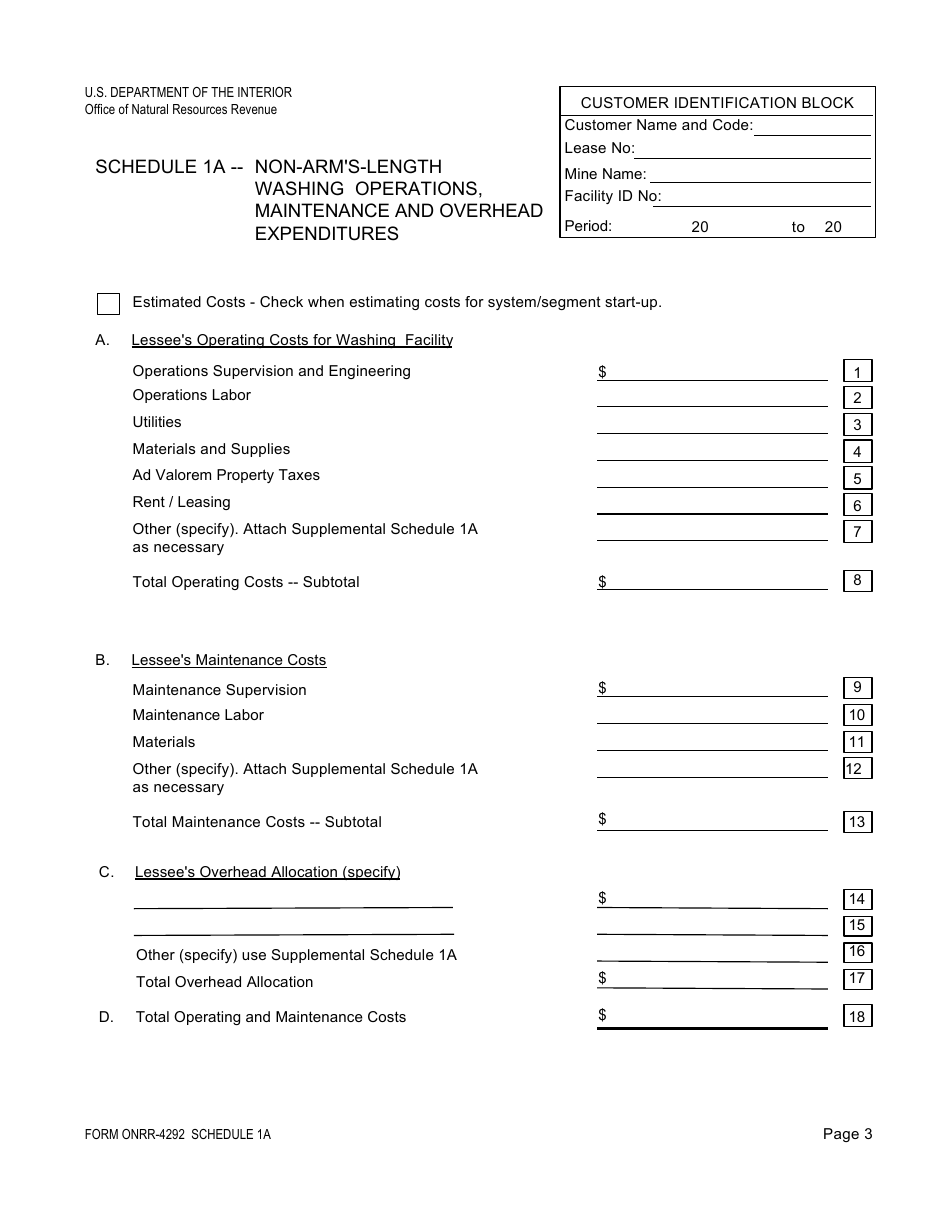

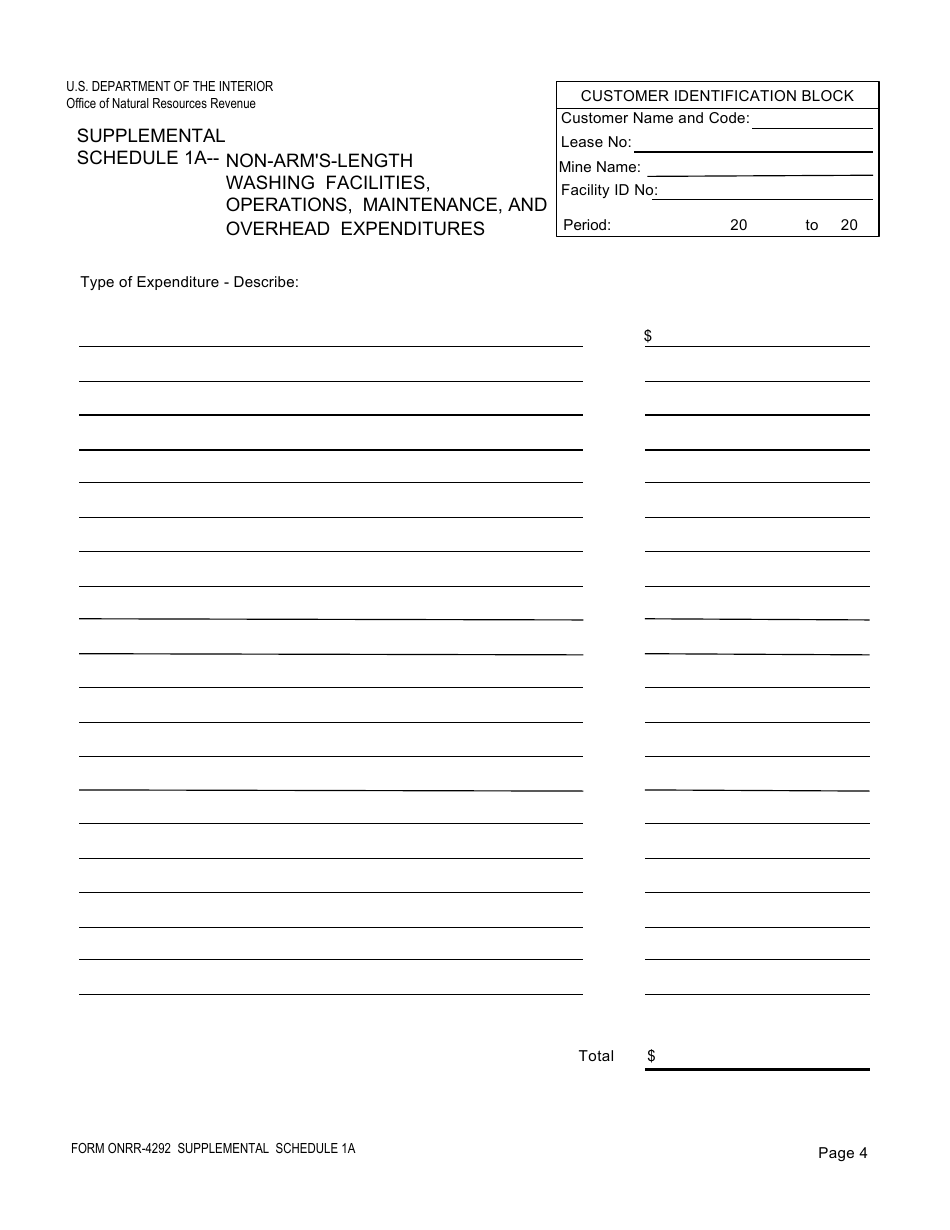

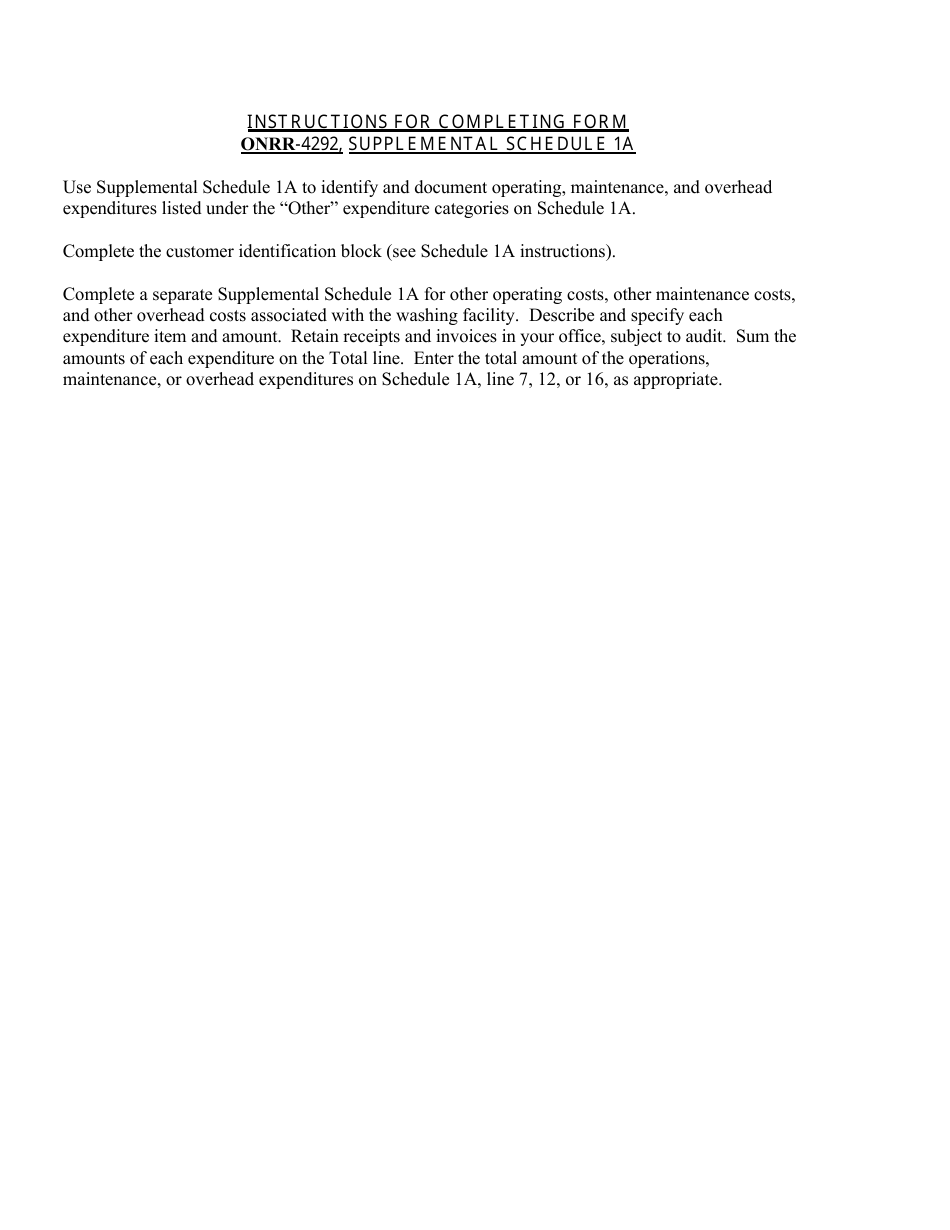

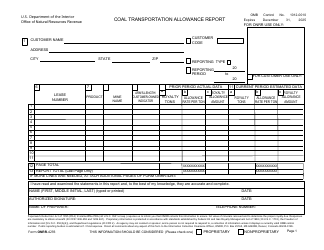

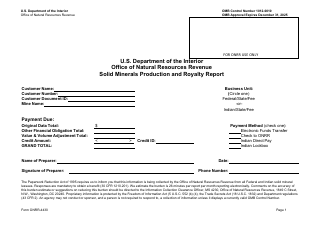

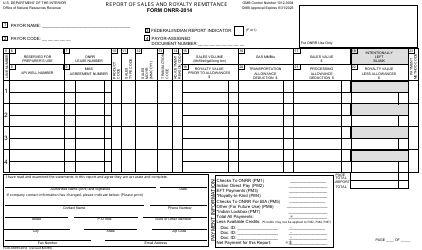

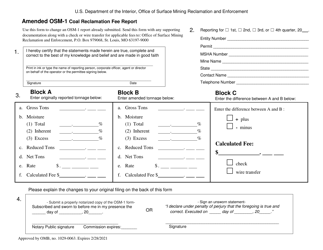

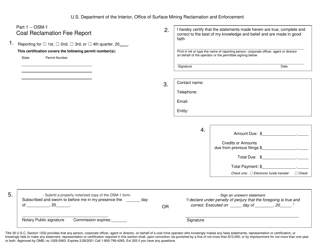

Form ONRR-4292 Coal Washing Allowance Report

What Is Form ONRR-4292?

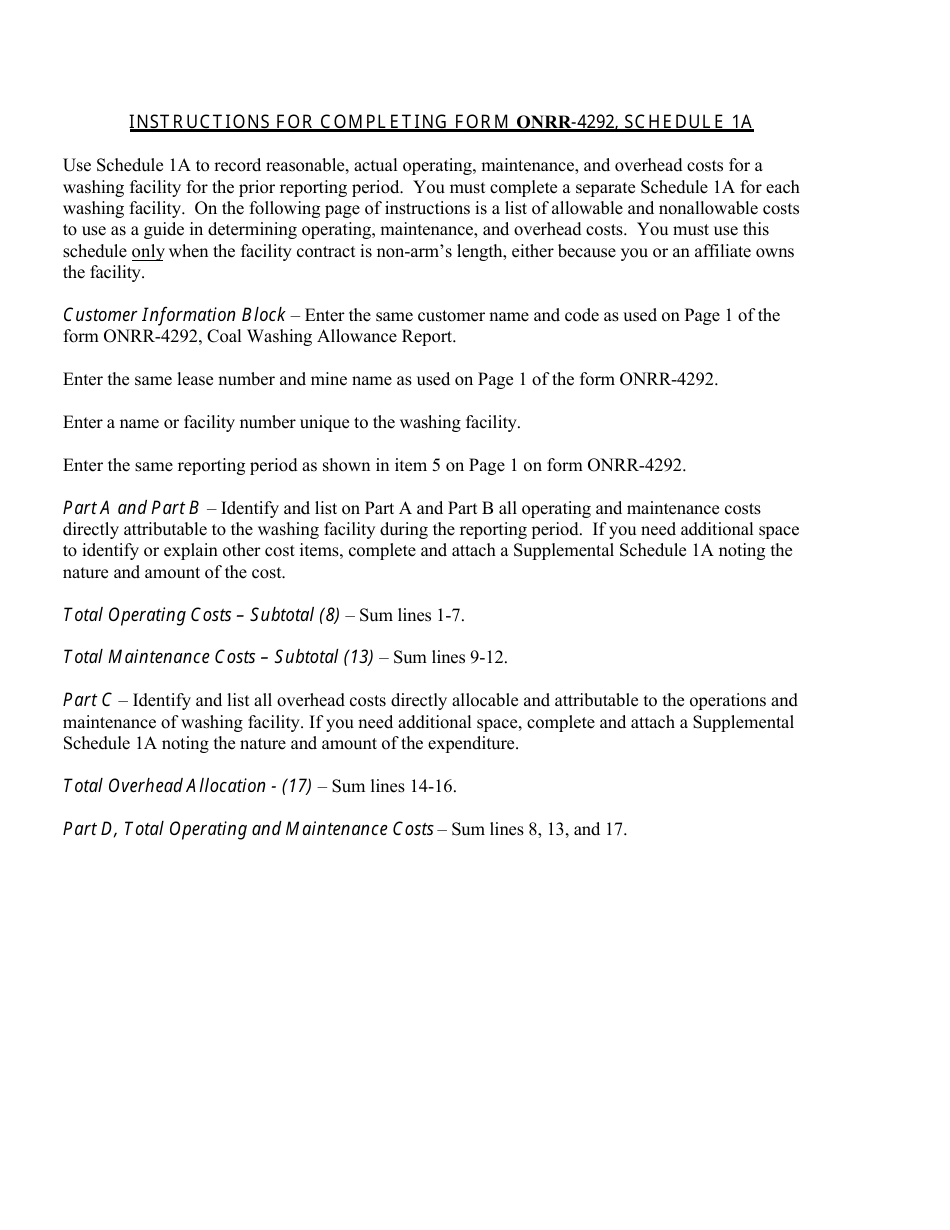

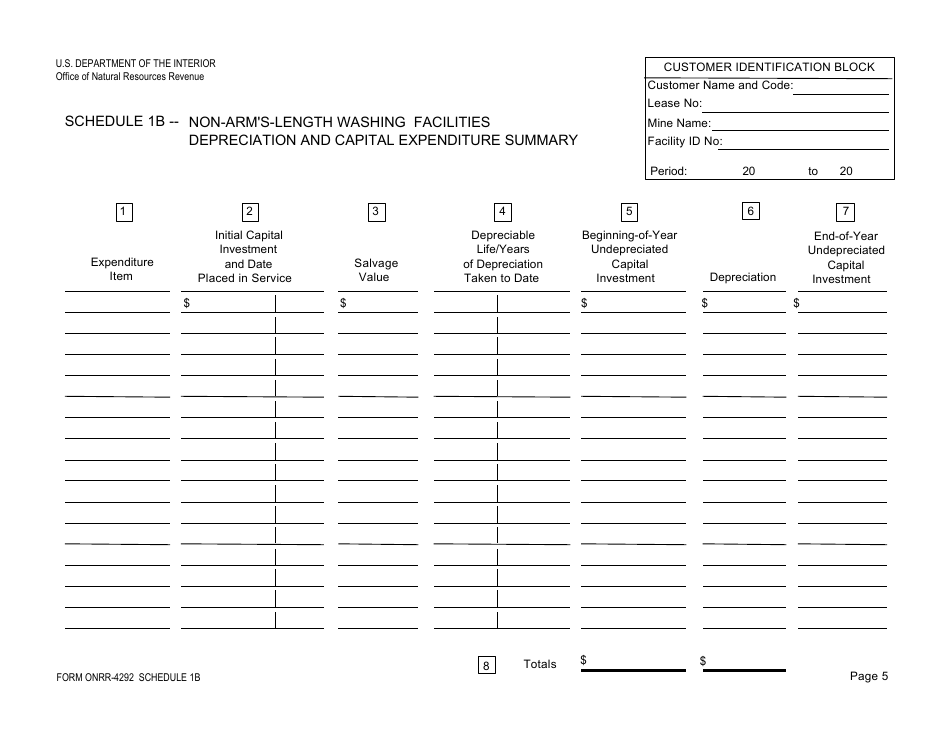

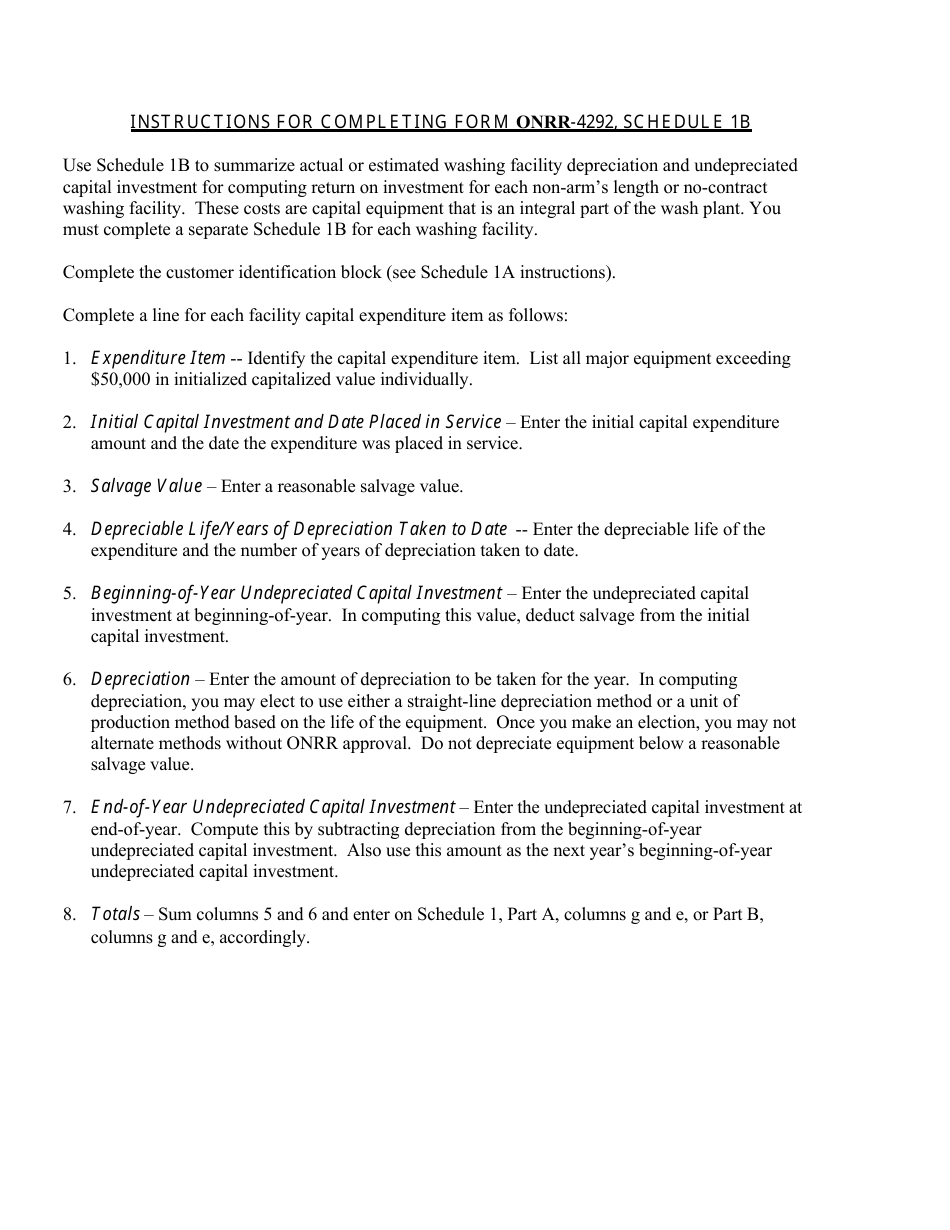

This is a legal form that was released by the U.S. Department of the Interior - Office of Natural Resources Revenue and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

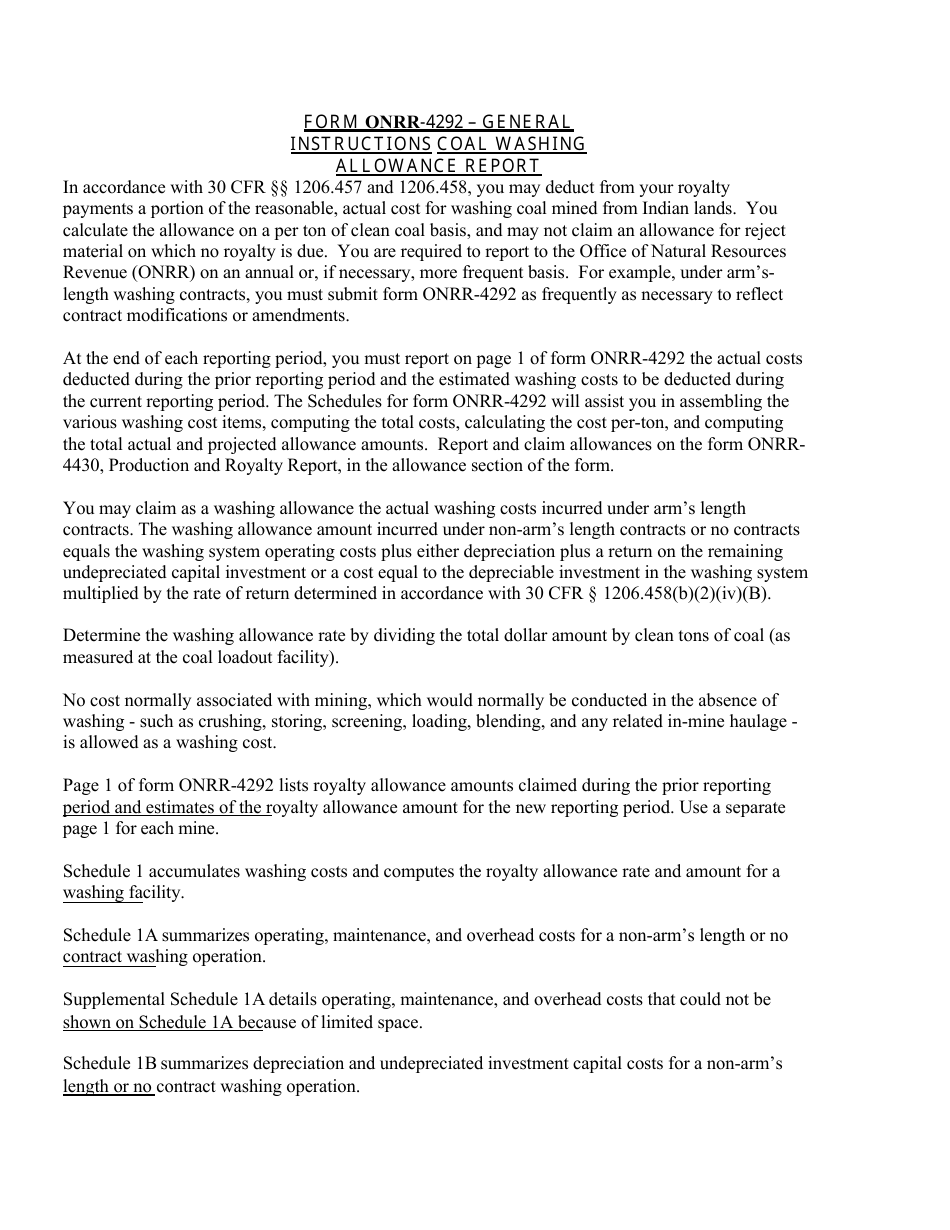

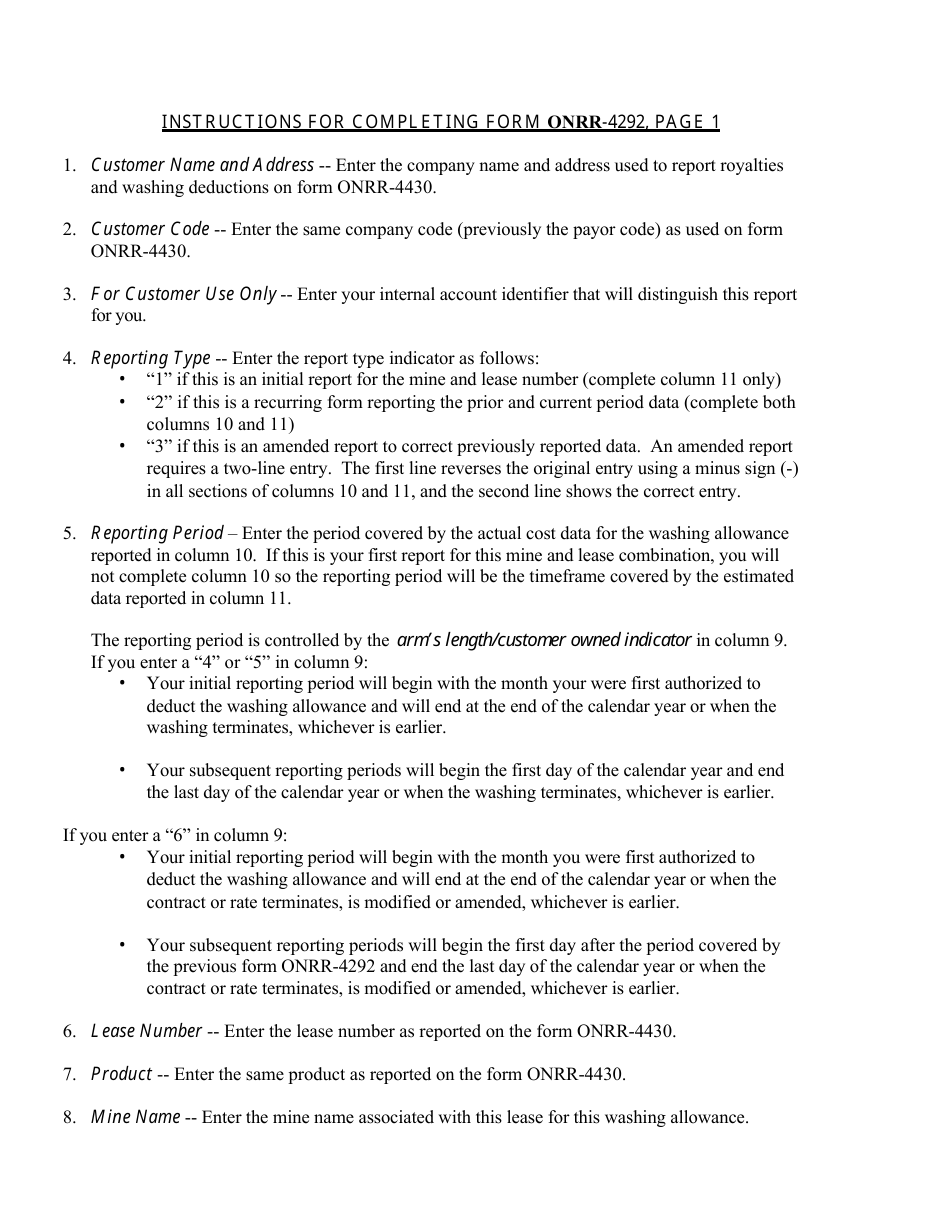

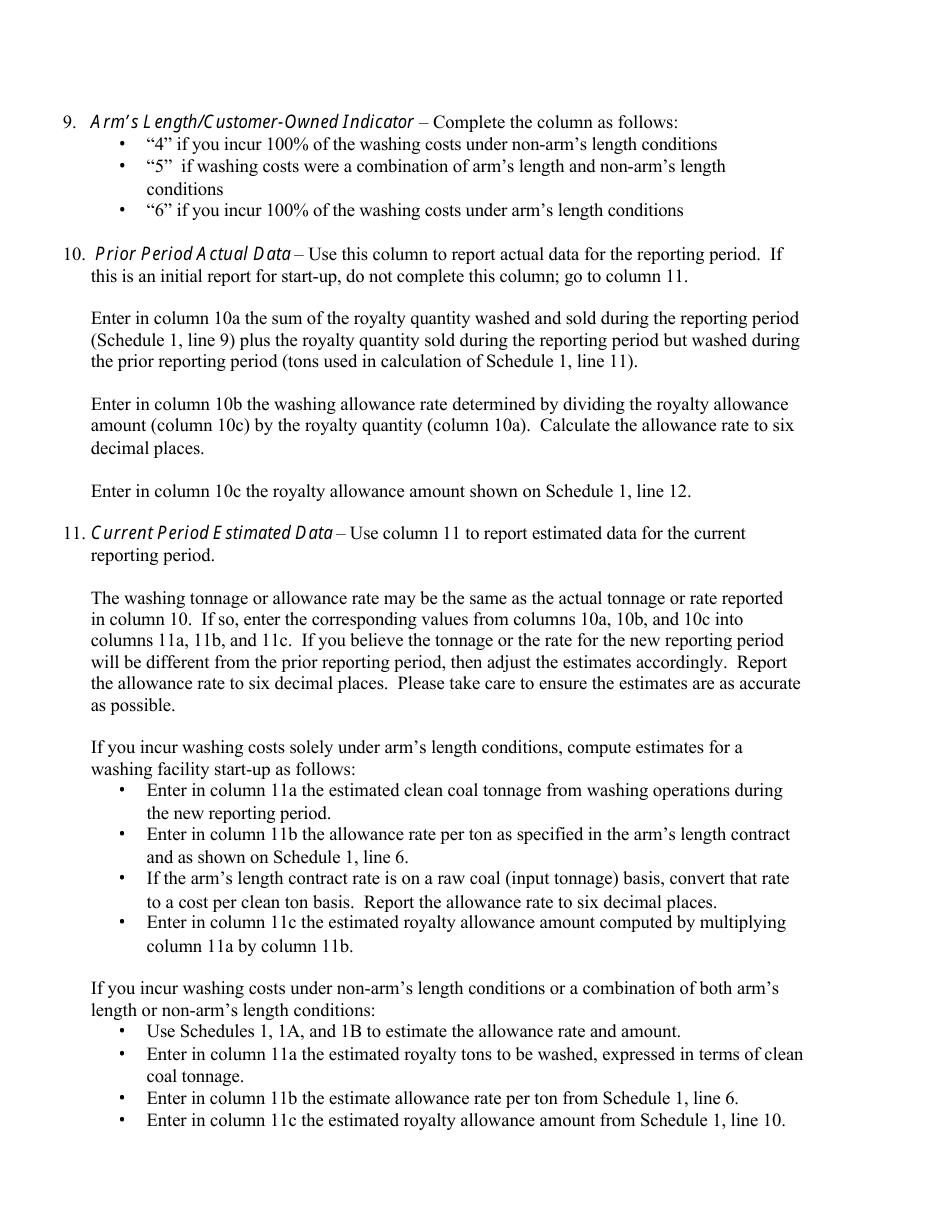

Q: What is an ONRR-4292 Coal Washing Allowance Report?

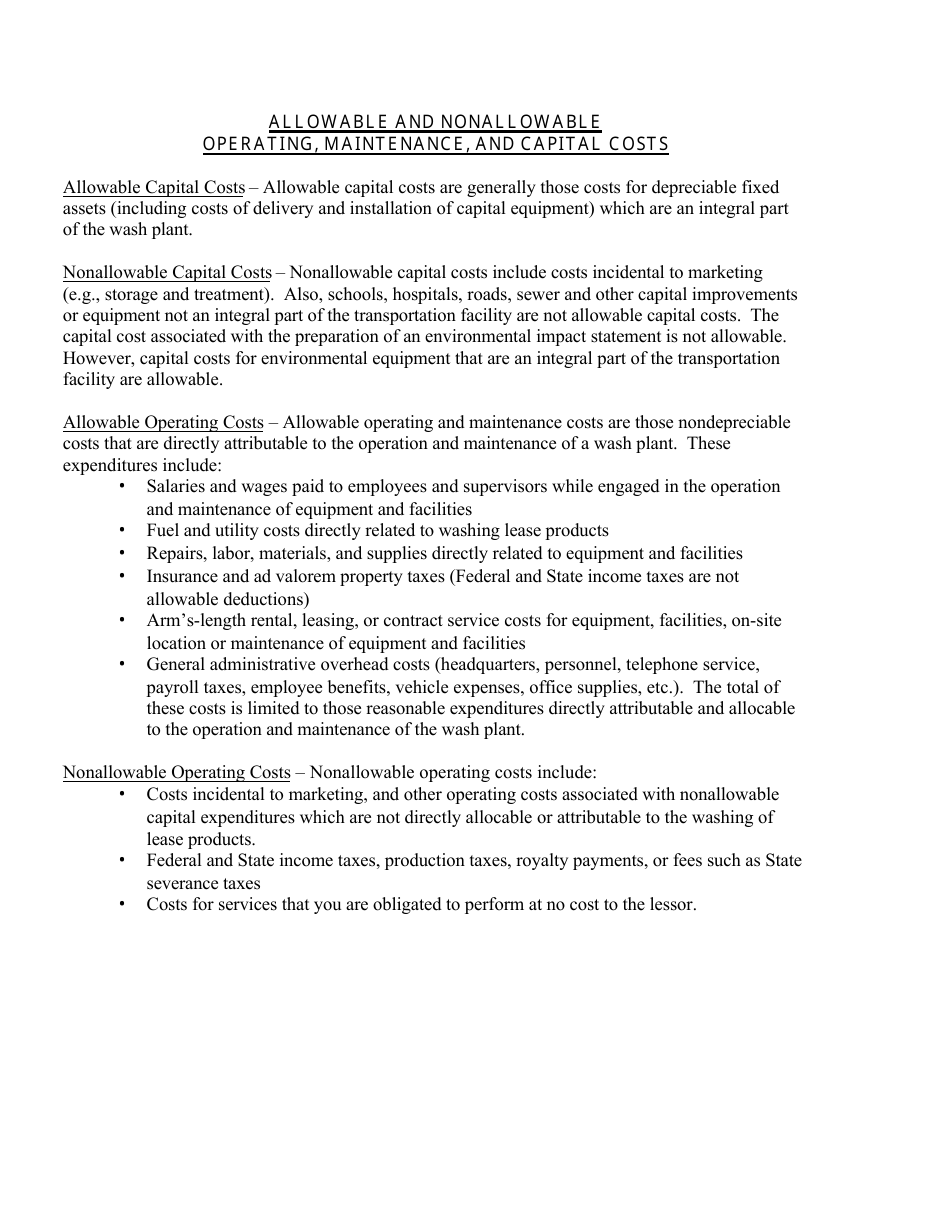

A: The ONRR-4292 Coal Washing Allowance Report is a form used to report coal washing allowances to the Office of Natural Resources Revenue (ONRR).

Q: Who is required to file the ONRR-4292 Coal Washing Allowance Report?

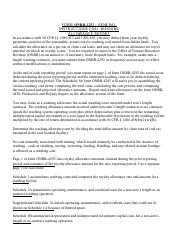

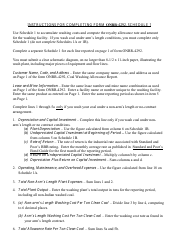

A: Coal operators who are entitled to receive a coal washing allowance must file the ONRR-4292 Coal Washing Allowance Report with ONRR.

Q: What is a coal washing allowance?

A: A coal washing allowance is a payment made to coal operators that incur costs for washing coal to reduce its ash and sulfur content.

Q: Why is the ONRR-4292 Coal Washing Allowance Report important?

A: The ONRR-4292 Coal Washing Allowance Report helps ONRR track and regulate coal washing allowances to ensure accurate and fair payments.

Q: When is the deadline for filing the ONRR-4292 Coal Washing Allowance Report?

A: The deadline for filing the ONRR-4292 Coal Washing Allowance Report is typically 30 days after the end of each calendar quarter.

Q: Are there any penalties for not filing the ONRR-4292 Coal Washing Allowance Report?

A: Yes, failure to file the ONRR-4292 Coal Washing Allowance Report or filing inaccurate information may result in penalties and interest charges.

Q: Who should I contact for more information about the ONRR-4292 Coal Washing Allowance Report?

A: For more information about the ONRR-4292 Coal Washing Allowance Report, you can contact the Office of Natural Resources Revenue directly.

Form Details:

- The latest available edition released by the U.S. Department of the Interior - Office of Natural Resources Revenue;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ONRR-4292 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Interior - Office of Natural Resources Revenue.