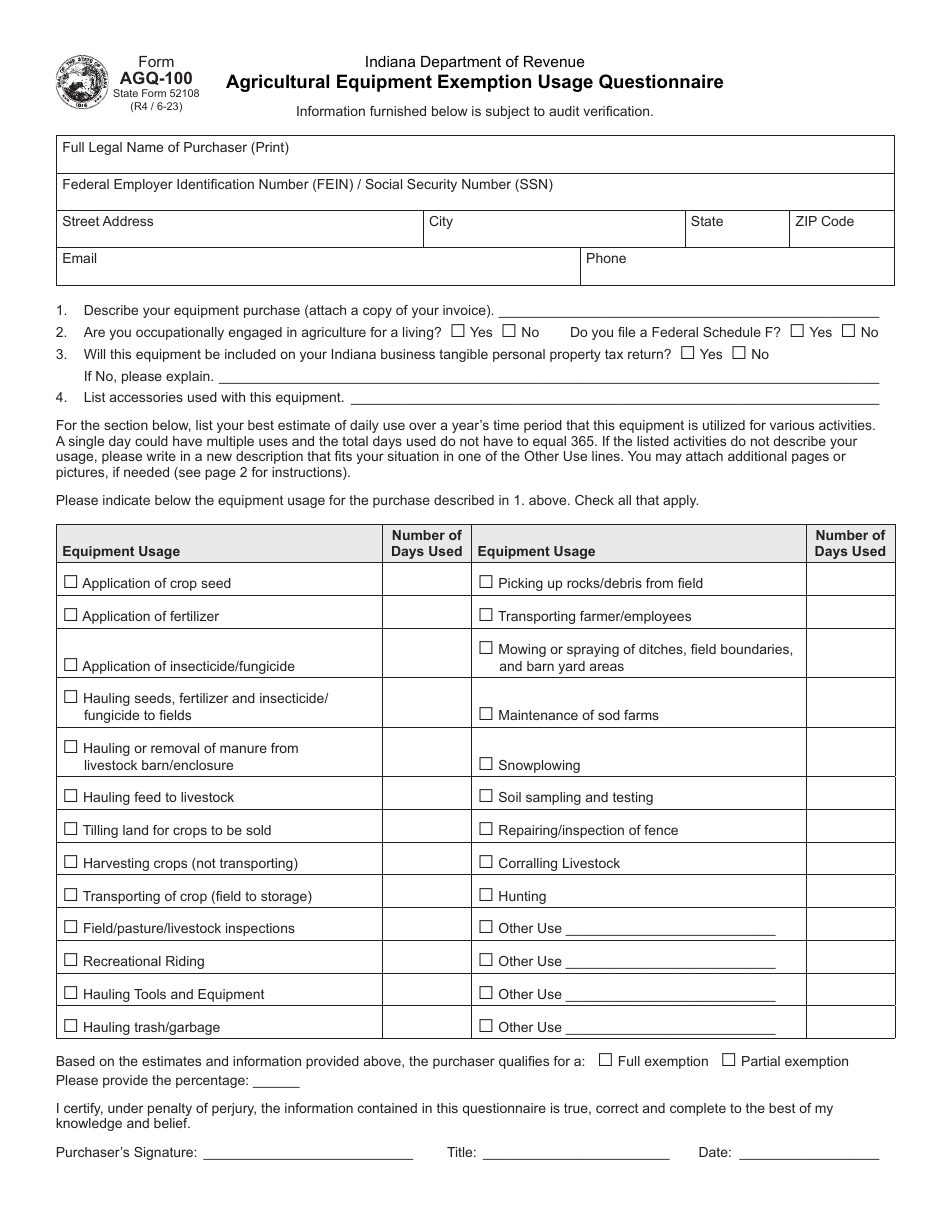

Form AGQ-100 (State Form 52108) Agricultural Equipment Exemption Usage Questionnaire - Indiana

What Is Form AGQ-100 (State Form 52108)?

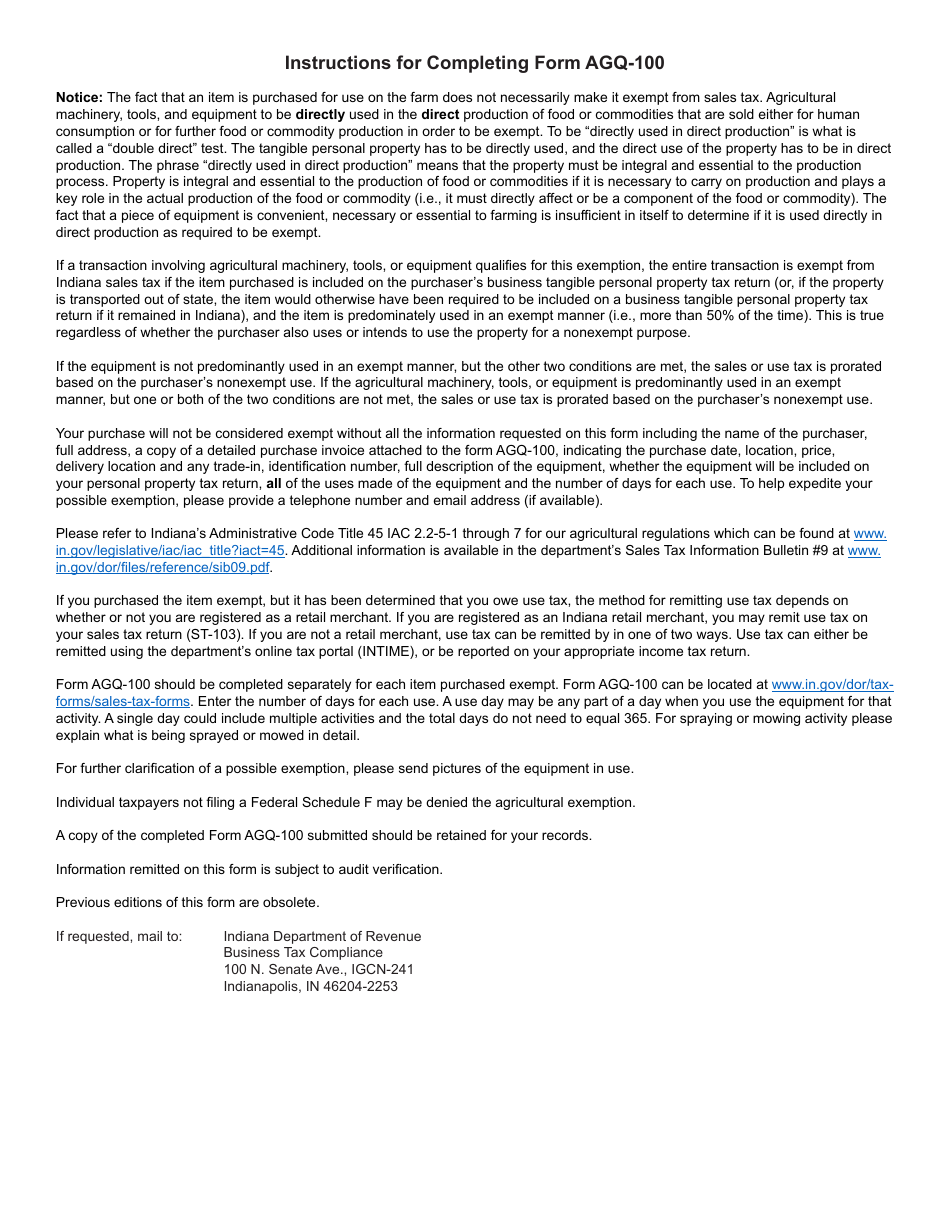

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AGQ-100?

A: Form AGQ-100 is a questionnaire used in Indiana to determine the usage of agricultural equipment.

Q: What is the purpose of Form AGQ-100?

A: The purpose of Form AGQ-100 is to determine if agricultural equipment is eligible for exemption from certain taxes.

Q: Who needs to complete Form AGQ-100?

A: Those who own or operate agricultural equipment in Indiana need to complete Form AGQ-100.

Q: What information is required on Form AGQ-100?

A: Form AGQ-100 requires information about the agricultural equipment, its usage, and supporting documentation.

Q: When is Form AGQ-100 due?

A: Form AGQ-100 is due on or before May 15th of each year.

Q: What happens if I fail to submit Form AGQ-100?

A: Failure to submit Form AGQ-100 may result in the loss of the agricultural equipment exemption.

Q: Is there a fee for submitting Form AGQ-100?

A: No, there is no fee for submitting Form AGQ-100.

Q: Who can I contact for more information about Form AGQ-100?

A: For more information about Form AGQ-100, you can contact the Indiana Department of Revenue.

Form Details:

- Released on June 1, 2023;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AGQ-100 (State Form 52108) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.