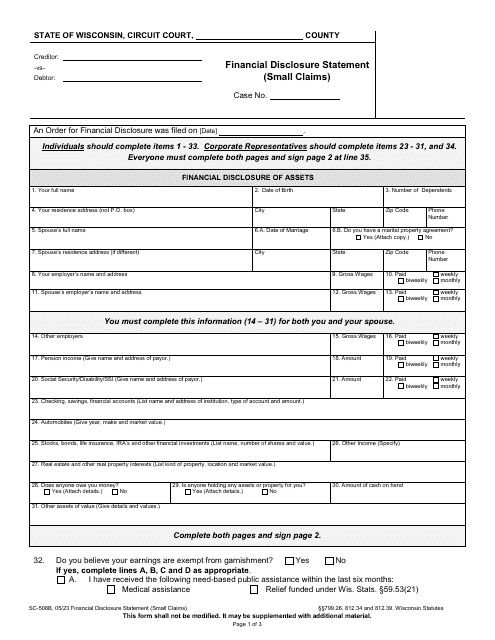

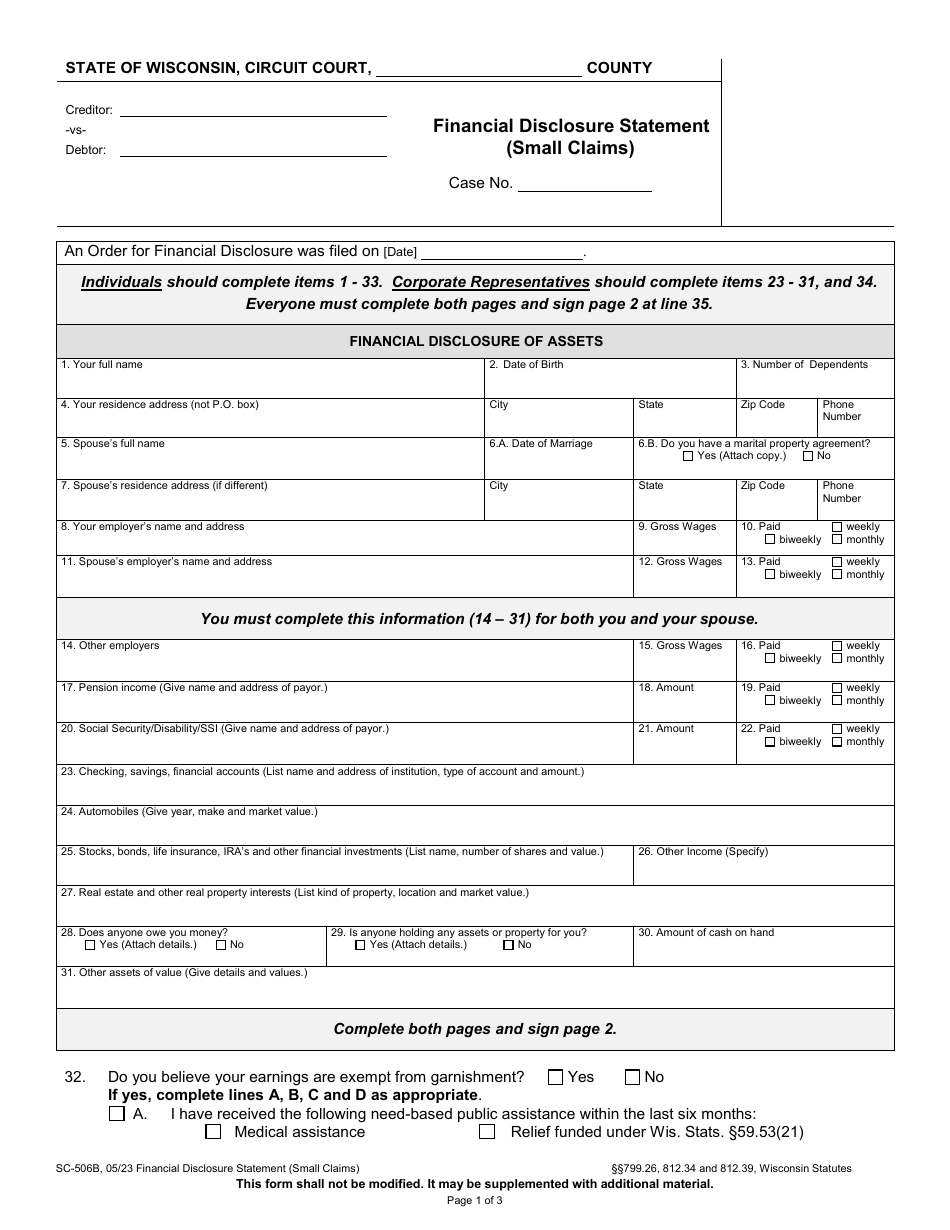

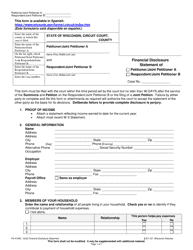

Form SC-506B Financial Disclosure Statement (Small Claims) - Wisconsin

What Is Form SC-506B?

This is a legal form that was released by the Wisconsin Circuit Court - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC-506B?

A: Form SC-506B is the Financial Disclosure Statement used in small claims cases in Wisconsin.

Q: When is Form SC-506B used?

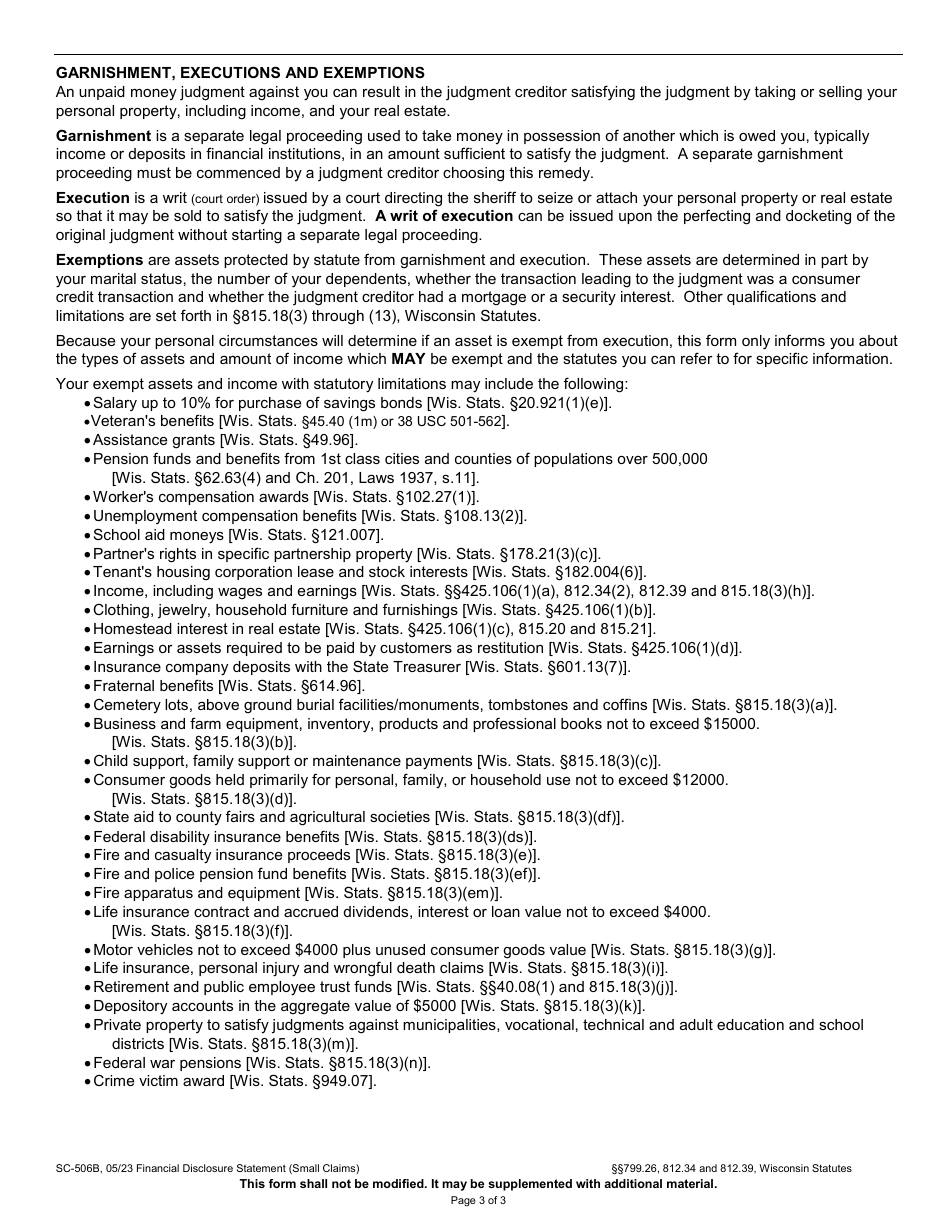

A: Form SC-506B is used when a party is seeking to collect or enforce a money judgment in a small claims case.

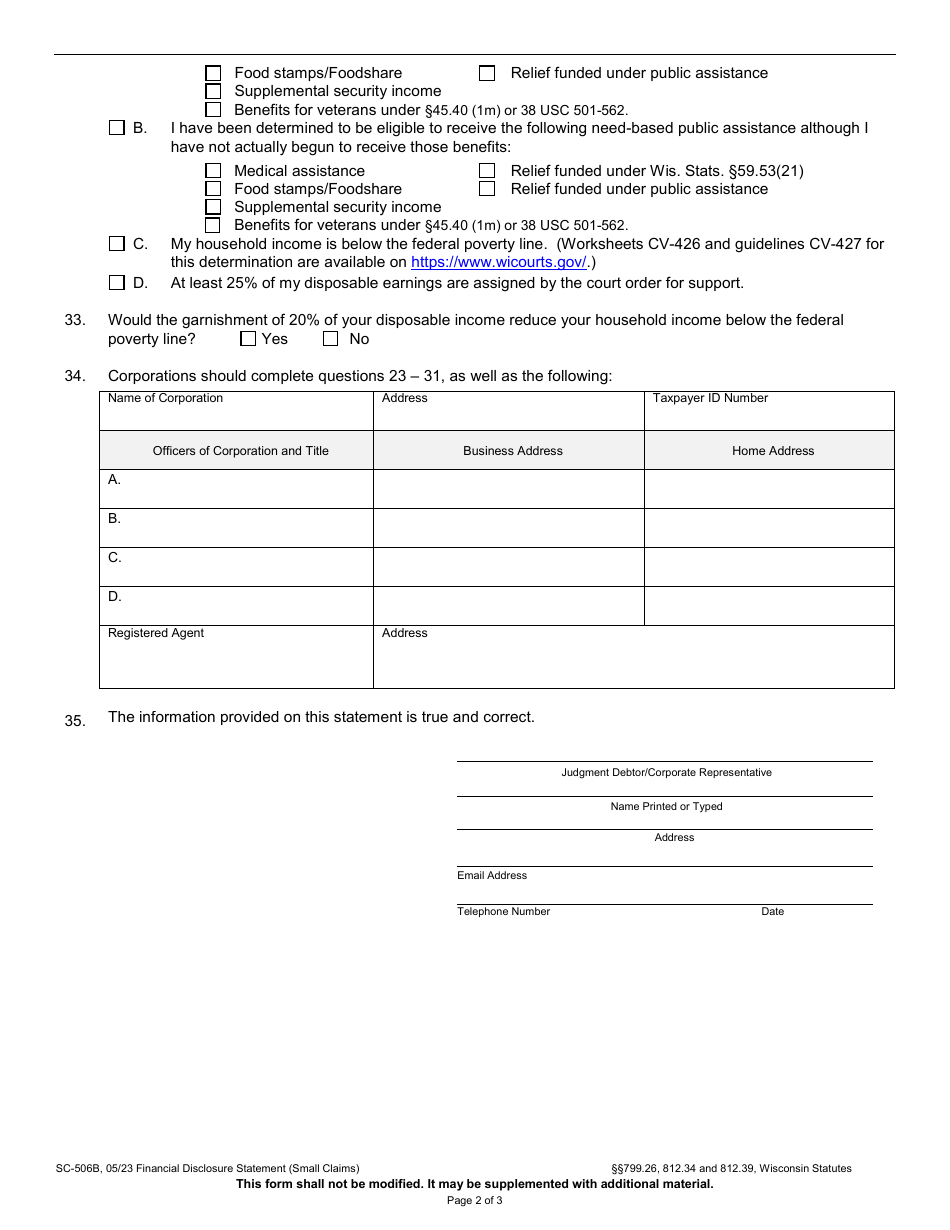

Q: What information is required in Form SC-506B?

A: Form SC-506B requires the party to disclose their income, assets, and expenses.

Q: Why is financial disclosure important in small claims cases?

A: Financial disclosure is important because it helps the court determine the party's ability to pay the judgment.

Q: Are there any filing fees for Form SC-506B?

A: There may be filing fees associated with Form SC-506B. The specific fee amount can vary depending on the court and jurisdiction.

Q: Can I request a waiver of the filing fees?

A: Yes, you may be eligible to request a waiver of the filing fees if you meet certain income criteria. You can inquire about this option at the small claims court.

Q: What is the deadline for submitting Form SC-506B?

A: The deadline for submitting Form SC-506B is usually set by the court. It is important to check the specific instructions or contact the court clerk for the deadline.

Q: What happens after I submit Form SC-506B?

A: After you submit Form SC-506B, the court will review the financial information provided and make a determination on the party's ability to pay the judgment.

Q: Can the information provided in Form SC-506B be used against me?

A: The information provided in Form SC-506B is generally protected and cannot be used against you in other legal proceedings.

Form Details:

- Released on May 1, 2023;

- The latest edition provided by the Wisconsin Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC-506B by clicking the link below or browse more documents and templates provided by the Wisconsin Circuit Court.