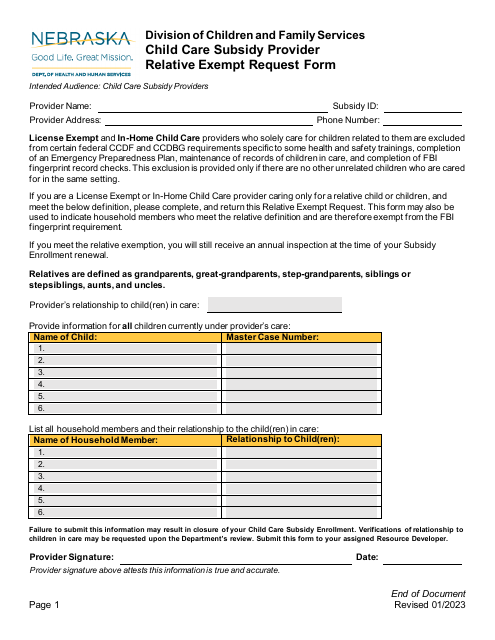

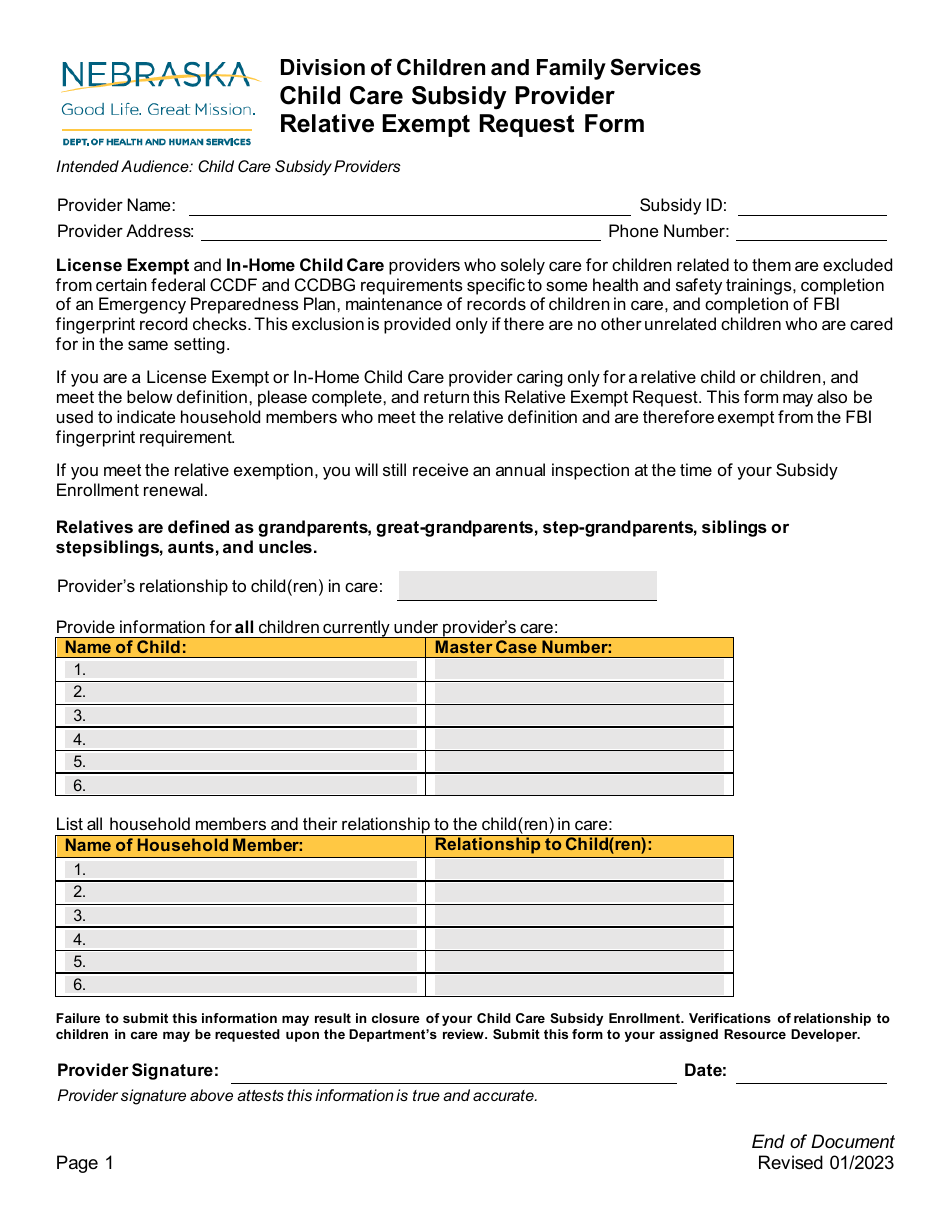

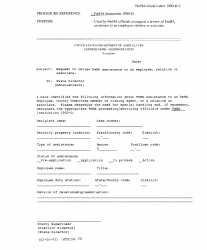

Relative Exempt Request Form - Nebraska

Relative Exempt Request Form is a legal document that was released by the Nebraska Department of Health and Human Services - a government authority operating within Nebraska.

FAQ

Q: What is a relative exempt request form?

A: A relative exempt request form is a document used in Nebraska to request exemption from property taxes for qualified relatives.

Q: Who is eligible to use the relative exempt request form?

A: Any Nebraska resident who owns their home and has a qualified relative residing in their home may be eligible to use the relative exempt request form.

Q: What qualifies as a qualified relative?

A: A qualified relative can include a parent, stepparent, grandparent, sibling, child, stepchild, grandchild, or spouse.

Q: How do I obtain a relative exempt request form?

A: You can obtain a relative exempt request form from the Nebraska Department of Revenue or your local county assessor's office.

Q: What is the purpose of the relative exempt request form?

A: The purpose of the relative exempt request form is to request exemption from property taxes on the portion of your home occupied by a qualified relative.

Form Details:

- Released on January 1, 2023;

- The latest edition currently provided by the Nebraska Department of Health and Human Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Health and Human Services.