This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

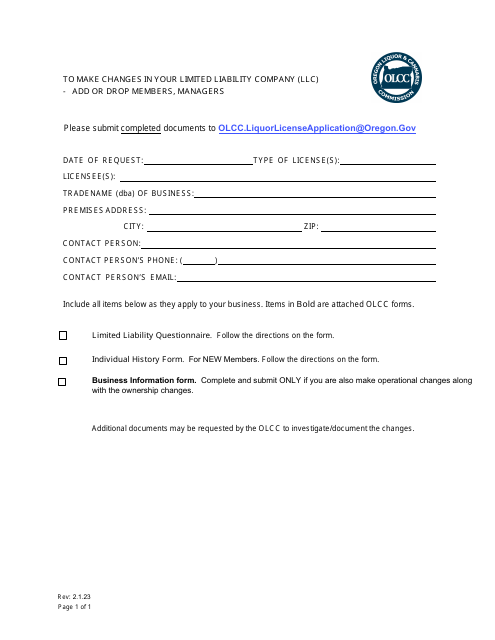

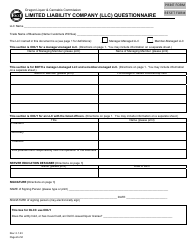

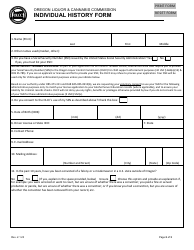

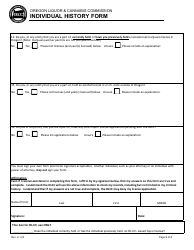

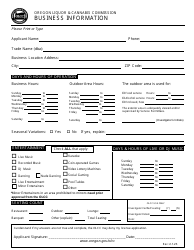

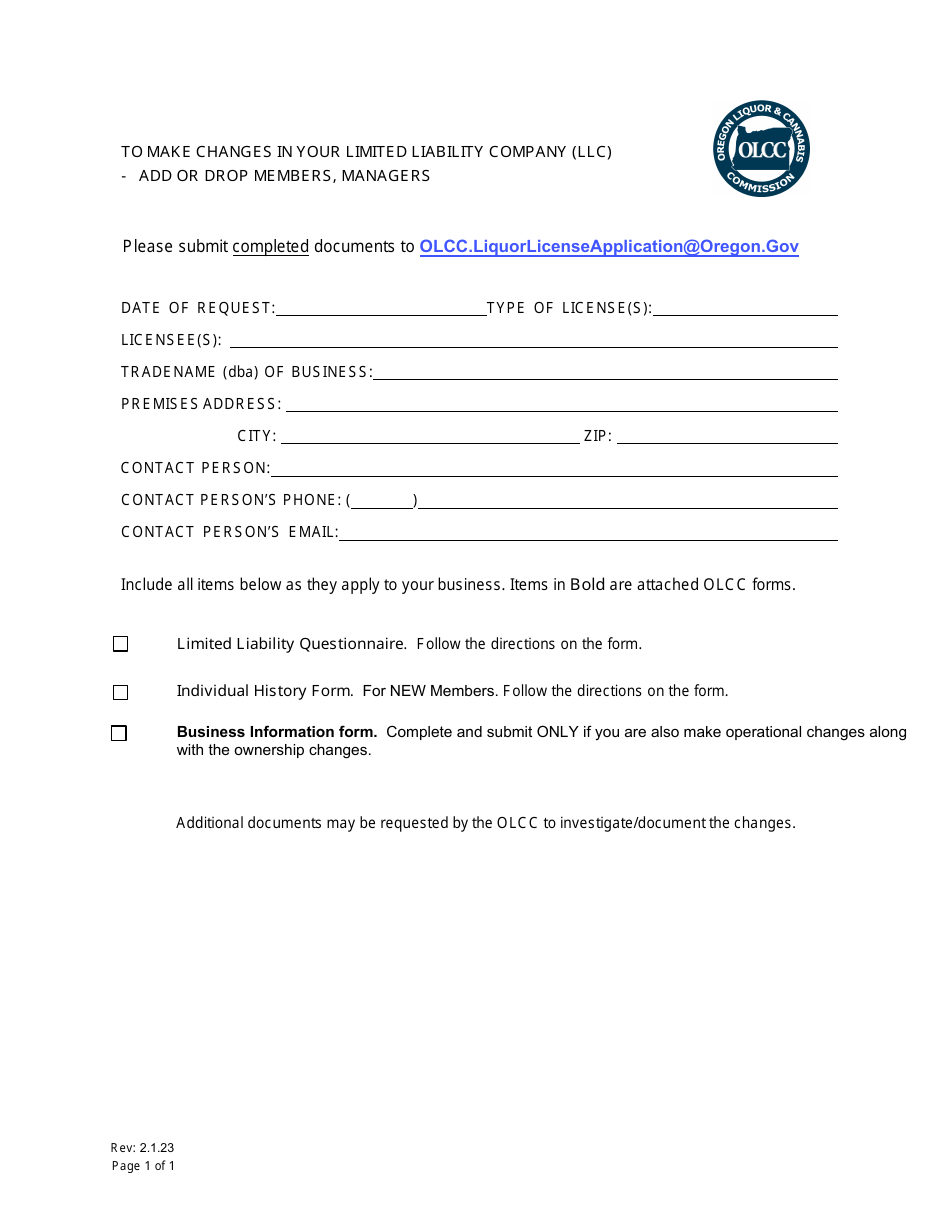

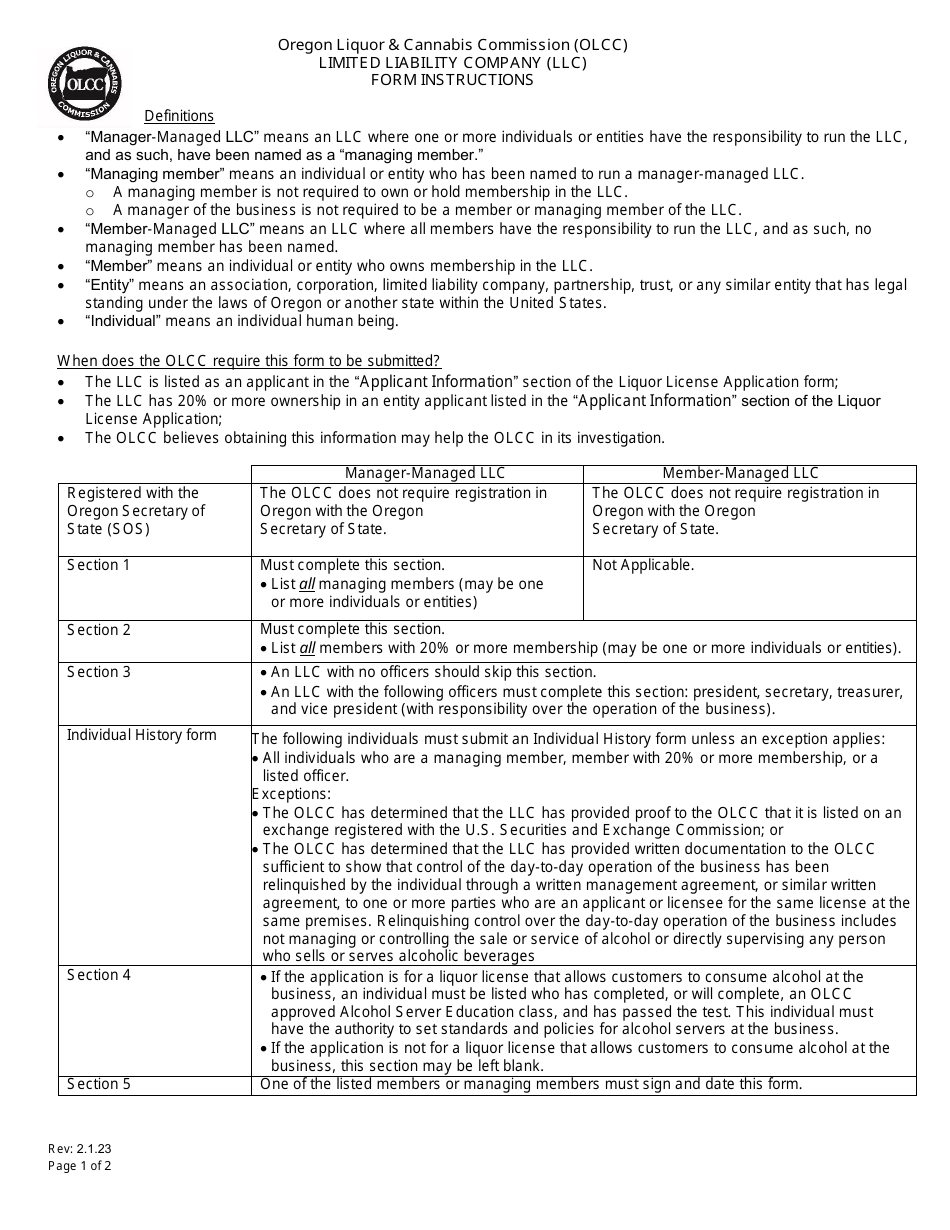

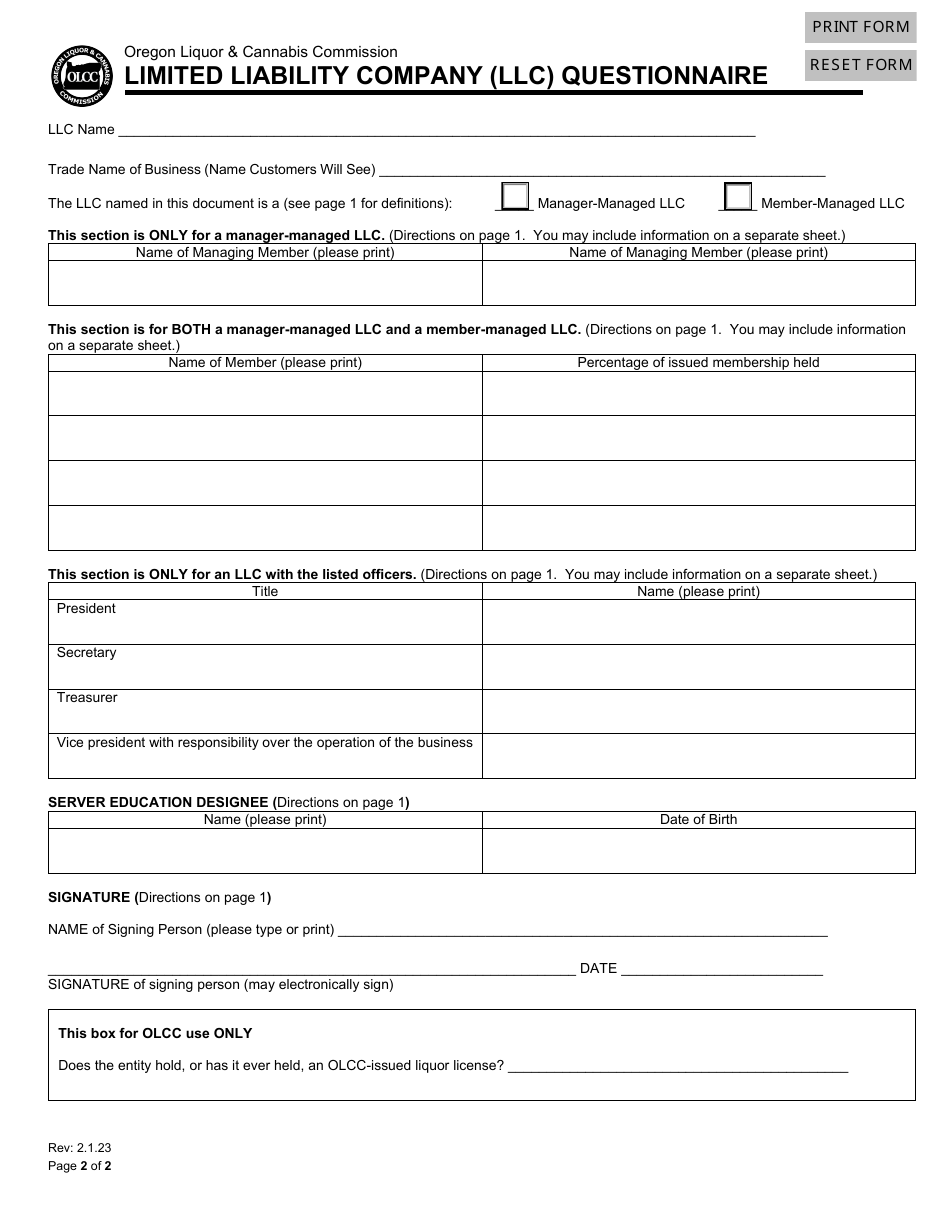

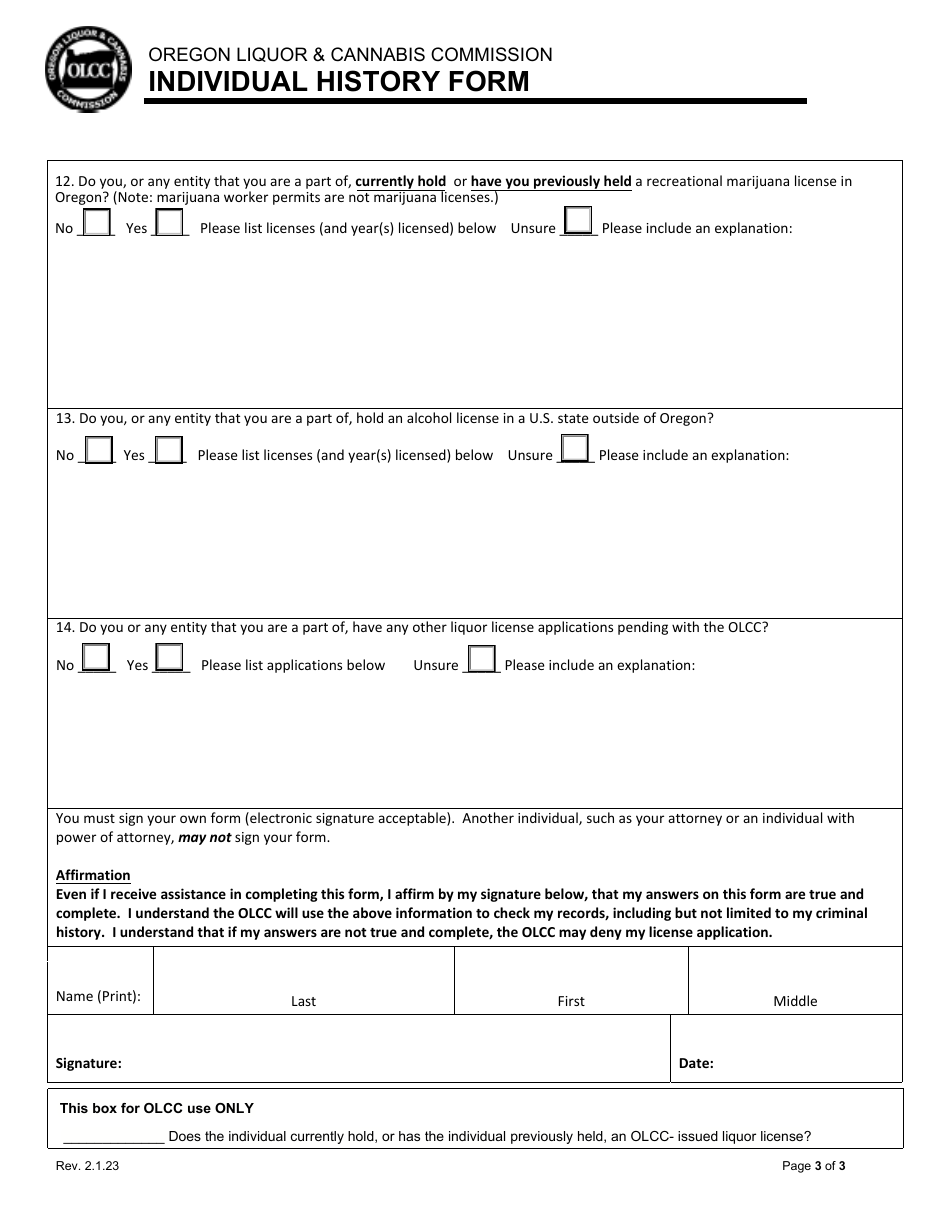

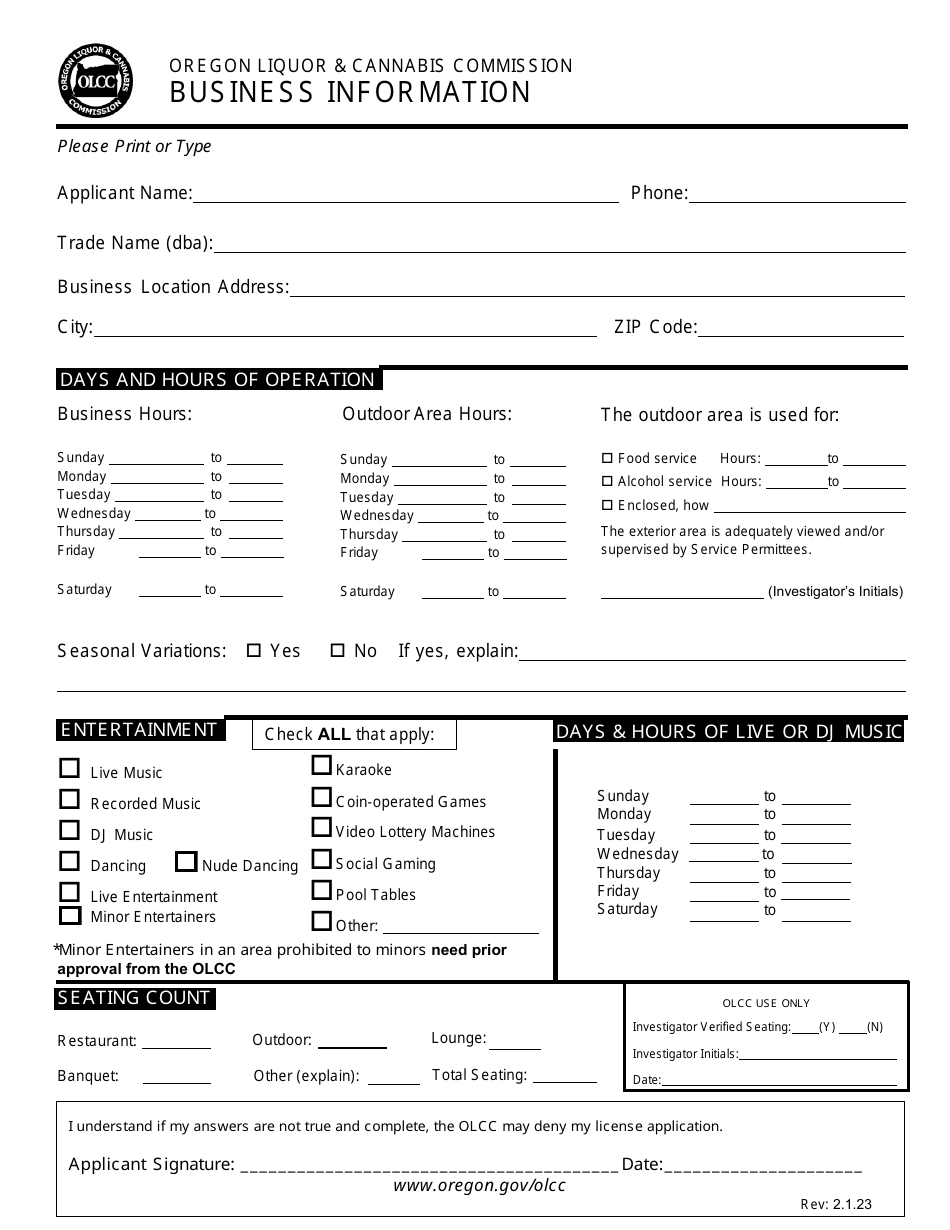

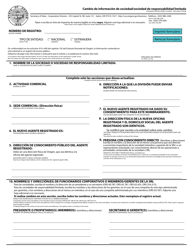

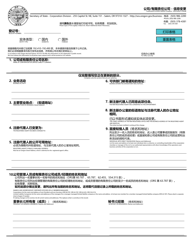

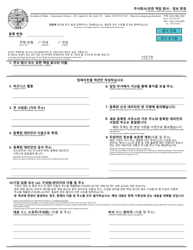

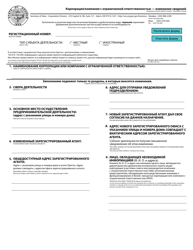

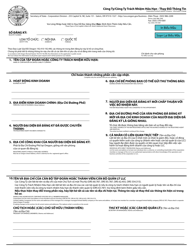

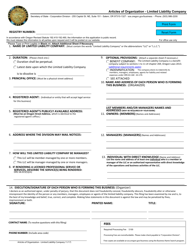

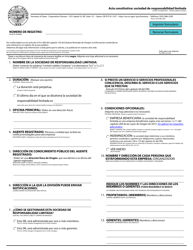

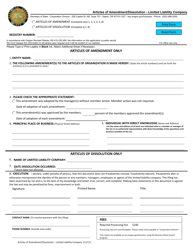

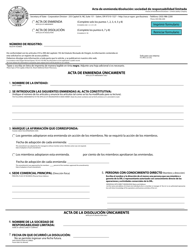

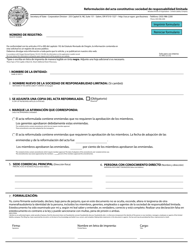

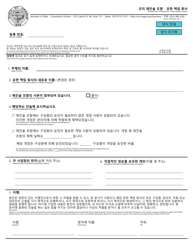

Change in Current Limited Liability Company (Membership / Interest) - Oregon

Change in Current Limited Liability Company (Membership/Interest) is a legal document that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon.

FAQ

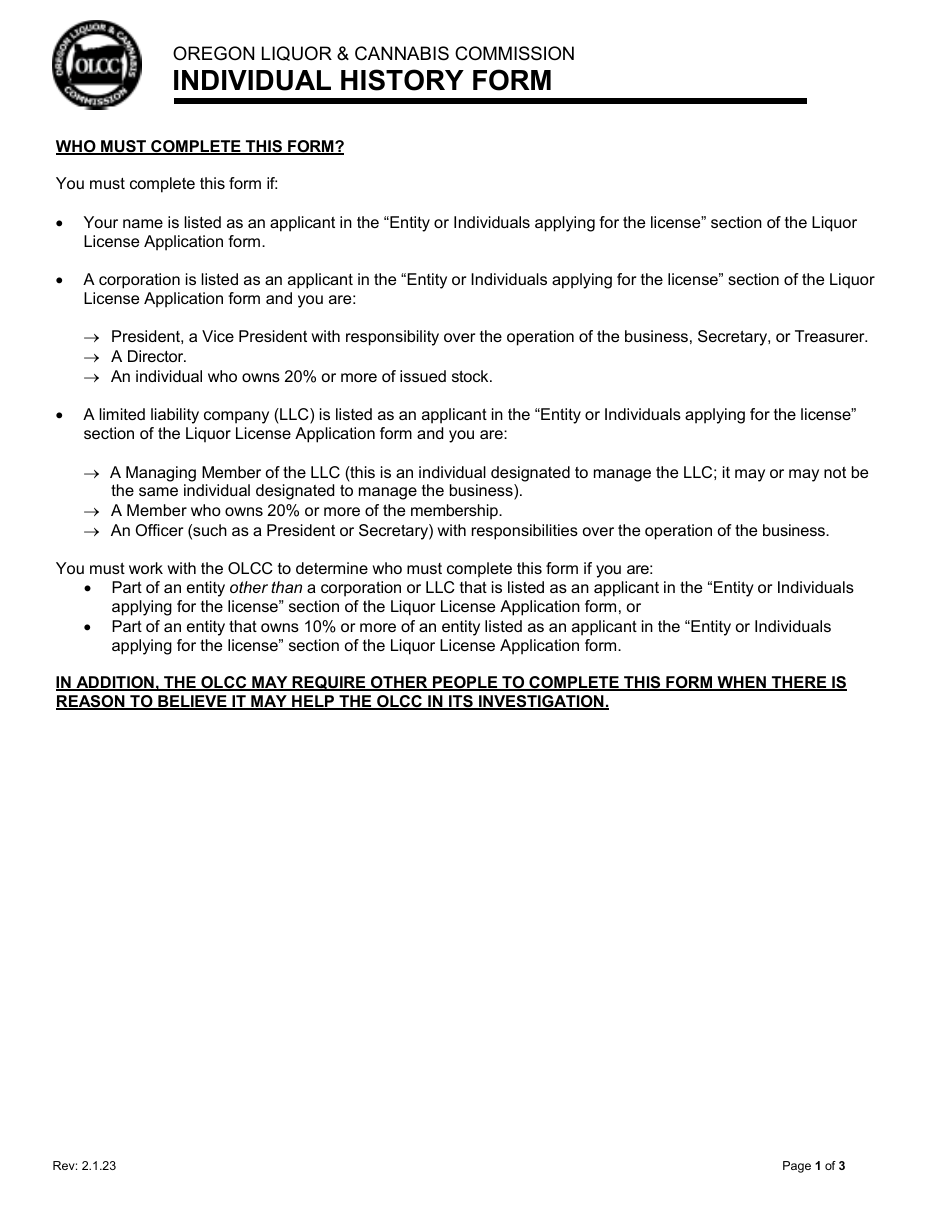

Q: What is a limited liability company (LLC)?

A: A limited liability company is a type of business structure that combines the limited liability protection of a corporation with the flexibility and tax benefits of a partnership.

Q: What is a membership/interest change in an LLC?

A: A membership/interest change in an LLC refers to any modifications made to the ownership or membership structure of the company. This could include adding or removing members, transferring ownership interests, or changing the voting rights or profit distribution among members.

Q: Why would an LLC need to make a membership/interest change?

A: There can be various reasons for an LLC to make a membership/interest change. It could be due to a new member joining the company, an existing member leaving, a change in ownership interests, or a restructuring of the company's management or ownership structure.

Q: What is the process for making a membership/interest change in an LLC in Oregon?

A: The process for making a membership/interest change in an LLC in Oregon typically involves filing a form or amendment with the Oregon Secretary of State's office. The specific requirements and forms may vary depending on the nature of the change and the existing operating agreement of the LLC. It is recommended to consult an attorney or professional advisor familiar with Oregon LLC laws for guidance.

Q: Are there any fees involved in making a membership/interest change in an LLC?

A: Yes, there are usually fees associated with making a membership/interest change in an LLC. These fees may include filing fees with the Oregon Secretary of State's office and any applicable professional fees for legal or advisory services. The exact amount of fees may vary depending on the nature and complexity of the change.

Q: Is it necessary to notify other members or stakeholders about a membership/interest change in an LLC?

A: In most cases, it is important to notify other members and stakeholders about a membership/interest change in an LLC. The LLC's operating agreement or state laws may require formal notice or consent from other members before a change can be made. Open and transparent communication is generally recommended to maintain trust and clarity within the LLC.

Q: Can a membership/interest change in an LLC affect the company's tax status?

A: Yes, a membership/interest change in an LLC can potentially affect the company's tax status. Depending on the specific circumstances and the election made by the LLC, changes in ownership or membership structure could trigger tax consequences or require the LLC to file certain tax forms. It is advisable to consult with a tax professional for guidance on the tax implications of a membership/interest change in an LLC.

Form Details:

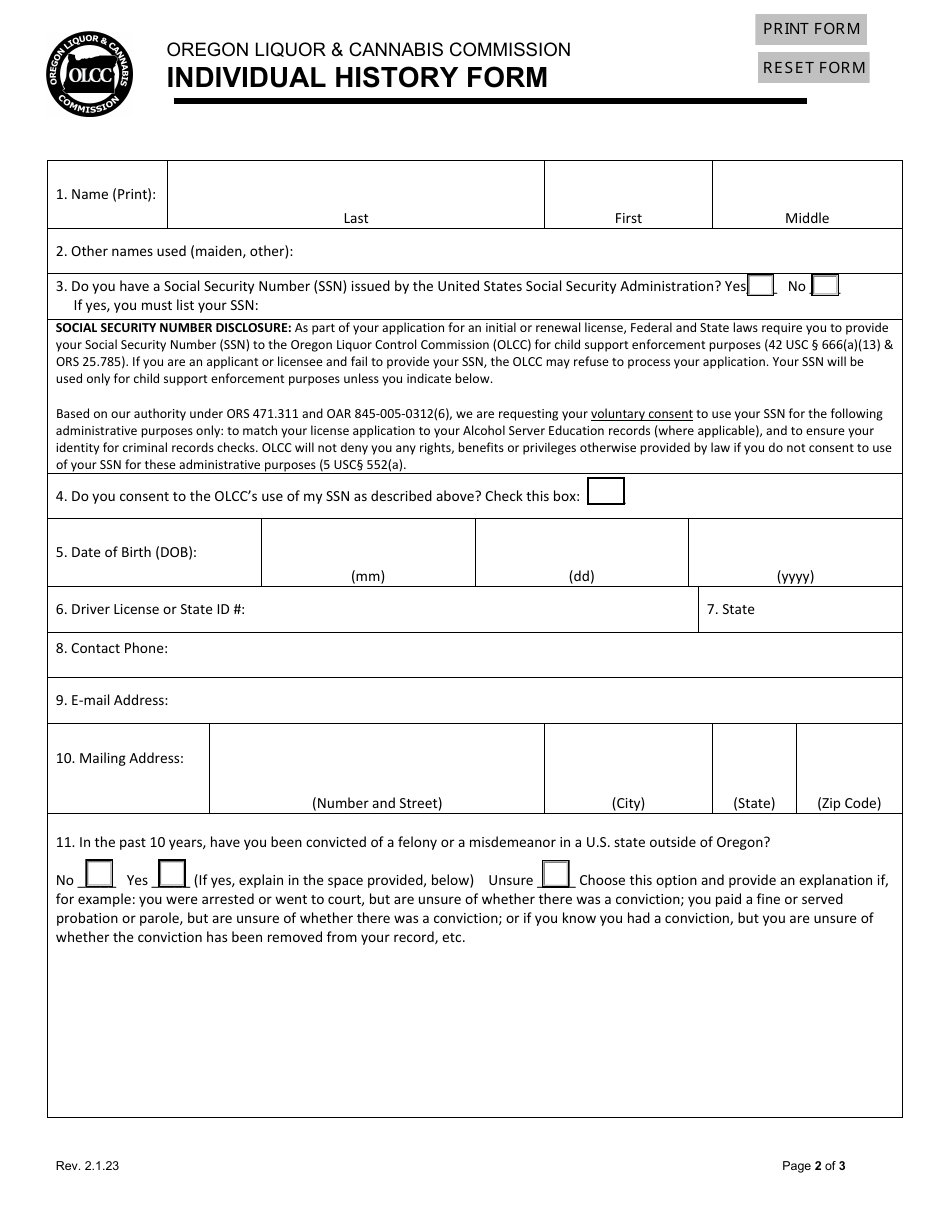

- Released on February 1, 2023;

- The latest edition currently provided by the Oregon Liquor and Cannabis Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.