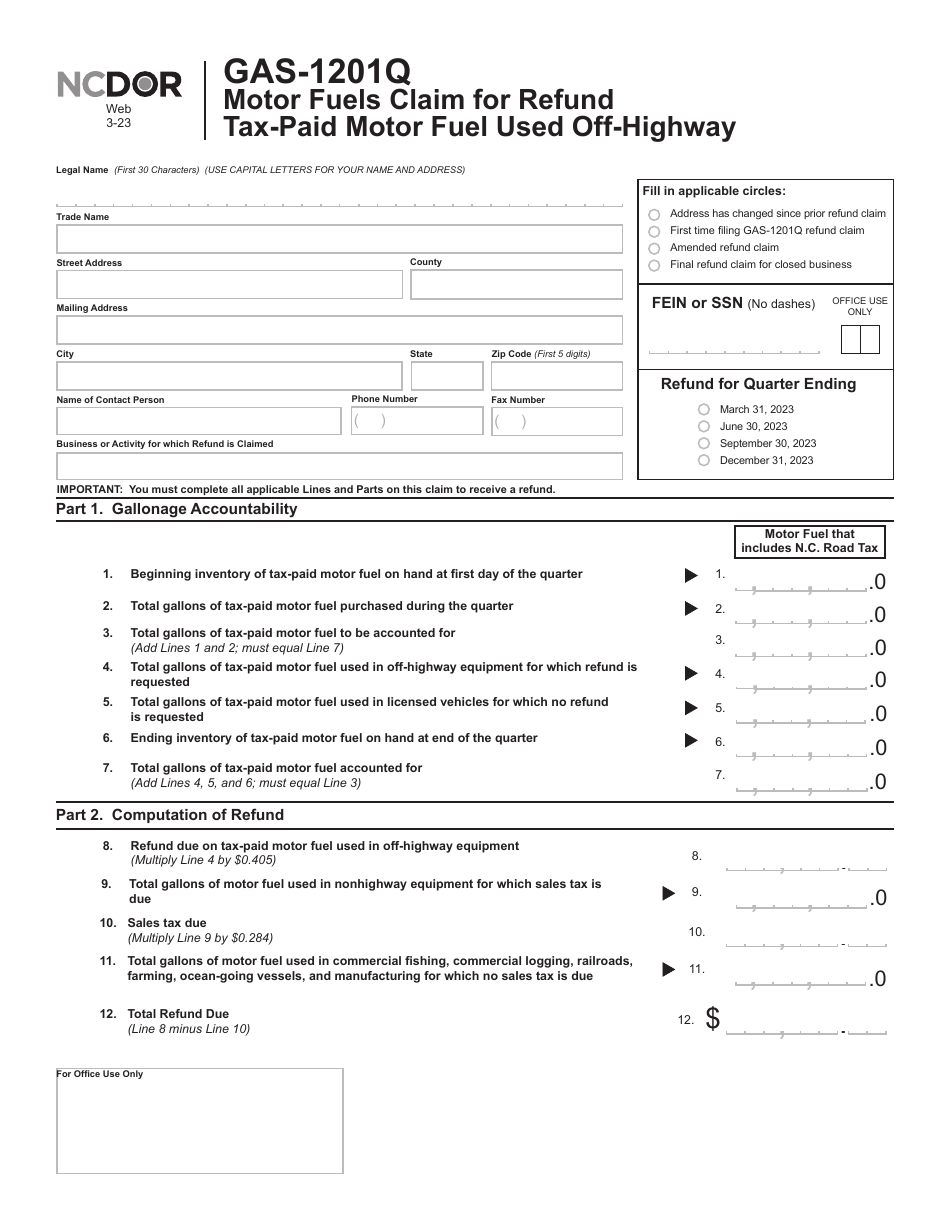

Form GAS-1201Q Motor Fuels Claim for Refund Tax-Paid Motor Fuel Used off-Highway - North Carolina

What Is Form GAS-1201Q?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is GAS-1201Q?

A: GAS-1201Q is a form used in North Carolina to claim a refund for tax-paid motor fuel used off-highway.

Q: What is the purpose of GAS-1201Q?

A: The purpose of GAS-1201Q is to claim a refund for tax-paid motor fuel that was used off-highway in North Carolina.

Q: Who can use GAS-1201Q?

A: Anyone who has purchased tax-paid motor fuel and used it off-highway in North Carolina can use GAS-1201Q to claim a refund.

Q: What types of motor fuel can be claimed for refund using GAS-1201Q?

A: GAS-1201Q can be used to claim a refund for tax-paid gasoline, diesel fuel, liquefied petroleum gas, compressed natural gas, and other special fuels.

Q: What information is required to complete GAS-1201Q?

A: To complete GAS-1201Q, you will need to provide information such as your name, address, fuel purchase details, off-highway use details, and the amount of refund you are claiming.

Q: Are there any deadlines for submitting GAS-1201Q?

A: Yes, there are deadlines for submitting GAS-1201Q. The form must be filed within six months from the end of the calendar quarter in which the fuel was used off-highway.

Q: How long does it take to receive the refund after submitting GAS-1201Q?

A: The processing time for GAS-1201Q refund claims can vary, but it generally takes around 6-8 weeks to receive the refund.

Q: What should I do if I have additional questions about GAS-1201Q?

A: If you have additional questions about GAS-1201Q, you can contact the North Carolina Department of Revenue for assistance.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the North Carolina Department of Revenue;

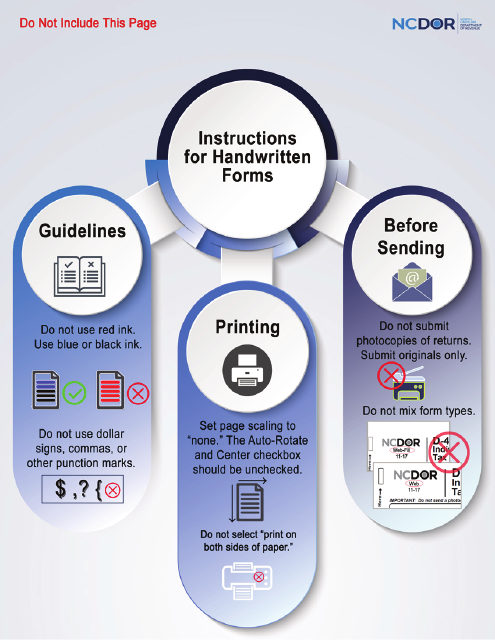

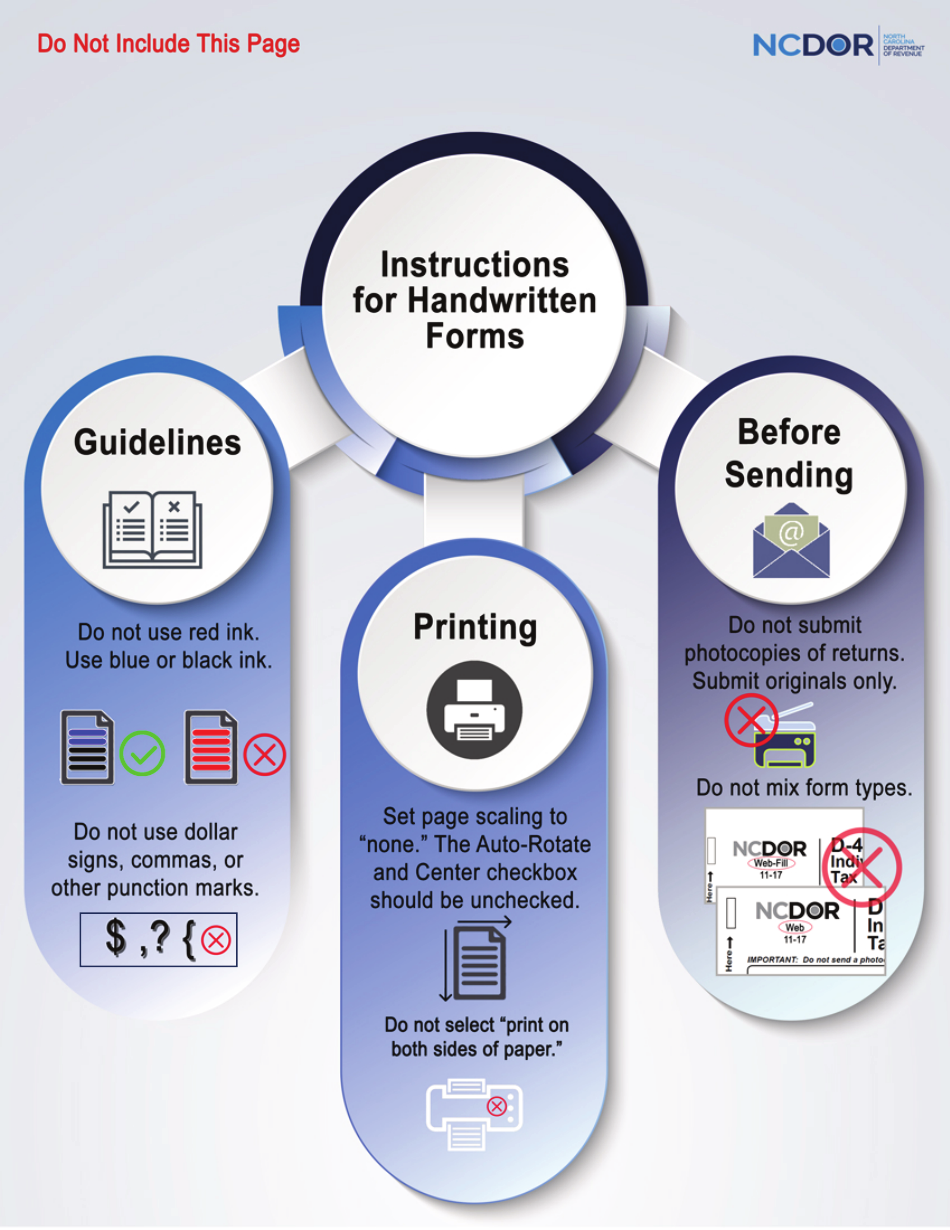

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1201Q by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.