This version of the form is not currently in use and is provided for reference only. Download this version of

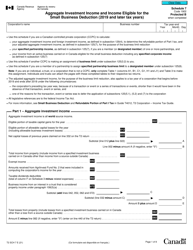

Form T2142

for the current year.

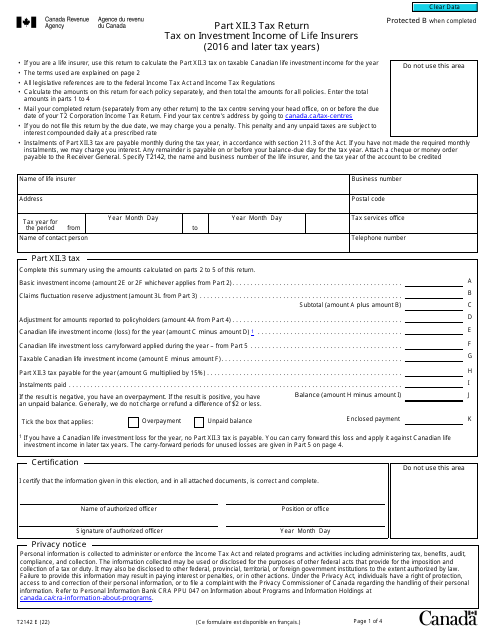

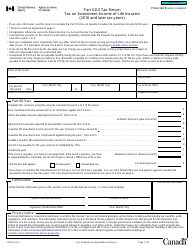

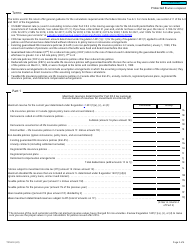

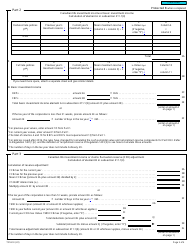

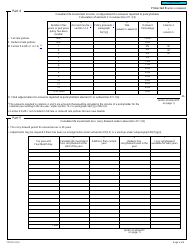

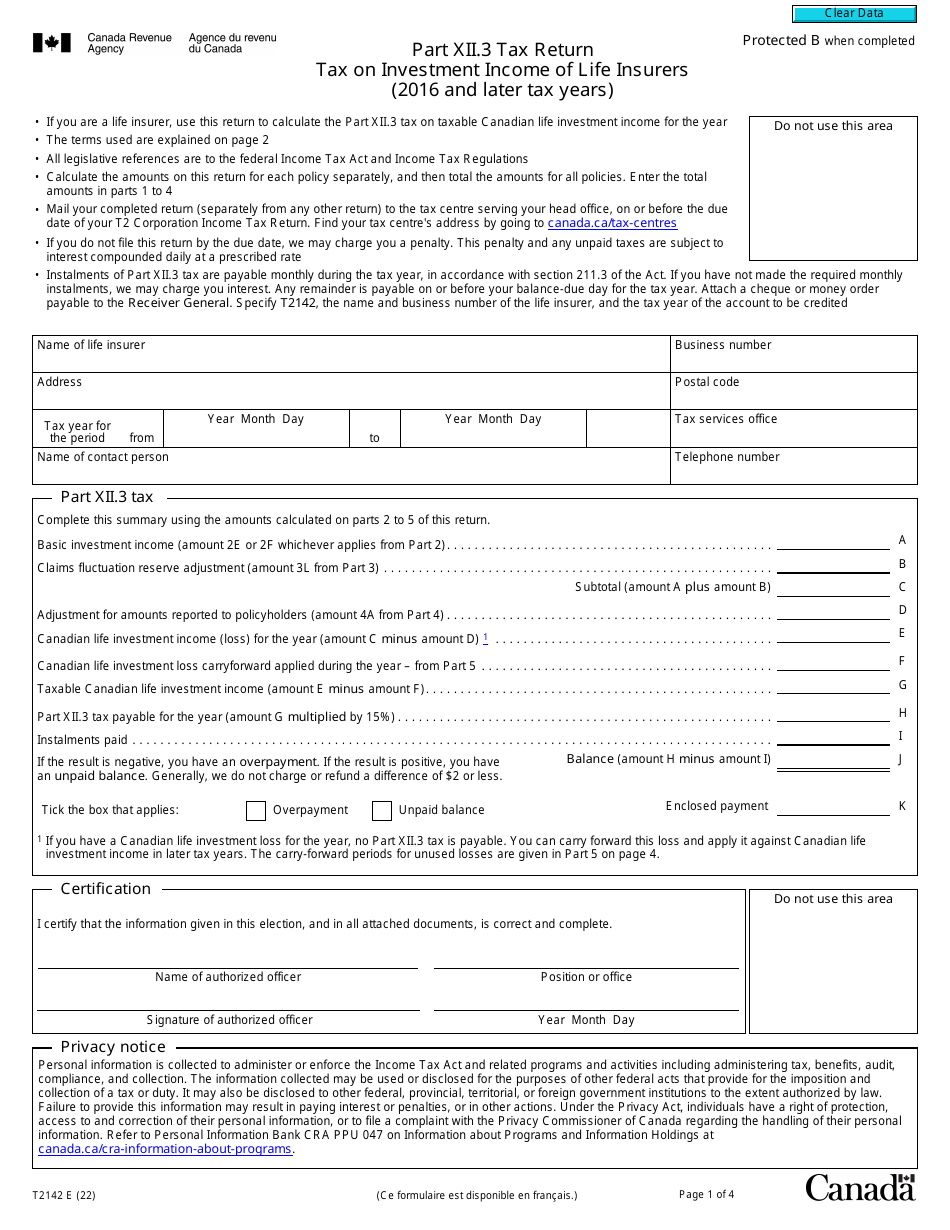

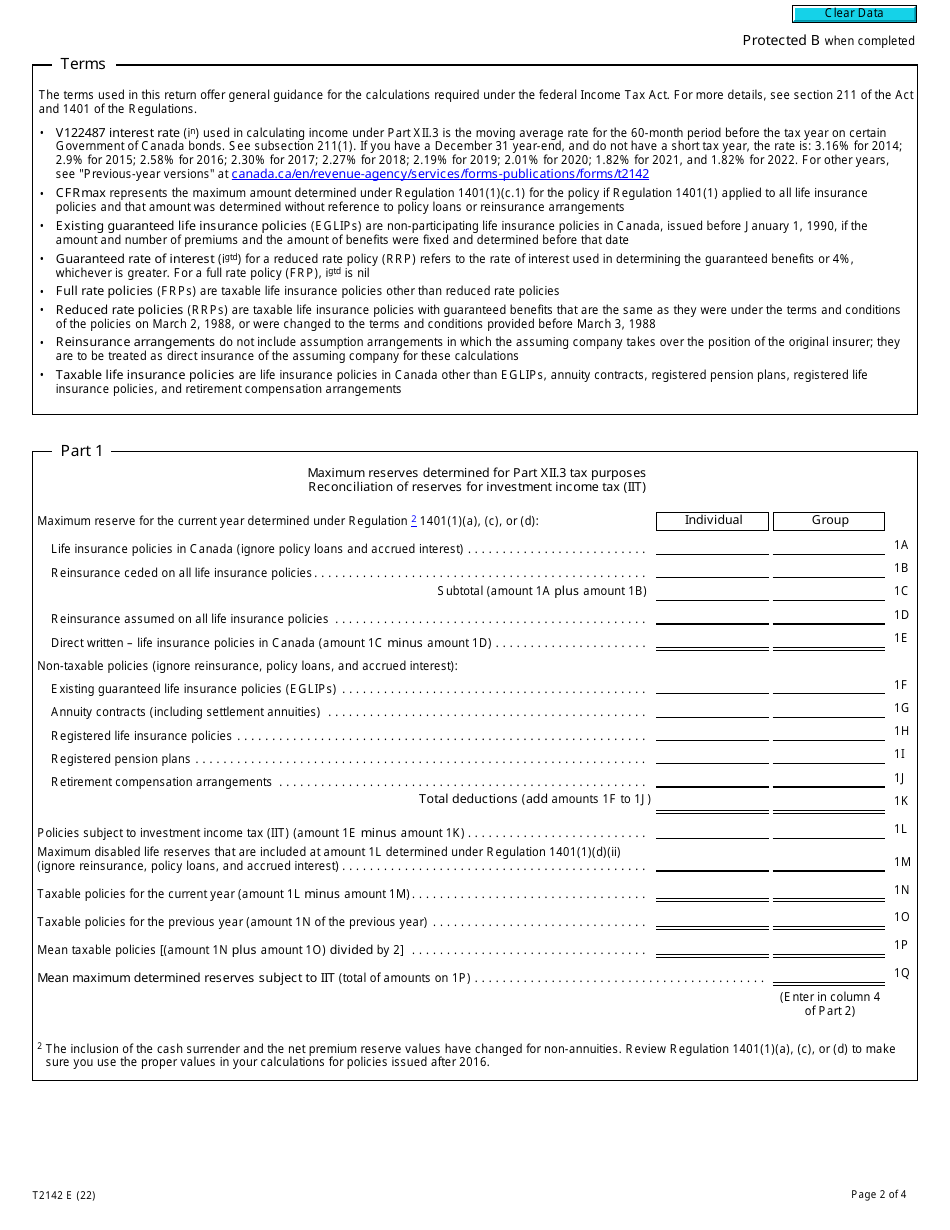

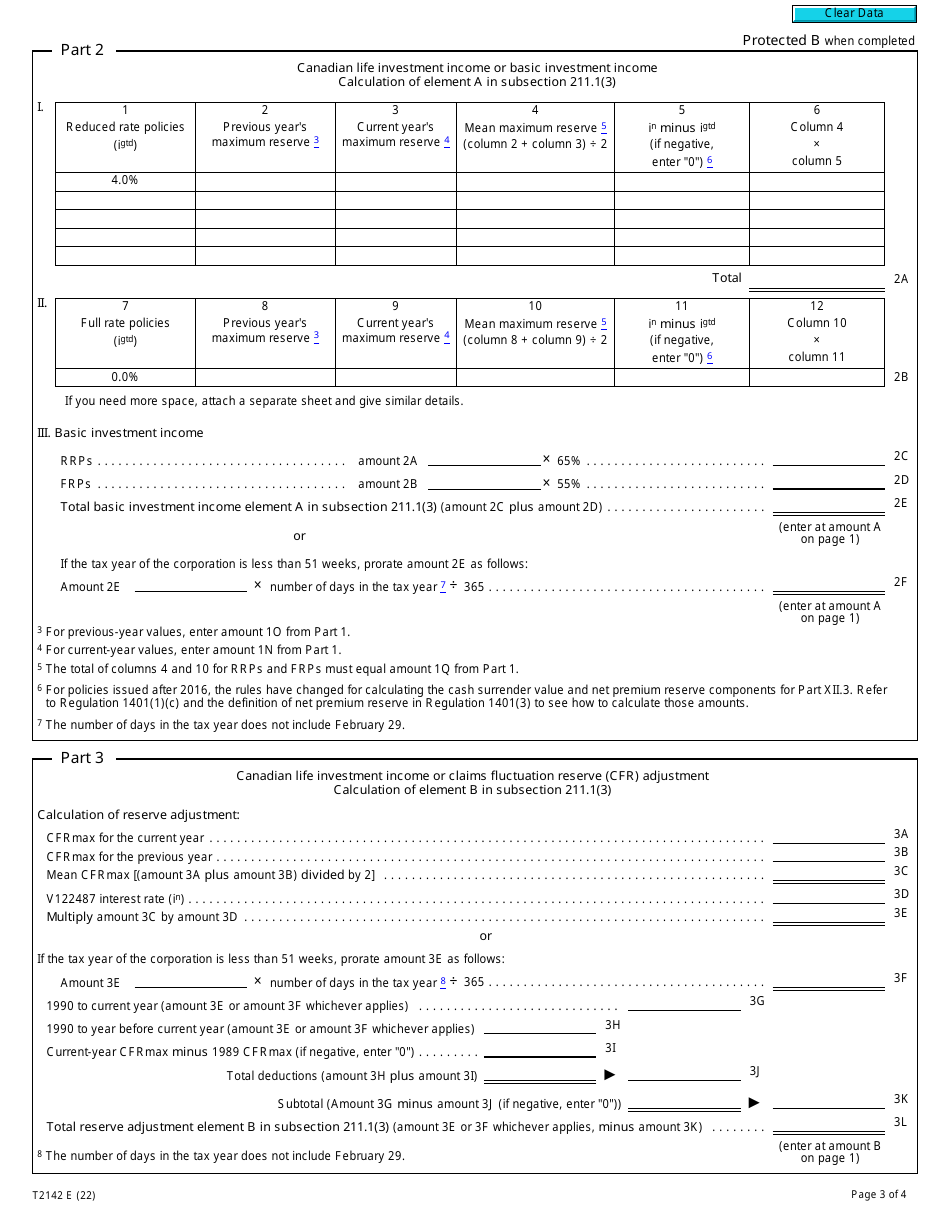

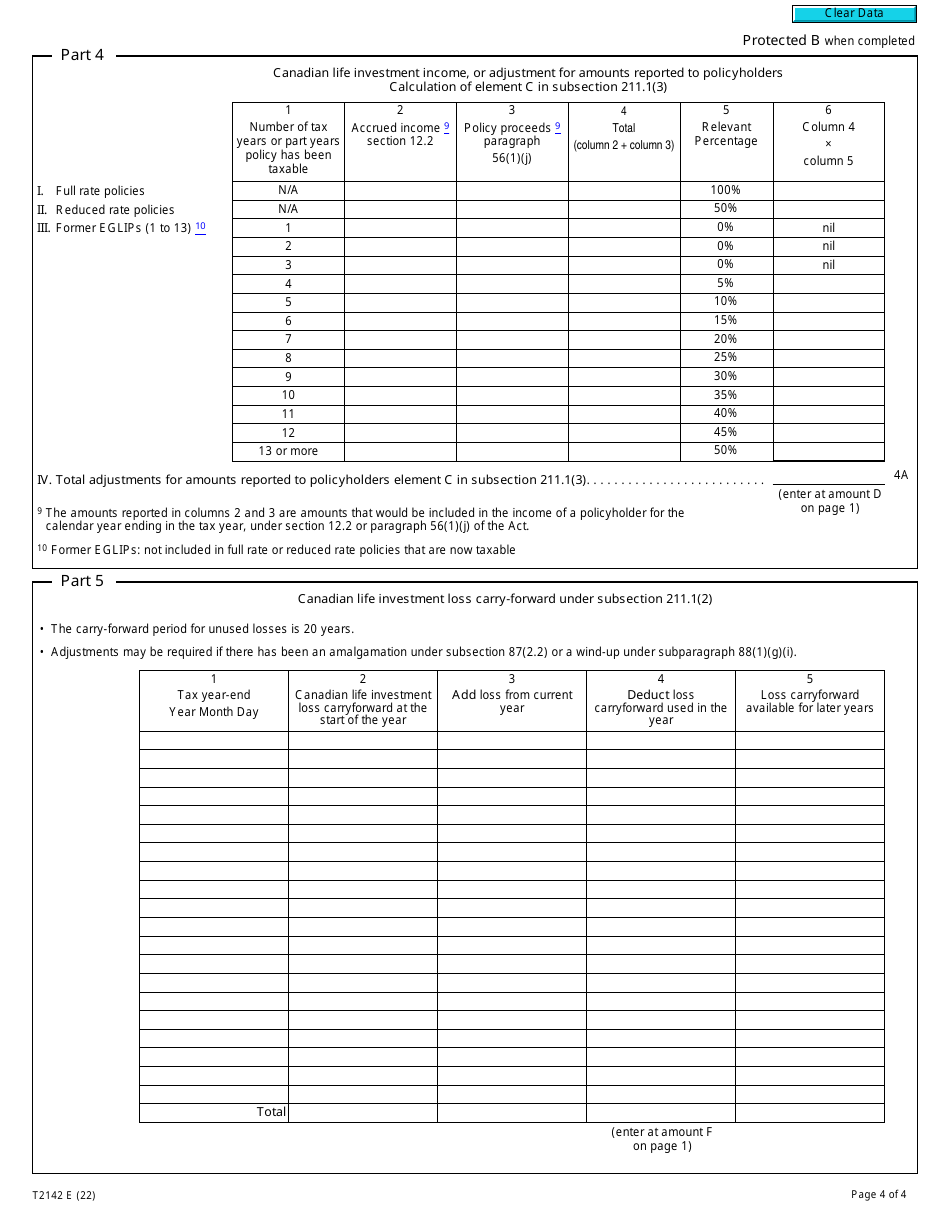

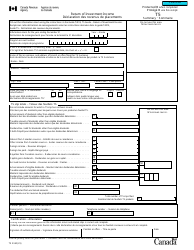

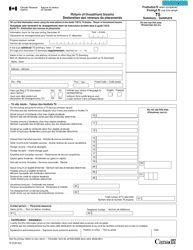

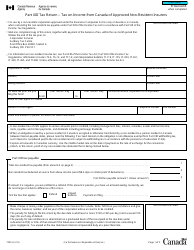

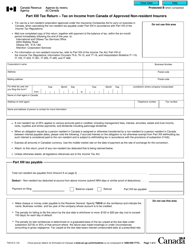

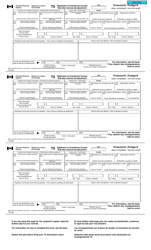

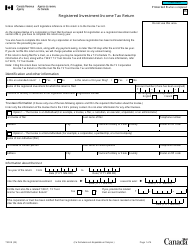

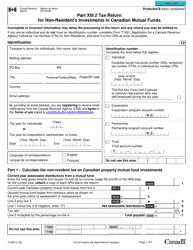

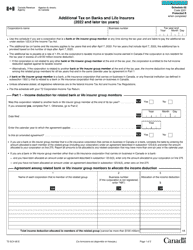

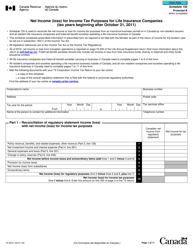

Form T2142 Part XII.3 Tax Return Tax on Investment Income of Life Insurers (2016 and Later Tax Years) - Canada

Form T2142 Part XII.3 Tax Return is used by life insurance companies in Canada to report and pay tax on their investment income. It applies to tax years starting in 2016 and later.

The Form T2142 Part XII.3 Tax Return Tax on Investment Income of Life Insurers in Canada is filed by life insurance companies.

FAQ

Q: What is Form T2142?

A: Form T2142 is a tax return form for reporting tax on investment income of life insurers.

Q: What is Part XII.3 of Form T2142?

A: Part XII.3 is the section of Form T2142 where life insurers report their investment income for tax purposes.

Q: What does the Tax on Investment Income of Life Insurers refer to?

A: The Tax on Investment Income of Life Insurers is the tax owed on the investment income earned by life insurers.

Q: Which tax years does Form T2142 Part XII.3 apply to?

A: Form T2142 Part XII.3 applies to tax years 2016 and later.

Q: Who needs to file Form T2142 Part XII.3?

A: Life insurers who earn investment income need to file Form T2142 Part XII.3 to report their taxable income.

Q: Are there any specific requirements for filling out Form T2142 Part XII.3?

A: Yes, there are specific requirements for filling out Form T2142 Part XII.3. It is recommended to consult the instructions provided with the form or seek professional assistance.

Q: What happens if I don't file Form T2142 Part XII.3?

A: If you are required to file Form T2142 Part XII.3 and fail to do so, you may be subject to penalties or other consequences imposed by the Canada Revenue Agency.