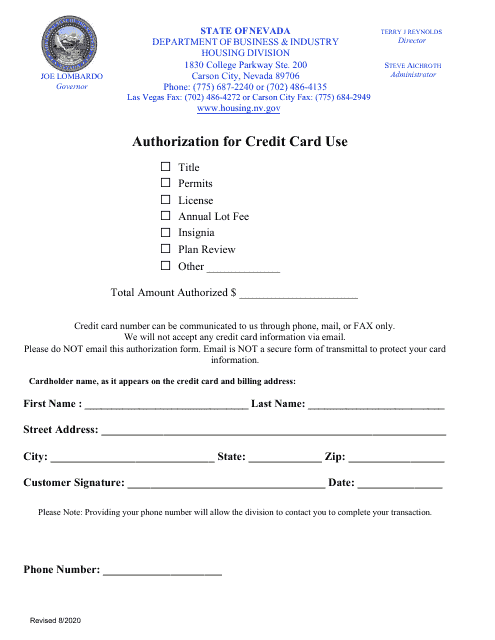

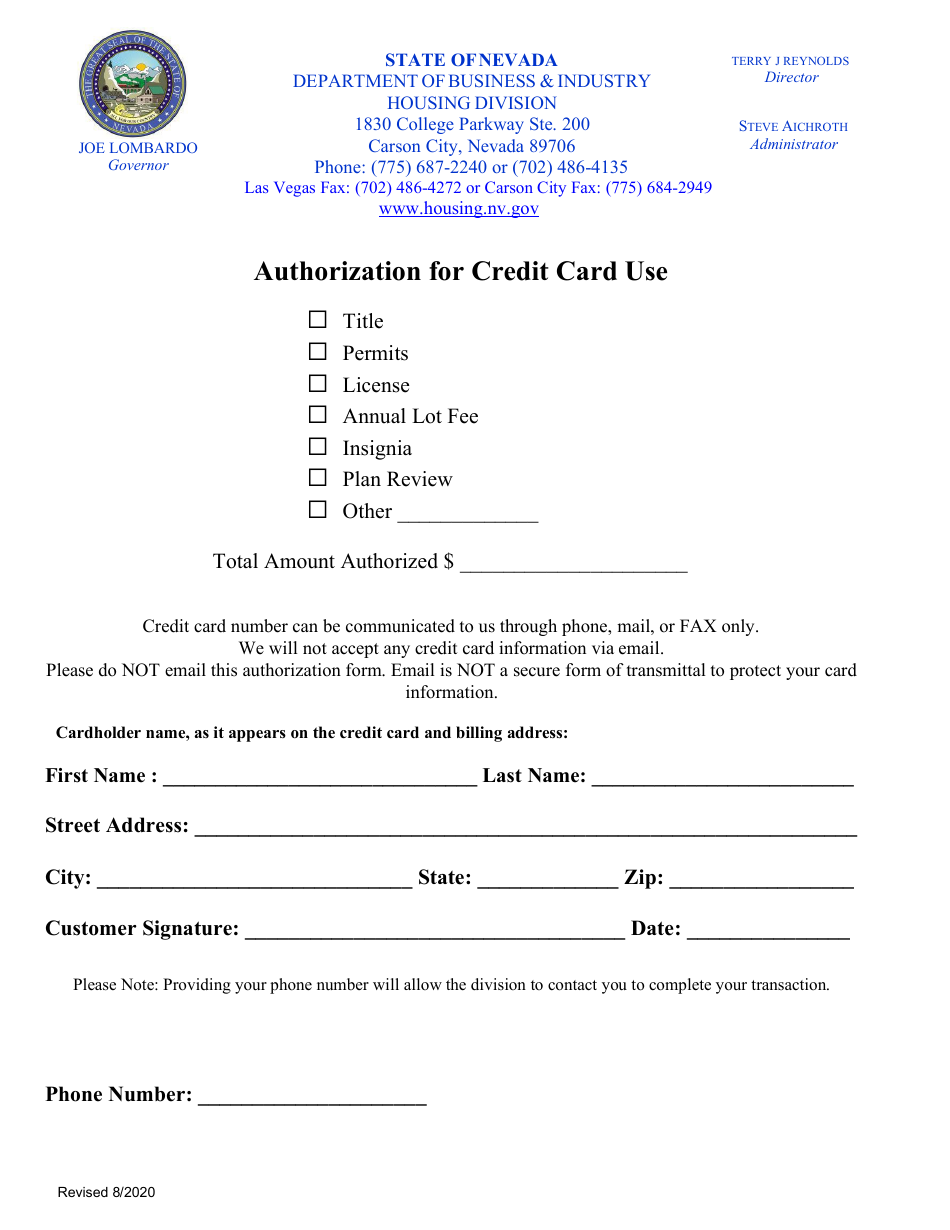

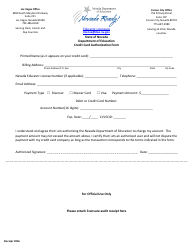

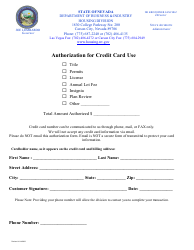

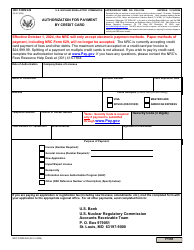

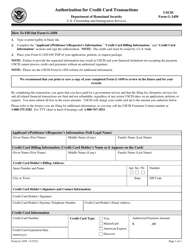

Authorization for Credit Card Use - Nevada

Authorization for Credit Card Use is a legal document that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada.

FAQ

Q: What is an authorization for credit card use?

A: An authorization for credit card use is a form that grants permission to charge a credit card for a specific purpose.

Q: Why would I need an authorization for credit card use?

A: You may need an authorization for credit card use if you want to allow someone else to use your credit card for a specific purpose, such as making a purchase or paying a bill.

Q: Is an authorization for credit card use legally binding?

A: Yes, an authorization for credit card use is legally binding once it is signed and accepted by the credit card holder.

Q: Do I need to provide my credit card information on the authorization form?

A: Yes, the authorization form typically requires you to provide your credit card number, expiration date, and CVV code.

Q: Can I set limits on the amount that can be charged with the authorization?

A: Yes, you can specify a maximum amount that can be charged with the authorization.

Q: How long is an authorization for credit card use valid?

A: The validity period of an authorization for credit card use may vary, but it is typically up to the discretion of the credit card holder.

Q: Can I revoke an authorization for credit card use?

A: Yes, you can revoke an authorization for credit card use at any time by notifying the credit card holder in writing.

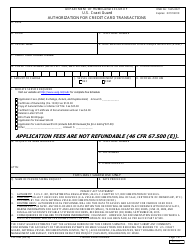

Q: Are there any fees associated with using an authorization for credit card use?

A: Fees associated with using an authorization for credit card use may vary depending on the terms set by the credit card issuer.

Q: Is an authorization for credit card use the same as giving someone my credit card?

A: No, an authorization for credit card use gives someone permission to use your credit card for a specific purpose, but it does not give them physical possession of the card.

Q: Can I use an authorization for credit card use to dispute unauthorized charges?

A: No, an authorization for credit card use does not provide protection against unauthorized charges. If you suspect fraudulent activity, you should contact your credit card issuer immediately.

Form Details:

- Released on August 1, 2020;

- The latest edition currently provided by the Nevada Department of Business and Industry;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.