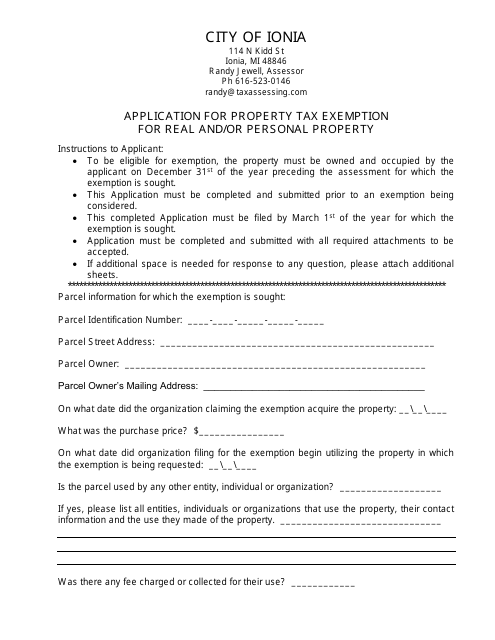

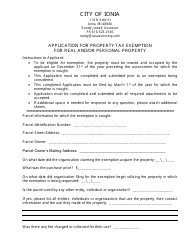

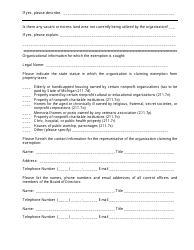

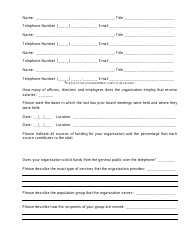

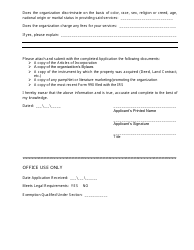

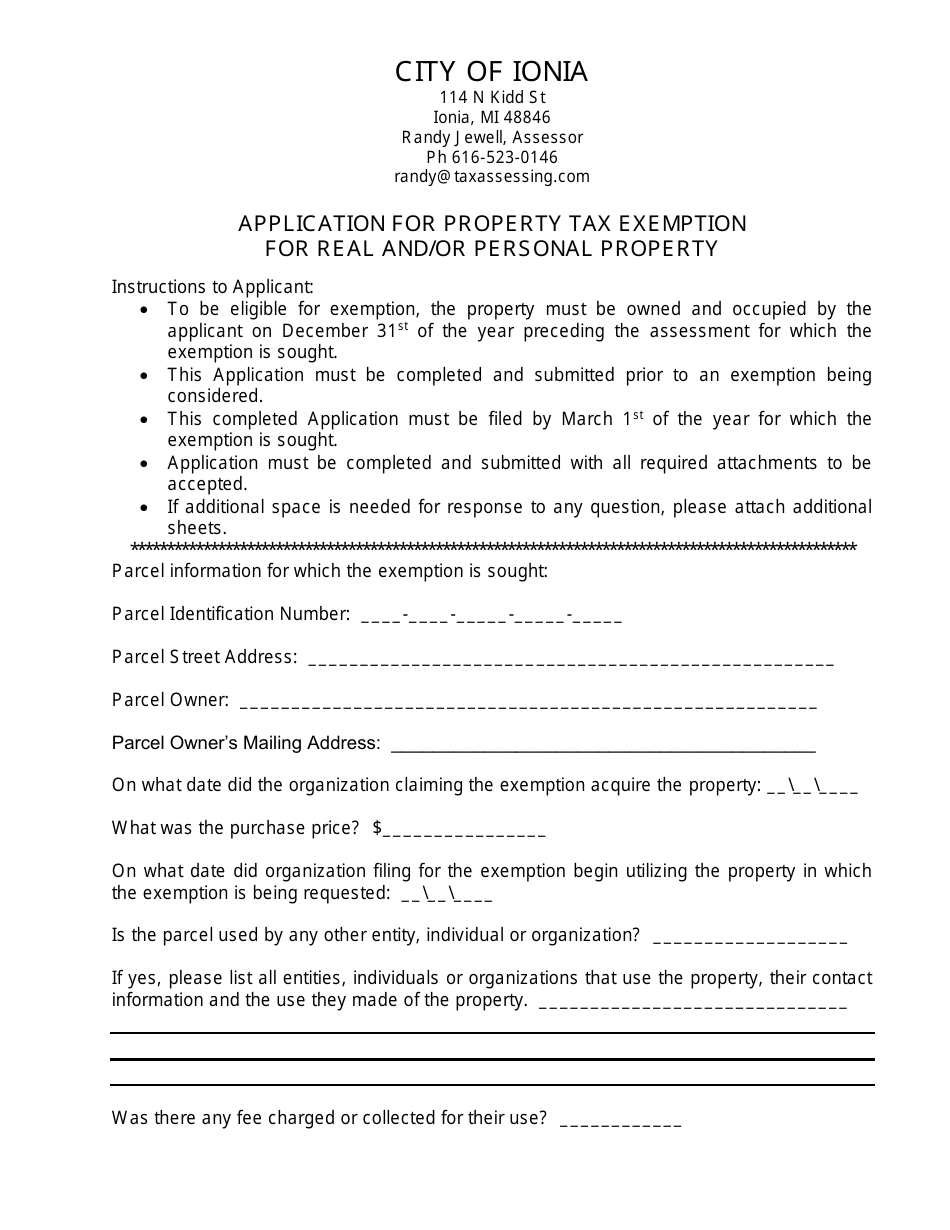

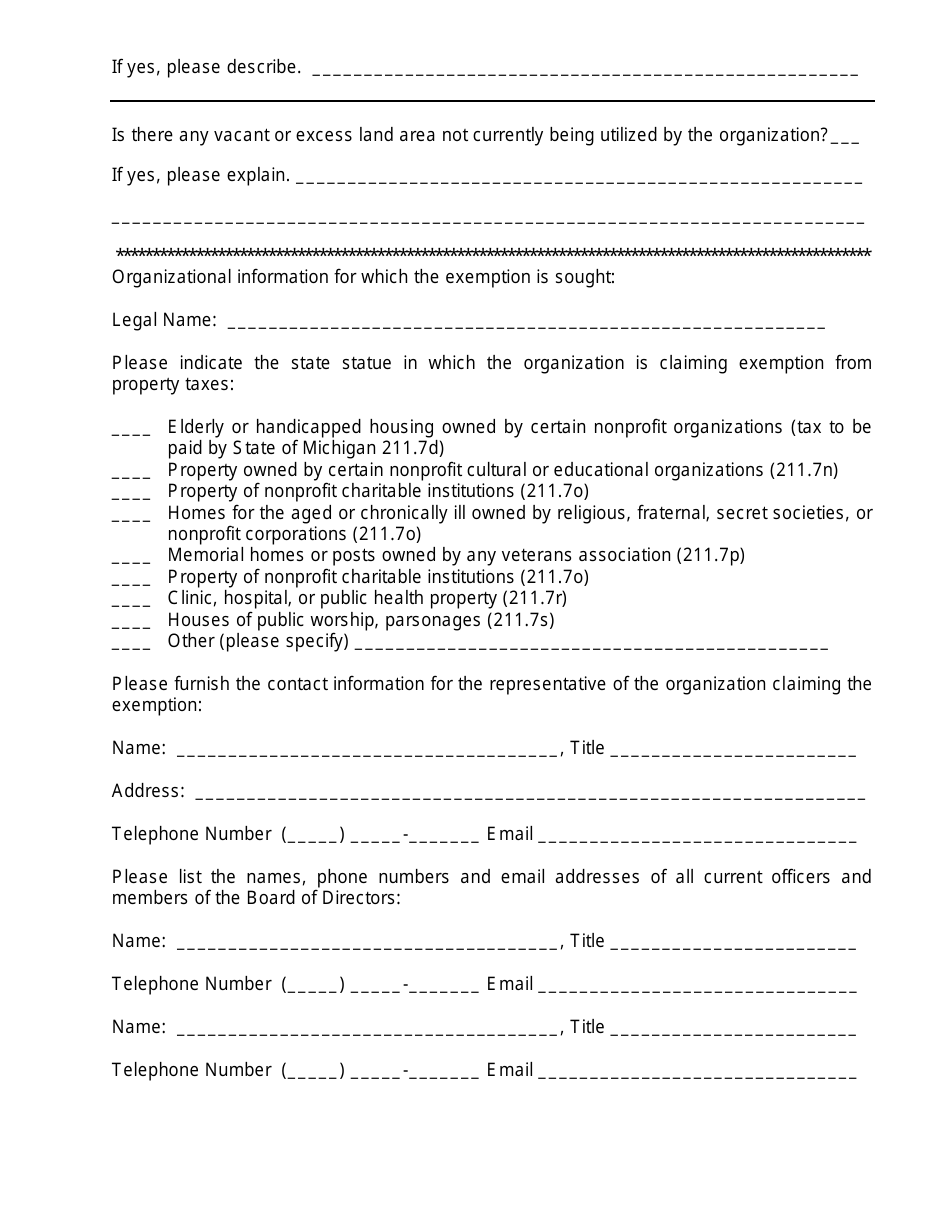

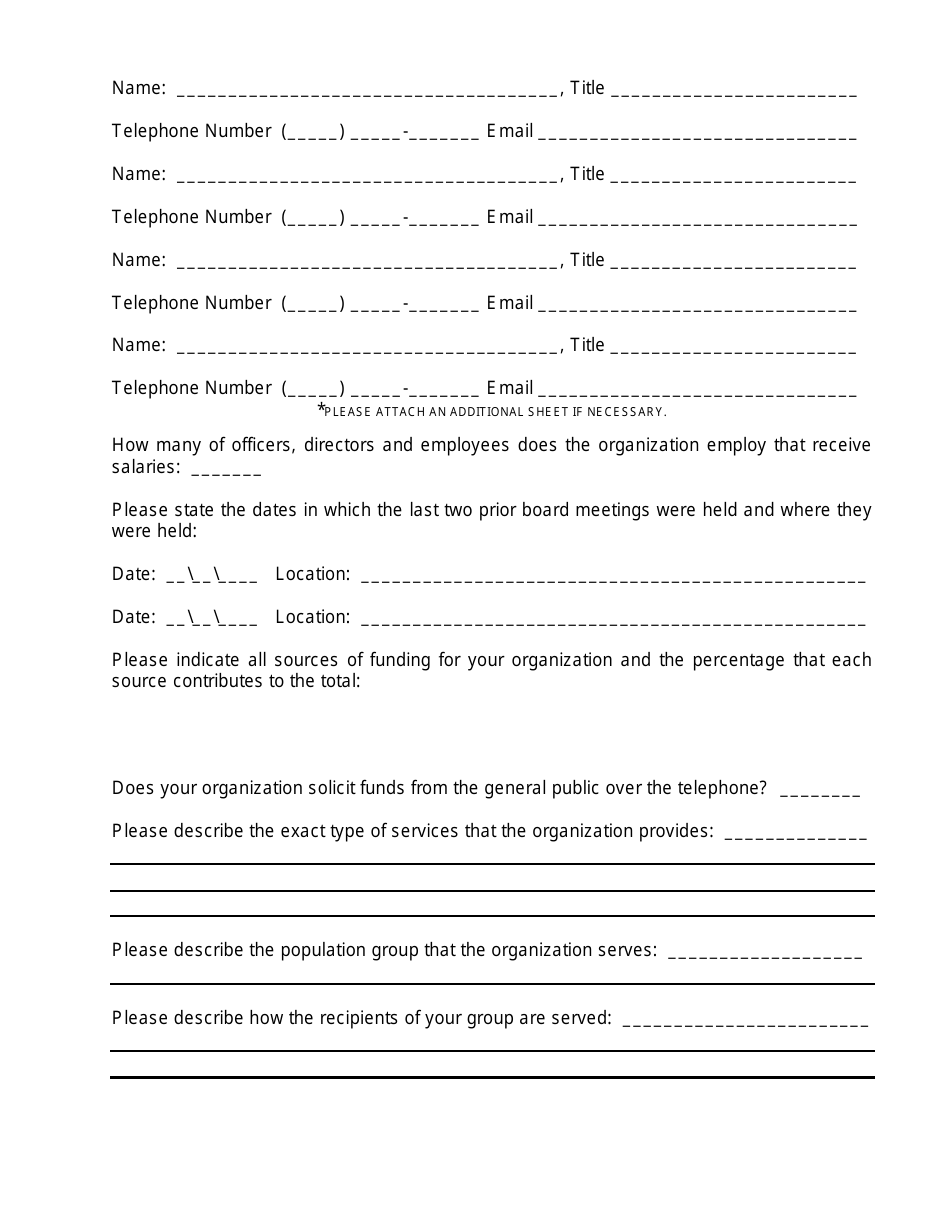

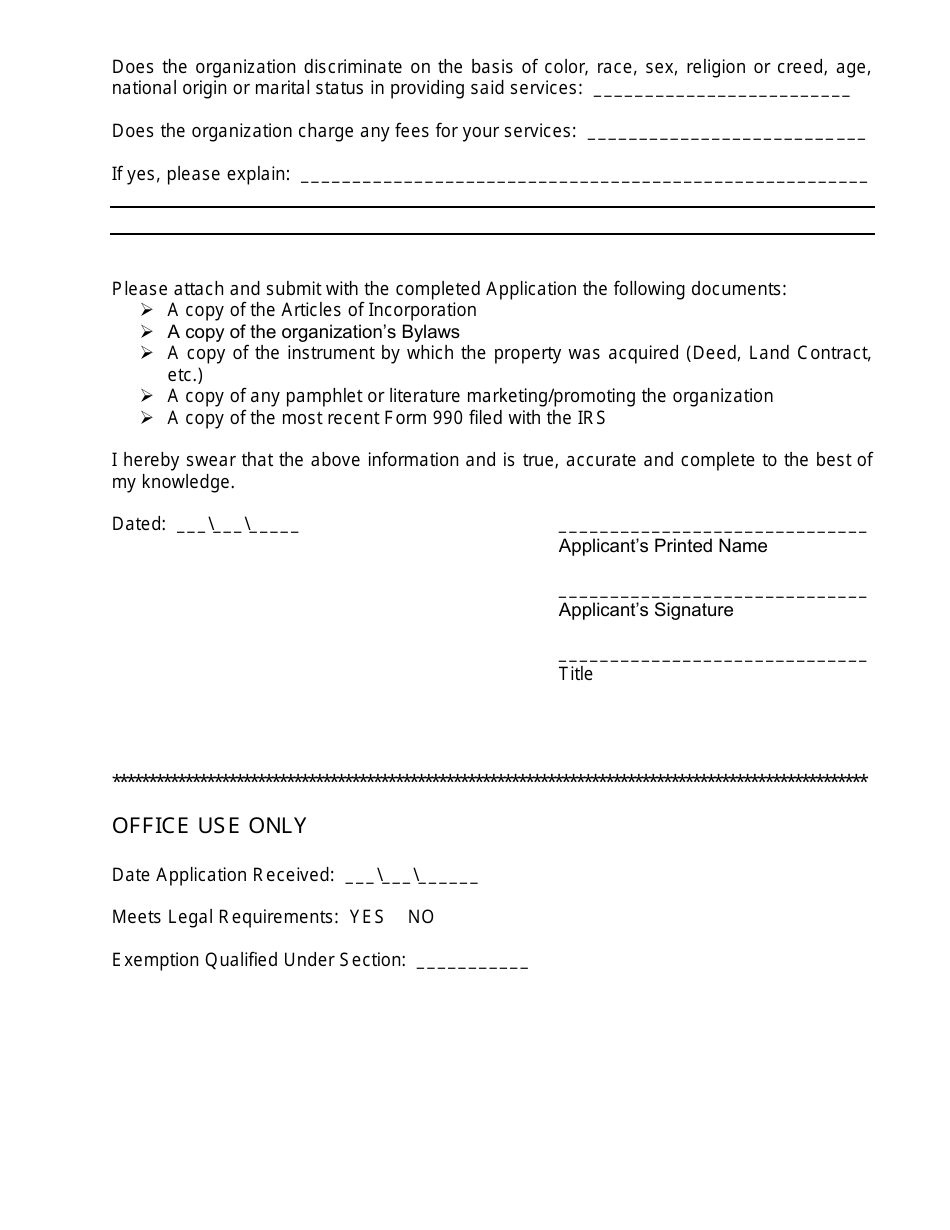

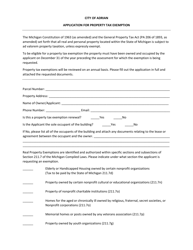

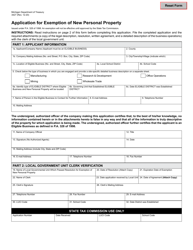

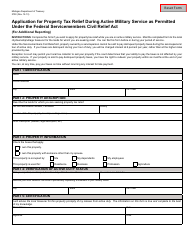

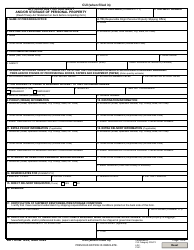

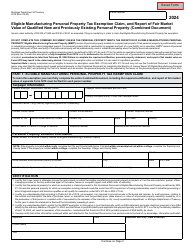

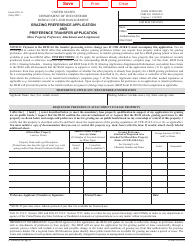

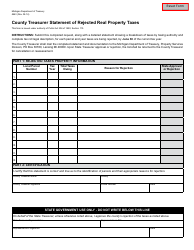

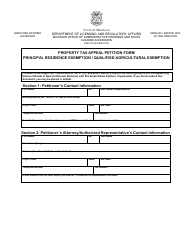

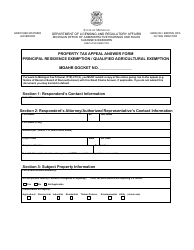

Application for Property Tax Exemption for Real and / or Personal Property - City of Ionia, Michigan

Application for Property Tax Exemption for Real and/or Personal Property is a legal document that was released by the Assessor's Office - City of Ionia, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Ionia.

FAQ

Q: What is the application for?

A: The application is for property tax exemption for real and/or personal property in the City of Ionia, Michigan.

Q: Who can apply for property tax exemption?

A: Property owners who meet certain criteria can apply for property tax exemption.

Q: What is the purpose of property tax exemption?

A: Property tax exemption is provided to eligible property owners as a way to reduce or eliminate their property tax obligations.

Q: How can I apply for property tax exemption?

A: To apply for property tax exemption, you need to complete and submit the application form to the City of Ionia, Michigan.

Q: What criteria do I need to meet to qualify for property tax exemption?

A: The specific criteria for property tax exemption vary, but generally include factors such as age, income level, disability status, or veteran status.

Q: Are there any application fees?

A: The document does not mention any application fees. Please contact the City of Ionia, Michigan for specific details regarding fees.

Q: What is the deadline for submitting the application?

A: The document does not mention a specific deadline for submitting the application. Please contact the City of Ionia, Michigan for deadline information.

Q: Is there an income limit for property tax exemption?

A: The document does not specify an income limit for property tax exemption. Please refer to the application and guidelines provided by the City of Ionia, Michigan.

Q: Can I apply for property tax exemption for both real and personal property?

A: Yes, the application allows you to apply for property tax exemption for both real and personal property.

Form Details:

- The latest edition currently provided by the Assessor's Office - City of Ionia, Michigan;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Assessor's Office - City of Ionia, Michigan.