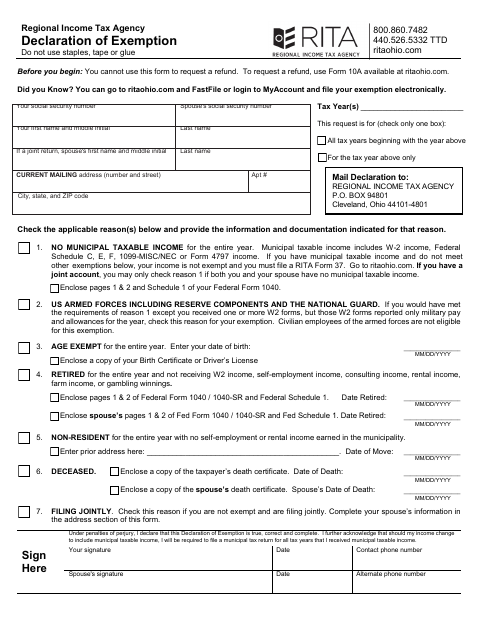

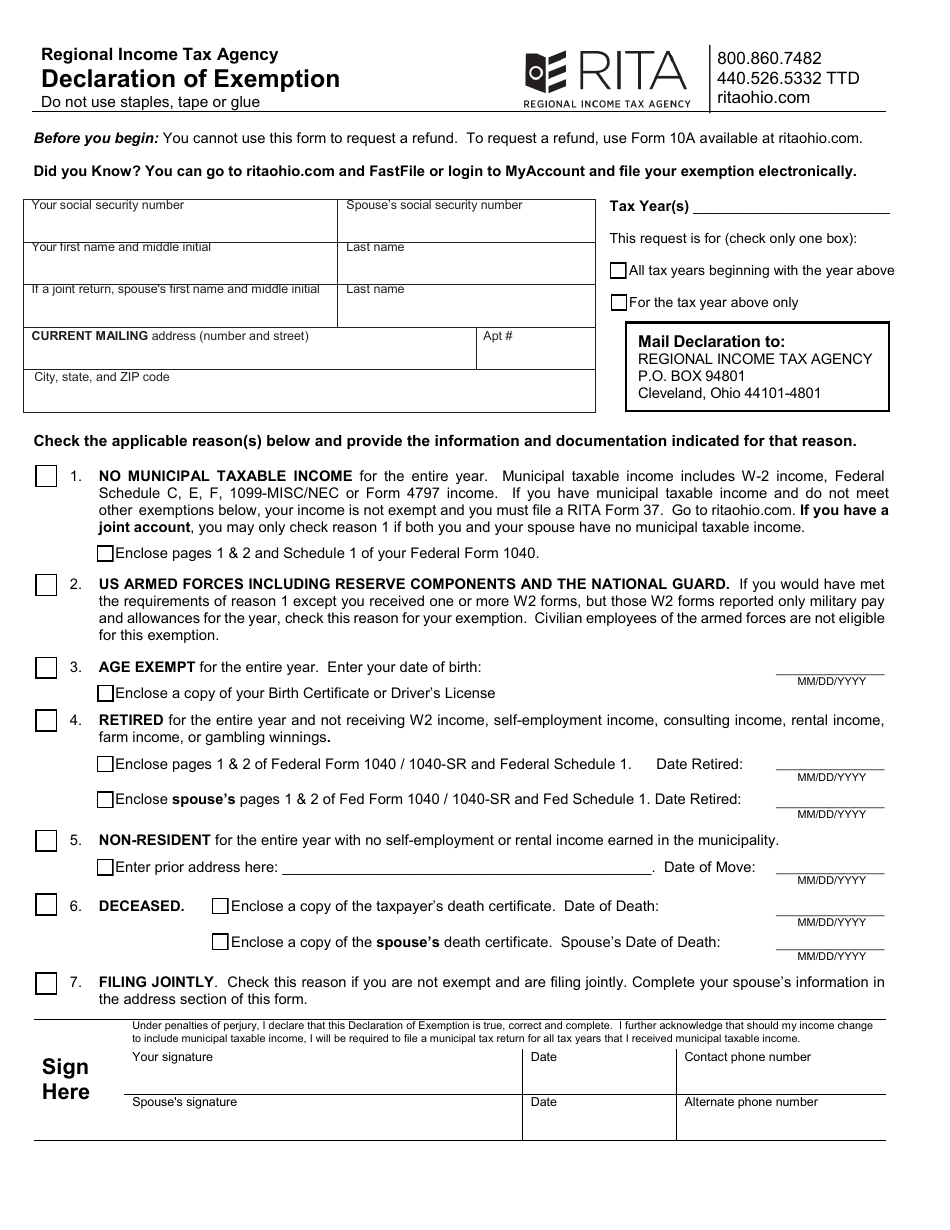

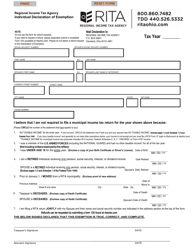

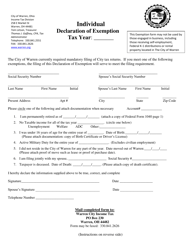

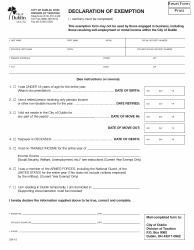

Declaration of Exemption - Ohio

Declaration of Exemption is a legal document that was released by the Ohio Regional Income Tax Agency (RITA) - a government authority operating within Ohio.

FAQ

Q: What is the Declaration of Exemption?

A: The Declaration of Exemption is a form used in Ohio to declare certain properties as exempt from taxation.

Q: What properties can be declared exempt?

A: Properties that can be declared exempt include religious, educational, charitable, and government-owned properties.

Q: How do I file a Declaration of Exemption?

A: You can file a Declaration of Exemption with the county auditor's office in the county where the property is located.

Q: What is the deadline to file a Declaration of Exemption?

A: The deadline to file a Declaration of Exemption is generally the first Monday in June each year.

Q: Are there any fees for filing a Declaration of Exemption?

A: There are usually no filing fees for filing a Declaration of Exemption, but you should check with the county auditor's office to confirm.

Q: What happens if my property is granted exemption?

A: If your property is granted exemption, it will be exempt from property taxes.

Q: Can I appeal if my property is not granted exemption?

A: Yes, you can appeal the decision if your property is not granted exemption. Contact the county auditor's office for more information on the appeals process.

Form Details:

- The latest edition currently provided by the Ohio Regional Income Tax Agency (RITA);

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Regional Income Tax Agency (RITA).