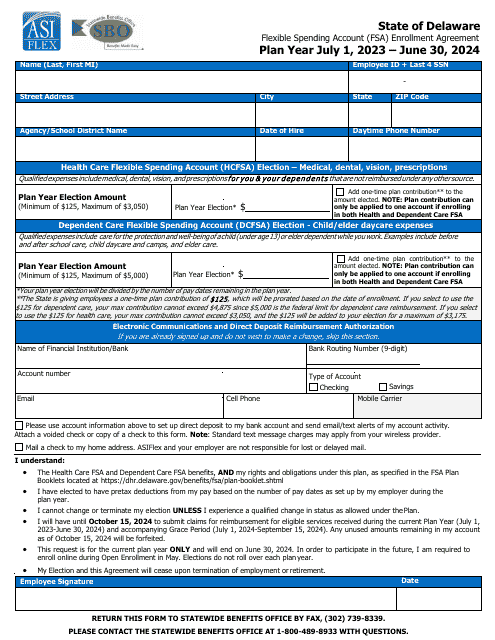

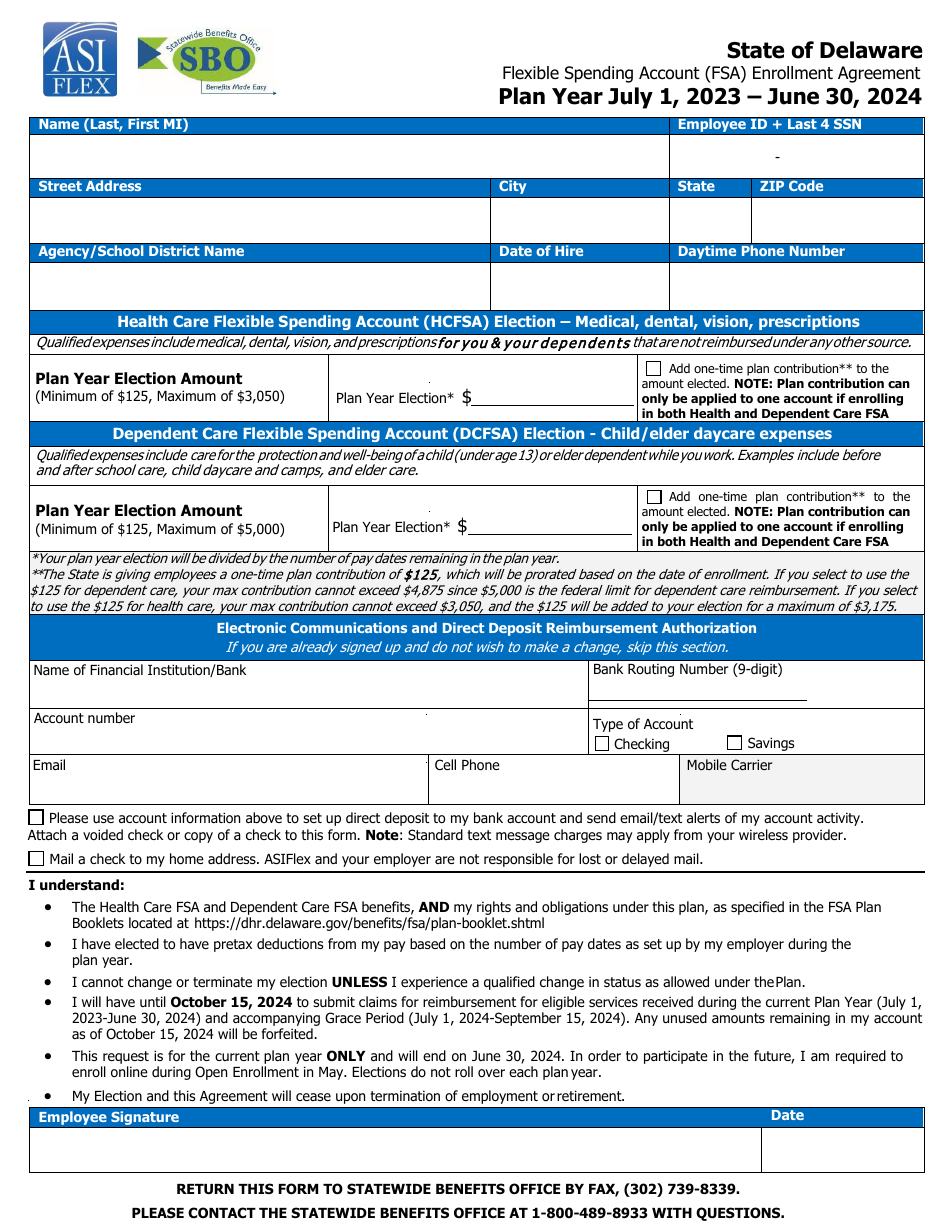

Flexible Spending Account (FSA) Enrollment Agreement - Asiflex - Delaware

Flexible Spending Account (FSA) Enrollment Agreement - Asiflex is a legal document that was released by the Delaware Department of Human Resources - a government authority operating within Delaware.

FAQ

Q: What is a Flexible Spending Account (FSA)?

A: A Flexible Spending Account (FSA) is a healthcare benefit program that allows employees to set aside pre-tax dollars to pay for qualified medical expenses.

Q: Who is eligible to participate in a Flexible Spending Account (FSA)?

A: Employees of participating employers are eligible to participate in a Flexible Spending Account (FSA).

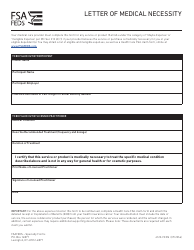

Q: What expenses can be reimbursed through a Flexible Spending Account (FSA)?

A: Qualified medical expenses such as doctor visits, prescription medications, and dental care can be reimbursed through a Flexible Spending Account (FSA).

Q: How much money can I contribute to a Flexible Spending Account (FSA)?

A: The maximum annual contribution limit for a Flexible Spending Account (FSA) is set by the employer and can vary. However, the IRS sets a general limit each year, which is $2,750 for 2021.

Q: Can I use my Flexible Spending Account (FSA) funds for over-the-counter (OTC) medications?

A: Yes, you can use your Flexible Spending Account (FSA) funds for eligible over-the-counter (OTC) medications. However, as of January 1, 2021, a prescription is required for certain OTC items.

Q: What happens if I don't use all of the money in my Flexible Spending Account (FSA) by the end of the plan year?

A: Any unused money in your Flexible Spending Account (FSA) at the end of the plan year may be forfeited, depending on your employer's plan. Some employers offer a grace period or carryover provision.

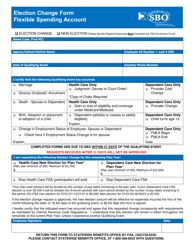

Q: Can I change my Flexible Spending Account (FSA) contribution amount during the plan year?

A: Generally, you can only change your Flexible Spending Account (FSA) contribution amount during the annual open enrollment period. However, certain qualifying life events may allow for a mid-year change.

Q: Can I use my Flexible Spending Account (FSA) funds for dependent care expenses?

A: Yes, you can use your Flexible Spending Account (FSA) funds for eligible dependent care expenses, such as daycare or babysitting services, as long as the expenses allow you to work.

Q: How long do I have to submit a claim for reimbursement from my Flexible Spending Account (FSA)?

A: The deadline for submitting a claim for reimbursement from your Flexible Spending Account (FSA) is typically set by your FSA administrator. It is important to submit claims promptly after incurring the expenses.

Form Details:

- The latest edition currently provided by the Delaware Department of Human Resources;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Human Resources.