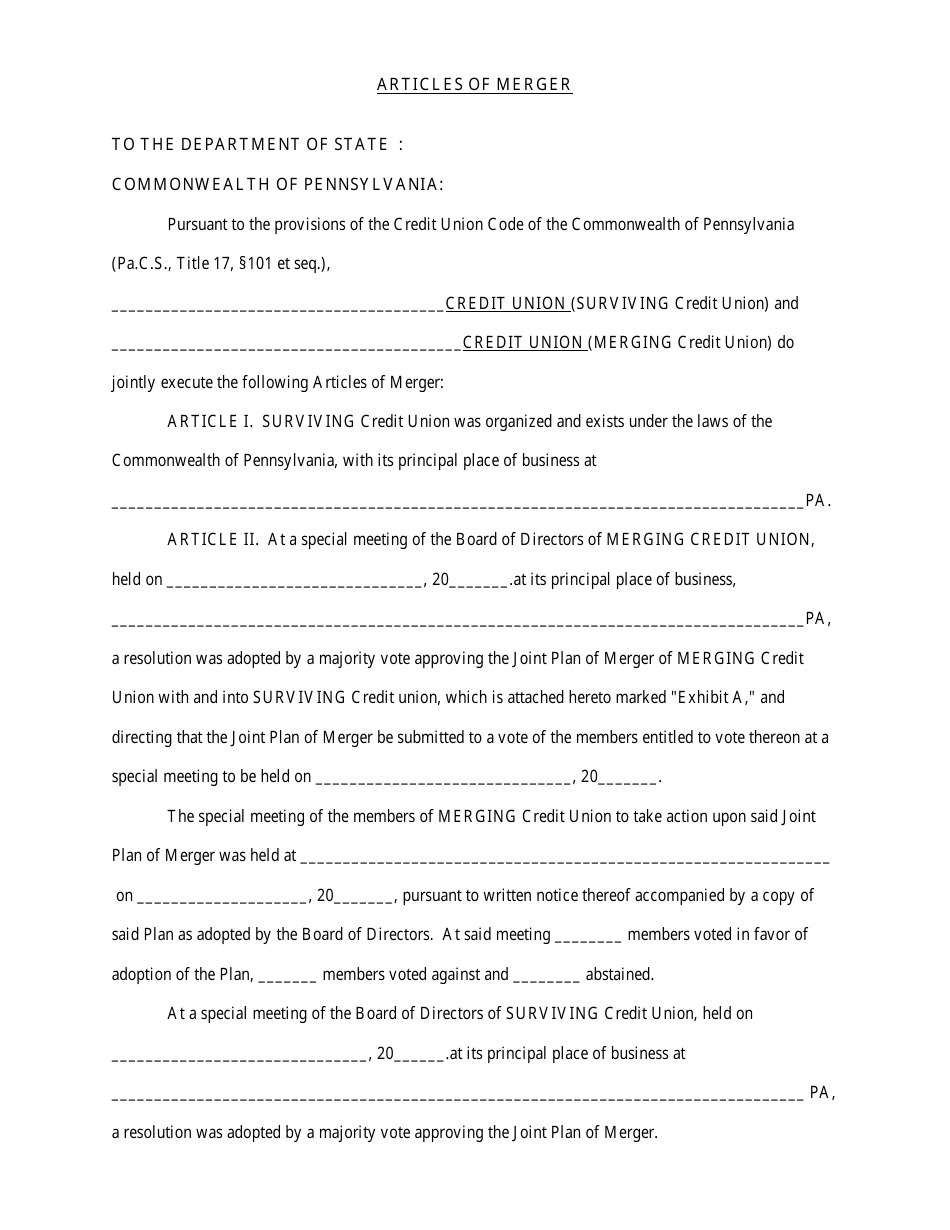

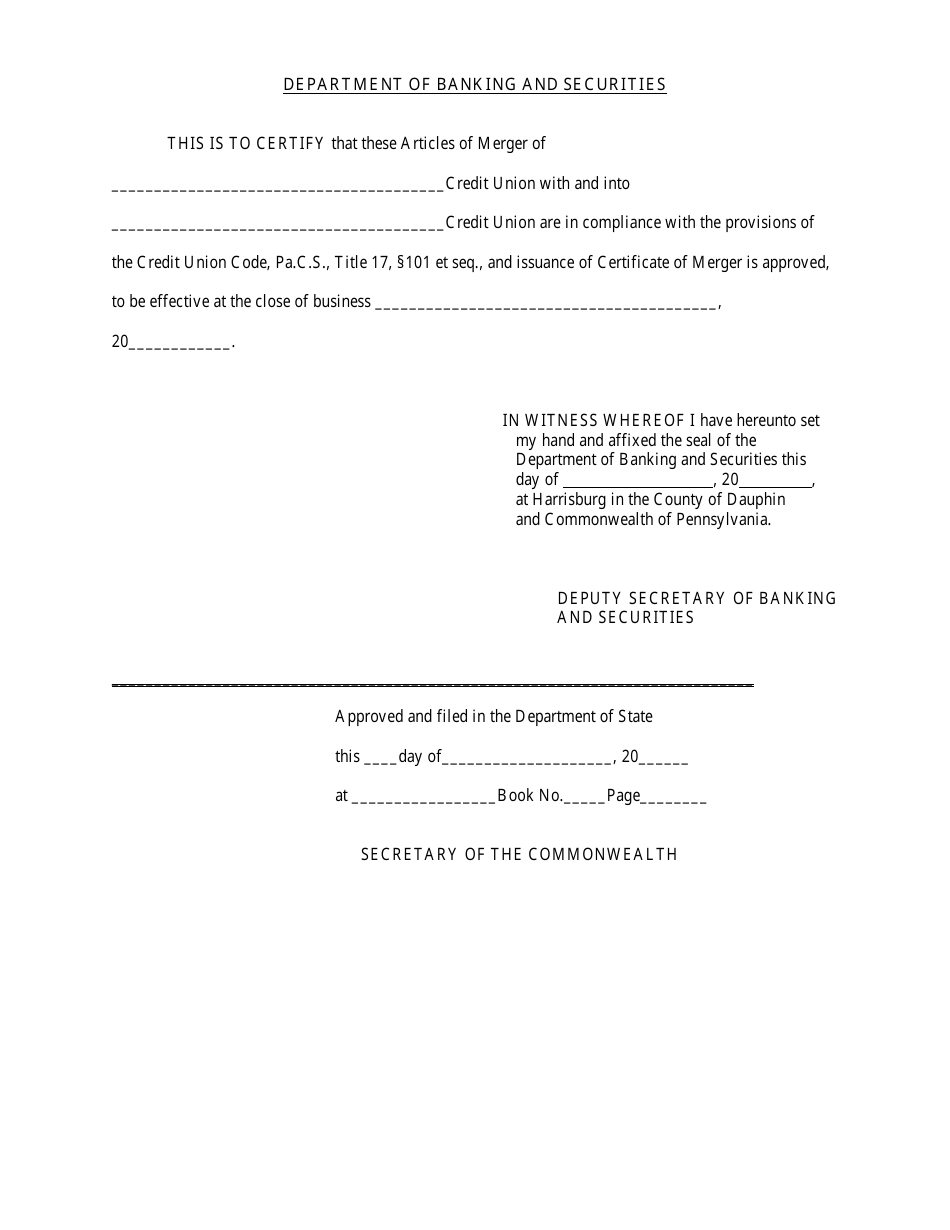

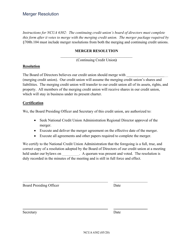

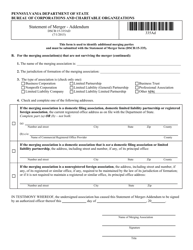

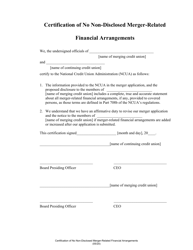

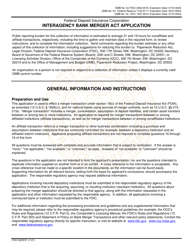

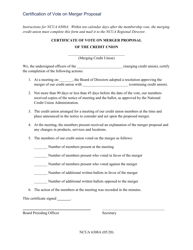

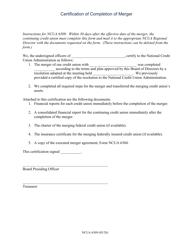

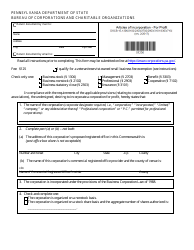

Articles of Merger - Pennsylvania

Articles of Merger is a legal document that was released by the Pennsylvania Department of Banking and Securities - a government authority operating within Pennsylvania.

FAQ

Q: What is an Articles of Merger in Pennsylvania?

A: The Articles of Merger is a legal document used in Pennsylvania to combine two or more businesses into a single entity.

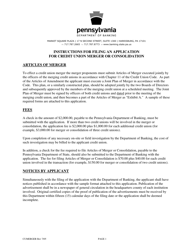

Q: How do I file Articles of Merger in Pennsylvania?

A: To file Articles of Merger in Pennsylvania, you need to complete the appropriate form provided by the Pennsylvania Department of State and submit it with the required filing fee.

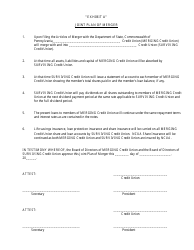

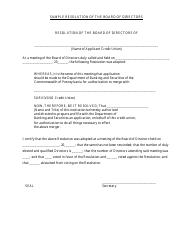

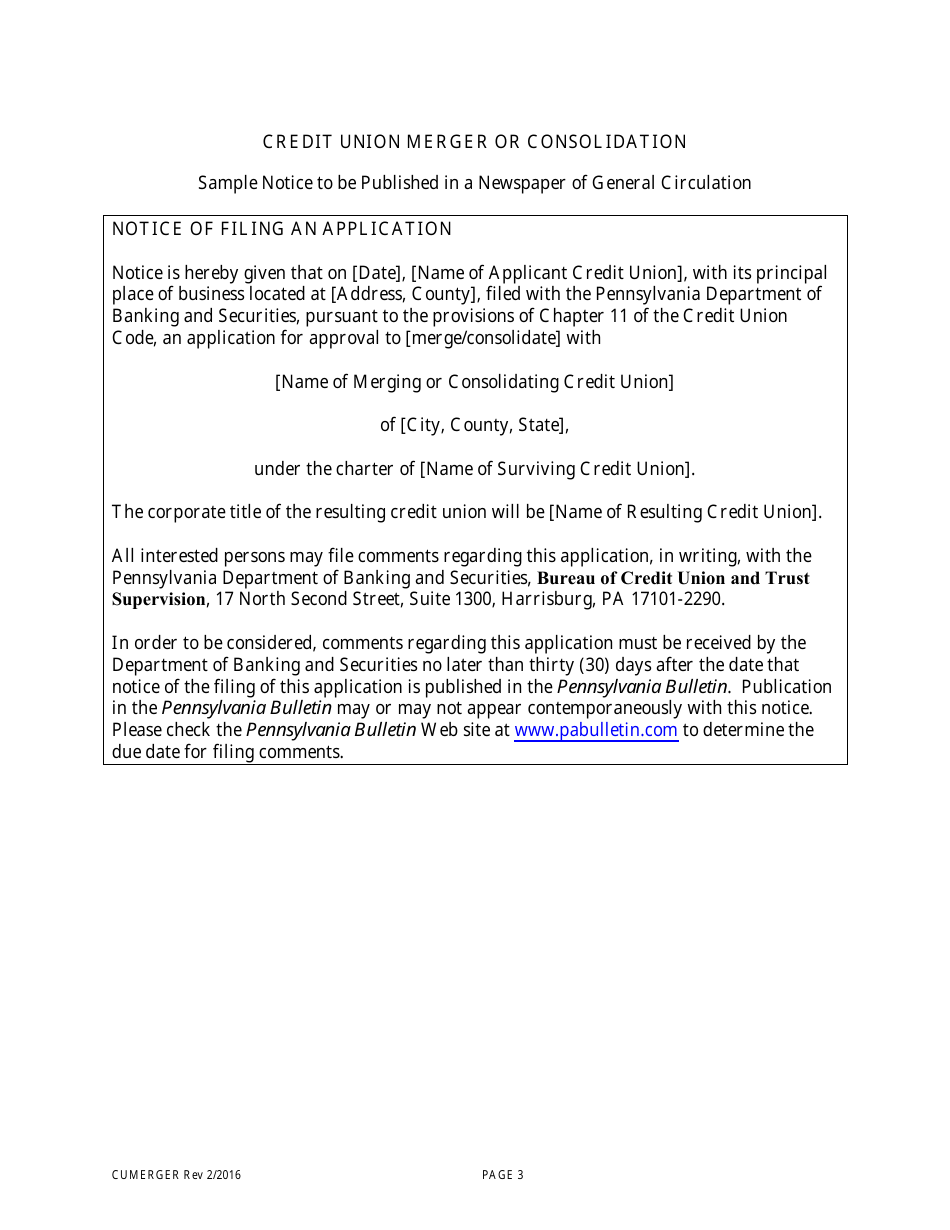

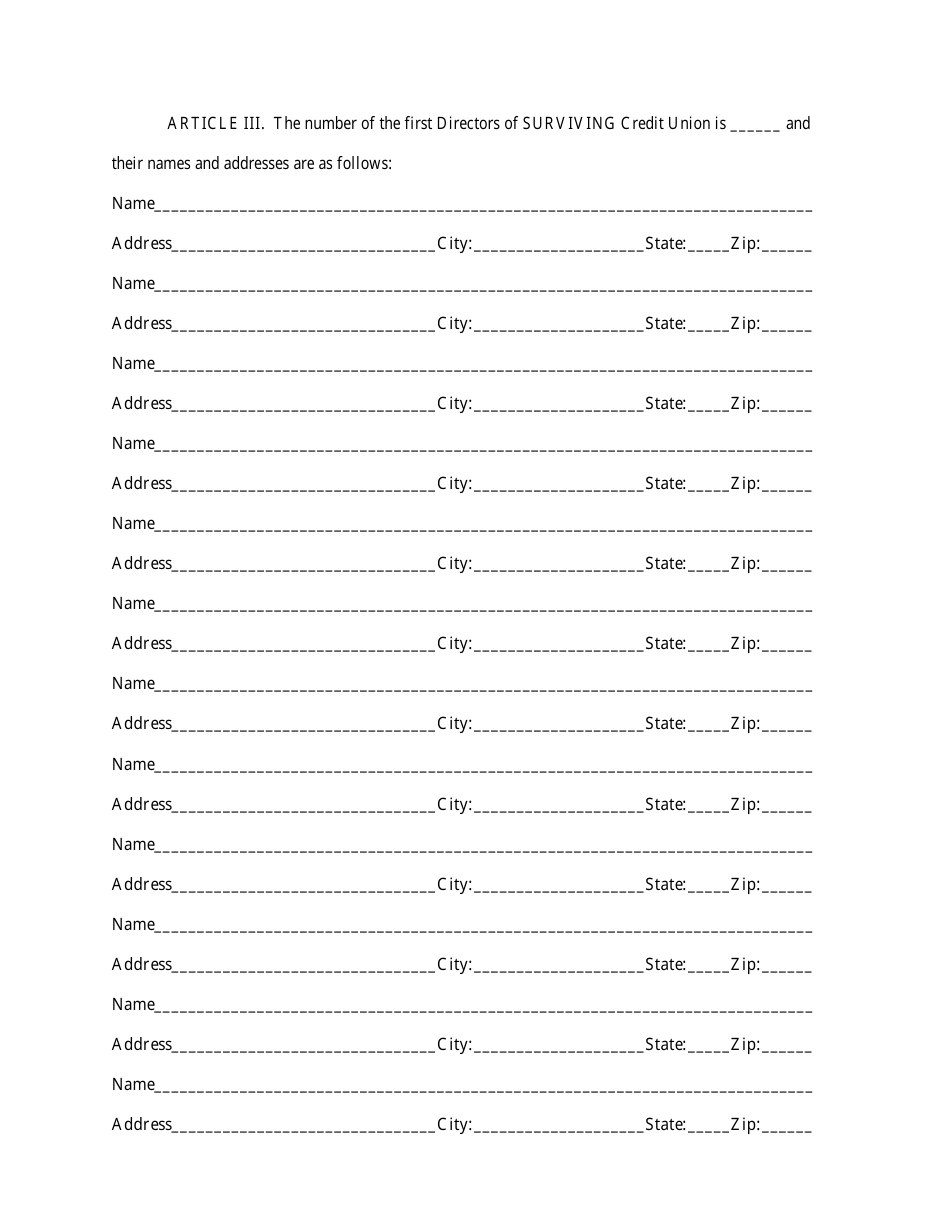

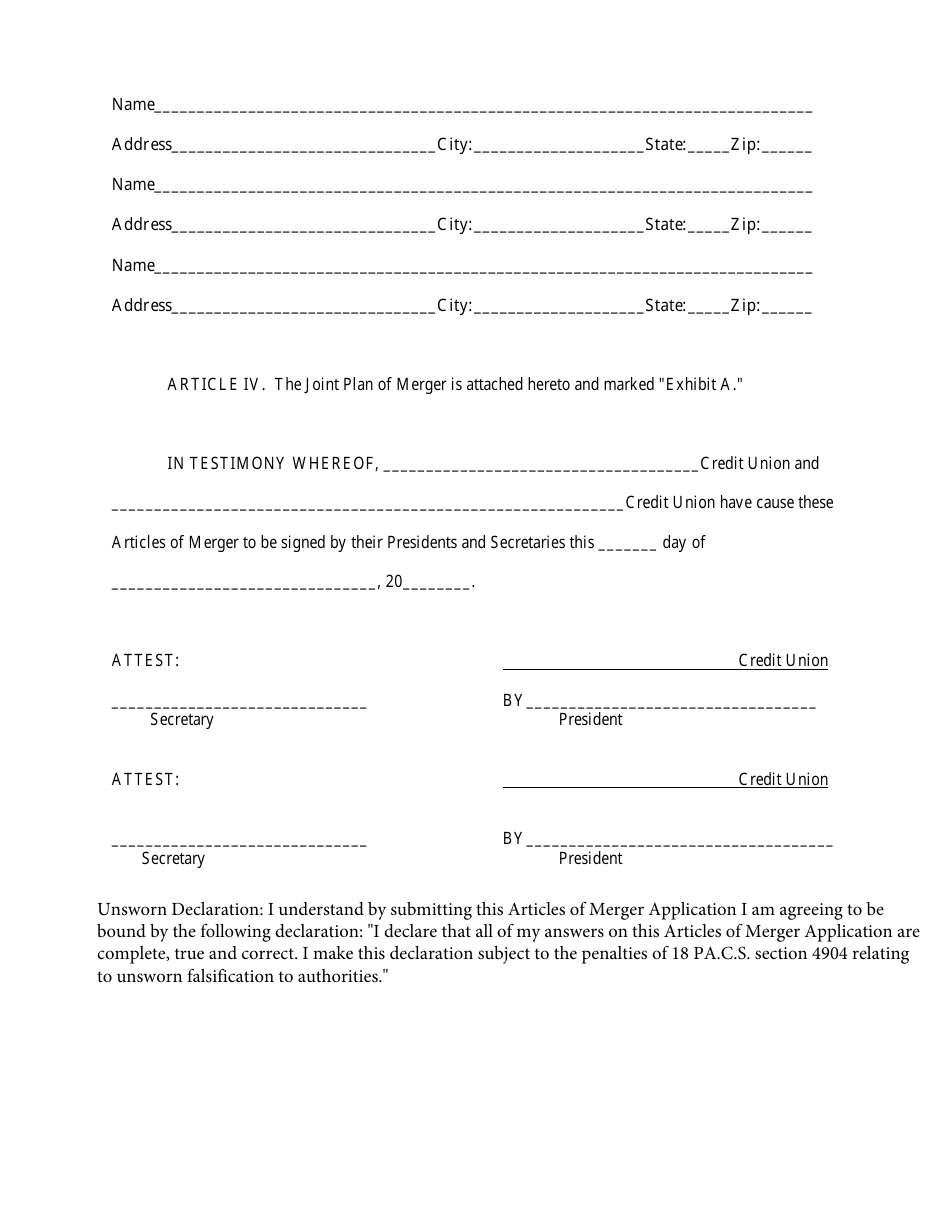

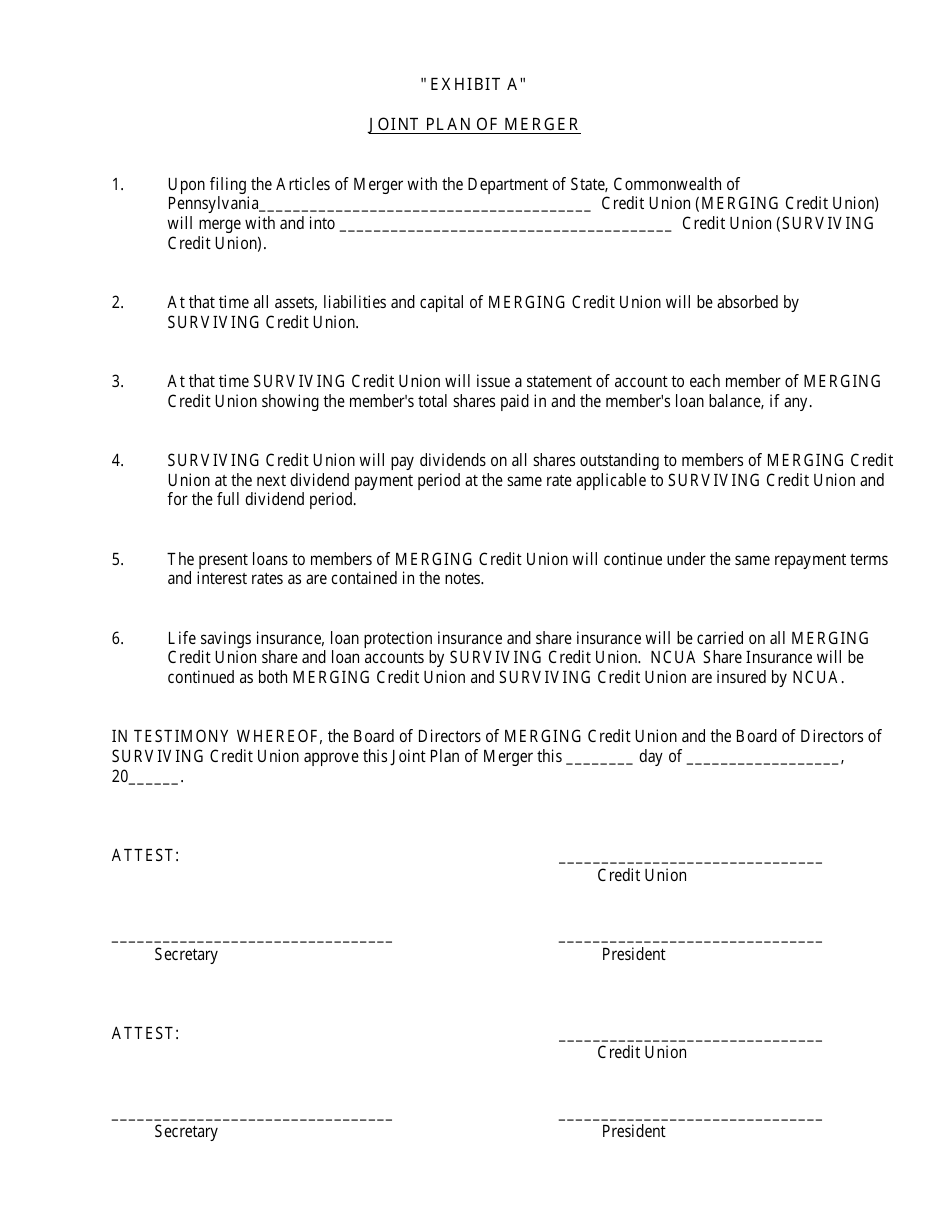

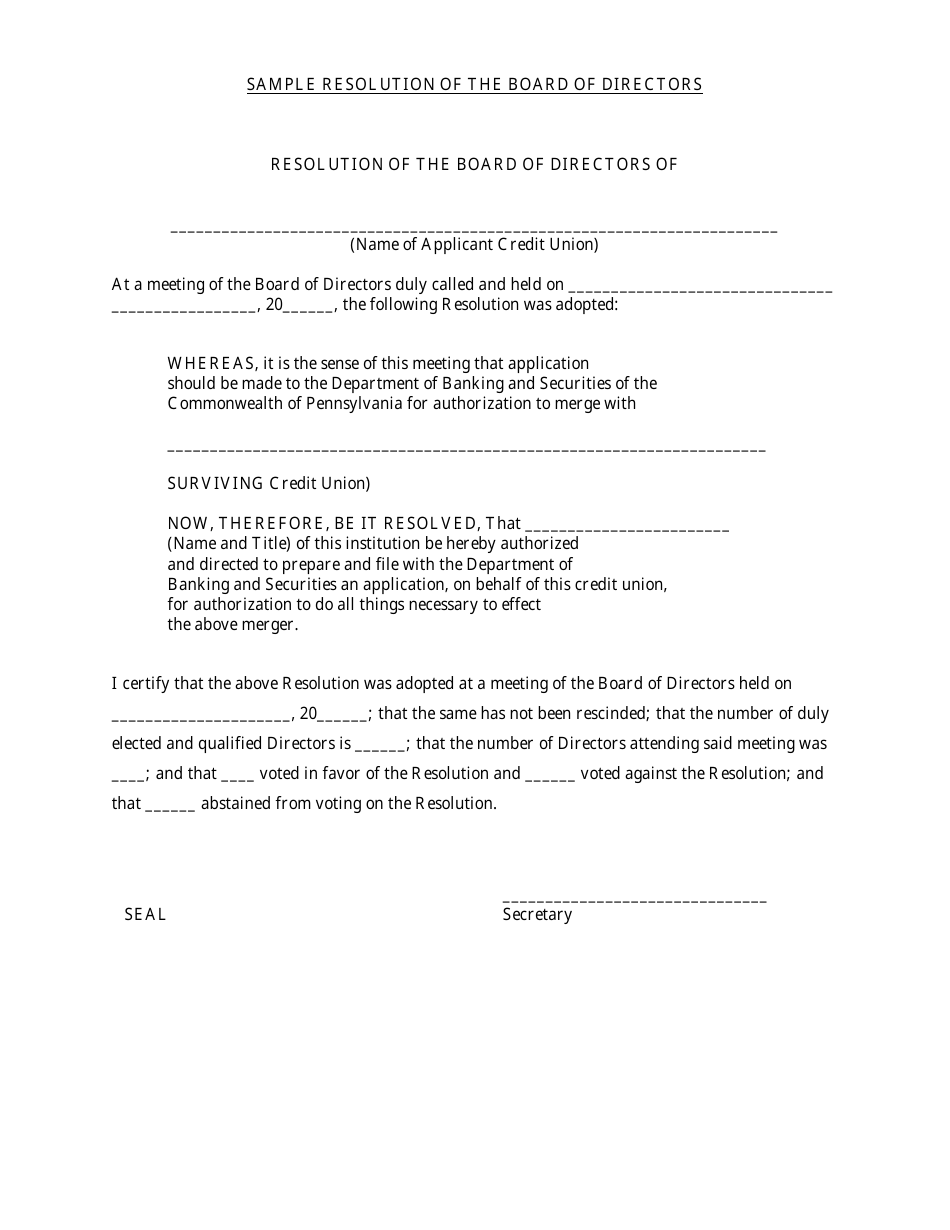

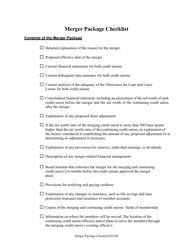

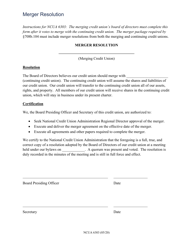

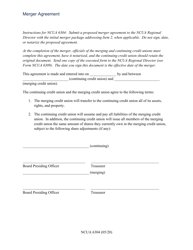

Q: What information is required in the Articles of Merger?

A: The Articles of Merger generally require information about the merging entities, including their names, addresses, and the details of the merger, such as the effective date and the surviving entity.

Q: Do I need a lawyer to file Articles of Merger in Pennsylvania?

A: While it is not required to have a lawyer, it is recommended to seek legal advice to ensure your merger is compliant with Pennsylvania laws and regulations.

Q: How long does it take to process the filing of Articles of Merger in Pennsylvania?

A: The processing time for filing Articles of Merger in Pennsylvania can vary, but it typically takes several weeks. You can expedite the process by paying an additional fee.

Q: Are there any fees associated with filing Articles of Merger in Pennsylvania?

A: Yes, there is a filing fee associated with submitting the Articles of Merger in Pennsylvania. The fee amount can vary, so it is advised to check the current fee structure with the Pennsylvania Department of State.

Q: What happens after the Articles of Merger are approved?

A: Once the Articles of Merger are approved by the Pennsylvania Department of State, the merger becomes legally effective, and the surviving entity assumes the rights and obligations of the merged entities.

Q: Can I cancel or revoke the Articles of Merger in Pennsylvania?

A: Yes, in certain circumstances, you may be able to cancel or revoke the Articles of Merger in Pennsylvania. You should consult with a lawyer to understand the specific requirements and process for cancellation or revocation.

Q: Are there any ongoing reporting or compliance requirements after filing Articles of Merger in Pennsylvania?

A: Yes, the surviving entity is still responsible for meeting any ongoing reporting and compliance requirements imposed by Pennsylvania laws and regulations, such as annual reports and tax filings.

Q: Can a foreign entity merge with a domestic entity in Pennsylvania?

A: Yes, a foreign entity can merge with a domestic entity in Pennsylvania by following the applicable laws and regulations for mergers involving foreign entities. It is advisable to seek legal guidance for this process.

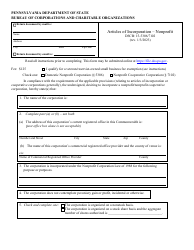

Form Details:

- Released on February 1, 2016;

- The latest edition currently provided by the Pennsylvania Department of Banking and Securities;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Banking and Securities.