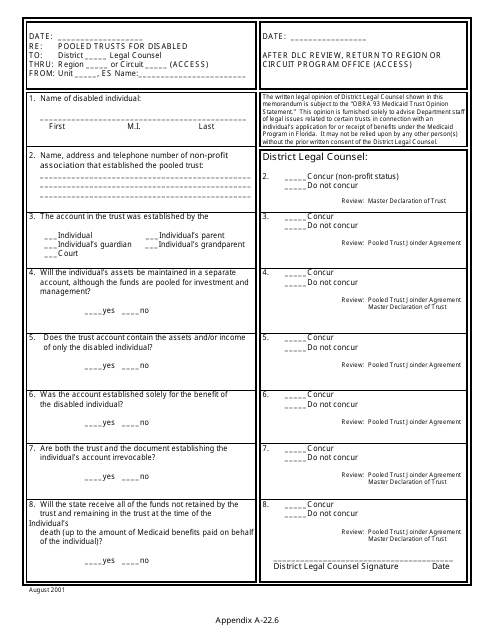

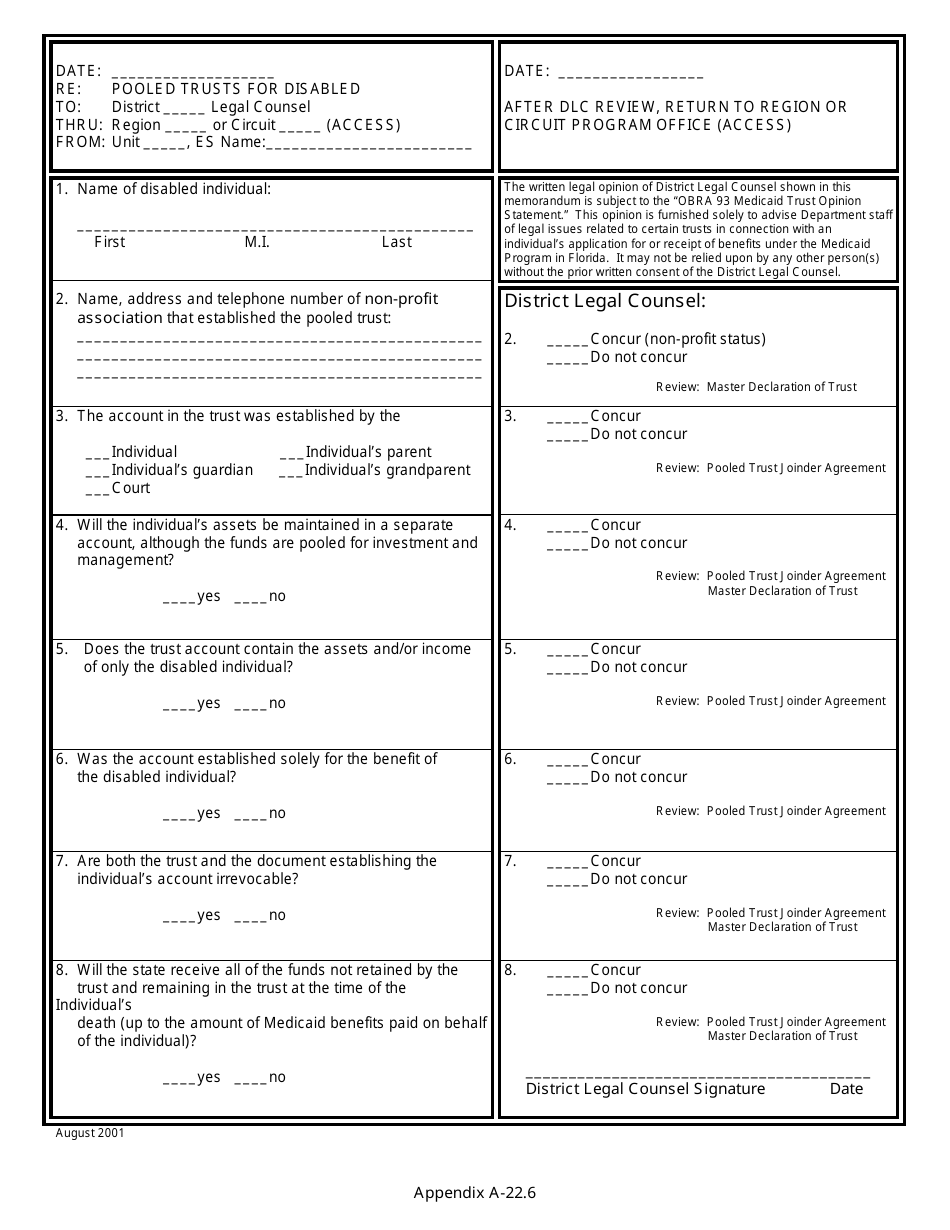

Appendix A-22.6 Pooled Trusts for Disabled - Florida

What Is Appendix A-22.6?

This is a legal form that was released by the Florida Department of Children and Families - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a pooled trust for disabled individuals?

A: A pooled trust is a type of trust designed to manage the assets of disabled individuals while preserving their eligibility for government benefits.

Q: How does a pooled trust work?

A: A pooled trust combines the assets of multiple disabled individuals for investment and management purposes, ensuring that each individual's funds are separate but pooled together for more efficient administration.

Q: Why would someone use a pooled trust?

A: A pooled trust can be useful for disabled individuals who receive government benefits and want to preserve their eligibility, while also having their funds managed professionally and efficiently.

Q: Can a disabled individual create their own pooled trust?

A: No, a disabled individual cannot create their own pooled trust. They can only join an existing pooled trust established by a nonprofit organization or a parent, grandparent, legal guardian, or court.

Q: Are there different types of pooled trusts?

A: Yes, there are two main types of pooled trusts: first-party pooled trusts and third-party pooled trusts. The main difference is the source of funds that are contributed to the trust.

Q: What is a first-party pooled trust?

A: A first-party pooled trust is funded with the disabled individual's own assets, such as a personal injury settlement or an inheritance. After the individual's death, any remaining funds may be used to reimburse the government for Medicaid benefits received.

Q: What is a third-party pooled trust?

A: A third-party pooled trust is funded with assets belonging to someone other than the disabled individual, such as a family member or friend. After the disabled individual's death, any remaining funds can be distributed to other beneficiaries chosen by the person who established the trust.

Q: Are there any restrictions on using a pooled trust in Florida?

A: Yes, in Florida, pooled trusts for disabled individuals must be established and managed by a nonprofit organization, and they must comply with certain state regulations.

Q: Is a pooled trust the right choice for everyone?

A: No, whether or not a pooled trust is the right choice depends on an individual's specific circumstances and financial goals. It is recommended to consult with a financial advisor or attorney specializing in special needs planning to determine the best option.

Q: Are there any alternatives to a pooled trust?

A: Yes, there are other options for managing the assets of disabled individuals, such as individual special needs trusts, ABLE accounts, and structured settlements. Each option has its own advantages and considerations.

Q: Can a pooled trust be used in other states besides Florida?

A: Yes, pooled trusts for disabled individuals are available in many states across the country. Each state may have its own specific regulations and requirements.

Q: Can a pooled trust be modified or revoked?

A: Generally, a pooled trust cannot be modified or revoked once it is established. However, it is important to review the specific terms and conditions of the trust document and consult with legal professionals for guidance.

Q: What happens to funds in a pooled trust upon the death of the disabled individual?

A: The distribution of funds upon the death of a disabled individual depends on the type of trust and the specific terms established. It is important to review the trust document and consult with legal professionals for guidance.

Q: Can government benefits be affected by a pooled trust?

A: Properly structured pooled trusts should not affect the eligibility for government benefits, such as Medicaid. However, it is important to establish and manage the trust according to the applicable rules and regulations.

Q: What are the advantages of using a pooled trust?

A: Some advantages of using a pooled trust include professional management of funds, preservation of government benefits, potential investment growth, and access to pooled resources and services for disabled individuals.

Q: What are the potential disadvantages of using a pooled trust?

A: Some potential disadvantages of using a pooled trust include limited control over investment decisions, administrative fees, and restrictions on the use of funds. It is important to weigh the benefits and drawbacks before making a decision.

Q: Can funds in a pooled trust be used for any purpose?

A: The use of funds in a pooled trust must be in accordance with the trust's purpose and regulations. Generally, the funds are intended to be used for the benefit of the disabled individual, such as paying for medical expenses or improving quality of life.

Q: Who can provide more information about pooled trusts for disabled individuals in Florida?

A: Nonprofit organizations, disability advocacy groups, legal aid organizations, and specialized attorneys can provide more information and guidance on pooled trusts for disabled individuals in Florida.

Form Details:

- The latest edition provided by the Florida Department of Children and Families;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Appendix A-22.6 by clicking the link below or browse more documents and templates provided by the Florida Department of Children and Families.