This version of the form is not currently in use and is provided for reference only. Download this version of

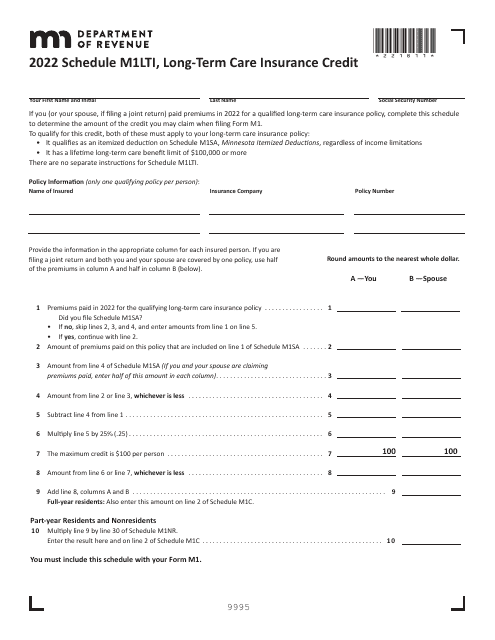

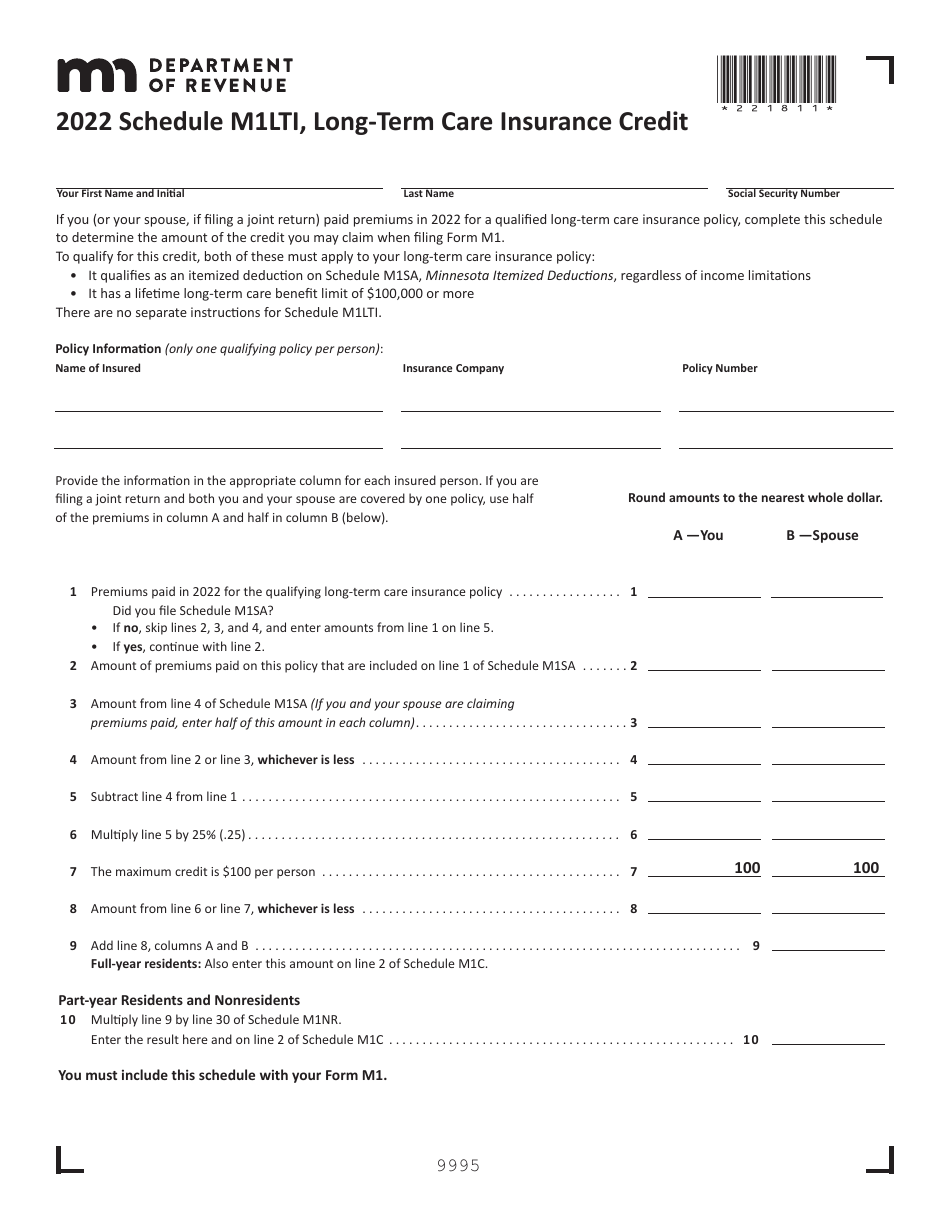

Schedule M1LTI

for the current year.

Schedule M1LTI Long-Term Care Insurance Credit - Minnesota

What Is Schedule M1LTI?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M1LTI?

A: Schedule M1LTI is a tax form used in Minnesota to claim the Long-Term Care Insurance Credit.

Q: What is the Long-Term Care Insurance Credit?

A: The Long-Term Care Insurance Credit is a tax credit in Minnesota for individuals who have long-term care insurance.

Q: Who can claim the Long-Term Care Insurance Credit?

A: Individuals who have paid premiums for long-term care insurance in Minnesota may be eligible to claim this credit.

Q: How do I claim the Long-Term Care Insurance Credit?

A: To claim the Long-Term Care Insurance Credit, you need to complete Schedule M1LTI and include it with your state tax return.

Q: What expenses are eligible for the Long-Term Care Insurance Credit?

A: Premiums paid for qualified long-term care insurance policies are eligible for the credit.

Q: Is there a limit to the amount of the credit?

A: Yes, there is a maximum credit amount that can be claimed based on the age of the insured person.

Q: Are there any other requirements to claim the Long-Term Care Insurance Credit?

A: Yes, you must meet the criteria specified by the state of Minnesota to be eligible for this credit.

Q: Can I claim the Long-Term Care Insurance Credit if I live in another state?

A: No, the Long-Term Care Insurance Credit is specific to Minnesota residents only.

Q: Is the Long-Term Care Insurance Credit refundable?

A: No, the credit is nonrefundable, but any excess credit can be carried forward to future tax years.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M1LTI by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.