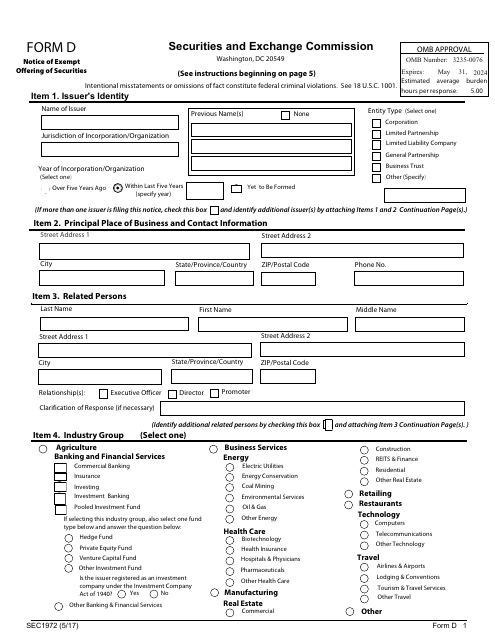

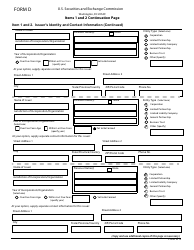

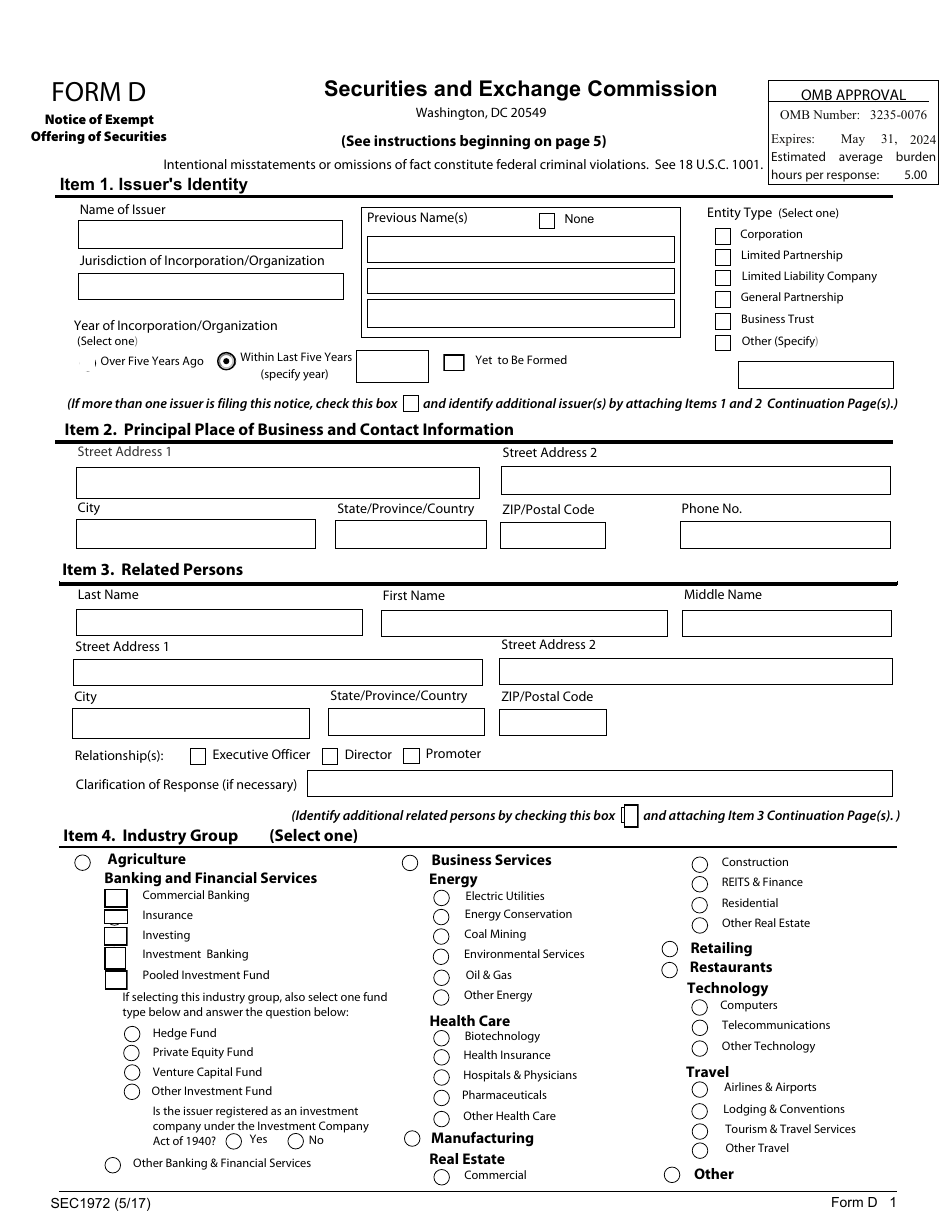

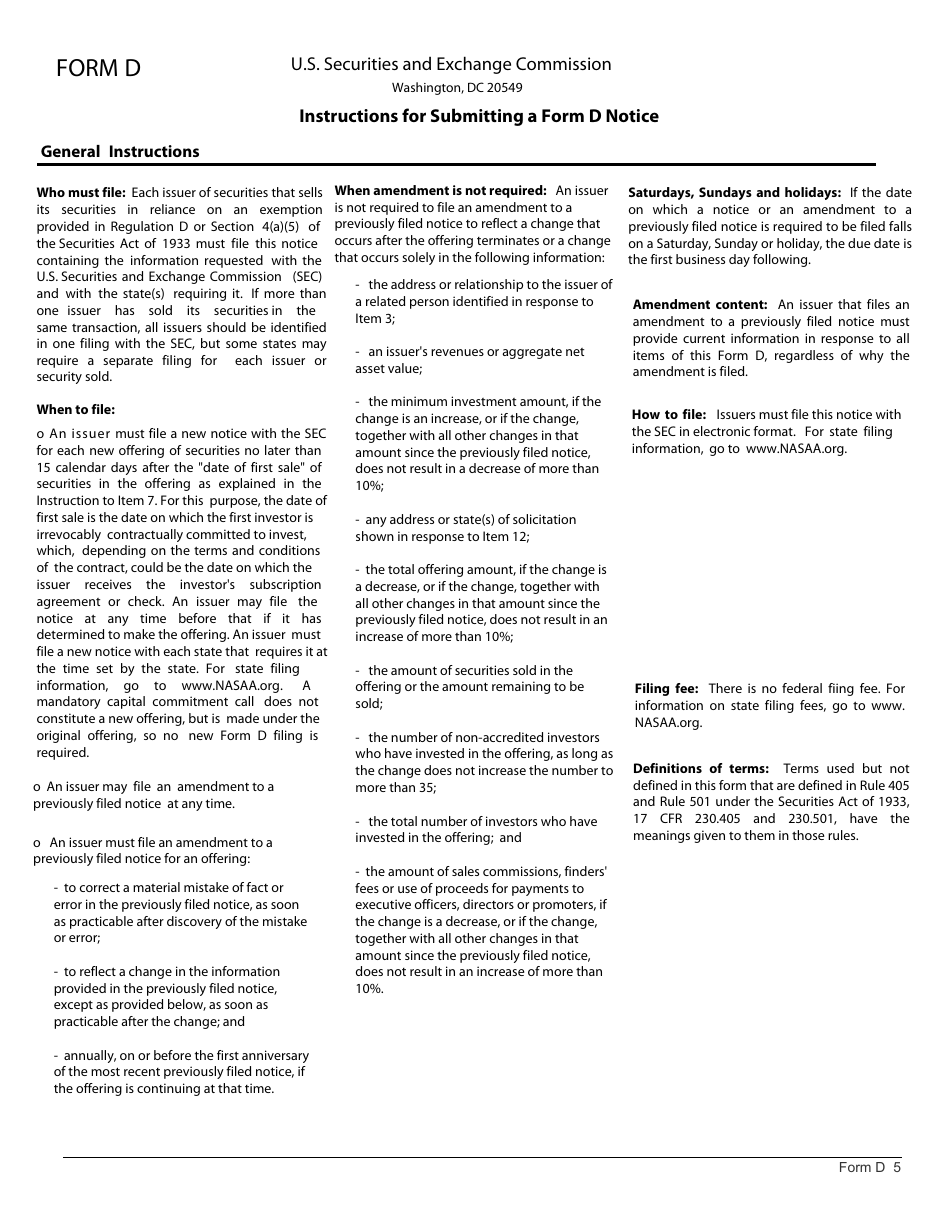

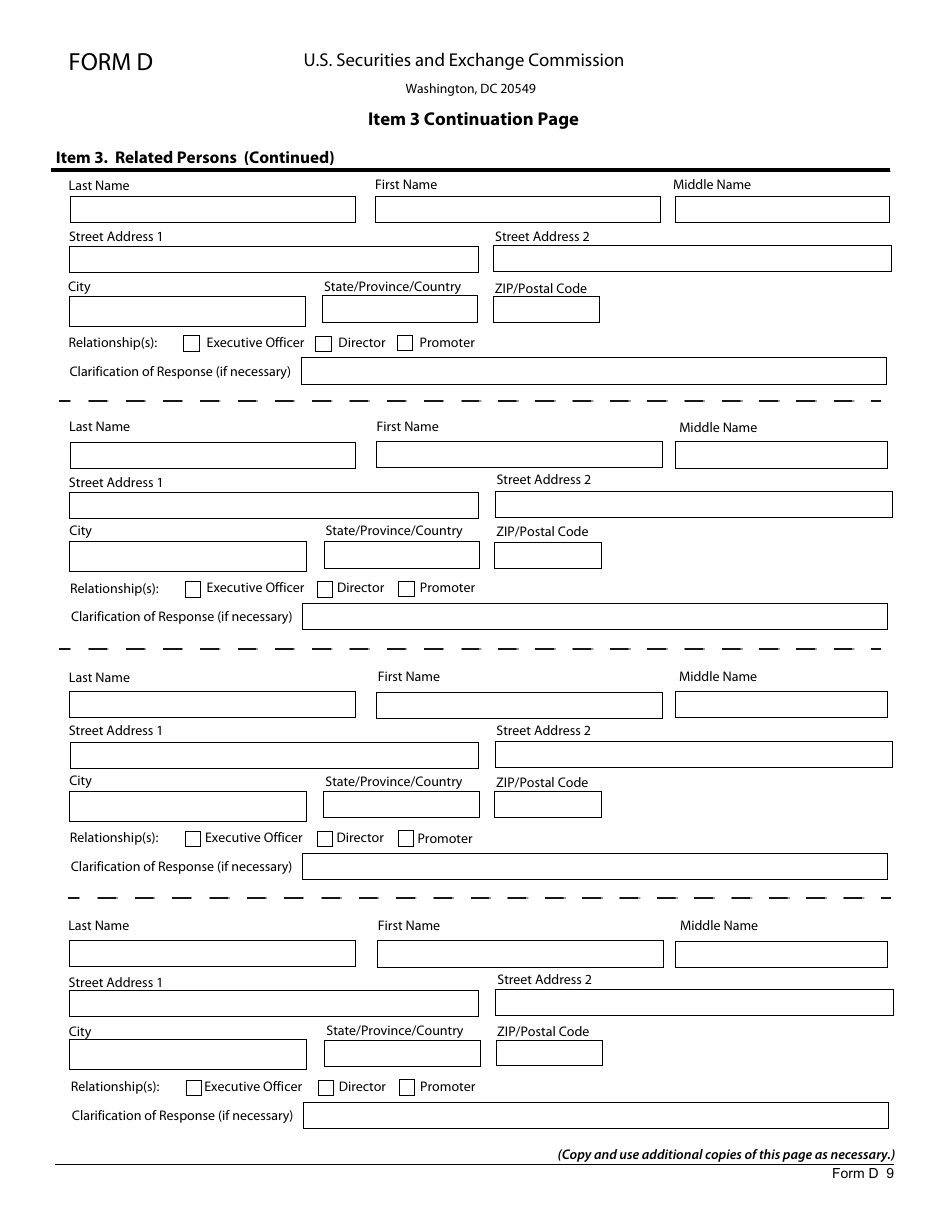

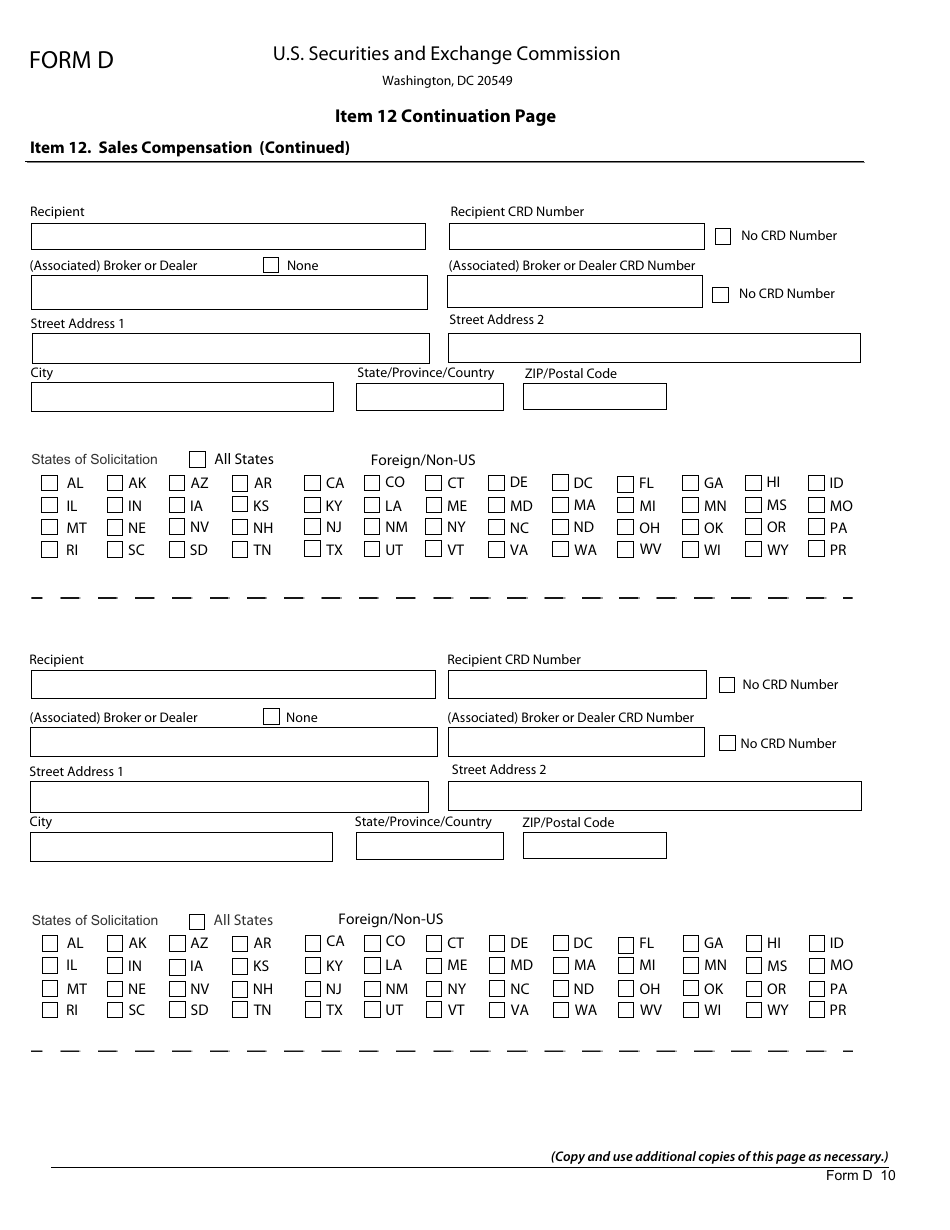

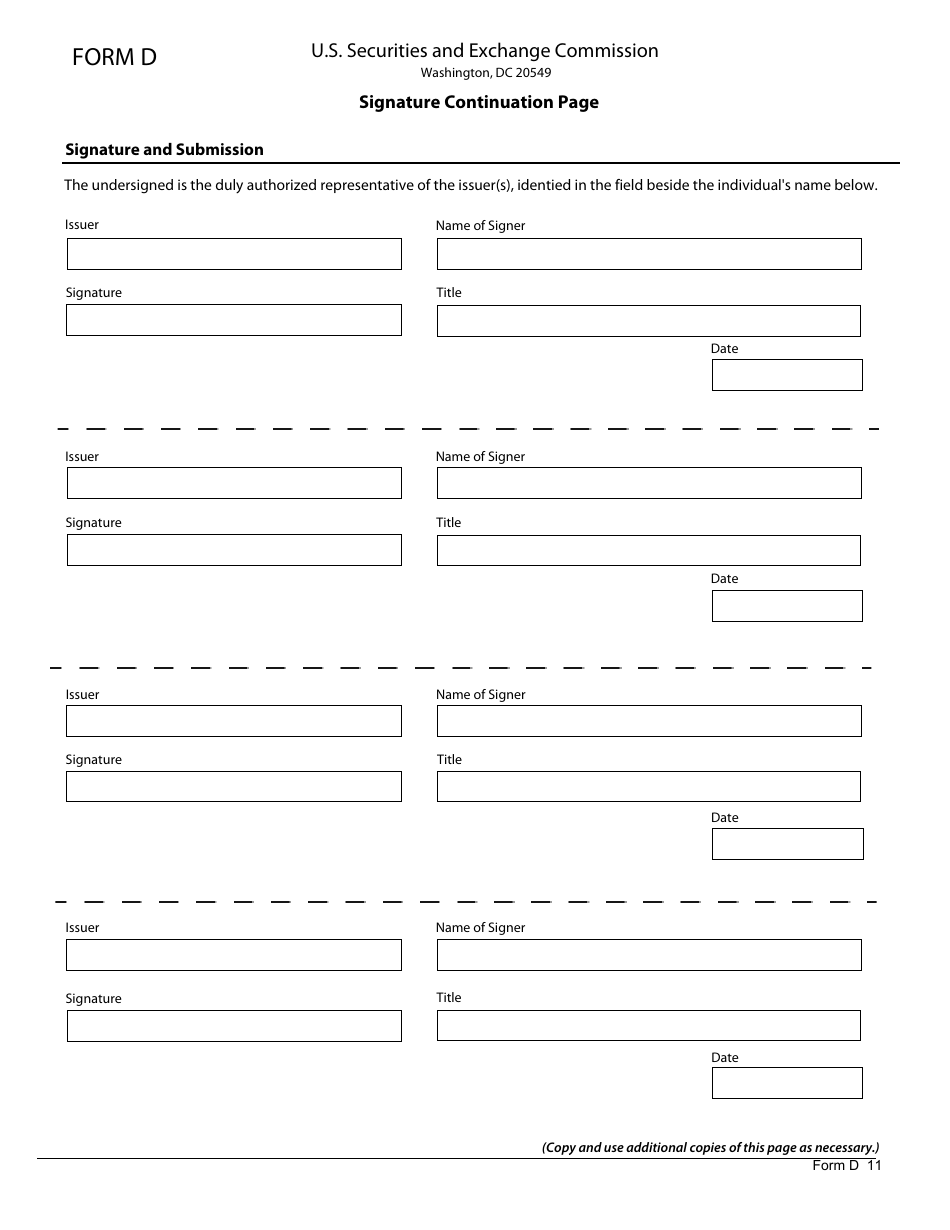

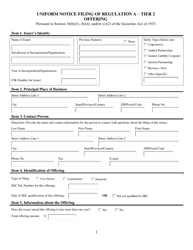

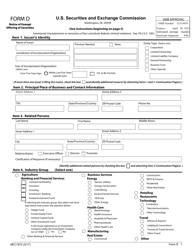

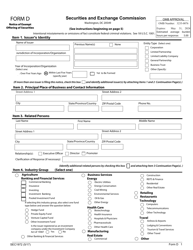

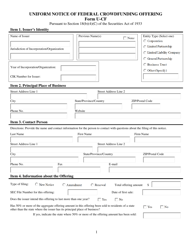

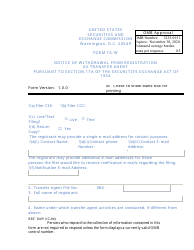

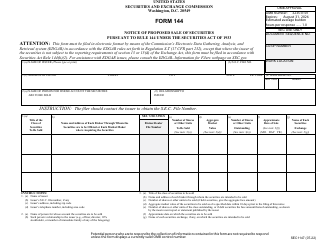

Form D (SEC1972) Notice of Exempt Offering of Securities

What Is Form D (SEC1972)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on May 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D?

A: Form D is a notice that must be filed with the Securities and Exchange Commission (SEC) by companies selling securities in an exempt offering.

Q: What is an exempt offering?

A: An exempt offering is a securities offering that is exempt from the registration requirements of the Securities Act of 1933.

Q: Who is required to file Form D?

A: Companies offering securities in an exempt offering must file Form D with the SEC.

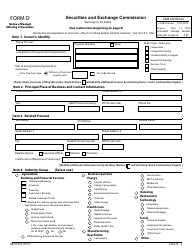

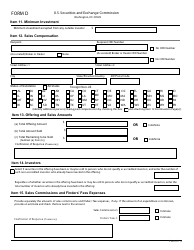

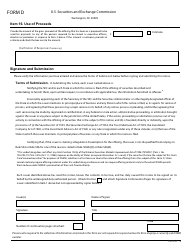

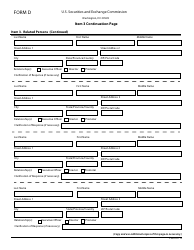

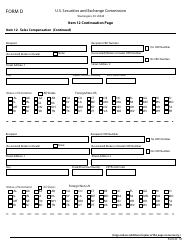

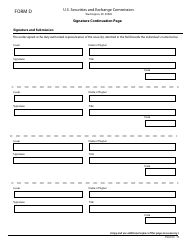

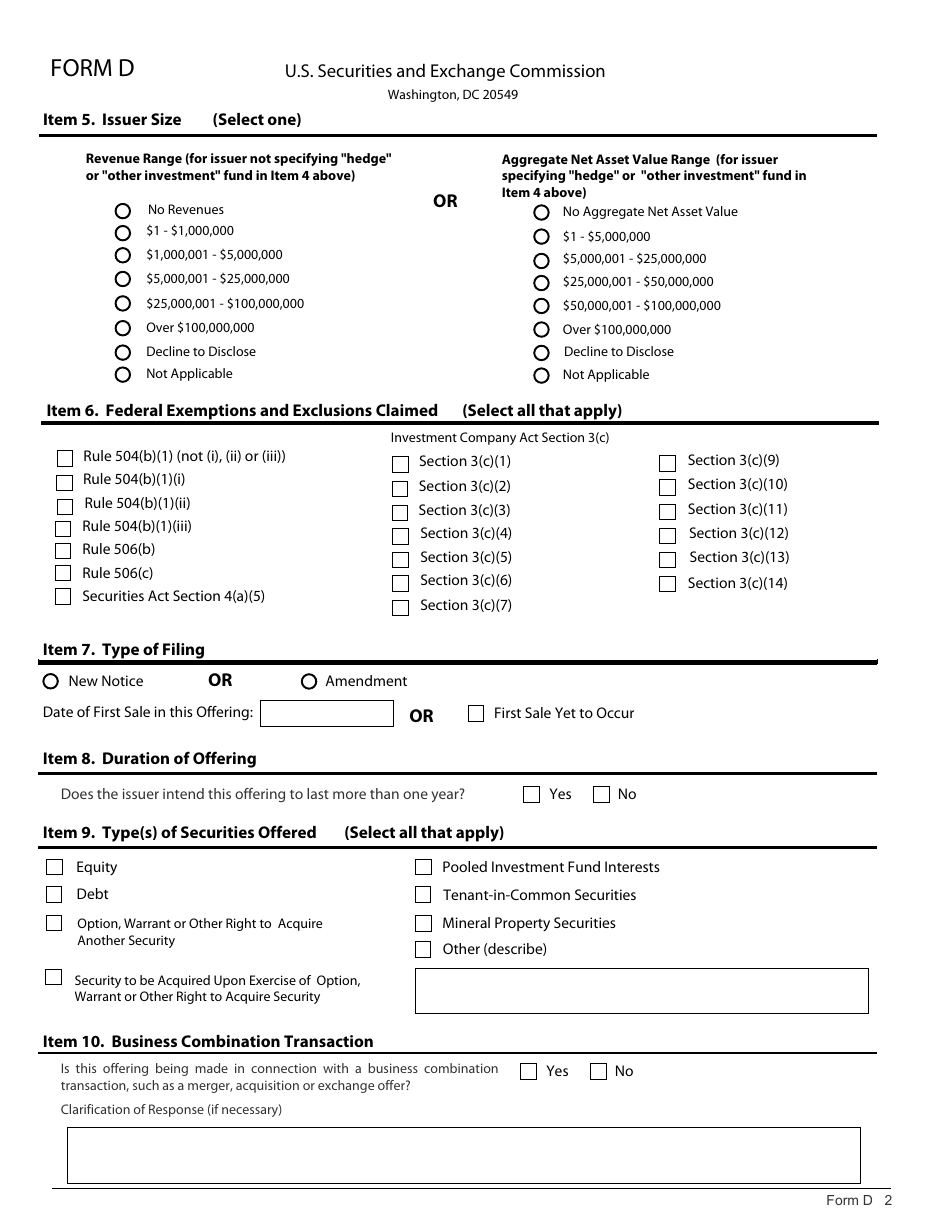

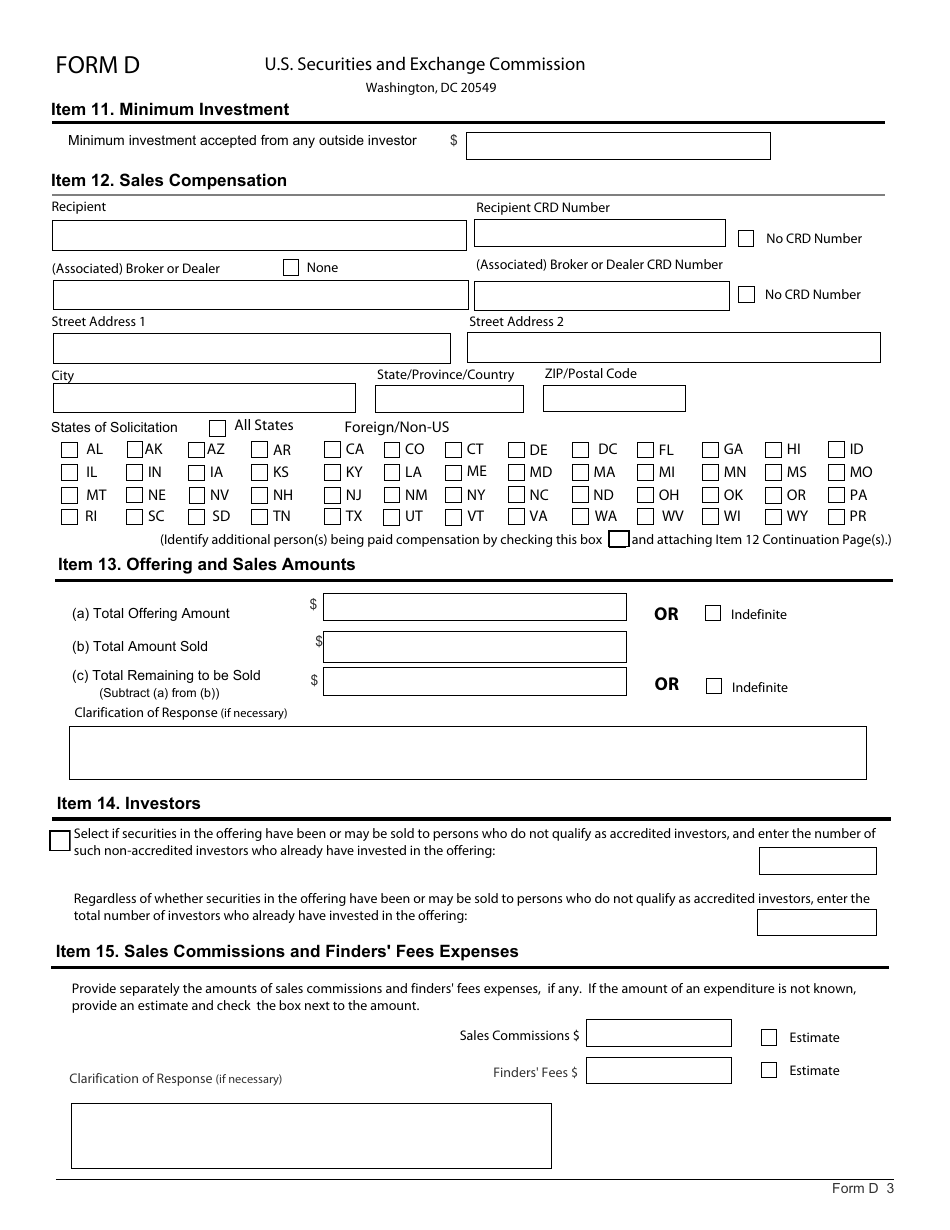

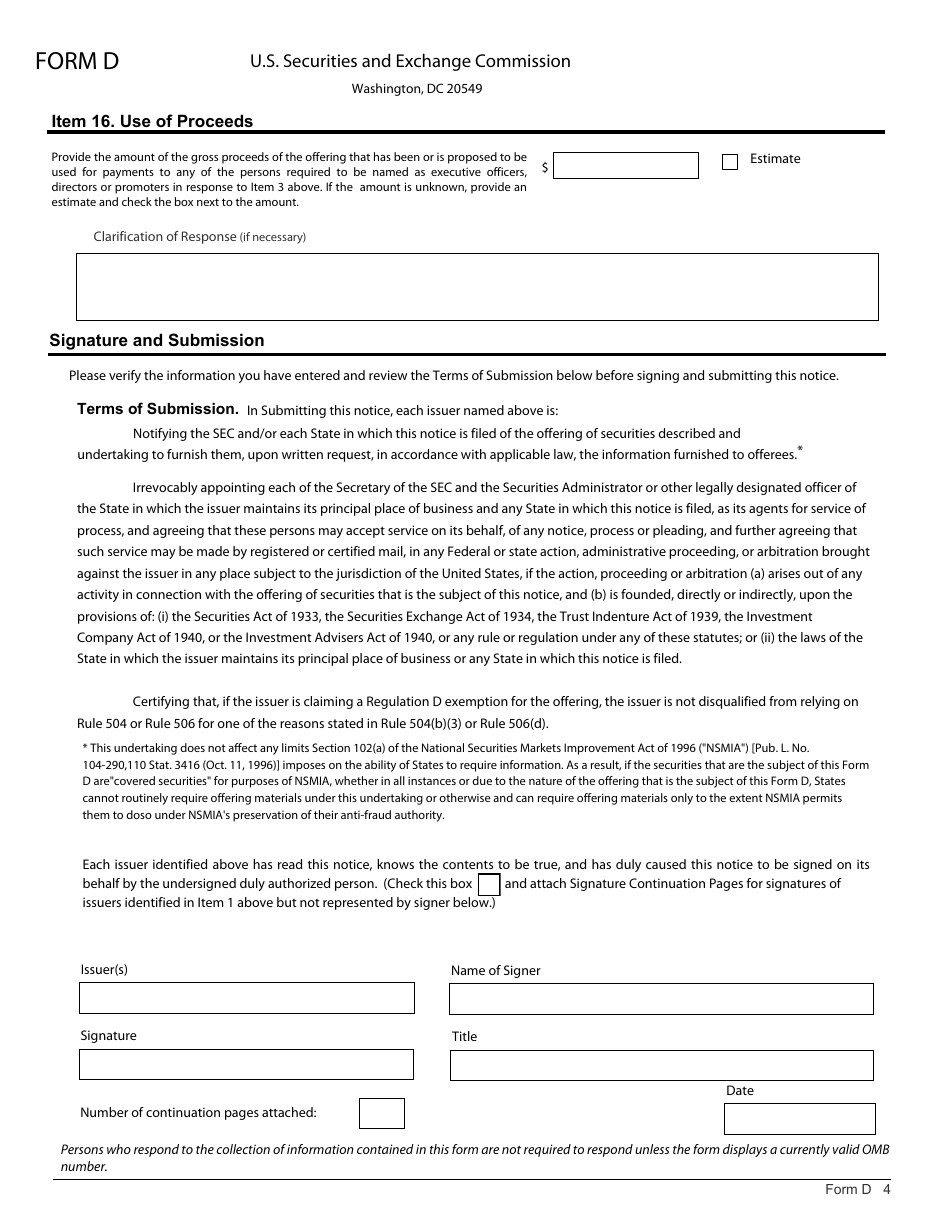

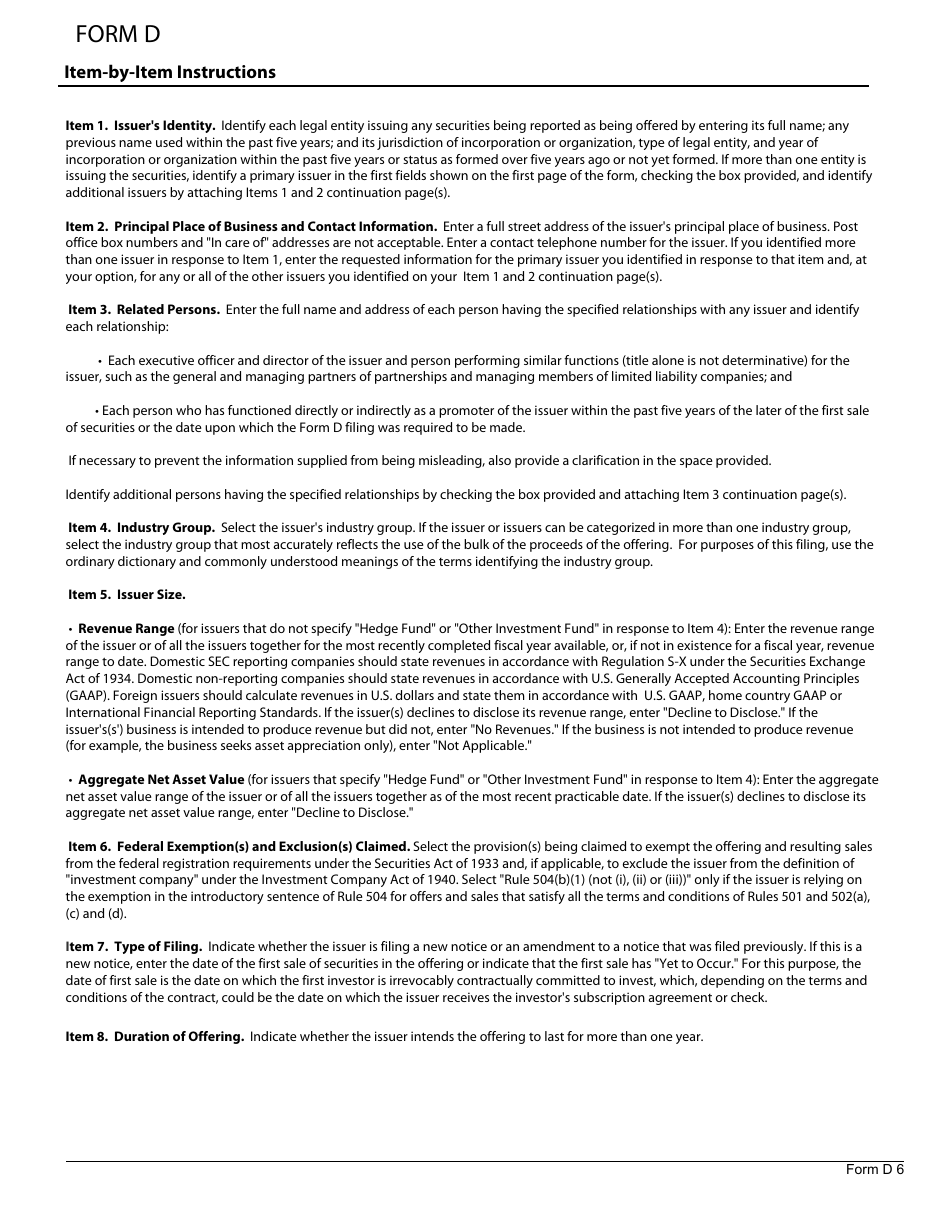

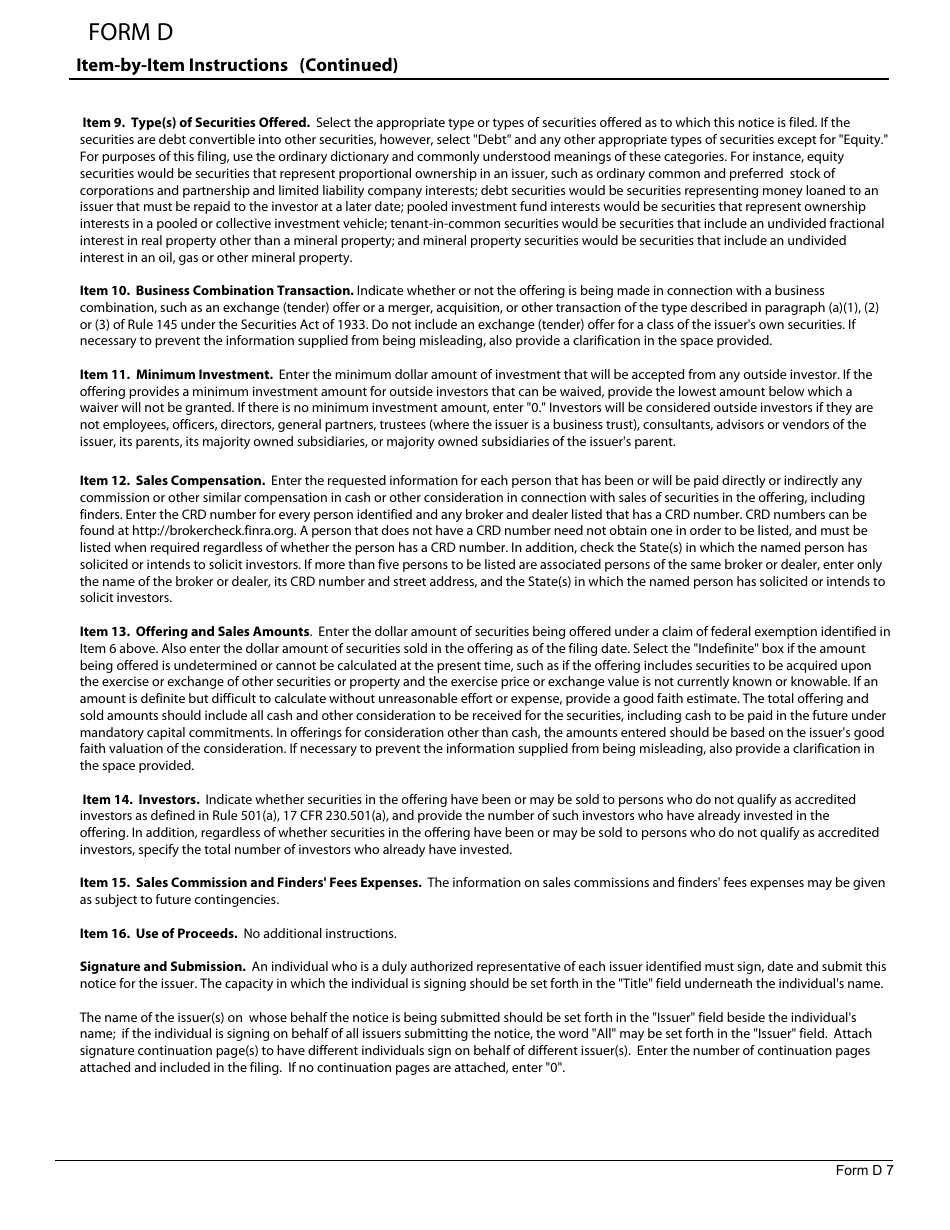

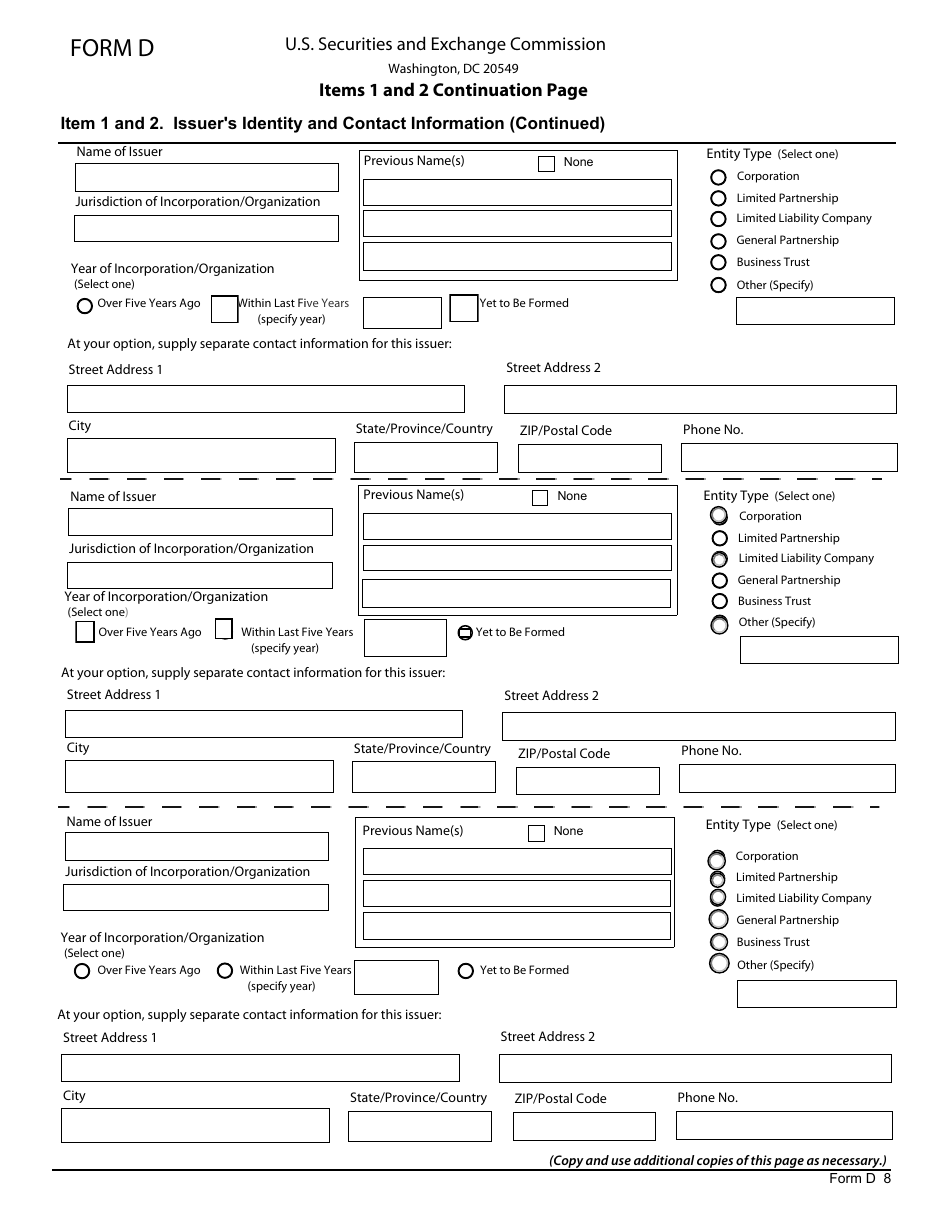

Q: What information is included in Form D?

A: Form D includes information about the issuer, the offering, and the terms of the offering.

Q: Why is Form D important?

A: Form D provides important information to the SEC and potential investors about exempt offerings of securities.

Q: Are there any filing fees associated with Form D?

A: No, there are no filing fees for Form D.

Q: Can a company make multiple Form D filings?

A: Yes, a company can make multiple Form D filings for different exempt offerings.

Q: What happens if a company fails to file Form D?

A: Failure to file Form D can result in penalties and legal consequences.

Q: Do investors need to rely solely on Form D for information about an offering?

A: No, investors should conduct their own due diligence and consider other sources of information before making investment decisions.

Form Details:

- Released on May 1, 2017;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D (SEC1972) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.