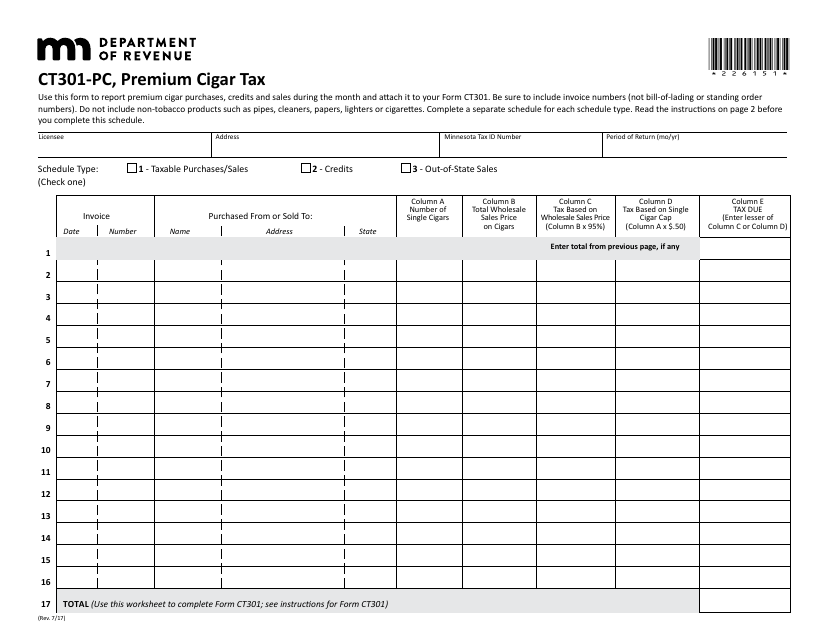

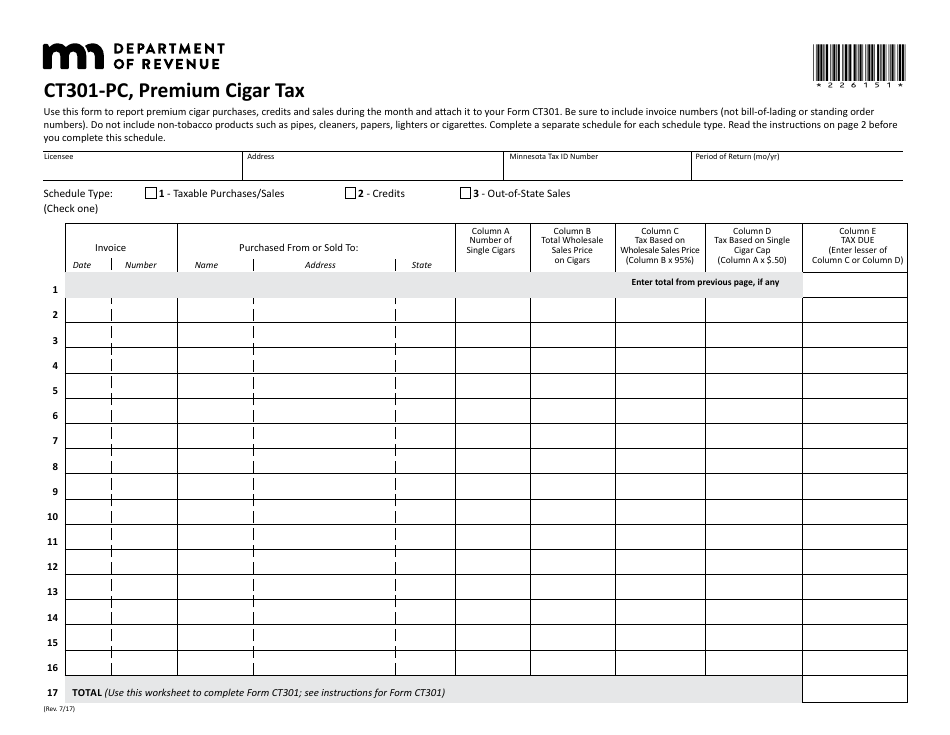

Form CT301-PC Premium Cigar Tax - Minnesota

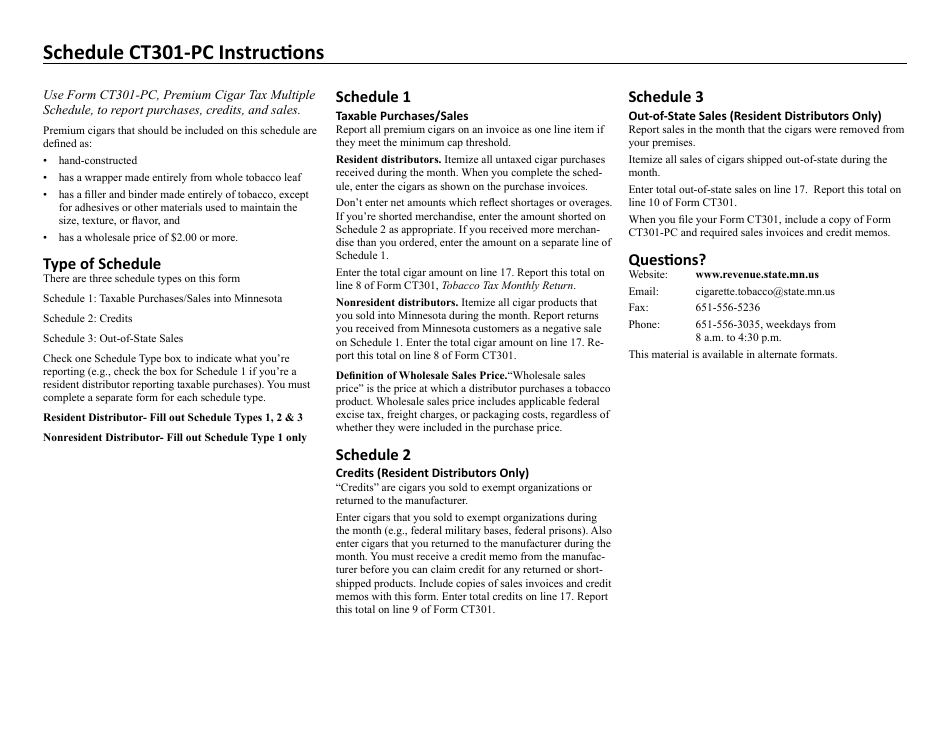

What Is Form CT301-PC?

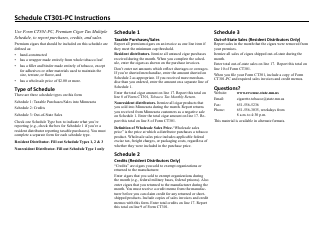

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT301-PC?

A: Form CT301-PC is the Premium Cigar Tax form used in Minnesota.

Q: What is the purpose of Form CT301-PC?

A: Form CT301-PC is used to report and pay the premium cigar tax in Minnesota.

Q: Who should file Form CT301-PC?

A: Retailers or distributors of premium cigars in Minnesota should file Form CT301-PC.

Q: When is Form CT301-PC due?

A: Form CT301-PC is due on a monthly basis, with the due date falling on the 18th of the following month.

Q: Are there any penalties for late filing or payment?

A: Yes, there are penalties for late filing or payment, including interest charges and possible license suspension.

Q: Can I file Form CT301-PC electronically?

A: Yes, you can file Form CT301-PC electronically through the Minnesota Department of Revenue's e-Services.

Q: Are there any exemptions or deductions available for premium cigar tax?

A: No, there are no exemptions or deductions available for premium cigar tax in Minnesota.

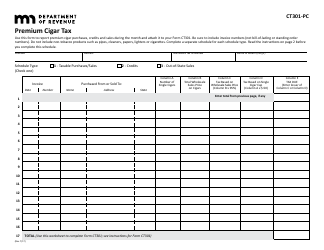

Q: What information do I need to complete Form CT301-PC?

A: You will need information such as the quantity and value of premium cigars sold during the reporting period.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT301-PC by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.