This version of the form is not currently in use and is provided for reference only. Download this version of

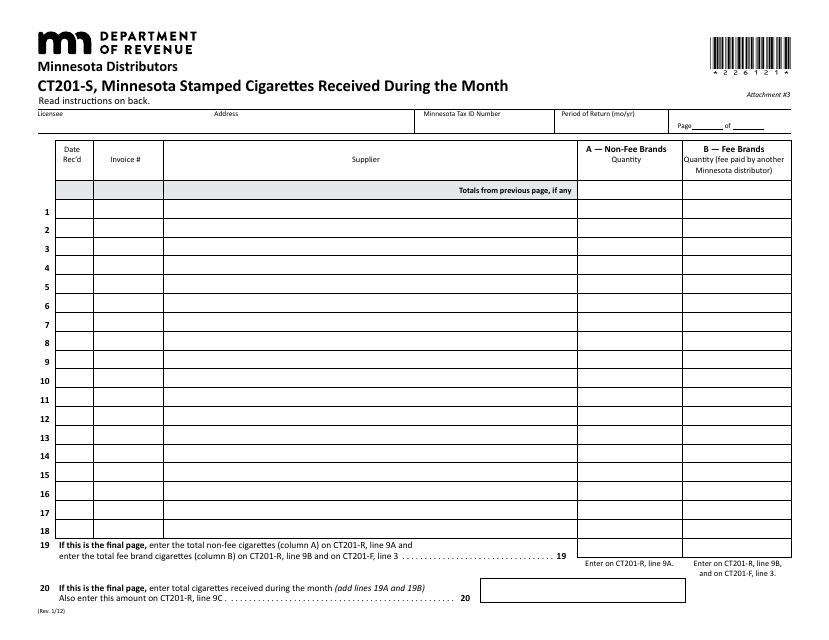

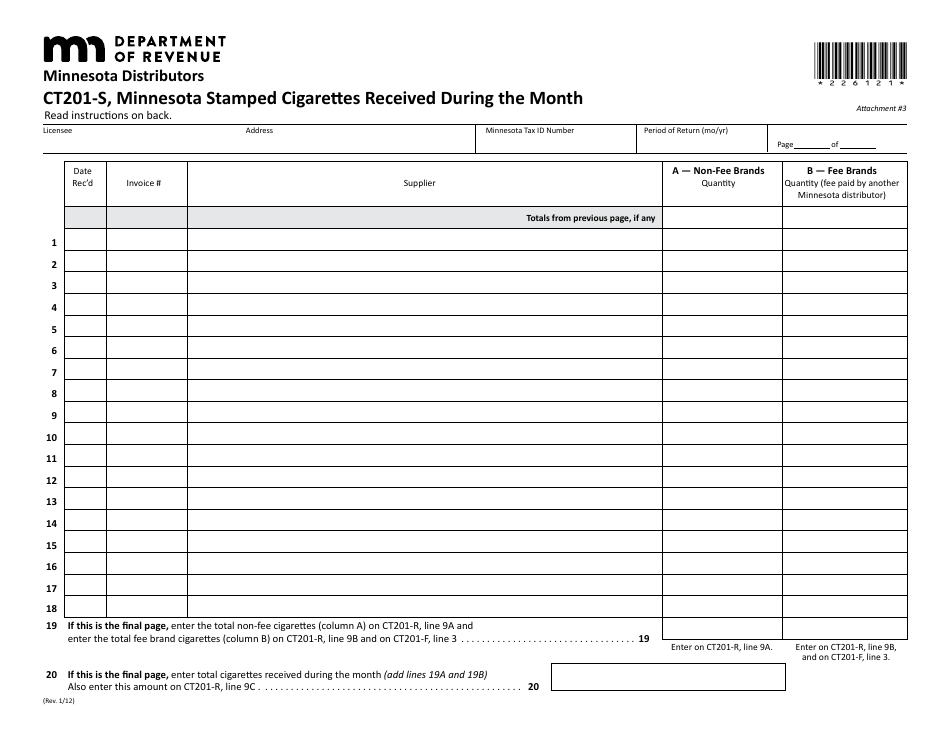

Form CT201-S

for the current year.

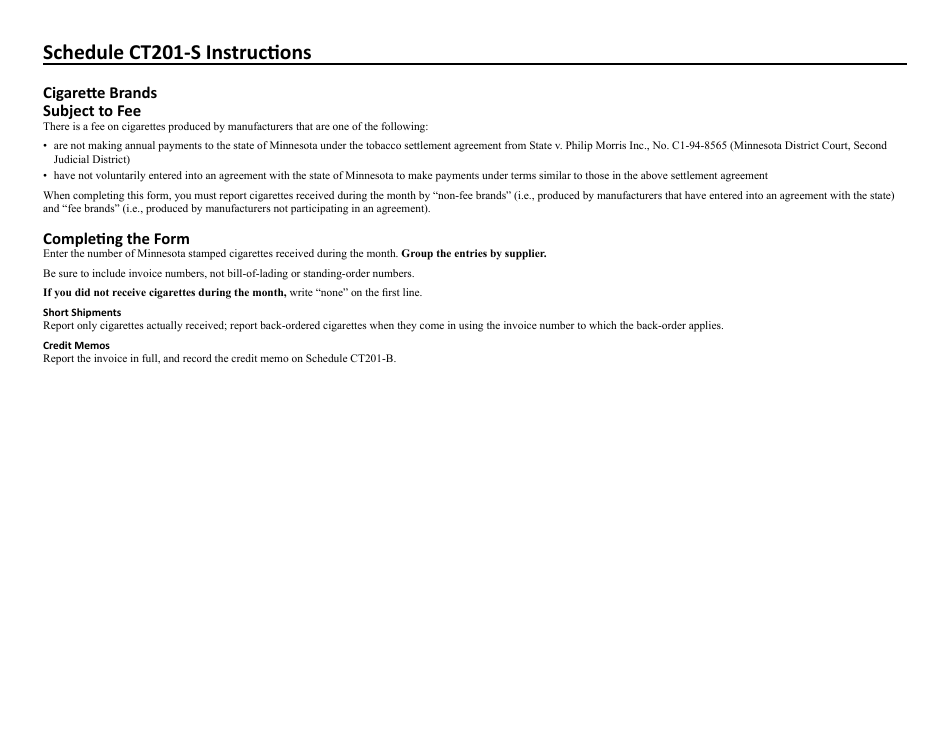

Form CT201-S Minnesota Stamped Cigarettes Received During the Month - Minnesota

What Is Form CT201-S?

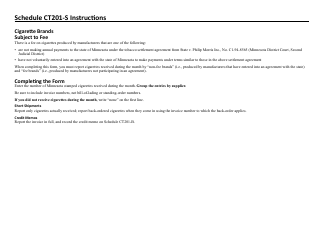

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT201-S?

A: Form CT201-S is a form used in Minnesota to report the stamped cigarettes received during the month.

Q: Who needs to file Form CT201-S?

A: Any person or entity in Minnesota who receives stamped cigarettes during the month needs to file Form CT201-S.

Q: What is the purpose of filing Form CT201-S?

A: The purpose of filing Form CT201-S is to report the quantity of stamped cigarettes received during the month in Minnesota.

Q: When is Form CT201-S due?

A: Form CT201-S is due on the 18th day of the month following the month being reported.

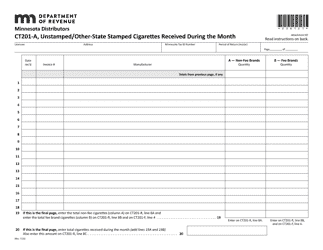

Q: What information is required on Form CT201-S?

A: On Form CT201-S, you need to provide your name, address, the number of cigarettes received, and other related information.

Q: Is there a penalty for not filing Form CT201-S?

A: Yes, there is a penalty for not filing Form CT201-S. It is important to file the form on time to avoid any penalties or consequences.

Q: Are there any exemptions or exceptions to filing Form CT201-S?

A: There may be exemptions or exceptions to filing Form CT201-S. It is best to consult the Minnesota Department of Revenue or a tax professional for specific details.

Q: Can I file Form CT201-S electronically?

A: Yes, you can file Form CT201-S electronically through the Minnesota Department of Revenue's e-Services system.

Q: Can I amend Form CT201-S if I made a mistake?

A: Yes, you can amend Form CT201-S if you made a mistake. You will need to file an amended form with the Minnesota Department of Revenue to correct any errors.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT201-S by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.