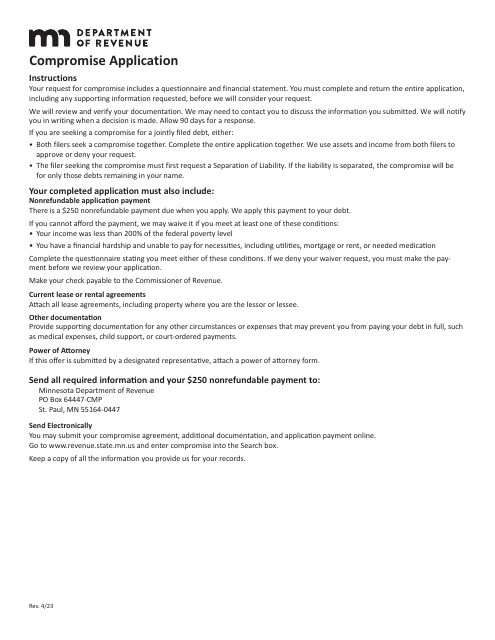

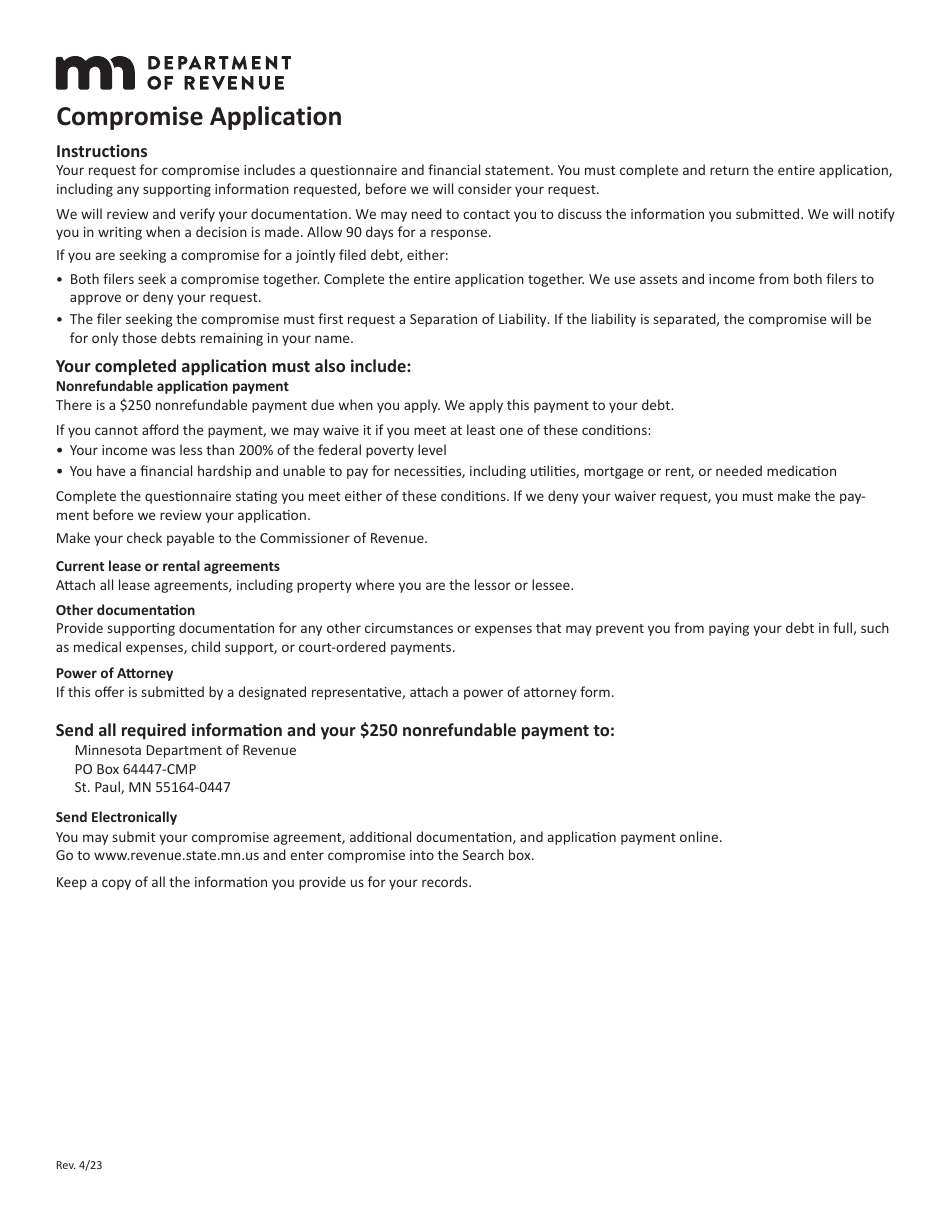

Compromise Questionnaire and Application - Minnesota

Compromise Questionnaire and Application is a legal document that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota.

FAQ

Q: What is a Compromise Questionnaire and Application?

A: Compromise Questionnaire and Application is a form used in Minnesota to request a compromise settlement of tax debt.

Q: Who can use the Compromise Questionnaire and Application?

A: The Compromise Questionnaire and Application can be used by individuals and businesses who have tax debt in Minnesota.

Q: What is the purpose of the Compromise Questionnaire and Application?

A: The purpose of the Compromise Questionnaire and Application is to apply for a compromise settlement of tax debt, which allows individuals and businesses to pay a reduced amount in order to resolve their tax liability.

Q: How does the compromise settlement work?

A: The compromise settlement allows individuals and businesses to negotiate with the Minnesota Department of Revenue to settle their tax debt for a reduced amount based on their financial situation.

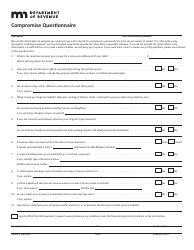

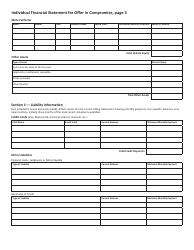

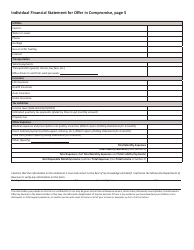

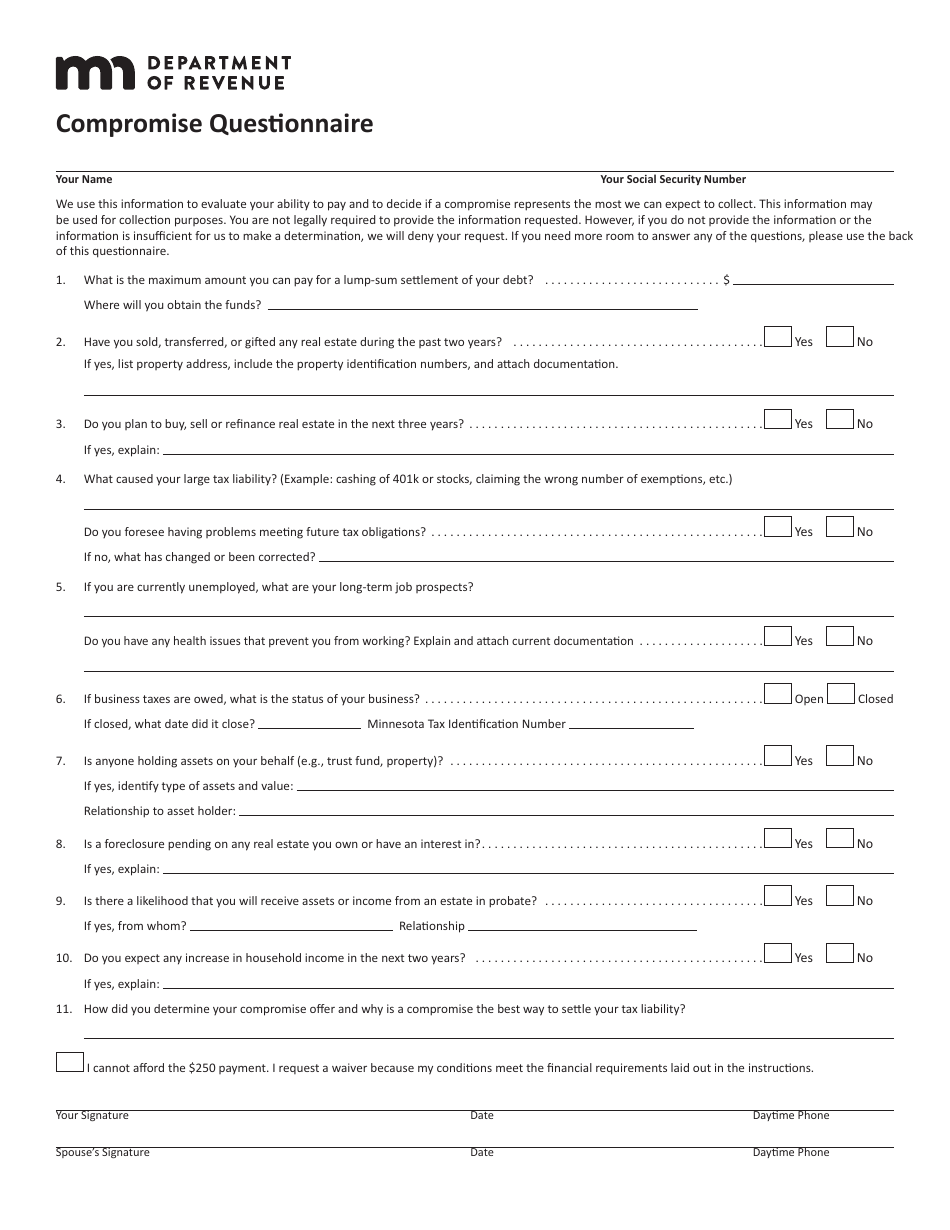

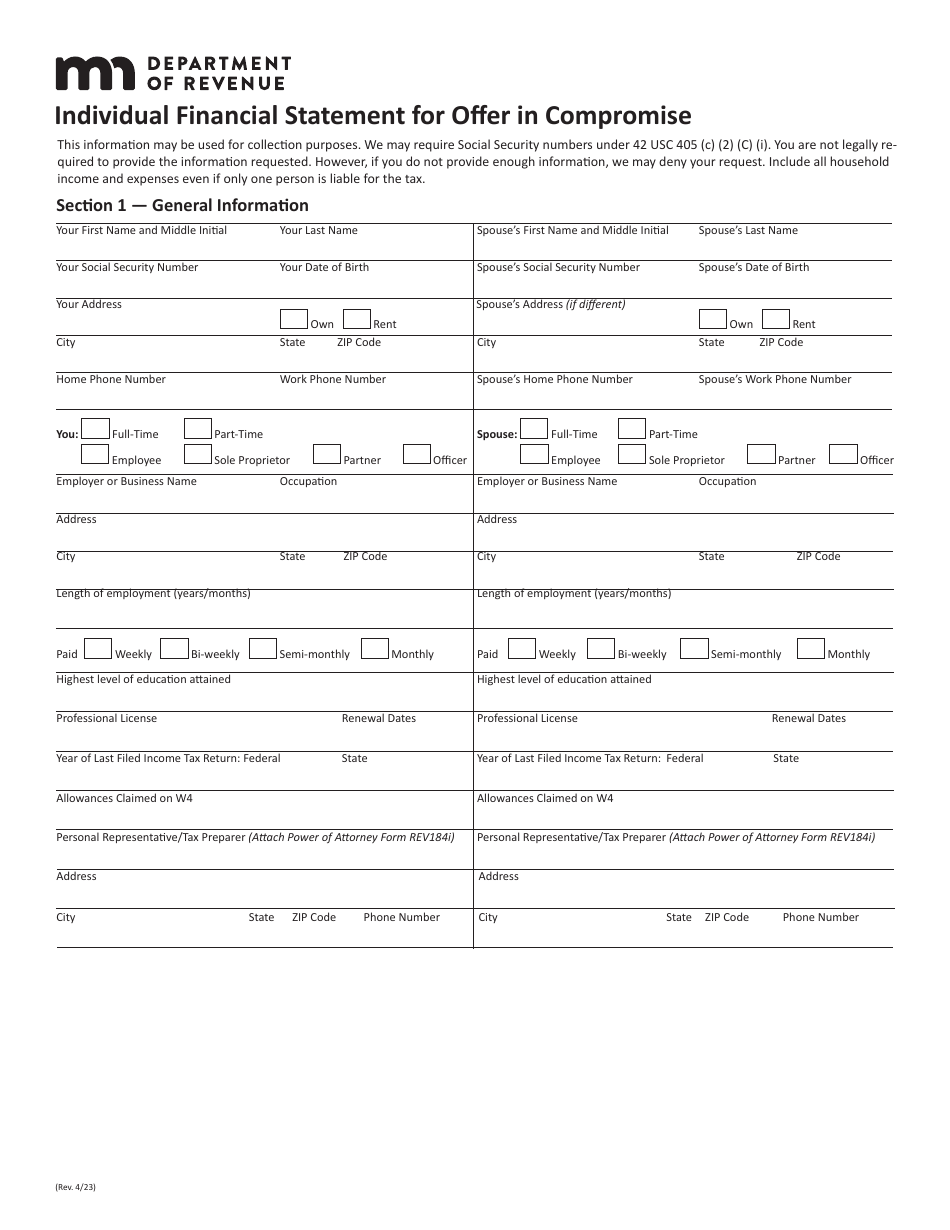

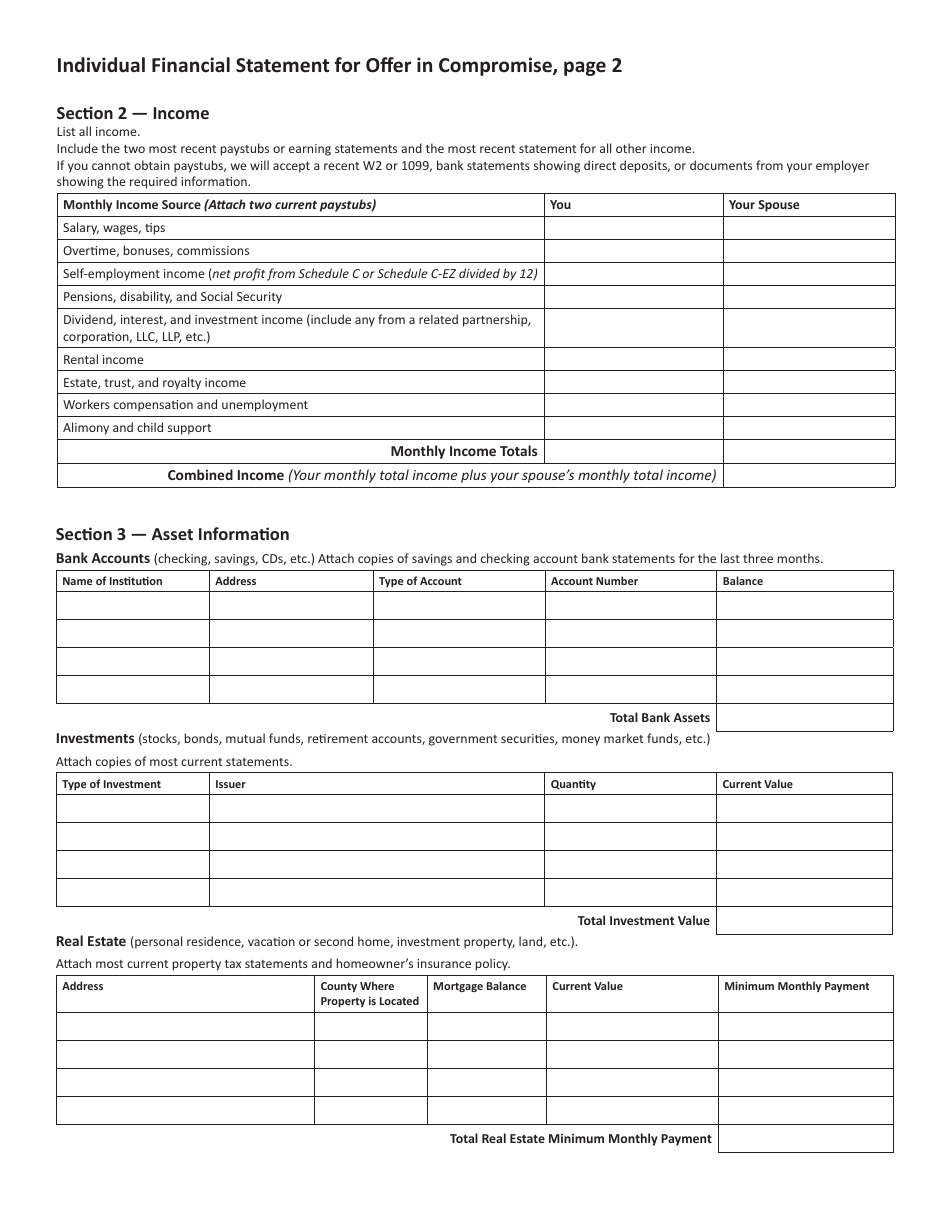

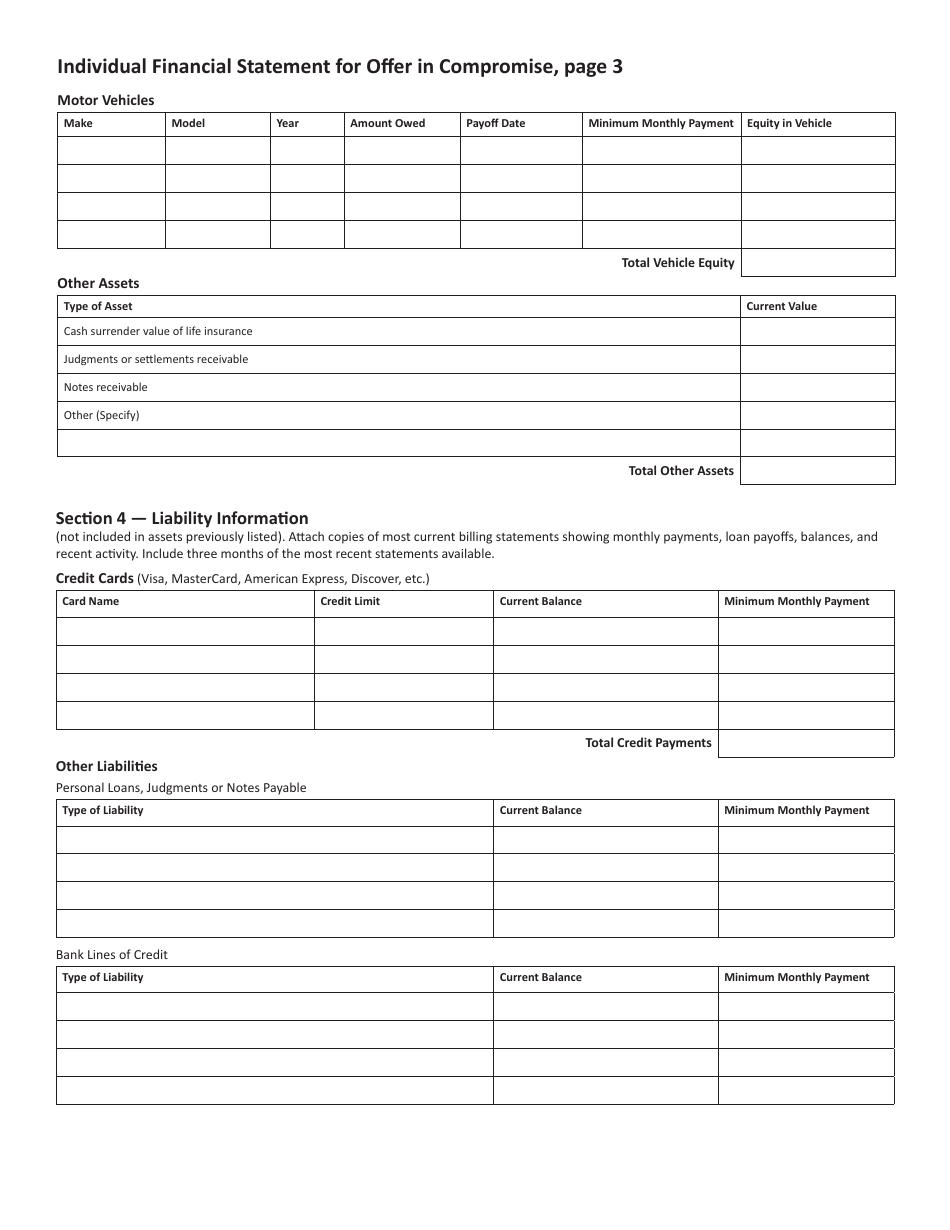

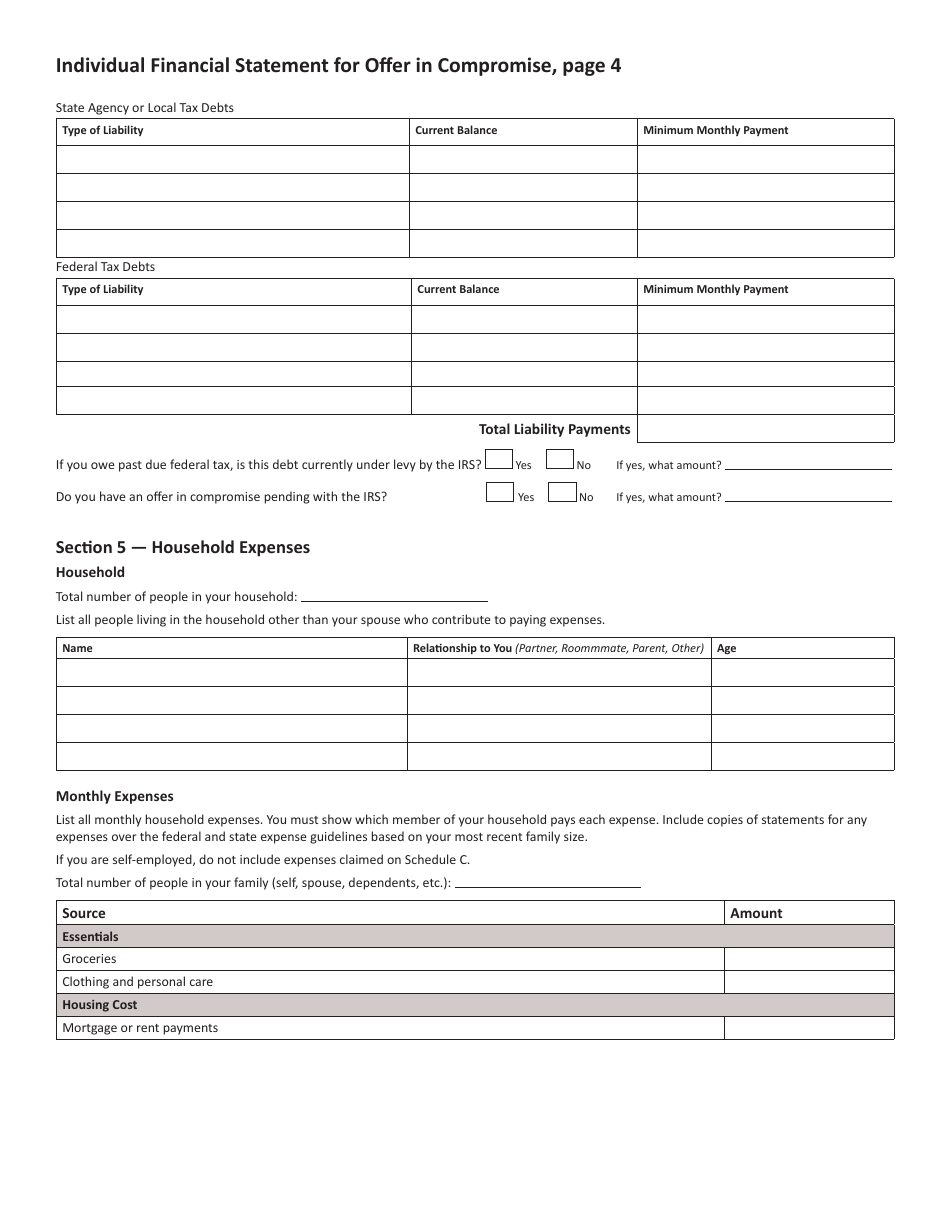

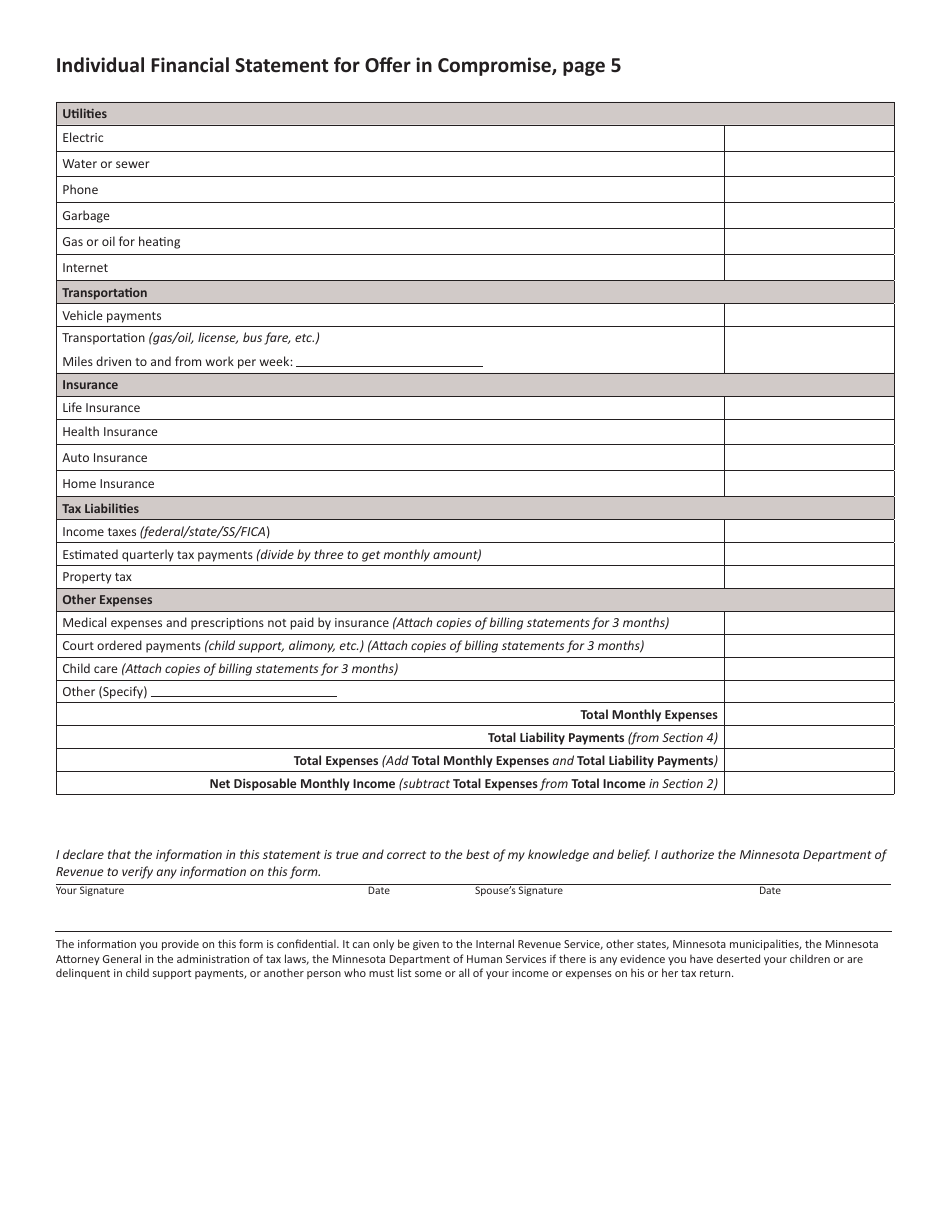

Q: What information is required in the Compromise Questionnaire and Application?

A: The Compromise Questionnaire and Application requires detailed information about the applicant's financial situation, including income, assets, and expenses.

Q: Is there a fee to submit the Compromise Questionnaire and Application?

A: Yes, there is a non-refundable fee of $420 to submit the Compromise Questionnaire and Application.

Q: What happens after I submit the Compromise Questionnaire and Application?

A: After submitting the Compromise Questionnaire and Application, the Minnesota Department of Revenue will review the application and determine if the applicant qualifies for a compromise settlement.

Form Details:

- Released on April 1, 2023;

- The latest edition currently provided by the Minnesota Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.