This version of the form is not currently in use and is provided for reference only. Download this version of

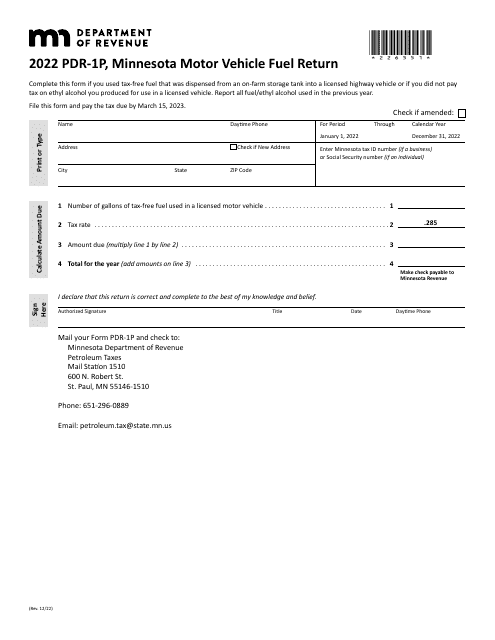

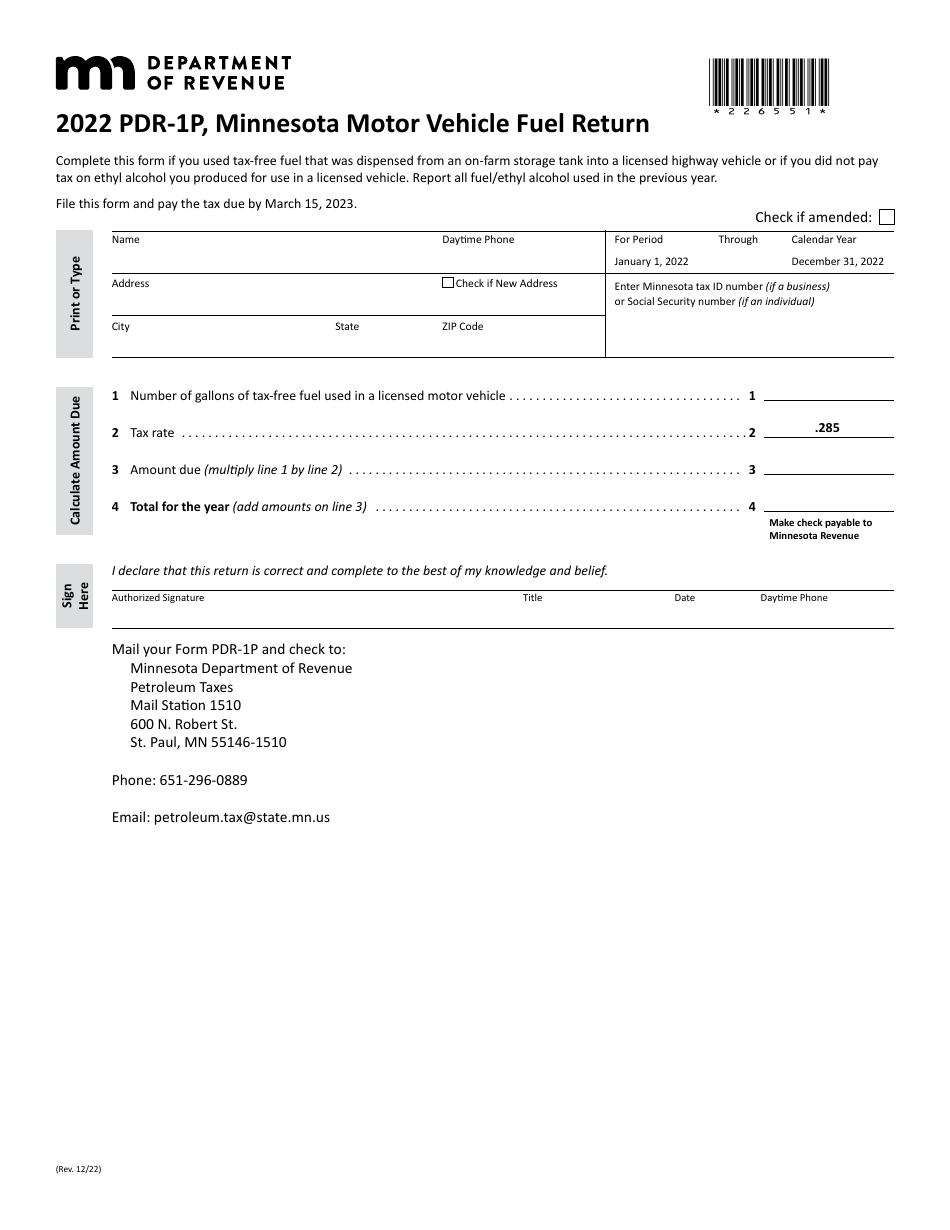

Form PDR-1P

for the current year.

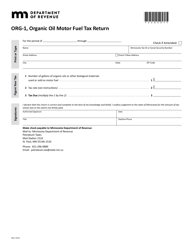

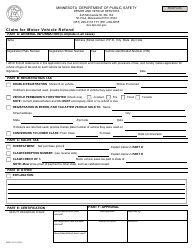

Form PDR-1P Minnesota Motor Vehicle Fuel Return - Minnesota

What Is Form PDR-1P?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PDR-1P?

A: Form PDR-1P is the Minnesota Motor Vehicle Fuel Return form.

Q: What is the purpose of Form PDR-1P?

A: Form PDR-1P is used to report and pay the Minnesota motor vehicle fuel tax.

Q: Who needs to file Form PDR-1P?

A: Any person or entity who distributes motor vehicle fuel in Minnesota needs to file Form PDR-1P.

Q: What information is required on Form PDR-1P?

A: Form PDR-1P requires information such as the gallons of motor vehicle fuel distributed, the tax rate, and any credits or refunds.

Q: When is Form PDR-1P due?

A: Form PDR-1P is due on a monthly basis, with the due date falling on the 22nd day of the month following the end of the reporting period.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PDR-1P by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.