This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT401-LC

for the current year.

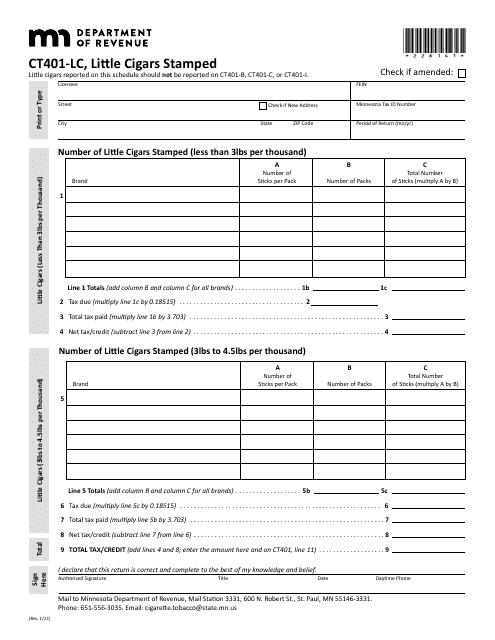

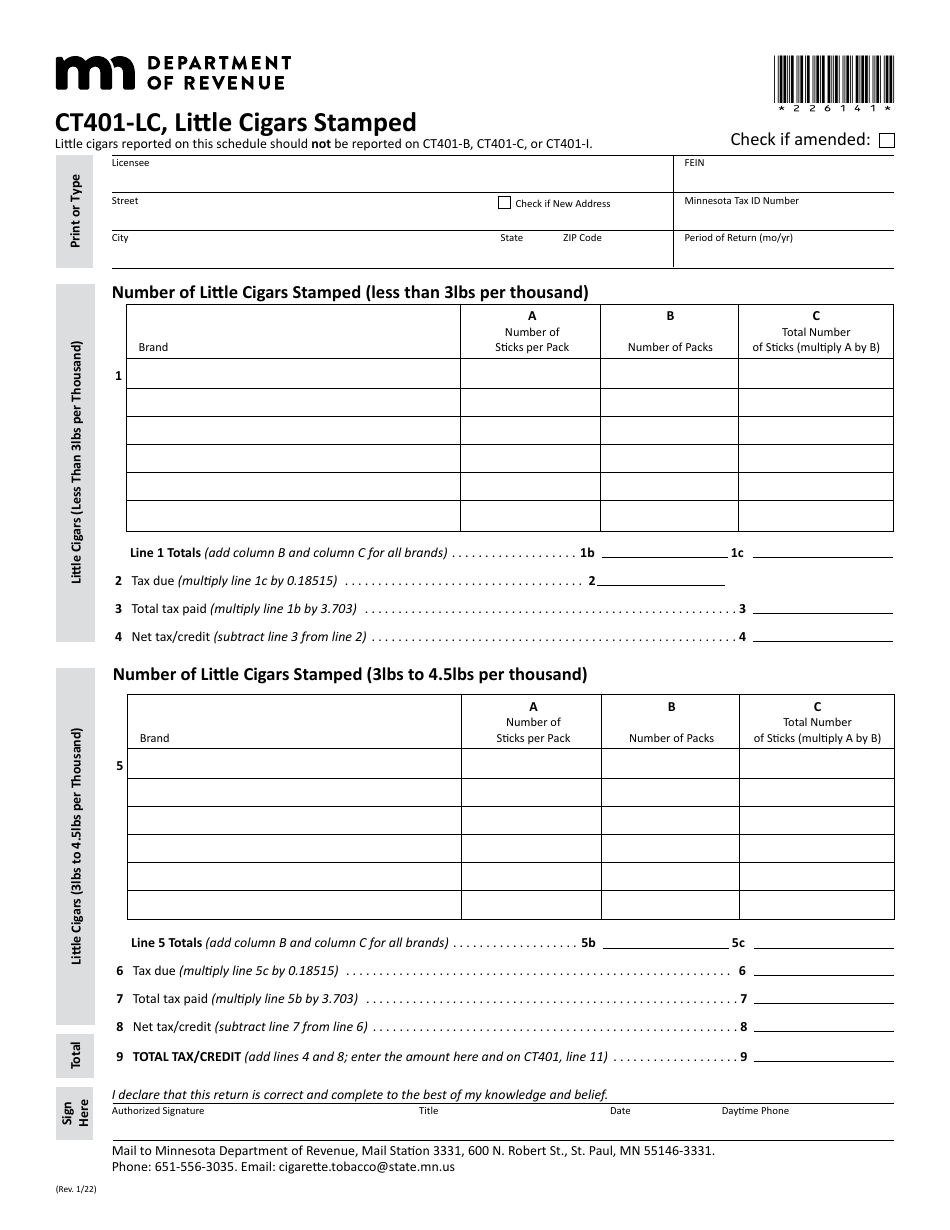

Form CT401-LC Little Cigars Stamped (Periods Prior to Jan. 1, 2023) - Minnesota

What Is Form CT401-LC?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

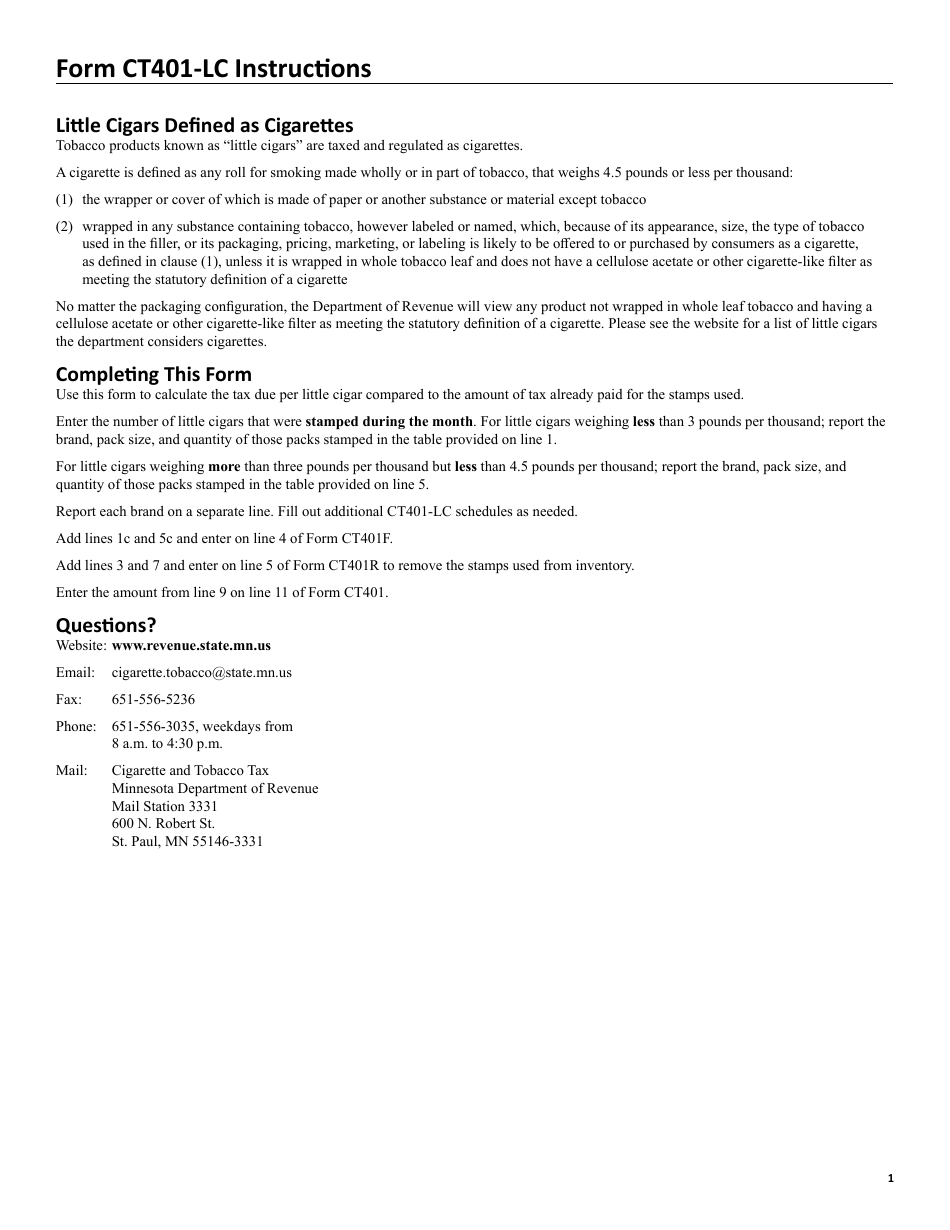

Q: What is Form CT401-LC?

A: Form CT401-LC is a tax form used in Minnesota for reporting little cigars that have been stamped before January 1, 2023.

Q: What are little cigars?

A: Little cigars are small cigars that resemble cigarettes but are classified as cigars for tax purposes.

Q: What is the purpose of Form CT401-LC?

A: The purpose of Form CT401-LC is to report the sale and distribution of little cigars that have been stamped prior to January 1, 2023.

Q: Who is required to file Form CT401-LC?

A: Any individual or business that sells or distributes little cigars stamped prior to January 1, 2023 in Minnesota is required to file Form CT401-LC.

Q: When is the due date for filing Form CT401-LC?

A: Form CT401-LC must be filed on a monthly basis, with the due date falling on the 18th of the following month.

Q: Are there any penalties for late filing of Form CT401-LC?

A: Yes, there are penalties for late filing of Form CT401-LC, including interest on unpaid taxes and potential criminal charges for willful noncompliance.

Q: Can Form CT401-LC be filed electronically?

A: Yes, Form CT401-LC can be filed electronically through the Minnesota Department of Revenue's e-Services portal.

Q: What information is required to complete Form CT401-LC?

A: To complete Form CT401-LC, you will need to provide information about the quantity and sale/distribution details of the little cigars.

Q: Do I need to keep copies of filed Form CT401-LC?

A: Yes, it is recommended to keep copies of filed Form CT401-LC and related records for a minimum of four years for auditing purposes.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT401-LC by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.