This version of the form is not currently in use and is provided for reference only. Download this version of

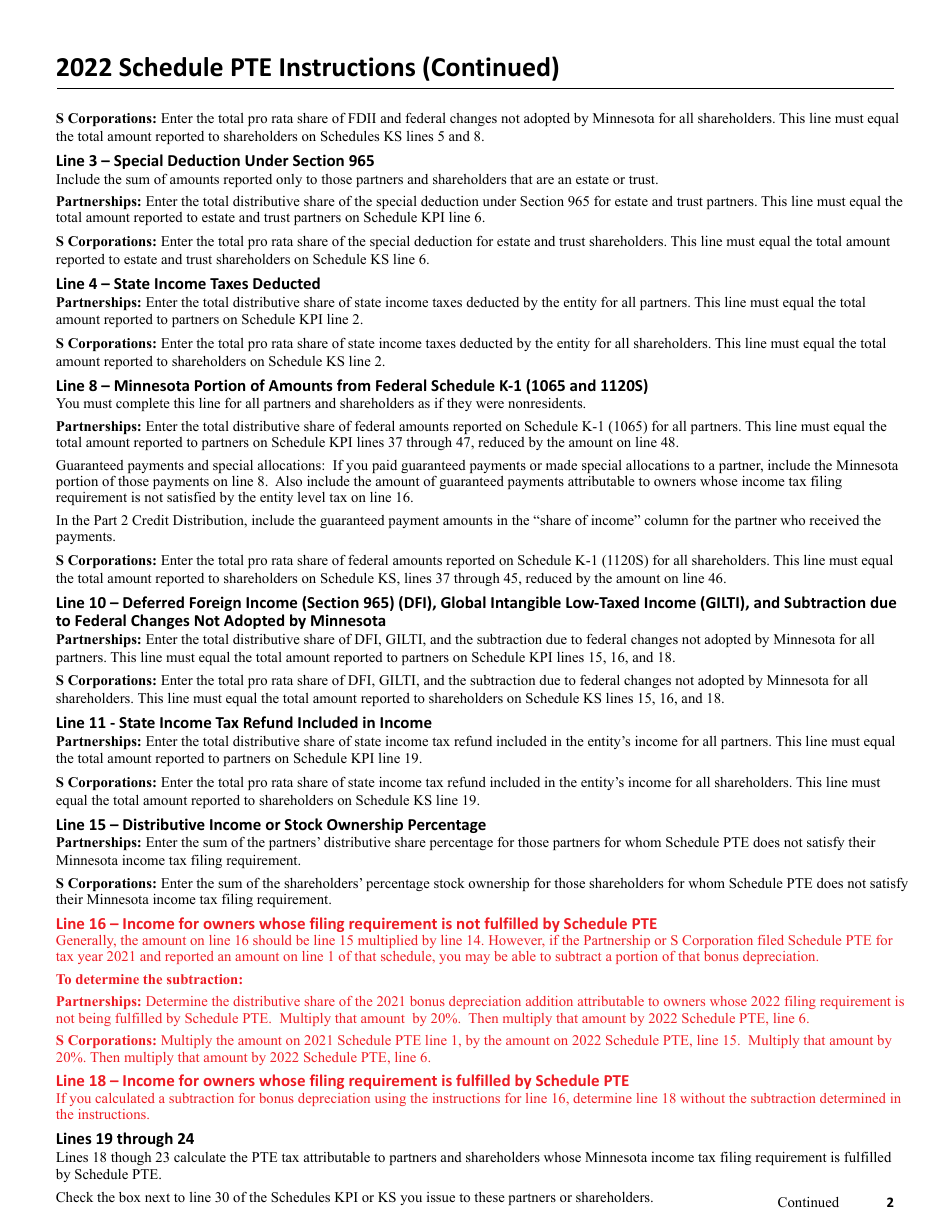

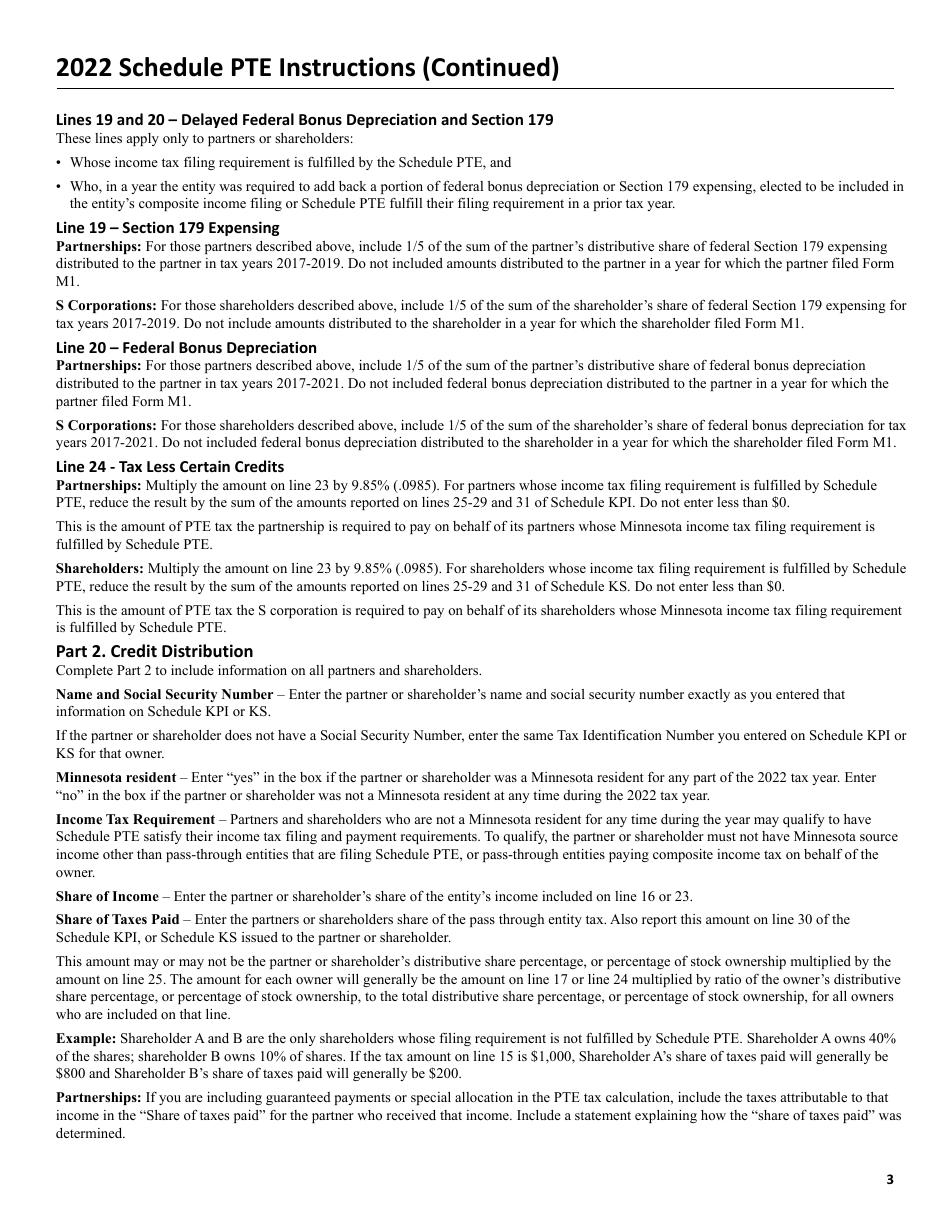

Schedule PTE

for the current year.

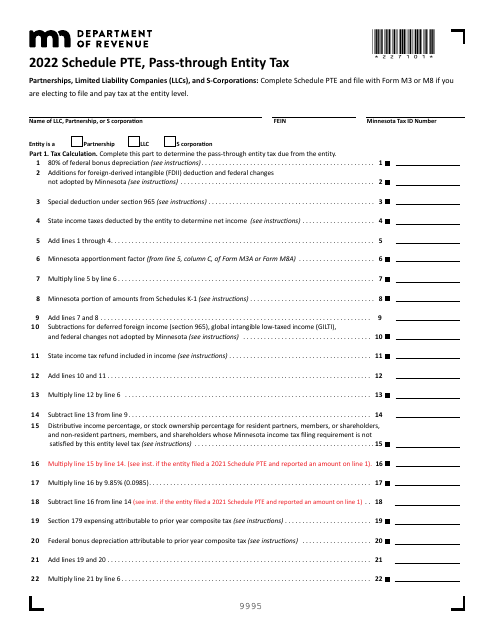

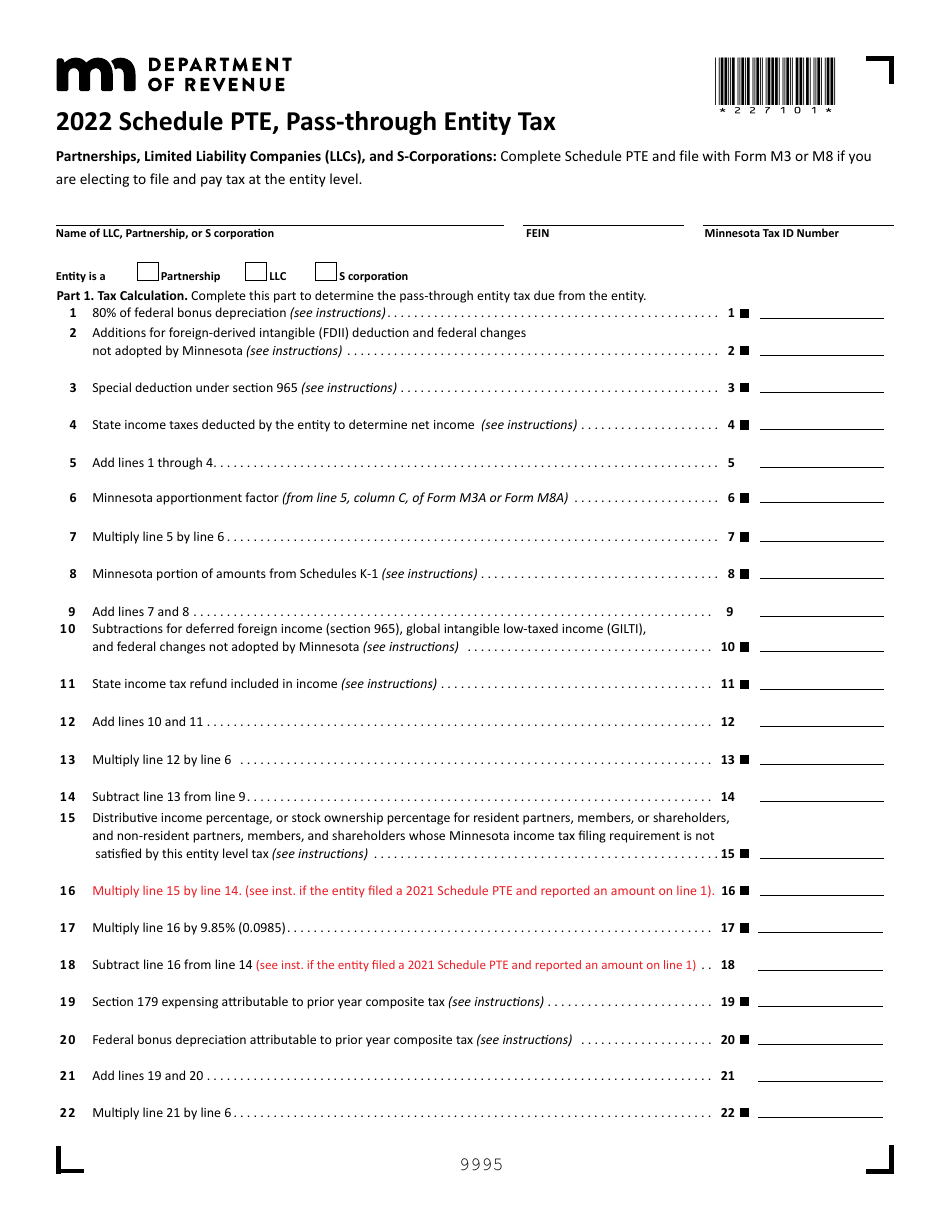

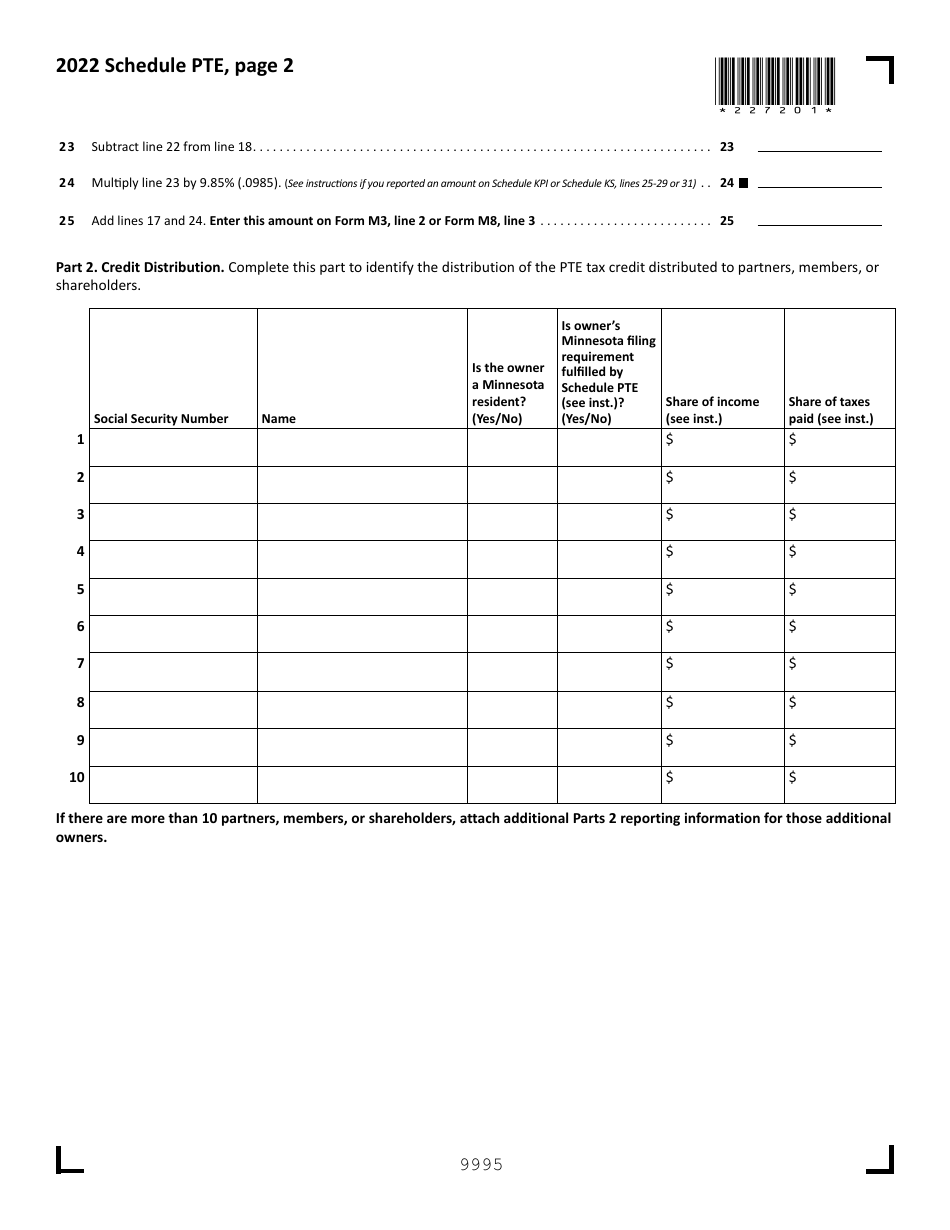

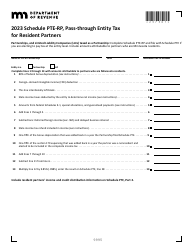

Schedule PTE Pass-Through Entity Tax - Minnesota

What Is Schedule PTE?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

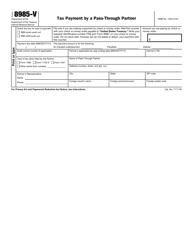

Q: What is PTE Pass-Through Entity Tax?

A: PTE Pass-Through Entity Tax is a tax imposed on pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs), in Minnesota.

Q: Who needs to pay PTE Pass-Through Entity Tax?

A: Pass-through entities doing business in Minnesota are generally required to pay PTE Pass-Through Entity Tax.

Q: How is the PTE Pass-Through Entity Tax calculated?

A: The PTE Pass-Through Entity Tax is calculated based on the entity's Minnesota source income, which includes income, gains, losses, and deductions attributable to Minnesota.

Q: What is the purpose of the PTE Pass-Through Entity Tax?

A: The purpose of the PTE Pass-Through Entity Tax is to ensure that pass-through entities pay their fair share of taxes on income earned in Minnesota.

Q: When is the PTE Pass-Through Entity Tax due?

A: The Minnesota PTE Pass-Through Entity Tax is due on the 15th day of the fourth month following the close of the tax year, which is typically April 15th for calendar year taxpayers.

Q: Are there any exemptions or deductions available for the PTE Pass-Through Entity Tax?

A: Yes, there are exemptions and deductions available for the PTE Pass-Through Entity Tax. It is recommended to consult with a tax professional or refer to the official guidelines provided by the Minnesota Department of Revenue for more information.

Q: What are the penalties for not paying or filing the PTE Pass-Through Entity Tax?

A: Penalties may be imposed for failure to pay or file the PTE Pass-Through Entity Tax on time. It is important to comply with the tax requirements to avoid potential penalties and interest.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule PTE by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.