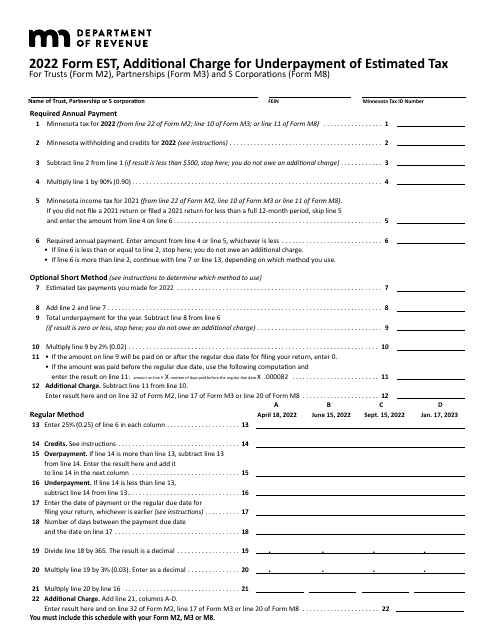

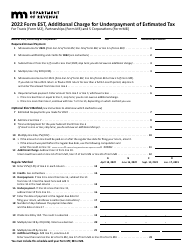

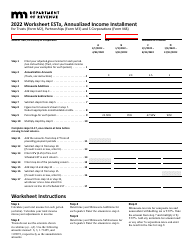

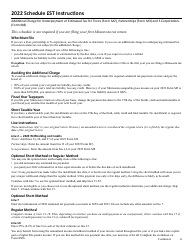

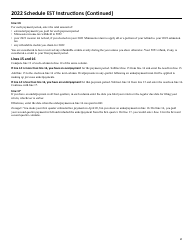

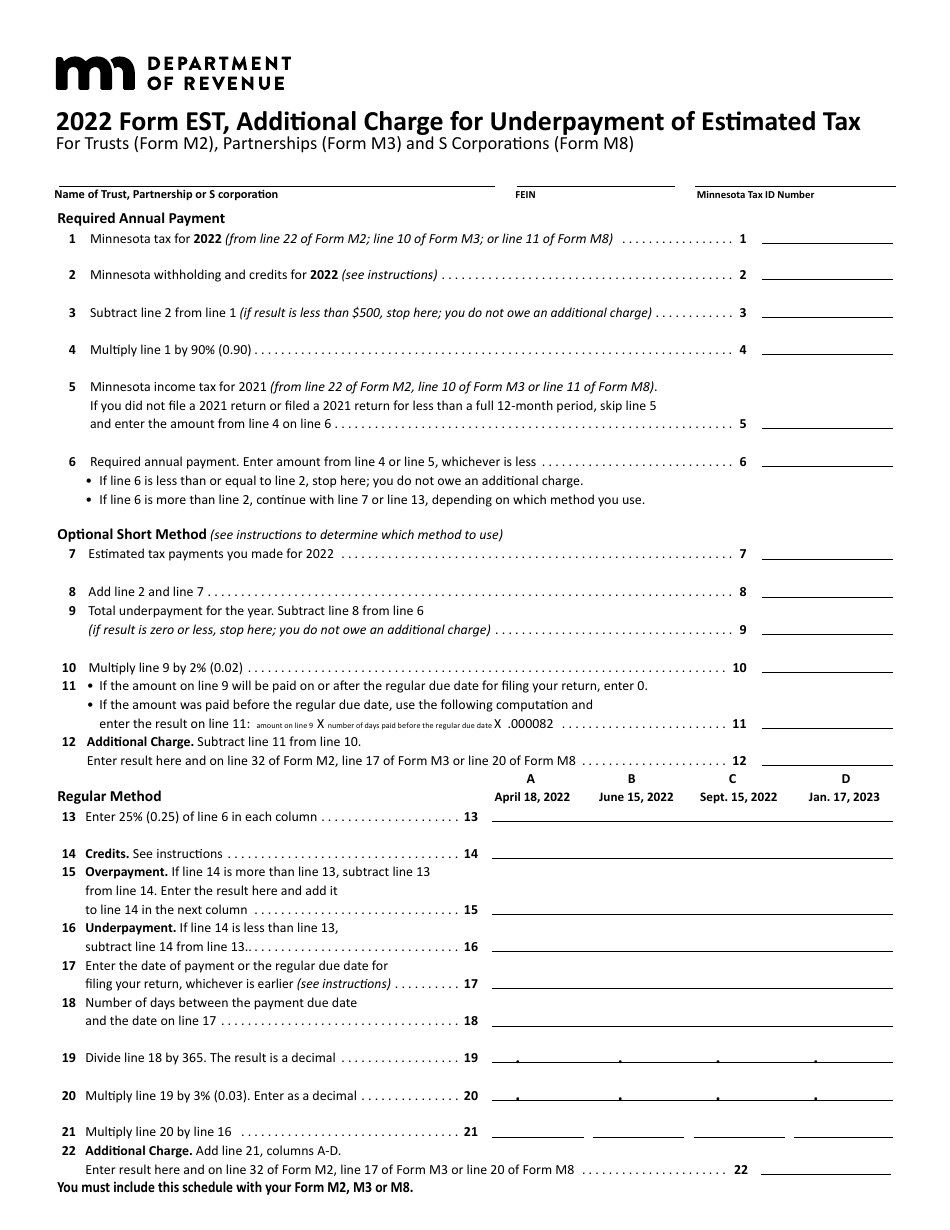

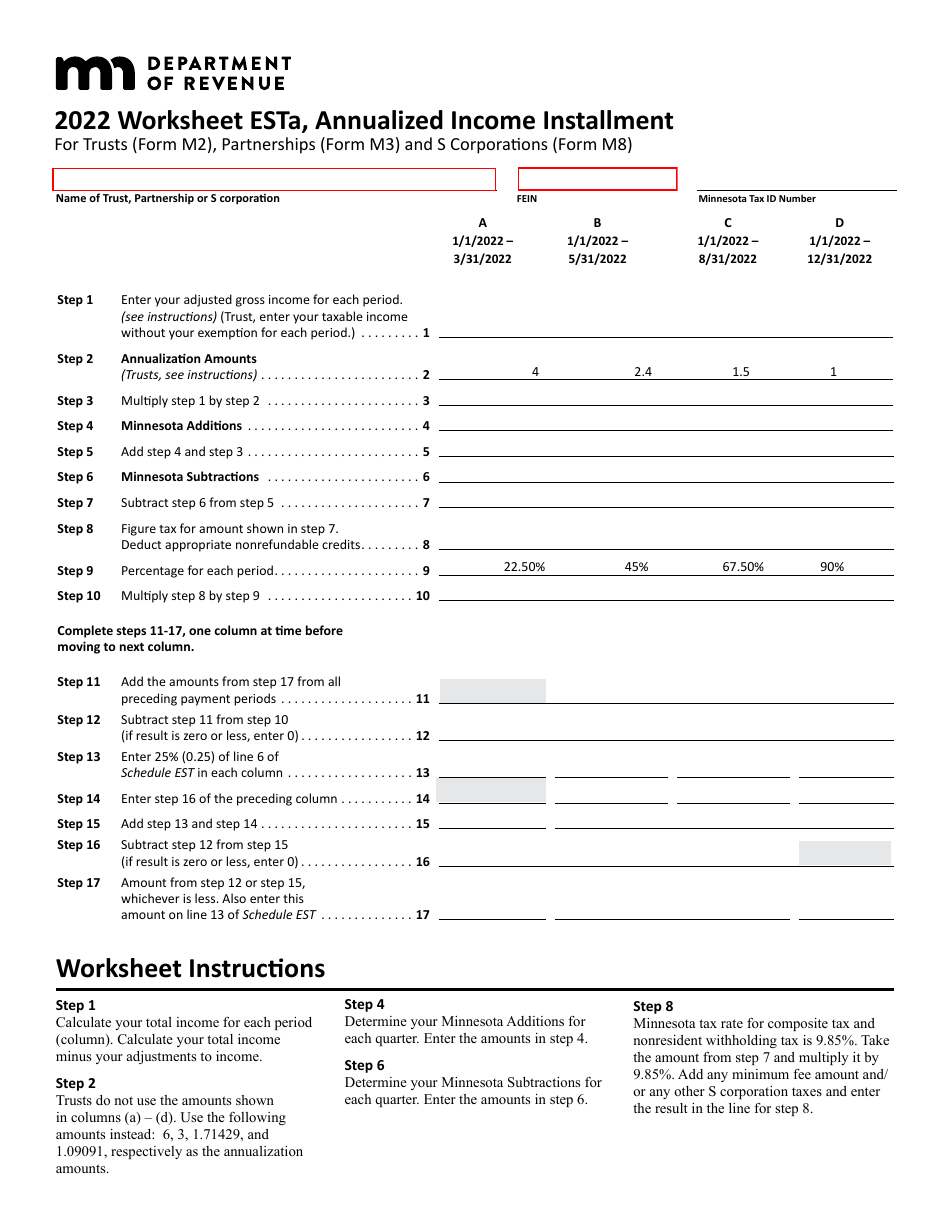

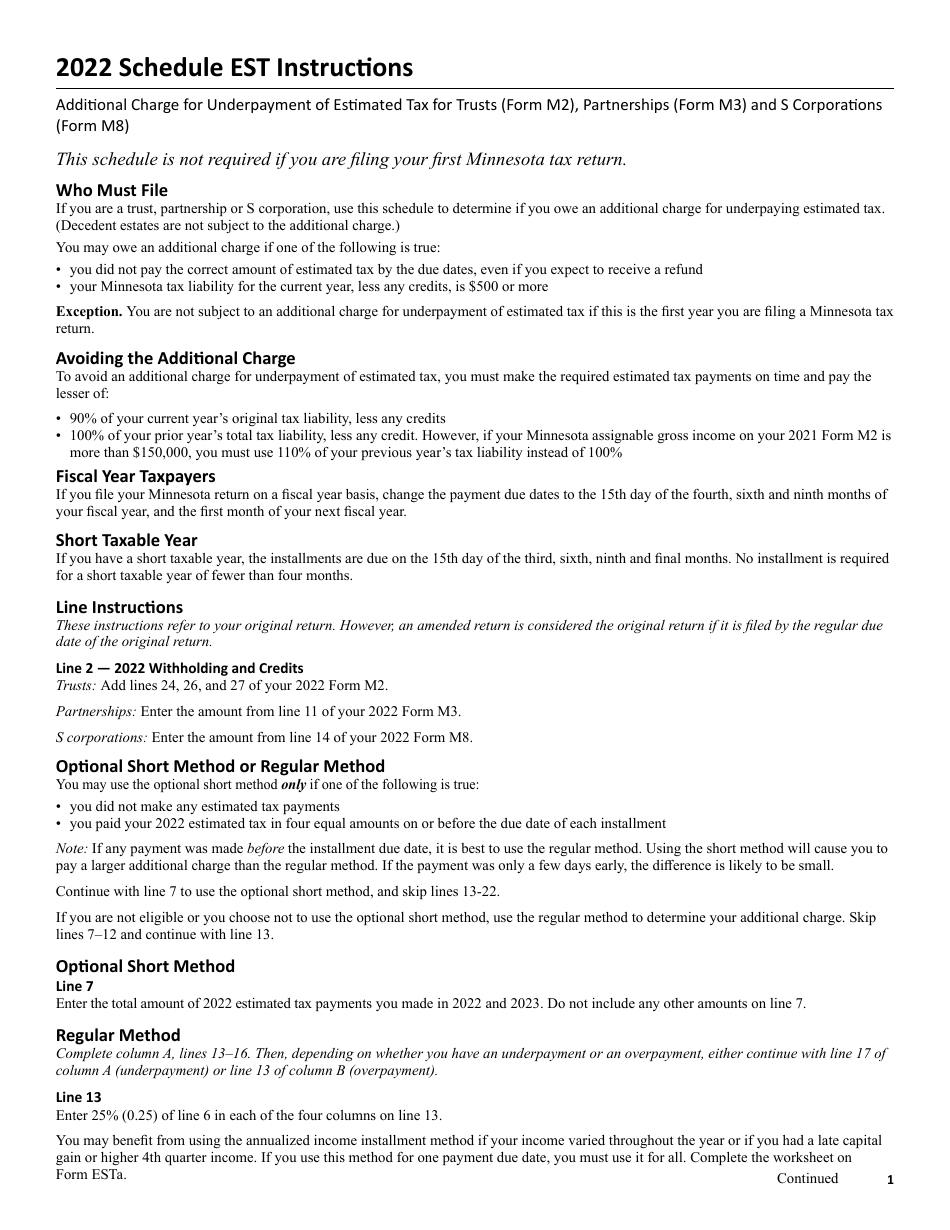

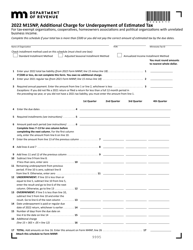

Form EST Additional Charge for Underpayment of Estimated Tax for Trusts (Form M2), Partnerships (Form M3) and S Corporations (Form M8) - Minnesota

What Is Form EST?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EST?

A: Form EST is a tax form used in Minnesota.

Q: Who is required to file Form EST?

A: Trusts, partnerships, and S corporations in Minnesota are required to file Form EST.

Q: What is the purpose of Form EST?

A: Form EST is used to report and pay an additional charge for underpayment of estimated tax for trusts, partnerships, and S corporations in Minnesota.

Q: When is Form EST due?

A: Form EST is due on the same date as the taxpayer's income tax return, which is typically April 15th.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EST by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.