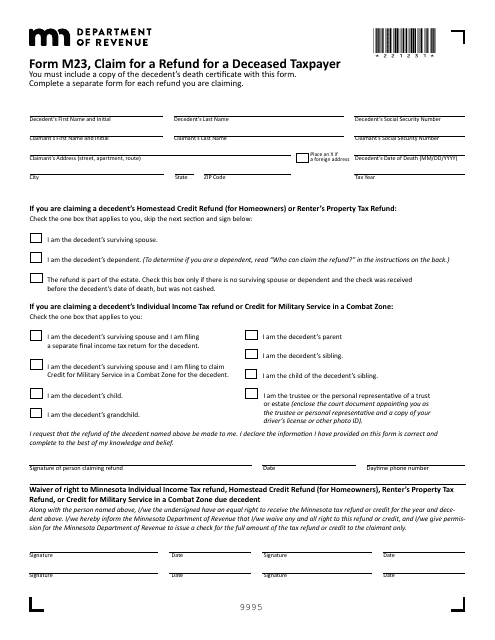

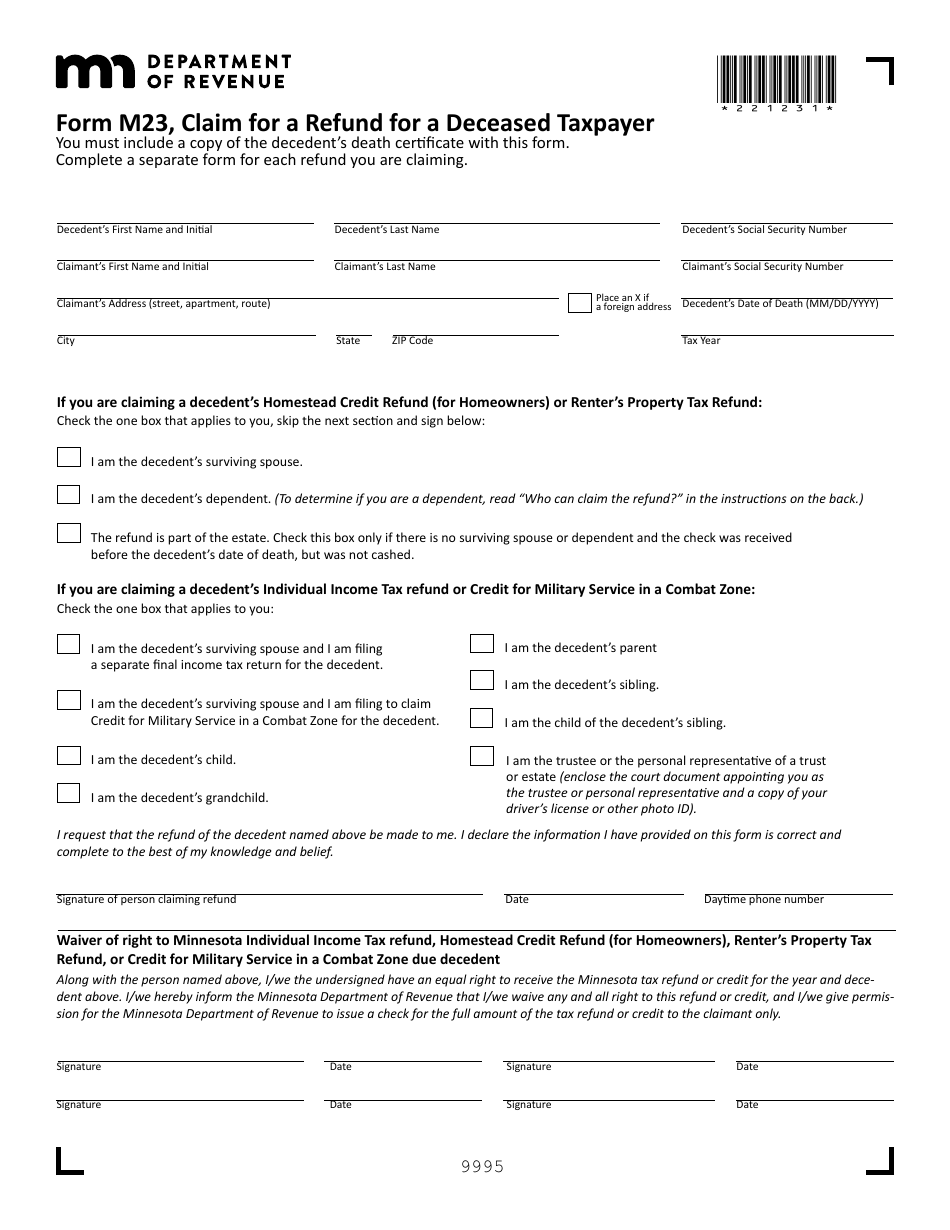

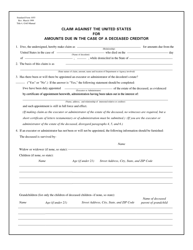

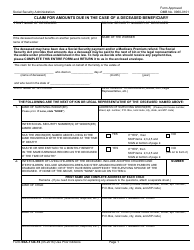

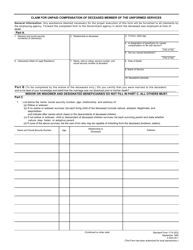

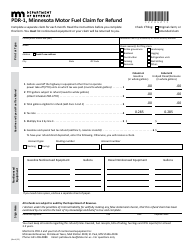

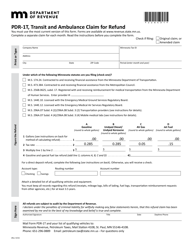

Form M23 Claim for a Refund for a Deceased Taxpayer - Minnesota

What Is Form M23?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M23?

A: Form M23 is a claim for a refund for a deceased taxpayer in Minnesota.

Q: Who can file Form M23?

A: The personal representative or surviving spouse can file Form M23.

Q: When should Form M23 be filed?

A: Form M23 should be filed within 3 years from the date of the taxpayer's death.

Q: What information is required to fill out Form M23?

A: You will need the taxpayer's information, details of the income and deductions, and a copy of the death certificate.

Q: How long does it take to process Form M23?

A: It can take up to 16 weeks to process Form M23.

Q: Can Form M23 be filed electronically?

A: No, Form M23 cannot be filed electronically; it must be filed by mail.

Q: Is there a fee to file Form M23?

A: No, there is no fee to file Form M23.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M23 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.