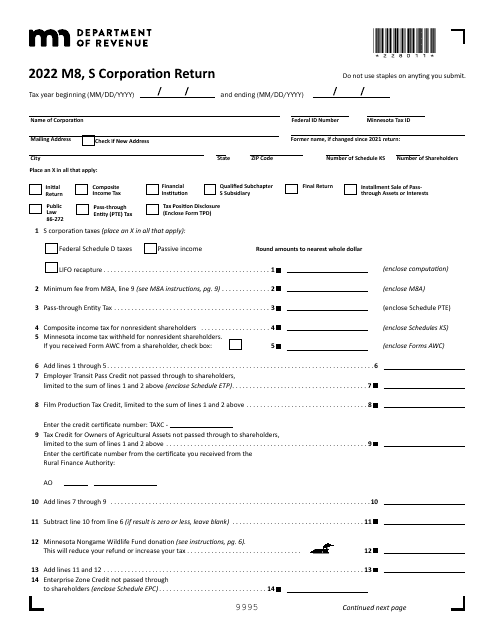

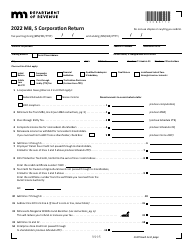

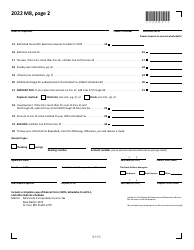

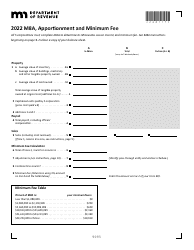

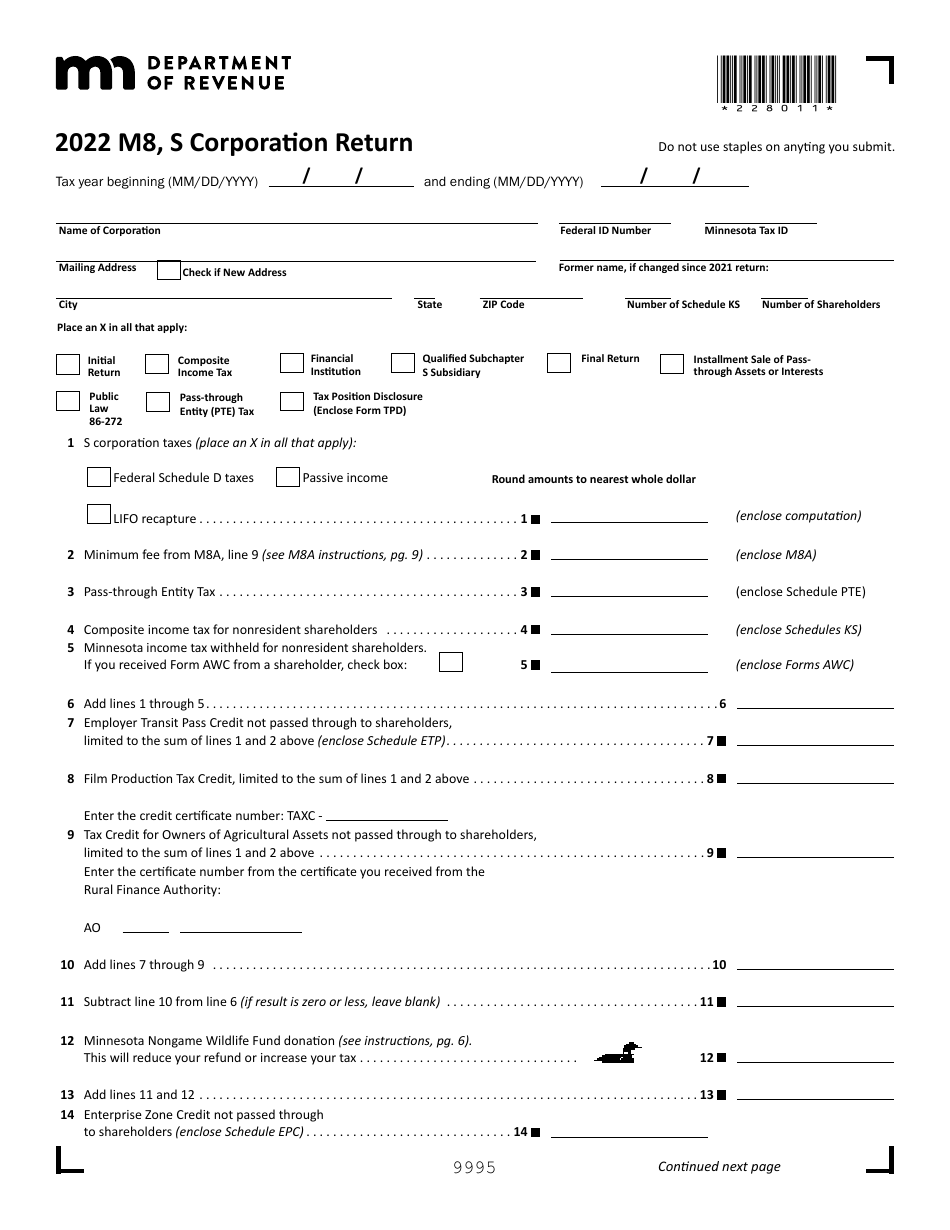

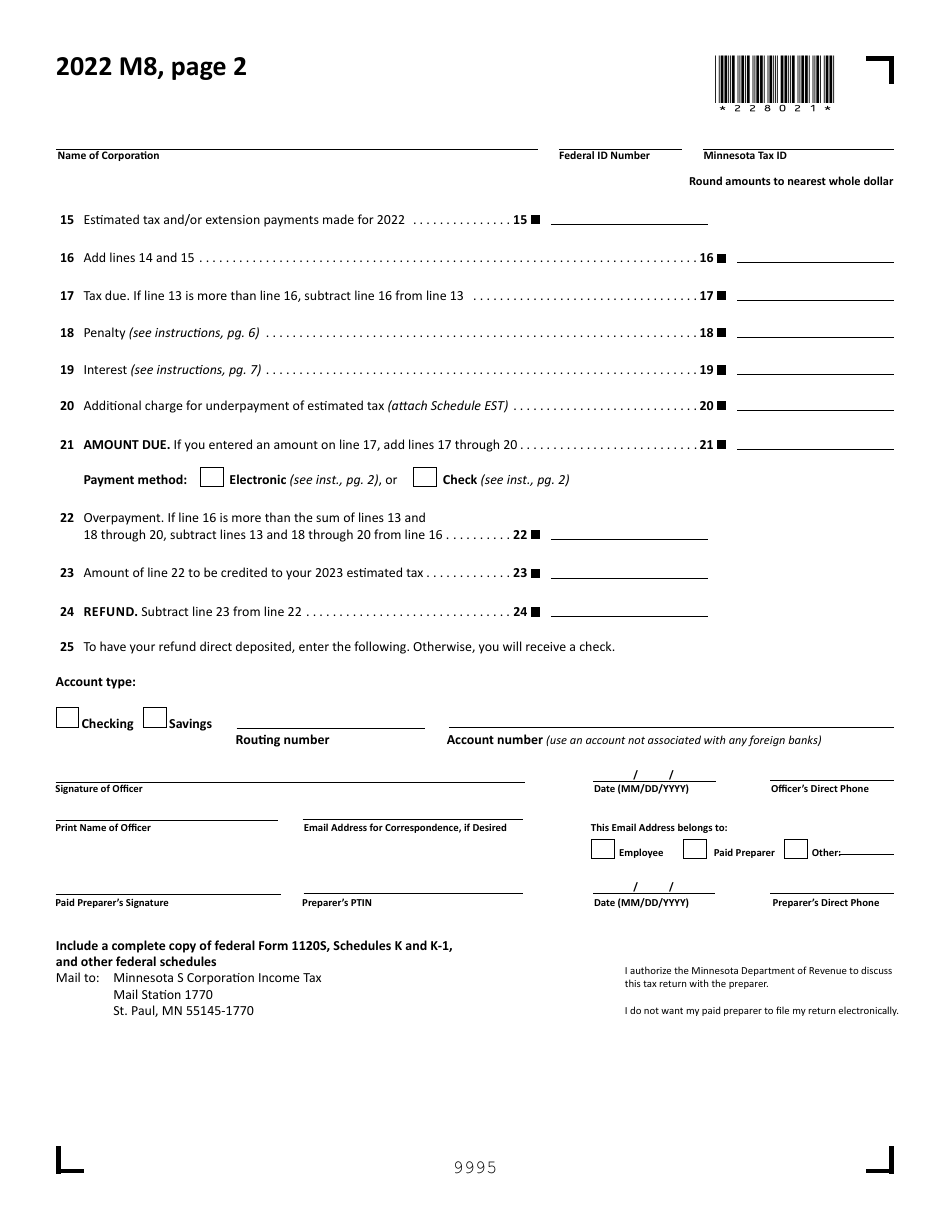

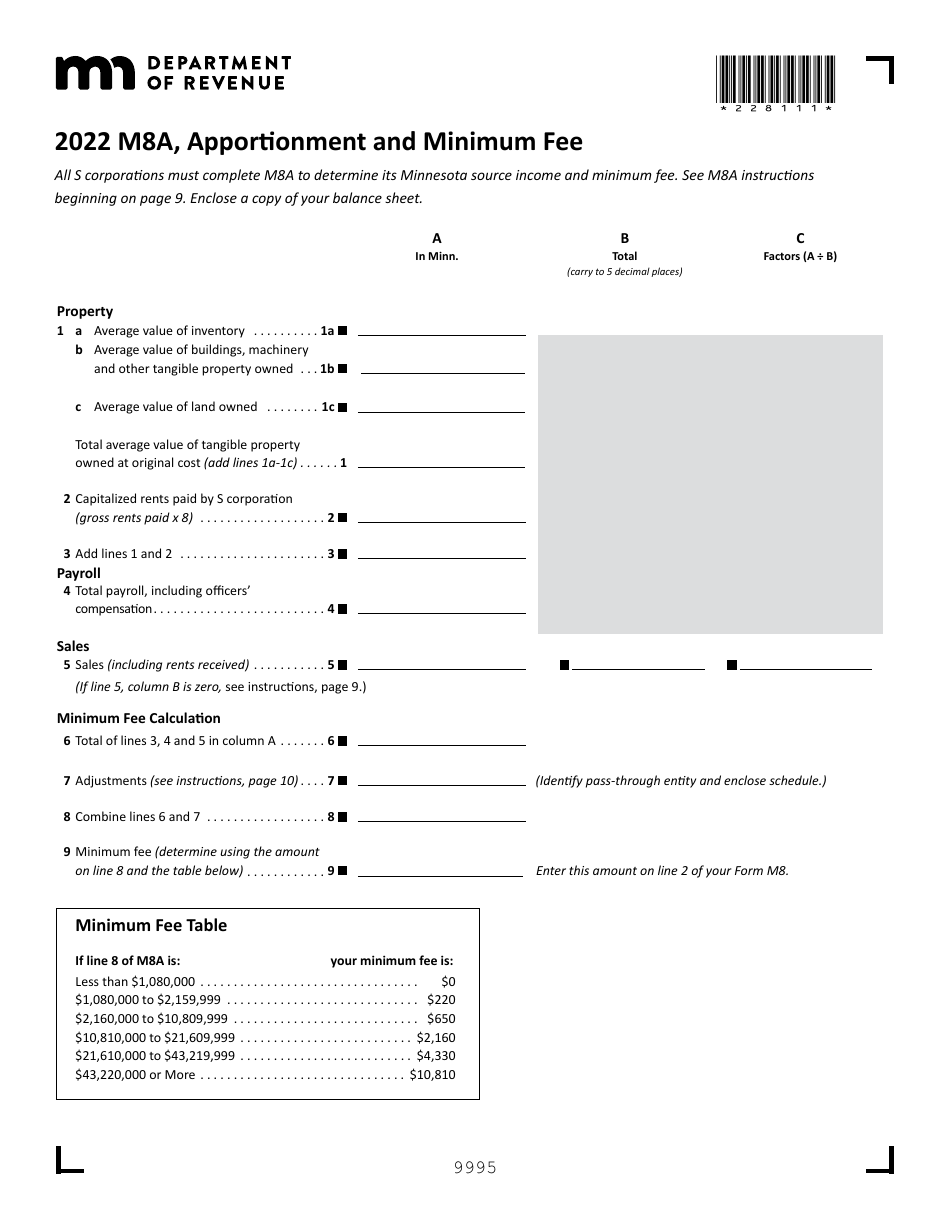

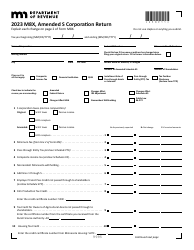

Form M8 S Corporation Return - Minnesota

What Is Form M8?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M8?

A: Form M8 is the tax return form used by S corporations in Minnesota.

Q: What is an S corporation?

A: An S corporation is a type of business entity that is treated as a pass-through entity for tax purposes.

Q: Who needs to file Form M8?

A: S corporations operating in Minnesota need to file Form M8.

Q: What information is required on Form M8?

A: Form M8 requires information about the S corporation's income, deductions, credits, and other tax-related details.

Q: When is the deadline to file Form M8?

A: The deadline to file Form M8 is the 15th day of the 3rd month after the end of the corporation's fiscal year.

Q: Are there any payment requirements with Form M8?

A: Yes, S corporations may need to make estimated tax payments throughout the year.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M8 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.