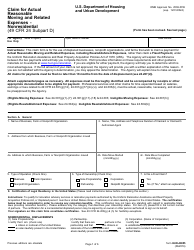

This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule M2NM

for the current year.

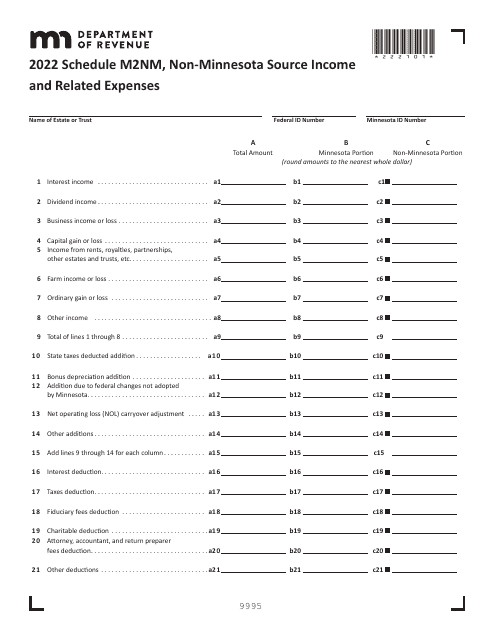

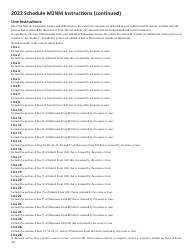

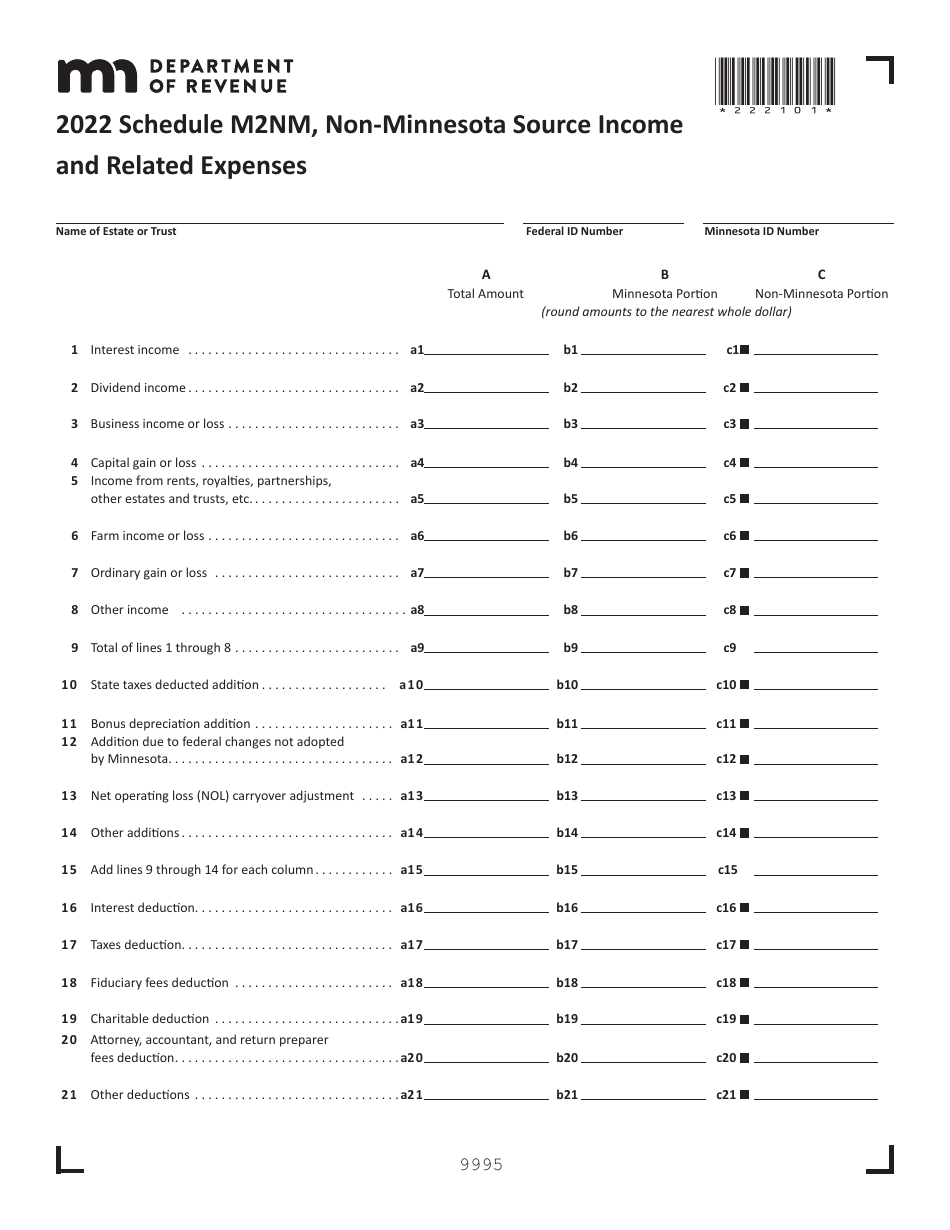

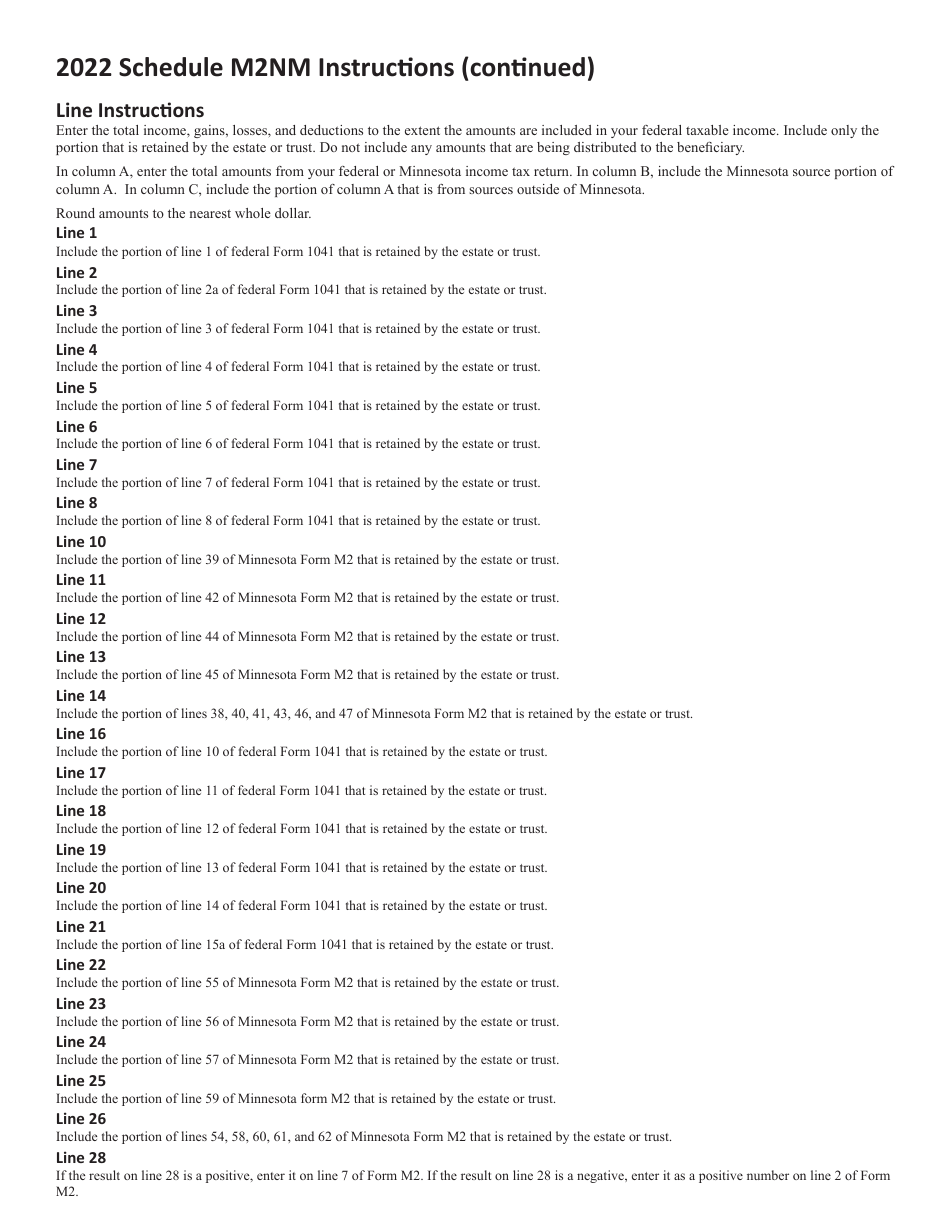

Schedule M2NM Non-minnesota Source Income and Related Expenses - Minnesota

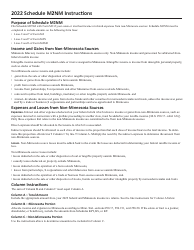

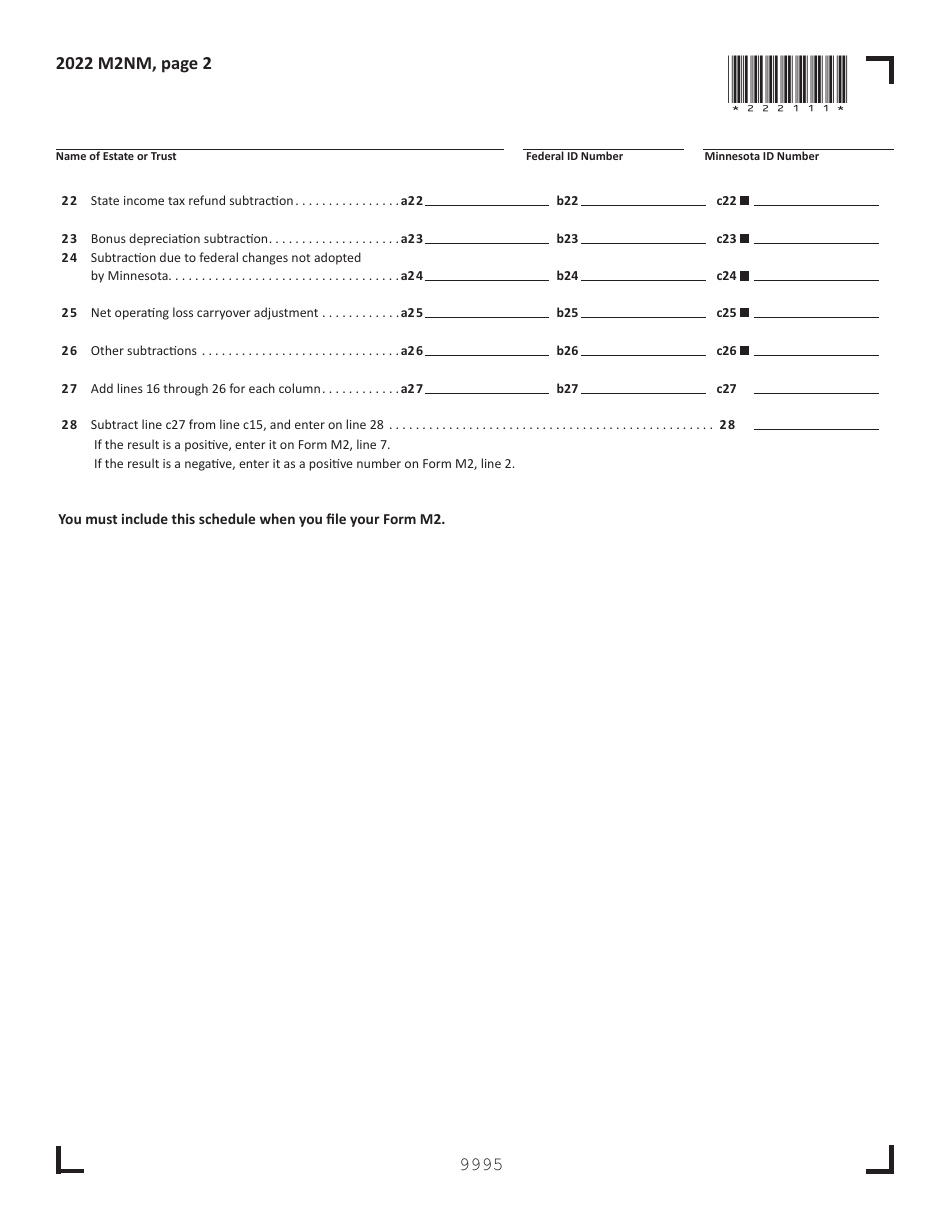

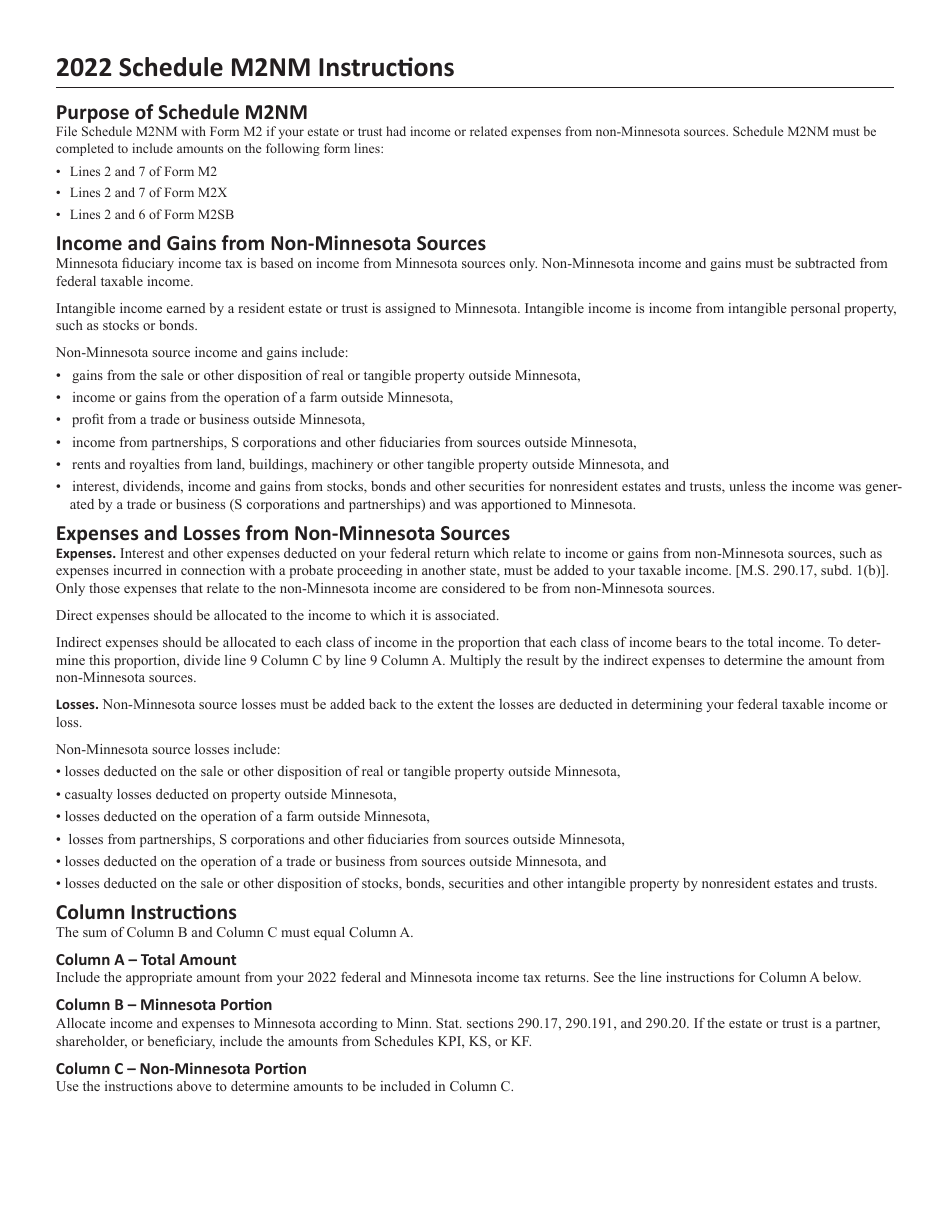

What Is Schedule M2NM?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M2NM?

A: Schedule M2NM is a tax form used by Minnesota residents to report non-Minnesota source income and related expenses.

Q: Who needs to file Schedule M2NM?

A: Minnesota residents who have non-Minnesota source income and related expenses need to file Schedule M2NM.

Q: What is considered non-Minnesota source income?

A: Non-Minnesota source income refers to income that is earned outside of the state of Minnesota, such as income from investments or employment in other states.

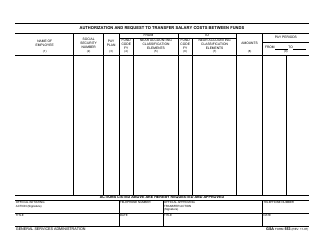

Q: What expenses can be deducted on Schedule M2NM?

A: Expenses directly related to earning non-Minnesota source income can be deducted on Schedule M2NM. Examples include travel expenses and professional fees.

Q: Do I need to file Schedule M2NM if I have no non-Minnesota source income?

A: No, if you don't have any non-Minnesota source income, you do not need to file Schedule M2NM.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M2NM by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.